Supply Zone

APLAPOLLO – Technical & Educational Snapshot📊 APLAPOLLO – Technical & Educational Snapshot

Timeframe: Daily / Weekly / Monthly

Overall Bias (for learning): ⭐⭐⭐⭐ Moderately Bullish – supply & demand zones identified, breakout study in progress

🔹 Candlestick Observations

Daily Bullish Piercing → Bullish Engulfing Buyers showing short-term strength

Weekly Three Black Crows → Bullish Engulfing Bearish pressure absorbed; case study of reversal attempt

Monthly NA No clear signal on higher timeframe

🔹 Supply & Demand Zones (Learning Reference)

Supply Zone (Resistance area): ₹1872 – ₹1921.40

(Stop Loss Ref: 1923.95 → possible invalidation if breached)

Demand Zone (Support area): ₹1494 – ₹1527.60

(Stop Loss Ref: 1491 → possible invalidation if broken)

🔹 Technical Observations

✅ Strong bullish candles forming

✅ Bullish Engulfing → buyer dominance visible

✅ Open = Low → intraday bullish bias illustration

✅ Double Wick → rejection from lower levels

✅ Breakout probability higher if weekly channel is cleared

📊 Volume Study

Any breakout is more reliable when supported by higher-than-average volume.

Traders typically wait for volume confirmation alongside bullish candlestick follow-through before validating a breakout.

📌 Summary (Learning View Only)

APLAPOLLO is a useful case study in demand-supply dynamics and bullish engulfing setups.

Lesson: Breakouts above consolidation + volume confirmation often strengthen trend continuation.

⚠️ Disclaimer (SEBI-Compliant)

This post is for educational & informational purposes only. It is not a buy/sell recommendation, not research, and not investment advice.

I am not a SEBI-registered advisor. Examples are for learning through chart patterns and public market data. Please consult a SEBI-registered financial advisor before making investment decisions.

💬 Found this useful?

🔼 Tap Boost so more traders can learn from structured analysis.

✍️ Share your views in the comments — let’s grow together.

✅ Follow @simpletradewithpatience for clean, zone-based setups & beginner-friendly market education.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

GBPJPY GJ is continuing its decline and is approaching a key demand zone around 194.800, which previously initiated bullish order flow.

I’ll definitely be monitoring this area closely for potential buy setups, as I’m anticipating a possible retracement. As always, confirmation will come from observing the 15-minute structure—once that aligns, I’ll adapt accordingly.

Supply & Demand + Patterns: A Simple Yet Powerful Swing StrategyExplore how supply-demand zones interact with patterns to create high-probability setups. This session breaks down rallies, pullbacks, and a simple process to start building a reliable swing trading strategy . Clear, structured, and beginner-friendly.

CEAT Ltd: Is a Rebound on the Horizon? A Confluence of TechnicalTraders — let’s dig into CEAT Ltd NSE:CEATLTD . where both demand-supply dynamics and classic technical signals are flashing something worth watching. What’s setting up here isn’t just noise — there’s real structure underneath the surface.

Demand Zone & Institutional Footprints

Let’s start with the core of this setup: the Demand Zone. CEAT’s price is inching toward a daily timeframe Rally-Base-Rally zone — and not just any zone, but one that stands out in terms of quality.

Why does this matter? Because these aren’t retail-driven bounces. These are often the hidden footprints of institutions quietly building positions.

On June 23rd, price came close to this very demand zone — and without even touching it, we saw a sharp bounce. That’s a strong tell. There’s clear demand waiting just below.

Institutions don’t throw their entire order book at the market in one go. They scale in. So when price comes back to this area, it’s likely to trigger those leftover buy orders — potentially leading to another move higher.

Zooming out to the broader view : Both weekly and monthly charts are still in an uptrend. There are no obvious supply zones on the higher timeframes That clears the runway for bullish continuation.

💡 Traditional Technical Analysis Perspective 💡

Now let’s switch gears for a moment and take a look through the lens of classic technical analysis. What’s the chart telling us in plain sight?

CEAT spent months coiling within a consolidation range — nothing impulsive, just sideways chop.

But that changed on April 30th with a decisive breakout. And this wasn’t on light volume — it came with strong participation, a real sign of conviction.

Post-breakout, we’ve seen consistent volume buildup alongside price progression. This isn’t a one-day wonder — it’s been developing.

Act of Polarity at Work: The breakout level had previously acted as firm resistance multiple times. Now that price is retesting it from above, it’s doing exactly what we expect — flipping that resistance into potential support.

Interestingly, this retracement is happening on declining volume. That’s key. It often suggests a healthy retest rather than a breakdown — a potential “buy the dip” scenario, if you will.

🤝 The Confluence: Where Two Worlds Meet 🤝

Here’s where things get really compelling — that demand zone we highlighted? It aligns perfectly with the same level that’s being retested post-breakout. That overlap — this confluence — is no coincidence.

It dramatically increases the odds of a strong bounce, because we’re getting validation from two independent analytical frameworks. When price, psychology, and institutional footprints all point to the same zone — you pay attention.

We could consider a tactical Stop Loss just below the demand zone. And in terms of upside? The previous swing high near ₹4000 stands out as a logical first target.

"Success in trading is a marathon, not a sprint. Consistency, discipline, and effective risk management are your true North Stars."

