XAUUSD (H1) – Liam PlanUptrend intact, but signs of short-term exhaustion | Trade reactions, not impulse

Quick summary

Gold remains in a strong H1 uptrend, continuing to print higher highs and higher lows within a well-defined bullish structure. However, after the recent sharp advance, price is starting to slow near the highs, increasing the likelihood of short-term pullbacks and two-sided price action.

➡️ The broader trend stays bullish, but execution should now be level-driven and reaction-based, not momentum chasing.

Technical view

Price is currently trading at elevated levels relative to recent structure, where prior buying activity has already been absorbed.

Key price areas to watch:

Short-term sell area: 5520 – 5530

Upper resistance area: around 5600

Pullback buy area: 5405 – 5420

Primary buy zone: 5150 – 5155

The current structure favors a pullback and rebalancing phase before any sustained continuation higher.

Trading scenarios

SELL – short-term reaction trades

Look for sell reactions around 5520 – 5530 if price shows weakness.

Downside targets sit near 5420, with further extension possible if the pullback develops.

These sells are tactical and short-term, not calls for a trend reversal.

BUY – aligned with the main trend

Primary scenario

Buy pullbacks into 5405 – 5420 if the area holds.

Targets back toward 5520 and higher.

Deeper scenario

If volatility increases, wait for price to retrace toward 5150 – 5155.

This area offers the best risk-to-reward for trend continuation.

Key notes

Strong trends still correct; patience matters.

Avoid entries in the middle of the range where risk outweighs reward.

Short positions are tactical only while the broader structure remains bullish.

What’s your plan:

selling reactions near 5520 – 5530, or patiently waiting for a pullback into 5405 – 5420 to rejoin the uptrend?

— Liam

Trading

GVT&D 1 Week View 📊 Current context (end-Jan 2026):

The stock is trading near ₹3,100-₹3,200 levels recently.

📈 Resistance Levels (Upside Targets)

1. ~₹3,170 – ₹3,200

– Near recent intraday highs and short-term caps on rallies.

2. ~₹3,250 – ₹3,324

– Approaching the 52-week high zone (~₹3,323.8).

3. ~₹3,350 +

– Above the prior yearly highs — next structural resistance if breakout confirmed.

📉 Support Levels (Downside Floors)

1. ~₹2,670 – ₹2,680

– First solid support zone from pivot analyses & moving averages.

2. ~₹2,600 – ₹2,610

– Secondary support around longer-term EMA levels / 200-day average and prior consolidations.

3. ~₹2,520 – ₹2,550

– Lower support in case of deeper correction — near the 1-week recent low zone.

🔄 Pivot & Momentum Signals

Technical tools (e.g., trading platforms) suggest mixed/neutral to moderately bullish momentum in the 1-week context, with some indicators leaning positive but others neutral.

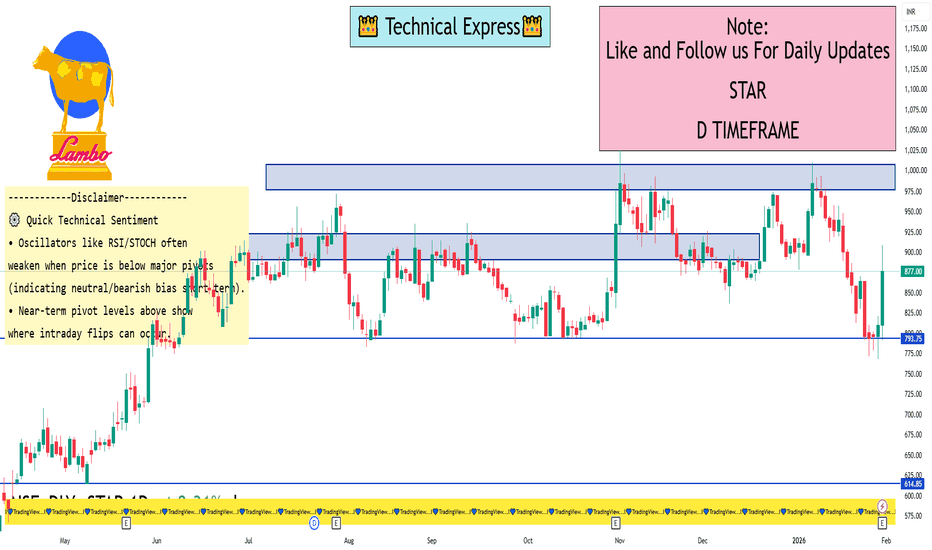

STAR 1 Day View 📌 Live Price Snapshot

• Current price: ~₹877.00 on NSE (Last traded)