Stay sharp. Even the cleanest setup can fail — and that’s why managing risk isn’t optional. If price violates the zone and closes below your SL, step out without hesitation.

Thanks for reading — your support, feedback, and questions always help drive this community forward. Let’s keep sharpening our edge together.

🚀 Trade smart, stay disciplined, and let your journey be one of continuous learning! 🚀

Disclaimer: This analysis is intended purely for educational purposes. It does not constitute investment advice or a trading recommendation. I am not a SEBI-registered advisor.

Demand & Supply Price Action Play – CMSINFO Price Structure & Market Context

CMSINFO’s recent price action has followed a textbook path, respecting clean structural levels driven by institutional order flow. It's one of those charts where the zones aren’t just technical—they're telling a story. And right now, that story is setting up a potentially meaningful long opportunity.

💡 Daily Timeframe – Big Picture Bias

The daily chart remains resolutely bullish . We're still seeing that healthy rhythm of higher highs and higher lows , signaling that the uptrend is very much intact.

📍 Daily Supply Zone: ₹540 – ₹546

That said, price did face some resistance recently—right where we’d expect it to. A fresh supply zone Rally Base Drop around ₹540–₹546 served up a rejection and sparked the current pullback. Nothing unusual there. In fact, in strong trends, these kinds of pullbacks often offer the best risk-adjusted entries —as long as we’re positioned at the right zones.

⏱️ 125-Minute Timeframe – Precision Entry Layer

Zooming into the 125-minute chart gives us a much clearer map for potential execution.

🟢 Demand Zone: Rally Base Rally ₹500 – ₹498

Here’s where things get interesting. This demand zone hasn’t been touched since it formed—making it a fresh zone , and by definition, high-probability for a first bounce. Price has just tapped into it, which could attract short-term buyers looking to ride the next leg up.

🔴 Supply Zone: Rally Base Drop ₹532 – ₹537

This zone sits just overhead and marks the first potential resistance . If price moves up from the current demand area, this is where traders may begin trimming positions or tightening stops.

🎯 Trade Blueprint 🎯

Entry: Between ₹500 – ₹498 (inside 125-minute demand zone)

Stop Loss: Below ₹498 (conservative buffer: ₹495)

Target 1: ₹532 – ₹537 (nearest 125min supply)

🧩 Why This Setup Deserves Attention 🧩

Daily Trend Structure Remains Bullish – higher timeframe bias supports a continuation upward.

Fresh LTF Demand Zone – first touch makes this zone statistically favorable.

Defined Risk-Reward Parameters – tight stop with layered targets for flexible management.

Pure Price Action Logic – just clean, institutional footprints.

🚀 “Opportunities don’t come from chasing— they come from waiting in the right places.” 💡 Stay patient, respect your zones, and let the market come to you.

This analysis is purely for educational purposes and does not constitute a trading or investment recommendation. I am not a SEBI registered analyst.

Lastly, thank you for your support, your likes & comments. Feel free to ask if you have questions.

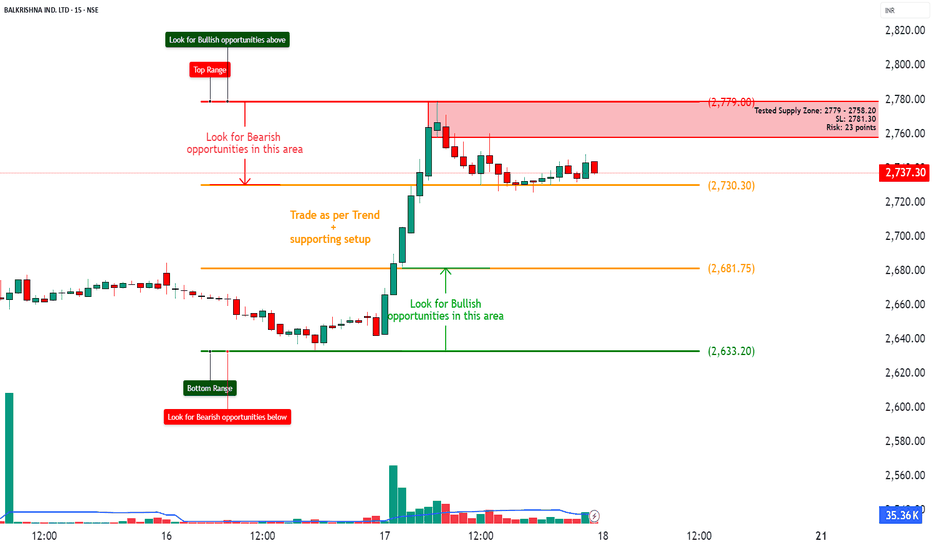

BALKRISIND – Zone Based Price Action Setup________________________________________________________________________________

📈 BALKRISIND – Zone Based Price Action Setup

🕒 Chart Type: 15-Min | 🗓 Date: 17th July 2025

🔍 Easy-to-Understand Setup for New Traders

________________________________________________________________________________

🚦 Key Zones to Watch

🔴 Top Range (Resistance) – 2779.00

🟠 Mid-Level Zones – 2730.30 | 2681.75

🟢 Bottom Range (Support) – 2633.20

________________________________________________________________________________

💡 What’s Happening on the Chart?

✅ Strong Up-Move seen from the support zone 📈

✅ Price is now consolidating below a tested Supply Zone (2779 - 2758)

✅ Volume spike shows interest near breakout

✅ A clean structure for price action-based planning 🔍

________________________________________________________________________________

🎯 How to Plan Trades (Educational Purpose Only):

🔼 Best Buy Setup:

• Entry: Above 2779 (Breakout signs)

• SL: Below 2730

• Target: R:R 1:1 | 1:2 +

• Reason: Trend continuation + price holding above key levels

🔽 Best Sell Setup:

• Entry: Near 2775–2780 (Supply Zone)

• SL: 2781.30

• Target: R:R 1:1 | 1:2 +

• Reason: Strong supply zone tested + limited upside + defined risk

________________________________________________________________________________

🧠 Simple Learning Points:

• ✅ Trade with the trend until price reaches an opposing zone

• 🧱 Use zones (not random entries) for planning

• 📉 If price enters Supply → look for bearish signs

• 📈 If price pulls back to Demand → look for bullish setups

________________________________________________________________________________

📦 Zone Markings for Reference:

• 🔴 Supply Zone: 2779 – 2758.20

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this helpful?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community – let them benefit from clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for charts, clean setups, and educational content based on price action, zones, and risk-managed trades.

🚀 Trade with patience, trust your charts, and stay clear-headed!

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

________________________________________________________________________________

SUNFLAG- Breakout from DTFSUNFLAG has resistance weakening on the Daily charts and has given a breakout with good volume.

The target of this pattern signals an upside potential of 10% from the current price level in the medium term.

The stock is trading above its 50- and 100-day simple moving averages (SMAs). The range is more than 1.2X, and the Volume is also >6X the average.

CMP- Rs. 316

Target Price- Rs347 ( 10% upside)

SL - 297

Disclaimer: This is not a buy/sell recommendation. For educational purpose only. Kindly consult your financial advisor before entering a trade.

BSE – Strong Call Writing | Tested Supply Zone in Play________________________________________________________________________________

📈 BSE – Strong Call Writing Below 2600 | Tested Supply Zone in Play

🕒 Chart: 15-Min

📆 July 8, 2025

________________________________________________________________________________

🔍 What’s Catching Our Eye:

Massive Call writing seen from ₹2400 to ₹2900, clearly indicating resistance at higher levels.

________________________________________________________________________________📌 What We’re Watching For:

Price is facing selling near the ₹2542–₹2589 supply zone; a rejection here can drag it toward ₹2395 or below.

________________________________________________________________________________📌 OI Inference:

CEs are heavily sold across all levels – especially 2600, 2500, 2700, and 2400 CE.

Strong Put buying from 2400 down to 2000 PE → Market participants are expecting downside.

________________________________________________________________________________🔁 Trend Bias:

🔴 Bearish to Range-Bound – unless price breaks above ₹2594.05 with volume and CE unwinding.

________________________________________________________________________________🧠 Trade Logic / Reasoning:

• 12+ Call Strikes under Short Build-Up = strong ceiling

• Long Build-Up in deep Puts (2500, 2400, 2300, even 2000)

• Tested supply zone between ₹2542–₹2589 = rejection likely

• PE IVs rising = fear building up, especially below 2500

________________________________________________________________________________📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹2731.6

🔻 Bottom Range (Support): ₹2395

🟢 Demand Zone: NA

🔴 Supply Zone: ₹2542.20 – ₹2589.10 | SL: ₹2594.05(Tested Zone)

________________________________________________________________________________🎯 Trade Plan (Educational Purpose Only):

✅ Sell (Equity): Near ₹2542–₹2589 if price rejects the supply zone

✅ Buy (Equity): Only above ₹2594.05 with strong volume

✅ Best Put to Buy: ₹2500 PE or ₹2400 PE on breakdown

❌ Avoid Call Buying: All Calls are under heavy selling

📌 Strategy Idea (Low Risk):

Bear Put Spread – Buy 2500 PE, Sell 2400 PE

→ Profitable if stock drops, risk stays limited

________________________________________________________________________________⚠️ Invalidation Levels:

🔺 Above ₹2594.05 = bearish setup may fail

🔻 Below ₹2395 = confirms breakdown and trend continuation

________________________________________________________________________________

⚠️ Disclaimer:

This post is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for any trading decisions based on this content.

________________________________________________________________________________

💬 Will BSE break supply and fly, or get rejected again?

⬇️ Share your view in the comments!

🔁 Repost this if you're watching BSE

✅ Follow STWP for clean Options + Price Action insights

🚀 Let’s trade with clarity and confidence!