• Today’s range: ₹791 – ₹908.40

• 52-Week range: ₹513.05 – ₹1,025.00

📊 Daily Pivot & Key Levels (1-Day Timeframe)

These are approximate pivot, support and resistance levels based on the most recent pivot analysis published today:

📍 Pivot Point

Central Pivot: ~ ₹850.8

🛑 Resistance Levels

R1: ~ ₹868.1

R2: ~ ₹891.0

R3: ~ ₹908.3

(These are short-term upside barriers where price may slow/reverse)

🟩 Support Levels

S1: ~ ₹827.9

S2: ~ ₹810.6

S3: ~ ₹787.7

(These are immediate downside zones where price could find buying interest)

📌 How to Use These Levels Today

✔ Bullish view:

• Above Pivot ₹850.8 → watch for closing above R1 (~₹868) to strengthen upside bias.

• Breaking and holding above R2 (~₹891) could extend toward R3 (~₹908).

✔ Bearish/Range view:

• Failure below Pivot ₹850.8 or S1 (~₹827.9) increases odds of deeper correction toward S2/S3.

• Intraday rejections at R1/R2 can signal short-term sellers.

Part 3 Institutional VS. TechnicalHow Option Premium Works

The premium is the price of the option. It has two parts:

1. Intrinsic Value

The real value if exercised today.

For calls:

Intrinsic = Spot Price – Strike Price

For puts:

Intrinsic = Strike Price – Spot Price

2. Time Value

Extra value due to remaining time before expiration.

Options with more time left are more expensive because:

There’s more chance the trade will go in your favor.

Volatility increases the uncertainty (and potential profit).

XAUUSD – H1 volatility surge | liquidity reset ongoingMarket Context

Gold is entering a high-volatility phase after an extended bullish run. The recent sharp impulse down from the upper zone is not random — it reflects liquidity distribution and aggressive profit-taking near highs, amplified by fast USD flows and event-driven positioning.

In this environment, Gold is no longer trending smoothly. Instead, it is rotating between liquidity zones, creating two-way risk intraday.

➡️ Key mindset: trade reactions at levels, not direction.

Structure & Price Action (H1)

The prior bullish structure has been temporarily broken by a strong bearish impulse.

Price failed to hold above 5,427 – 5,532, confirming this area as active supply / distribution.

The move down shows range expansion, typical after ATH phases.

Current price action suggests rebalancing and liquidity search, not a confirmed macro reversal yet.

Key read:

👉 Above supply = rejection

👉 Below supply = corrective / bearish bias until proven otherwise

Trading Plan – MMF Style

🔴 Primary Scenario – SELL on Pullback (Volatility Play)

While price remains below key supply, selling reactions is favored.

SELL Zone 1: 5,427 – 5,432

(Former demand → supply flip + trendline rejection)

SELL Zone 2: 5,301 – 5,315

(Mid-range supply / corrective retest)

Targets:

TP1: 5,215

TP2: 5,111

TP3: 5,060

Extension: 4,919 (major liquidity pool)

➡️ Only SELL after clear rejection / bearish confirmation.

➡️ No chasing breakdowns.

🟢 Alternative Scenario – BUY at Deep Liquidity

If price sweeps lower liquidity and shows absorption:

BUY Zone: 4,920 – 4,900

(Major demand + liquidity sweep zone)

Reaction targets:

5,060 → 5,215 → 5,300+

➡️ BUY only if structure stabilizes and bullish reaction appears.

Invalidation

A clean H1 close back above 5,432 invalidates the short-term bearish bias and shifts focus back to bullish continuation.

Summary

Gold is transitioning from trend extension to volatility expansion.

This is a market for discipline and level-based execution, not prediction.

MMF principle:

Volatility = opportunity, but only for those who wait for reaction.

Trade the levels. Control risk. Let price confirm.