________________________________________________________________________________

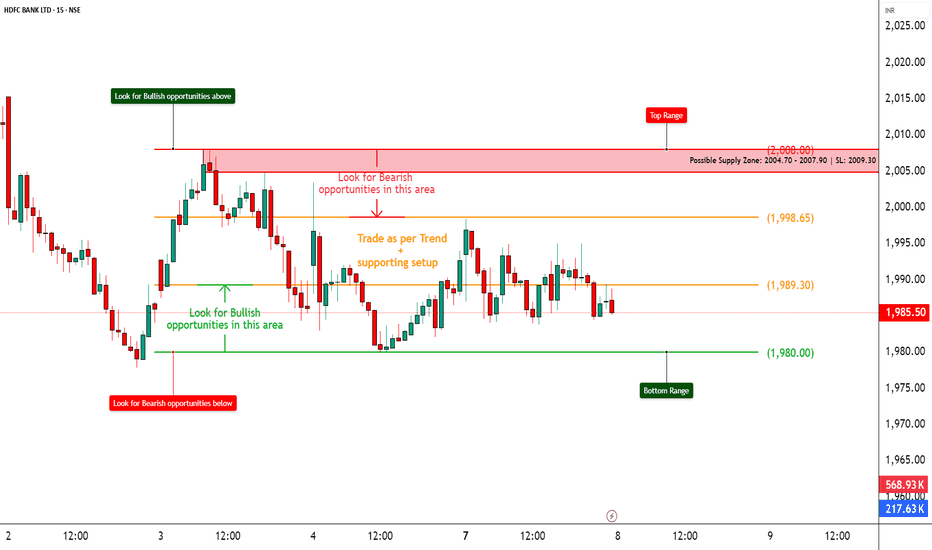

HDFCBANK – Heavy Call Writing Near 2000 Zone________________________________________

📈 HDFCBANK – Heavy Call Writing Near 2000 Zone | OI + Price Action Analysis

🕒 Chart Type: 15-Minute

📆 Date: July 7, 2025

________________________________________

🔍 What’s Catching Our Eye:

HDFCBANK closed at ₹1987.4, and the entire Call side from ₹1980 to ₹2100 is showing strong Short Build-Up, clearly suggesting resistance building up ahead, especially around ₹2000–₹2040 levels.

Meanwhile, Put side shows Long Unwinding at ₹2000 PE, suggesting lack of bullish confidence at current levels.

________________________________________

📌 What We’re Watching For:

Watch the zone between ₹2004.70 – ₹2007.90 very closely – it’s a visible Supply Zone based on price rejection + heavy CE OI.

If HDFCBANK fails to break and sustain above ₹2009.30 (SL), bears may take control again and drive it back to ₹1980 or below.

________________________________________

📊 Volume Footprint:

Heavy CE volumes hint at active resistance:

• ₹2000 CE – 9.3k+ contracts

• ₹2060 CE – 7.8k+ contracts

• ₹2020 CE & ₹2040 CE – ~5.6k contracts each

→ Strong presence of Call writers near current levels, pressuring the upside.

________________________________________

📈 Option Chain Highlights:

Calls (Short Build-Up):

• ₹2000 CE: +1,93,600 OI | Price ↓ 8.87%

• ₹2060 CE: +10,04,300 OI | Price ↓ 16.67% ✅ Major resistance buildup

• ₹2020 CE: +6,90,800 OI | Price ↓ 11.42%

• ₹2040 CE: +5,83,550 OI | Price ↓ 15.13%

• ₹1980 CE: +2,17,800 OI | Price ↓ 6.44%

• ₹2100 CE: +2,00,200 OI | Price ↓ 17.76%

Puts:

• ₹2000 PE: -84,150 OI | Price ↓ 0.87% → Long Unwinding = Bullish weakness

• ₹1980 PE: +6,050 OI | Price ↓ 2.33% → Weak Short Build-Up

📌 Inference:

Call writers are dominating the entire upper side. There’s no strong Put writing, and PE writers are exiting positions at ATM — this confirms limited bullish conviction.

________________________________________

🔁 Trend Bias:

🔴 Bearish to Range-Bound – unless ₹2009.30 gets taken out on closing basis

________________________________________

🧠 Trade Logic / Reasoning:

• Heavy Short Build-Up in all major CE strikes

• Lack of Put writing near spot

• Supply Zone aligning perfectly with Option Chain resistance

→ Expect rejection or pause unless strong buyers break ₹2009.30 with volume.

________________________________________

📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹2008

🔻 Bottom Range (Support): ₹1980

________________________________________

🎯 Trade Plan (Educational Purpose Only):

✅ Best Buy (Equity): Above ₹2009.30 with a bullish candle and volume

✅ Best Sell (Equity): Below ₹2004.70 for quick move to ₹1980

✅ Best CE to Long: None – CE side is under Short Build-Up

✅ Best PE to Long: ₹1980 PE if price starts rejecting ₹2000 zone again

🟢 Demand Zone: ₹1965 – ₹1980 (Intraday Bounce Possible)

🔴 Supply Zone: ₹2004.70 – ₹2007.90 (SL: ₹2009.30)

⚠️ Invalidation Levels (With Logic):

🔻 Bullish View Invalid Below: ₹1980 – breaks structure and confirms weakness

🔺 Bearish View Invalid Above: ₹2009.30 – a breakout above this level with volume + PE Short Build-Up will invalidate bearish trades

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Rejection from ₹2000 or breakout above ₹2009?

What’s your view on HDFCBANK? Comment below ⬇️

🔁 Share this if you're tracking the zone

✅ Follow STWP for clean Price Action + OI Trades

🚀 Let’s trade with clarity and confidence!

________________________________________

DIXON – Strong Bullish Sentiment with Heavy Long Build-Up in CE________________________________________

📈 DIXON – Strong Bullish Sentiment with Heavy Long Build-Up in Calls | OI + Price Action Analysis

🕒 Chart Type: 15-Minute

📆 Date: July 7, 2025

________________________________________

🔍 What’s Catching Our Eye:

DIXON closed around ₹15,433, and the Option Chain is reflecting dominant bullish momentum. Multiple strikes from 15500 to 18000 CE are seeing strong Long Build-Up, with aggressive participation even in far OTM calls. Simultaneously, Put writers are either unwinding or short building, which shows that traders expect price to rise further and downside is limited.

________________________________________

📌 What We’re Watching For:

If DIXON sustains above ₹15,500, expect continuation toward ₹16,000–₹16,250–₹16,500 and possibly ₹17,000+ if momentum persists. However, any slip below ₹15,250 may slow down the rally.

________________________________________

📊 Volume Footprint:

Options activity is backed by very high bullish volume —

• Over 20.7k contracts at ₹15,500 CE

• Over 18.1k contracts at ₹16,000 CE

• Over 14.5k contracts at ₹16,500 CE

→ Traders are clearly positioning for an upside breakout with strong intent.

________________________________________

📈 Option Chain Highlights:

Calls (Long Build-Up):

• ₹15,500 CE: +16,450 OI | Price ↑ 20.33%

• ₹16,500 CE: +6,650 OI | Price ↑ 21.91%

• ₹17,000 CE: +8,600 OI | Price ↑ 22.40%

• ₹18,000 CE: +11,350 OI | Price ↑ 17.51%

• ₹15,750 CE: +21,900 OI | Price ↑ 21.12%

• ₹16,250 CE: +8,950 OI | Price ↑ 22.07%

• ₹16,750 CE: +6,950 OI | Price ↑ 22.73%

Calls (Short Covering):

• ₹15,000 CE: -20,250 OI | Price ↑ 18%

• ₹15,250 CE: -16,950 OI | Price ↑ 18.58%

• ₹16,000 CE: -10,200 OI | Price ↑ 21.26%

Puts:

• ₹15,000 PE: +1,800 OI | Price ↓ 23.07% → Short Build-Up

• ₹15,500 PE: +15,750 OI | Price ↓ 19.74% → Short Build-Up

• ₹14,000 PE: +13,750 OI | Price ↓ 30.12% → Short Build-Up

• ₹14,500 PE: -2,300 OI | Price ↓ 26.24% → Long Unwinding

🧠 Inference:

Call buyers are aggressively taking positions across the board. Even deep OTM strikes like ₹17,000 & ₹18,000 CE are active. Put writers are backing off or adding shorts. This is a clear momentum breakout setup.

________________________________________

🔁 Trend Bias:

🟢 Bullish – Strong confirmation from both price & derivative action

________________________________________

🧠 Trade Logic / Reasoning:

Massive Long Build-Up from 15,500 to 18,000 CE confirms traders are betting on continued upside. Short covering at ATM strikes + short build-up at far PEs shows bears are backing off and bulls are in full control.

________________________________________

📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹15668

🔻 Bottom Range (Support): ₹14929

________________________________________

🎯 Trade Plan (Educational Purpose Only):

✅ Best Buy (Equity): Above ₹15,500 with volume confirmation

❌ Best Sell (Equity): Avoid – sentiment is too bullish

✅ Best CE to Long: ₹15,500 CE or ₹16,000 CE – both showing volume + fresh long build-up

❌ Best PE to Long: Avoid – no bearish signs from the Option Chain

🟢 Demand Zone: NA

🔴 Supply Zone: 15533 – 15590 | SL: 15613.85

⚠️ Invalidation Below:

If DIXON closes below ₹15,250 with heavy volume, the bullish momentum stands invalidated, and price may retrace toward ₹15,000–14,750 zones.

If DIXON closes above ₹15,500 with strong bullish candles and volume, any bearish anticipation becomes invalid. Price may then aim for ₹16,000–16,250 or higher.

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Did this help you ride DIXON’s bullish wave?

Let me know your views below ⬇️

🔁 Share this with traders watching DIXON

✅ Follow STWP for clean zone + OI + momentum trades

🚀 Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________

MAZDOCK – TECHNICAL ANALYSIS - W PATTERN________________________________________________________________________________

📈 MAZDOCK – TECHNICAL ANALYSIS

📆 Date: July 4, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range: 3775

• Resistance: 3362 – 3396 – 3423

• 🟢 Bottom Range: 3077.7

• Support: 3241 – 3274 – 3301

________________________________________________________________________________

🔹 Chart Pattern: ✅ W-Bottom Formation

A clean W-shaped reversal pattern is forming. Price is respecting demand zones and gradually forming higher lows. Neckline lies around 3369 — breakout above this may fuel further upside.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns:

⛔ No major reversal candle on 4th July 2025.

________________________________________________________________________________

🔹 Volume Footprint:

✅ Gradual volume pickup

🚨 Watch for breakout above 3362–3396 with volume >3.5M

🔼 A successful breakout may trigger a swift move toward 3425–3520.

________________________________________________________________________________

🔹 Trend Bias: ✅ Bullish

Short-term momentum favors the bulls with sectoral tailwinds from PSU + Defense themes.