SWIGGY 1 Day View 📊 SWIGGY – 1-Day Time Frame Key Levels (Daily Technical View)

📍 Latest Price Context (Approx)

Current/Live price range (recent session): ~₹305–₹315 (trading range today)

🔑 Daily Support Levels

These are price zones where buying interest could emerge if the stock dips:

📌 S1 (Immediate Support): ~₹313–₹315

📌 S2: ~₹307–₹310

📌 S3 (Deeper support): ~₹295–₹300

(levels help define where the stock may stabilize on a pullback)

📈 Daily Resistance Levels

These are zones where price may face selling pressure:

🔹 R1: ~₹329–₹330

🔹 R2: ~₹335–₹336

🔹 R3: ~₹345–₹346

(above these, the stock needs strong momentum to continue higher)

📊 Daily Pivot Levels

Pivot levels often act as reference for thematic direction:

📍 Pivot (Central daily level): ~₹326–₹327

(Above this = mildly bullish bias for the day; below this = bearish bias)

📌 Based on Technical Indicators

Short-term indicators show mixed to bearish bias in daily trend, with several oscillators and moving average signals leaning sell/oversold — reflecting current selling pressure in the market.

xauusd recently i capture #XAUUSD xauusd recently i capture #XAUUSD

Agar ak strong poi hai daily time frame ka strong poi ( fvg + opposite color ka breaker block + orderblock ) bias ke opposite direction me volume gap , imbalance ho to volume imbalance , gap ka value nahi rahega tab wo poi ka first fvg+ob ko tap karne jarur jayega

Aur jab strong poi ko tap kar lega phir wo jayega gap ko respact dene

xauusd recently captured #XAUUSD

If there is a strong POI (FVG + breaker block of opposite color + order block) on the daily time frame, the volume gap is in the opposite direction of the bias. If there is a volume imbalance, the gap value will not be there, then the POI will first tap the FVG + OB.

And once the strong POI is tapped, it will then go to respect the gap.

sorry my english is weak padh lena bhai log

XAUUSD (GOLD) | BREAKOUT VS BREAKDOWN LEVEL | 29th Jan'2026XAU/USD (Gold) Outlook | 29 Jan 2026

Gold (XAU/USD) is trading near 5513, maintaining a strong bullish structure across daily, weekly, and monthly timeframes. Price is holding well above key moving averages, indicating sustained buying momentum. As long as gold stays above the 5515–5495 support zone, the upside bias remains intact with potential continuation toward 5555–5590. A decisive break below 5495 may trigger short-term corrective pressure, but the broader trend remains positive.

Breakout & Breakdown Levels

Bullish Breakout: Above 5555 | Bearish Breakdown: Below 5495

Disclaimer: This content is for educational purposes only and not financial advice. Trading involves risk; manage your position size wisely.

Part 4 Technical Analysis Vs Institution Option TradingA. When to Buy Options

Breakout from consolidation

High volume at breakout

Trend confirmed

IV low → premiums cheap

Clear direction available

B. When to Sell Options

Range-bound market

No trending structure

IV high → premiums expensive

Event after event → IV crash expected

XAUUSD – M30 Technical AnalysisMild Pullback Before the Next High | Lana ✨

Gold has extended sharply and is now trading into a high-resistance zone, where price often needs a light correction or consolidation to rebuild liquidity before attempting higher levels again. The broader trend remains bullish, but the next clean opportunity is more likely to come from a pullback into structure, not from chasing the highs.

📈 Market Structure & Trend Context

Price is still respecting the broader bullish structure, but the current leg is stretched after a strong impulsive run. The market is now reacting under the highest resistance zone, which typically creates short-term profit-taking and liquidity reactions before continuation.

As long as price holds above key structural support, the bullish trend remains intact.

🔍 Key Technical Zones

Highest resistance zone: 5585 – 5600 This is a premium area where price may hesitate or reject in the short term.

First support zone: 5508 A key decision level where price can rebalance before choosing direction.

Buy liquidity zone: 5446 – 5450 A strong liquidity pocket where buyers are more likely to step back in.

Long-term support zone: 5265 – 5285 A deeper base area if volatility expands into a broader correction.

🎯 Trading Scenarios

Gold may correct modestly from resistance and retest structure before pushing higher.

Buy Entry: 5446 – 5450 Stop Loss: 5438 – 5440

Take Profit targets:

TP1: 5508

TP2: 5538 – 5545

TP3: 5585 – 5600

TP4: 5650+

A shallower pullback toward 5508 could also be enough to reset momentum before another attempt higher, but repeated rejection at the top would increase the risk of deeper consolidation.

🧠 Lana’s View

Gold remains bullish, but the market is now at a level where patience matters more than speed. Rather than chasing price near resistance, the focus should stay on how price reacts during pullbacks into key structural zones.

✨ Respect the structure, manage risk, and let price come to your level.

GRSE 1 Day Time Frame 📈 Live Price & Intraday Range (as of mid‑session)

Current Price (approx): ₹ 2,570 – ₹ 2,573 (NSE) — showing a positive move vs previous close.