________________________________________________________________________________

📌 What’s Catching Our Eye:

• W-Bottom Pattern nearing breakout

• Price reclaimed key demand zone and consolidating just below resistance

• PSU + Defense theme rally adds sector momentum

________________________________________________________________________________

👀 What We’re Watching For:

• Breakout Confirmation: Daily close above 3396 with 3.5M+ volume

• Pullback Re-entry: Ideal zone 3300–3310 for fresh entries

• Volume Spike: Key trigger for breakout validation

________________________________________________________________________________

⚠️ Risks to Watch:

• Low volume breakout = Bull trap risk

• Sector rotation or sudden weakness in PSU/Defense

• Breakdown below 3240 = pattern failure & shift in bias

________________________________________________________________________________

🔮 What to Expect Next:

• ⚡ Retest of 3362–3396 range likely

• 🔄 Minor consolidation / handle formation possible

• 🔄 Watch for volatility near resistance (intraday fakeouts)

________________________________________________________________________________

📊 Trade Plan (Based on Logic + Volume Confirmation)

🔼 Breakout Long Setup:

• Entry: Above 3369

• Stop Loss: 3300

• Risk–Reward: ~1:1 to 1:2

📌 Why:

• W-bottom breakout

• Sector strength + price structure alignment

• Volume >3.5M is the key trigger

________________________________________________________________________________

🔁 Pullback Long Setup:

• Entry Zone: 3305–3310

• Stop Loss: 3240 (Support 3)

• Risk–Reward: ~1:1 to 1:2

📌 Why:

• Tight SL near structure

• Good risk-reward for early entry

________________________________________________________________________________

🔽 Bearish Setup (Rejection from Resistance):

• Entry: Below 3300

• Stop Loss: Above 3365

• Risk–Reward: ~Flexible — as per individual trader's strategy and risk appetite

📌 Why:

• Rejection from neckline

• Low-volume breakout = trap

• Breakdown below support shifts structure to bearish

________________________________________________________________________________

❌ Invalidation Triggers:

• Daily Close below 3240

• Bearish Marubozu with volume = shift to supply pressure

________________________________________________________________________________

📌 Intraday Supply Zones Noted (15-Min Chart):

The 15-minute chart reveals the presence of multiple intraday supply zones, indicating short-term selling pressure.

🟥 Tested Supply Zone: 3337.30 – 3346.30 | SL: 3352.20

🟥 Strong Supply Zone: 3349.40 – 3358.60 | SL: 3364.50

These zones may act as resistance levels for intraday traders. Watch for price rejection or confirmation candles in these areas before planning any breakout trades.

________________________________________________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this helpful?

Have you caught this W-pattern early?

Share your thoughts in the comments ⬇️

🔁 Spread the insight with fellow traders

✅ Follow STWP for smart technical setups backed by volume and price action

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

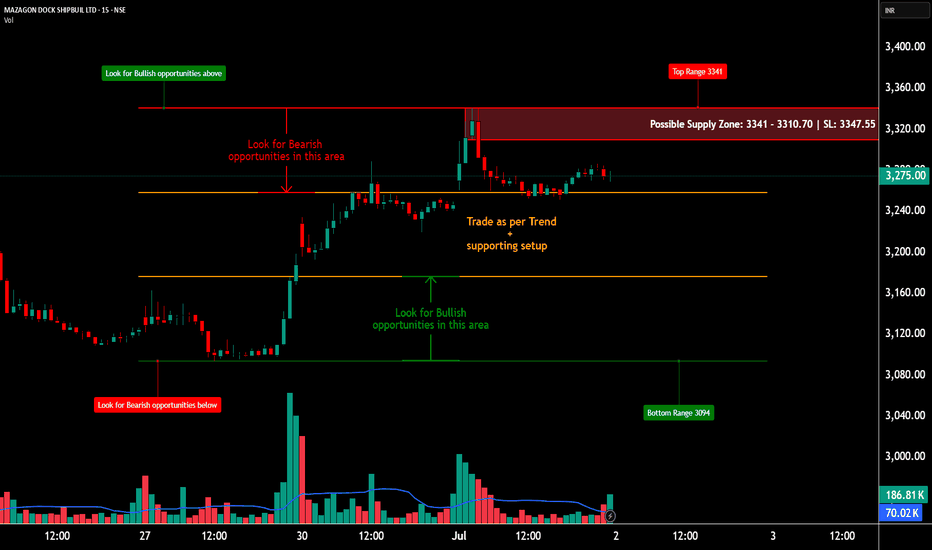

MAZDOCK - – INTRADAY ZONE ANALYSIS________________________________________________________________________________📈 MAZAGON DOCK SHIPBUILDERS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹3341

🟢 Bottom Range (Support): ₹3094

⚪ No Trade Zone: (Trade only with trend + confirmation in this zone)

________________________________________________________________________________

🧩 Chart Pattern: No visible chart pattern seen.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range:

✅ Multiple strong rejection candles near ₹3341 along with long upper wicks and volume drop — suggesting supply zone holding.

🟢 Bottom Range:

✅ Bullish Marubozu and wide-range green candles seen around ₹3094, confirming strong buyer interest and a potential reversal zone.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹3120–₹3094 demand zone with bullish confirmation (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹3090

Risk-Reward: 1:1 | 1:2+

Logic: Strong buyer reaction from demand zone previously suggests continued interest if tested again.

________________________________________________________________________________

🔽 Bearish Trade:

Idea: Short if price retests ₹3341–₹3310 and rejects with bearish candle formation (strong bearish candle, reversal candles, volume support, long wick).

Stop Loss: Above ₹3347.55

Risk-Reward: 1:1 | 1:2+

Logic: Supply zone confirmed with rejections earlier. Reversal here can lead to downside till mid or demand zone.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹3341 – ₹3310

SL: ₹3347.55

Plan: Enter short if price shows rejection with bearish confirmation at this zone.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹3120 – ₹3094

SL: ₹3090

Plan: Enter long on bullish reversal setup from this demand area.

Risk-Reward: 1:1 | 1:2+

________________________________________________________________________________

📌 Disclaimer

This analysis is for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before trading. Always use strict risk management and act only on confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on MAZDOCK?

Will it break the supply zone and rally higher, or revisit the demand zone before bouncing back?

Share your thoughts and chart setups below 👇

________________________________________________________________________________

BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS________________________________________________________________________________

📈 BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range(Resistance): 1324.50

🟢 Bottom Range(Support): ₹1270

⚪ No Trade Zone: Mid-range, no clear directional bias

________________________________________________________________________________

🧩 Chart Pattern: No

There is no visible or marked chart pattern (e.g., flag, triangle, head and shoulders) on the chart.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No visible reversal candle pattern at the supply zone on this chart snapshot, but the area has been marked for potential rejection.

🟢 Bottom Range: No textbook reversal candlestick (like pin bar, hammer, or engulfing) is clearly visible at ₹1270. However, the price bounced strongly from this level, indicating possible short-term support or buyer interest.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: If price retests ₹1270 and forms a bullish structure (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹1269

Risk-Reward: 1:1 | 1:2+

Logic: you need to give an actual logic to this

________________________________________________________________________________

🔽 Bearish Trade:

Idea: If price rejects 1324.50 and forms a bearish structure (strong bearish candle, reversal candles, volume support, long wick)

Stop Loss: ₹1325

Risk-Reward: 1:1 | 1:2+

Logic: Historically rejected area as marked on chart.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone Trade:

Zone: ₹1293.30 – ₹1299.90

SL: ₹1301.45

Plan: Trade the Supply Zone (only on rejection confirmation)

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: No defined demand zone.

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Bharat Forge?

Will it reject from the supply zone or hold the bottom range?

Share your charts or thoughts below 👇

________________________________________________________________________________

Identify Strong Supply Zones & Set Targets with RRR Logic📈HERO MOTOCORP LTD | 15-Min Chart Analysis

📆Date: June 3, 2025

Ticker: NSE:HEROMOTOCO

Price: ₹4,205.00

Chart Overview:

The chart shows a clear intraday rejection from a key supply zone followed by strong bearish price action. A decisive move below ₹4,220 indicates supply pressure.

Two critical supply zones are marked:

Possible Strong Supply Zone: 4225.30–4233.60 | SL above 4234

Possible Supply Zone: 4241–4247.20 | SL above 4248

Price is currently trading around ₹4,205, just below these zones, signaling a potential continuation of the short-term bearish trend.

Supply Zone Breakdown:

🟥🟥 Strong Supply Zone (4225–4233):

Multiple wick rejections seen previously.

Ideal for aggressive short entries with tight SL above 4234.

🟥 Upper Supply Zone (4241–4247):

Acts as a secondary resistance.

Conservative short traders can consider this zone with SL above 4248.

How to Trade Supply & Demand Zones:

When to Enter (Short Trade from Supply Zone):

Wait for price to retest the supply zone.

Watch for bearish confirmation candles like shooting stars, bearish engulfing, or rejections with volume.

Enter short near the top of the supply zone.

Keep a tight stop-loss just above the zone.

Stop-Loss Placement:

For Strong Supply Zone: SL above ₹4234.

For Higher Supply Zone: SL above ₹4248.

Targets: Book profits at logical RRR levels (1:2 or 1:3 for high probability setups).

Why Use Risk-Reward?

Helps you define targets objectively.

Protects capital with fixed stop-loss logic.

Avoids emotional exits; everything is pre-planned.

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

$ETH BULLS HAVE ENTERED ALREADY?From the chart we can say the bulls have entered around the green zone and trying their hard to push through the above red zone and and after every FUD the bulls just don't give up. What I see here is bulls would soon overpower the bears around the red zone and give a crazy upside spike clearing all shorts above. Now the question is how soon would that happen ?? Maybe a day or maybe a week or month. Sooner or later this would be cleared :). View is negated once closed below the green zone and broken the low of that candle. Rest you guys are smart enough to plan a trade and minimize your risk and enjoy the gains / learn with losses.

DISCLAIMER : VIEWS ARE PURELY EDUCATIONAL AND NOT AN INVESTMENT ADVICE IN ANY SENSE. PLEASE CHECK WITH YOUR FINANCIAL ADVISOR BEFORE FOLLOWING MY IDEAS BLINDLY

Nifty Update: Key Supply Zone Test Ahead – Time to Book Partial On 27th February, I shared a detailed analysis explaining why Nifty was likely to take support from the Monthly Demand Zone .

At that time, the entire market was extremely bearish. FIIs were selling heavily, and most people believed that catching the bottom was impossible. But as demand and supply zone traders , we trusted the footprints of smart money—and as expected, Nifty took support exactly at that zone and reversed.

Today, Nifty is trading just below 5% of its all-time high . This shows the power of demand zones, which are not just random boxes but clear evidence of institutional activity.

Now, let's focus on the current market development .

📈 Nifty Nearing a Critical Supply Zone 📉

If you look at the chart, you'll see that Nifty is now approaching a Daily Supply Zone (Drop-Base-Drop) Which have strong follow-through, making this a strong resistance area .

In addition, I’ve marked a Weekly Supply Zone (Drop-Base-Rally) on the chart. Interestingly, the daily supply zone lies inside this weekly supply zone , creating a powerful confluence of resistance. This stacking of zones increases the probability of price facing rejection in this area.