Today’s High: ~₹ 2,647.90

Today’s Low: ~₹ 2,550.00

This indicates bullish participation intraday so far.

📌 Intraday Pivot & Support / Resistance Levels

Based on standard pivot calculation using the previous session’s range:

Pivot Point (PP): ~₹ 2,480.8

Resistance Levels:

R1: ~₹ 2,565.9

R2: ~₹ 2,613.1

R3: ~₹ 2,698.2

Support Levels:

S1: ~₹ 2,433.6

S2: ~₹ 2,348.5

S3: ~₹ 2,301.3

📌 Interpretation (Day Trading)

Above pivot (~₹ 2,480): bullish bias for the session.

Key breakout trigger: above R1/R2 levels (~₹ 2,565–2,613).

Downside support zones: around ₹ 2,433 then ₹ 2,348 if sellers step in.

🧠 How Traders Use These Levels Today

✅ Bullish scenario:

If the stock sustains above R1 (~₹ 2,566) and R2 (~₹ 2,613) with volume, buyers could push towards R3 (~₹ 2,698).

❗ If price weakens below S1/S2 (~₹ 2,433 / ₹ 2,348), short‑term downward pressure could emerge.

📍 Pivot (~₹ 2,480) is the key “bull vs bear” session decision level — staying above it generally suggests bulls are in control.

⚠️ Quick Risk Notes

These are intraday technical levels, not investment advice.

Stock prices can move fast; levels won’t guarantee direction.

Combine with volume and real‑time charts for best intraday decisions.

DATAPATTNS 1 Week time Frame 📌 Current Price Snapshot (Live / Latest Data)

Data Patterns (India) Ltd price (approx): ~ ₹2,592 — ₹2,620 per share (NSE) based on latest trading session updates.

52‑Week Range:

• High: ₹3,268.80

• Low: ₹1,351.15

📈 Weekly Pivot & Levels (classic method)

Level Price (Approx)

Weekly Pivot (central) ₹2,943.7

Weekly R1 ₹3,277.0

Weekly R2 ₹3,453.4

Weekly R3 ₹3,786.7

Weekly S1 ₹2,767.3

Weekly S2 ₹2,433.9

Weekly S3 ₹2,257.6

🔁 Weekly Fibonacci Pivot Levels (Alternate)

Level Price (Approx)

Weekly Pivot (Fibo) ₹2,943.7

R1 (Fib) ₹3,138.4

R2 (Fib) ₹3,258.7

R3 (Fib) ₹3,453.4

S1 (Fib) ₹2,748.9

S2 (Fib) ₹2,628.7

S3 (Fib) ₹2,433.9

📌 Quick Weekly Levels Summary

Current level (approx): ₹2,592 – ₹2,620

Weekly Pivot: ~₹2,943

Weekly Resistance 1: ~₹3,277

Weekly Resistance 2: ~₹3,453

Weekly Support 1: ~₹2,767

Weekly Support 2: ~₹2,433

Weekly Support 3: ~₹2,258

Part 1 Technical Analysis Vs Institution Option Trading What Are Options?

Options are contracts, not shares.

They give you a right (not an obligation) to buy or sell an underlying asset—usually a stock or index—at a predetermined price.

You do not own the stock, you only trade the contract.

Options derive their value from something else → an index (Nifty, Bank Nifty), stock (Reliance, TCS), or commodities (gold).

Therefore, they are called “derivatives.”

Two basic types:

Call Option (CE) → Right to buy

Put Option (PE) → Right to sell

You can either Buy or Sell (Write) both types.

Option trading allows profits in up, down, and sideways markets.

XAUUSD – Bullish trend, focus on Buy pullbacks to 5,700Market Context (M30)

Gold continues to trade in a strong bullish continuation after a clean impulsive leg higher. The recent consolidation above former resistance shows acceptance at higher prices, not exhaustion. This behavior suggests the market is rebalancing liquidity before the next expansion leg.

On the macro side, USD remains under pressure, while safe-haven demand stays firm. Even though bond yields are relatively stable, capital flows continue to favor gold, keeping the upside bias intact.

➡️ Intraday bias: Bullish – trade with the trend, not against it.

Structure & Price Action

• Market structure remains bullish with Higher Highs – Higher Lows

• Previous resistance has flipped into demand and is being respected

• No bearish CHoCH or structural breakdown confirmed

• Current pullbacks are corrective moves within an active uptrend

Key takeaway:

👉 As long as price holds above key demand, pullbacks are opportunities for continuation.

Trading Plan – MMF Style

Primary Scenario – Buy the Pullback

Patience is key. Avoid chasing price into extensions.

• BUY Zone 1: 5,502 – 5,480

(Minor demand + short-term rebalancing zone)

• BUY Zone 2: 5,425 – 5,400

(Trendline support + deeper liquidity zone)

➡️ Only execute BUYs after clear bullish reaction and structure confirmation.

➡️ No FOMO at highs.

Upside Targets

• TP1: 5,601

• TP2: 5,705 (upper Fibonacci extension / expansion target)

Alternative Scenario

If price holds above 5,601 without a meaningful pullback, wait for a break & retest to join the next continuation leg.

Invalidation

A confirmed M30 close below 5,400 would weaken the bullish structure and require reassessment.

Summary

Gold remains in a controlled bullish expansion supported by both structure and macro flow. The edge lies in discipline — buying pullbacks into demand while the trend stays intact, not predicting tops.

➡️ As long as structure holds, higher prices remain the path of least resistance.

XAUUSD – Brian | M45 Technical Analysis— Buyers Still in Control Above 5,200

Gold continues to trade firmly above the 5,000 milestone, with price action confirming strong bullish acceptance at higher levels. On the M45 timeframe, the market remains in an expansion phase, supported by aggressive buying volume and well-defended value areas.

Current conditions suggest that buyers are still in control, with pullbacks being absorbed rather than sold into. This behavior typically characterizes a strong trending environment rather than a distribution phase.

Macro Context (Brief Overview)

From a fundamental perspective, institutional positioning remains stable, with no signs of defensive de-risking despite gold trading at record highs. At the same time, the market remains sensitive to upcoming macro events, which may introduce short-term volatility but have not altered the broader bullish bias so far.

As long as uncertainty persists and risk appetite fluctuates, gold continues to benefit from its role as a strategic hedge.

Market Structure & Volume Context (M45)

The current structure on M45 remains constructive:

Price is holding above the rising trendline.

Buying volume remains elevated, indicating strong demand and reduced willingness to sell.

Pullbacks continue to develop in a corrective manner rather than impulsive declines.

In strong trends, high volume combined with shallow retracements often signals continuation rather than exhaustion.

Key Technical Zones to Watch

Based on the chart structure and volume profile, several zones stand out:

Upside Reaction Zone

5,385: A major resistance and extension area where price may pause, consolidate, or react before deciding the next directional leg.

Primary Value Support

POC + VAH: 5,243 – 5,347

This is the most critical zone for continuation. Acceptance and holding within this range would reinforce the bullish structure.

Secondary Support

VAL: 5,163 – 5,168

A deeper pullback into this zone would still be considered corrective as long as price stabilizes and reclaims value.

Deeper Structural Support

POC: 5,086 – 5,091

This level represents broader value and would likely come into play only during heightened volatility.

Forward Expectations & Bias

Primary bias: Bullish continuation while price holds above value zones

Pullbacks are currently viewed as opportunities for re-accumulation rather than trend reversal.

Short-term volatility is expected, but structure remains the key reference point rather than individual candles.

Strong trends rarely move in straight lines. The ability of gold to hold value during pauses continues to support the case for further upside.

Refer to the accompanying chart for a detailed view of value areas, trend structure, and projected paths.

Follow the TradingView channel to get early structure updates and join the discussion on key market levels.

Part 3 Institutional vs. TechnicalOption Trading StrategiesHere are some popular option trading strategies:

1. Long Call/Put- Long Call: Buy call option to bet on price increase.

- Long Put: Buy put option to bet on price decrease.

2. Covered Call- Sell call option on stock you own to generate income.

3. Protective Put- Buy put option on stock you own to hedge against losses.

4. Straddle- Buy call and put options at same strike price and expiry to profit from volatility.

5. Spread Strategies- Bull Call Spread: Buy call at lower strike, sell call at higher strike.

- Bear Put Spread: Buy put at higher strike, sell put at lower strike.

Part 2 Institutional vs. TechnicalOption trading involves buying and selling contracts that give the right, but not the obligation, to buy or sell an underlying asset at a set price (strike price) before a certain date (expiry).

- Call Option: Right to buy the asset.

- Put Option: Right to sell the asset.

- Buying Options: Limited risk, potential for high returns.

- Selling Options: Higher risk, potential for income.

BTC/USD 1 Month Time Frame 📈 Real‑Time BTC/USD Snapshot

Bitcoin live price (BTC → USD):

≈ $89,200 – $89,300 USD based on recent aggregated market data.