📊 What Should Traders Do?

If you are holding profitable positions in stocks, this could be a good time to book partial profits .

Be prepared for a possible price rejection from the daily and weekly supply zone .

However, it’s not guaranteed that Nifty will fall from here. Price can also break through the zone, but as traders, capital protection comes first .

The most likely scenario is a small pullback , not a major fall. After the pullback, Nifty may resume its upward move.

Always focus on high-probability setups and manage your risk smartly.

📢 Conclusion:

Nifty is at a crucial supply zone cluster. A pullback is likely, so this could be a smart time to lock in some gains. Watch price action closely and adjust your strategy accordingly.

Lastly, Thank you for your support. Feel free to ask if you have questions.

“Trade what you see, not what you hear. The chart always whispers before the news screams.” 📊🔥

This analysis is purely for educational purposes and is not intended as a trading or investment recommendation. I am not a SEBI registered analyst.

THYROCARE at a Make-or-Break Level: Strong Rejection Expected?🧠 Technical Overview

THYROCARE has recently approached a strong supply zone , which is formed by a classic Drop-Base-Drop structure — footprints of institutional players.

When price enters such zones, it often encounters heavy selling pressure due to pending sell orders placed by big players (smart money). This creates an ideal condition for a potential reversal or correction.

At the current level, there's a clear indication that the stock might face resistance. If you're trader and already holding THYROCARE in your portfolio, this could be a wise area to consider partial or full profit booking .

📊 Key Observations

Strong Supply Zone: Price has entered a well-defined Drop-Base-Drop zone.

Risk Management Tip: Booking profits here can protect gains if the expected rejection plays out.

Short-Term Outlook: A pullback or downward move is likely if supply pressure dominates.

📌 Important Note for Investors

If you're a long-term investor, use this opportunity to assess your risk-reward ratio. This zone could lead to a temporary dip, but keeping an eye on fundamentals alongside technicals will help with bigger decisions.

🔥 Motivational Nugget

"Every great trader was once a beginner who dared to learn, analyze, and act with courage." 🚀💼📉

Lastly, Thank you for your support, your likes & comments. Feel free to ask if you have questions.

This analysis is purely for educational purposes and is not a trading or investment recommendation . I am not a SEBI registered analyst.

Key Levels: Nifty at a Crucial Turning Point! What's Next? Nifty's price structure is showing a clear pattern of lower highs and lower lows, indicating a prevailing downtrend. However, the market is now at an interesting Demand Zone that could determine its next big move.

📊 Key Observations

On January 27, Nifty took support from an old demand zone, and formed new lower high.

This minor reversal also led to the creation of a new demand zone.

Currently, Nifty is approaching this fresh Demand zone & old Demand Zone, making it a highly significant area to watch.

🔍 Possible Scenarios Ahead

Reversal from the Demand Zone : If Nifty respects this demand zones and reverses, we may see a potential bottom forming.

Sideways Consolidation : Nifty may move sideways, indicating indecision before a breakout.

Breakdown Below Demand Zone : If the demand zone is breached, Nifty could make a new lower low, continuing its downward trend.

🔄 What’s Next?

The next few sessions will be crucial in determining whether Nifty finds strength or continues its downward trajectory. Traders should closely monitor price action and key levels to gauge market sentiment.

Lastly, thank you for your support, your likes & comments. Feel free to ask if you have questions.

🌟 “Patience and discipline separate the successful trader from the rest.”

This analysis is for educational purposes only and is not a trading or investment recommendation. I am not a SEBI-registered analyst.

SIYSIL: A Strong Demand Zone Setup with High Reward Potential!When it comes to technical analysis, understanding demand zones can give traders an edge in identifying potential reversal points. Demand zones represent the footprints of institutional players who significantly influence the market. These zones indicate unfilled buy orders, and when the price revisits these areas, institutions tend to buy again, leading to a reversal.

Let's dive into SIYSIL's price action and explore its technical structure!

🌟 Weekly Chart Analysis

SIYSIL is currently displaying a highly structured setup. If we analyze the weekly chart , we can clearly see a well-defined Rally-Base-Rally (RBR) Demand Zone . The strength of this demand zone is reinforced by the fact that it broke a previous significant resistance level and formed an all-time high .

📊 Daily Chart Confirmation

Upon shifting to the daily chart , the same demand zone is clearly visible. A strong follow-through from this zone has resulted in a powerful imbalance, further validating the structure.

Moreover, there are currently no nearby supply zones that could act as resistance, making this demand zone even more significant.

💡 Observations

Act of Polarity: The concept of polarity further strengthens this structure— the previous resistance level has now turned into support , aligning perfectly with the demand zone.

Market Conditions: While this setup appears strong, it's essential to consider the current weakness in the overall market . Even well-defined structures can face challenges in uncertain conditions, so risk management is crucial.

📈 Final Thoughts

SIYSIL presents a structured demand zone setup with multiple confirmations on both the weekly and daily charts. The alignment of the demand zone with previous resistance-turned-support adds a strong layer of confluence.

Lastly, thank you for your support. Feel free to ask if you have questions.

🚀 "A successful trader is not the one who never loses but the one who learns to manage losses."

Disclaimer: This analysis is purely for educational purposes and is not intended as a trading or investment recommendation. I am not a SEBI-registered analyst.