Over the past month, Bitcoin’s price has fluctuated between:

High ≈ $97,759

Low ≈ $86,181

with a net mild upside in the 30‑day range.

📊 Key 1‑Month Support & Resistance Levels

🚧 Resistance Levels

These are ceilings where price has historically struggled to rise above:

$95,800 – $97,800 — upper resistance band near recent 1‑month highs.

$100,000 psychological level — big round‑number resistance, important if price approaches it again.

$103,500+ — longer technical resistance above $100K (higher timeframe).

Short‑term focus: a close above $96K–$97K could signal short‑term bullish momentum.

🛟 Support Levels

These are floors where price finds buying interest:

$88,900 – $89,000 — current intermediate support around today’s price band.

$86,000 – $87,000 — stronger support range near recent lows.

$84,000 – $84,200 — volatility support zone (lower boundary).

Bearish risk: if price drops below $86K, the next deeper support is near $84K–$83K.

🧠 How to Use These Levels

Traders: Use $88,000, $86,000 as potential swing supports; $95,000 and above as breakout targets.

Long‑term holders: These levels help understand volatility zones, but long‑term trends require larger time frame analysis.

HINDZINC 1 Month View 📊 Current Price Context (as of late Jan 28, 2026)

Stock is trading near its recent highs around ₹720–₹730 on NSE.

📈 1-Month Key Levels (Support & Resistance)

🔁 Major Resistance Levels

1. ~₹730–₹735 — Immediate resistance around recent highs/upper range of the month (where price struggled on breakout)

2. ~₹750 — Psychological resistance zone above current levels (weekly/medium term trend)

3. ~₹770–₹780+ — Extended upside if breakout sustains (higher supply zone)

(Break above ~₹735 with strong volume can open room toward these higher targets.)

🔽 Immediate Support Levels

1. ~₹695–₹700 — First support pivot zone (near recent consolidation low)

2. ~₹675–₹680 — Next technical support from pivot and short-term averages

3. ~₹650–₹660 — Stronger 1-month base support if the stock pulls back further

4. ~₹620–₹630 — Major support zone if broader weakness emerges (coincides with longer moving averages)

📊 Moving Average Context

The 20/50/100/200-day SMAs/EMAs are generally positioned below the current price, showing positive slope — often interpreted as bullish momentum on the medium-term charts.

📌 Interpretation / Range Estimate (1-Month)

Based on recent trading dynamics and pivot analysis, a reasonable 1-month trading range could be approximately:

Bullish Scenario: ₹735 → ₹770+

Bearish / Pullback Range: ₹700 → ₹650

This gives a sense of where the stock may find near-term resistance and support around the current price action.

GOLD Buy Pullbacks in Bullish TrendMarket Context (M30)

Gold continues to trade within a strong bullish continuation phase, holding firmly inside a well-defined ascending channel. Recent pullbacks are technical retracements for liquidity rebalancing, not signs of distribution or trend exhaustion.

On the macro side, persistent USD weakness, sustained safe-haven demand, and only modest Fed easing expectations keep the broader backdrop supportive for gold. This combination allows upside momentum to remain controlled and constructive rather than emotional.

➡️ Overall bias: Bullish – prioritize BUY setups aligned with the main trend.

Structure & Price Action

M30 structure remains intact with clear Higher Highs and Higher Lows.

Price continues to respect previous demand and key levels, confirming active buyer participation.

No bearish CHoCH has been confirmed.

The current leg is expanding toward higher Fibonacci extensions, reinforcing trend continuation.

Key insight:

👉 As long as structure holds, pullbacks represent opportunity — not risk.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Focus on patience and execution at discounted levels, not chasing price at extensions.

BUY Zone 1: 5,185 – 5,170

(Short-term demand + channel support)

BUY Zone 2: 5,106 – 5,085

(Key level confluence + trendline support)

➡️ Execute BUYs only after clear bullish reaction and structure confirmation.

➡️ Avoid FOMO at extended highs.

Upside Targets:

TP1: 5,250

TP2: 5,309 (Next ATH extension zone)

Alternative Scenario

If price holds firmly above 5,250 without a meaningful pullback, wait for a break & retest before looking for continuation BUYs.

Invalidation

A confirmed M30 close below 5,044 would weaken the current bullish structure and require reassessment.

Summary

Gold remains in a controlled bullish expansion, driven by structure and macro flow. The edge is not calling the top, but buying pullbacks within demand while the trend remains intact. As long as structure holds, higher prices remain the path of least resistance.