Trading

HDFC Bank - Real Options Strategy ExecutedHDFC BANK - OPTIONS STRATEGY EXECUTED IN MY ACCOUNT

While I was getting ready to write a post cum video on the Infosys Strategy, I looked at my holdings and realized that HDFC Bank was once again at a make-or-break juncture - 1630. It has turned down from this level quite a few times. So exited half my position at the price and banked the gains.

This helped me regain objectivity related to the scrip. And immediately, I thought of checking if I could fund a Bull Call Spread in HDFC Bank with the proceeds that I received from the sale of equity in part. I know smart readers are now calculating how many shares I would have sold and that is OK! I like that kind of approach as it would help you develop your mind to your benefit. I also do such things so I know this is a natural reaction.

HDFC Bank is behaving like TCS as it is trying to scale higher highs as it gets ready to face the results that are due on 15-10-21. I know it is a bit too early to execute a strategy for the results but I had the funds today so for me, today was a good day.

I chose to create a Bull CE Spread as under:--

Long 1620 CE at 44.30

Short 1640 CE at 36.05

When I executed the strategy, the spot was at 1629.65-1630. EOD is at the same level and my strategy is at cost.

Please have a look at the video to know more about the details. In case you are reading this on your mobile App, you may not see the link. Please use a web version and you will see the video link in it. This issue has been flagged with Investing.com already.

I will get back to you on 18-11-21 as that is when the scrip would react to the Q2 results.

If you want to test a strategy like this, please remember that I am sharing this only for educational and informational purposes only. I believe that by sharing to the extent I can via such posts and videos, even I am able to improve my learnings and readings of the market.

Please take good care of you capital as you would be in the game as long as your capital is alive - money would eventually come in once you are good at the process that you end up developing for yourself.

Till we meet again,

Please keep learning, implementing & making money!

Best wishes,

Umesh

12-10-21

Infosys Q2 results based strategies INFOSYS Q2 RESULT BASED STRATEGIES

The IT heavyweight is scheduled to declare its results tomorrow. However, I am not sure at what time the results are likely to be declared so am creating the strategy now itself and have this post cum video explaining the basis on which I have created the strategy only for the purposes of tracking I have not taken a position. If I do take, I will let you know.

Infosys has been behaving in a very unusual manner for quite some time. Either it goes up quickly and then abruptly falls and then goes in to a drifting mode then leading to consolidation. I have traded Long Only options in the scrip and have gained good ROI. However, for the last few weeks I have stayed away from all IT scrips in Options as the behavior is not something that I like to trade.

Infosys Spot is at 1673 when I am writing this post so my strategies would be based on the same. Please watch the video to know the workings related to the strategy.

EFT BASED INVESTINGHello Readers!

As of EOD 01-10-2021, the indices ended in a good amount of Red and there is some sort of pessimism set in from the posts, messages that I have been reading and watching. People have started calling for downward levels citing DXY and global issues and whatnot.

As a trader/investor, I feel that the greater the pessimism and such pessimism is confirmed by a downward price move, the better it is. The reason is very simple -

We are not in a sorry state as we were in March-April 2020. So any dip may only be seen as a buying opportunity as indices eventually would go up. The problem occurs when one is trading in derivates where MTM losses have to be settled with the exchange via the broker and that is where the pain comes.

However, if one buys quality scrips during such dips, those would go up if not in line with the markets at least in line with the sectoral trend. But again, which stock to pick may be an issue as either these are already hanging in the air or are nowhere near fundamental/technical levels to initiate a buy.

So I thought of doing a check on the NIFTY as well as BANK NIFTY ETFs - where I already have some holdings invested at lower levels. I was quite pleased with what I ended up working out and therefore, thought of sharing the same with you folks. In fact, just before recording this video, I was talking to a friend and I explained to him what I have explained in the video and he was quite interested in placing the order next week.

Now, I am not a SEBI regd analyst / advisor, but my view is medium to long term as eventually, over a period of time indices tend to achieve higher highs and that is why I thought of this approach to investing.

Please let me know what do you think about it. Based on where NIFTY trades on 4-10-21, I may invest part of my funds into both the approaches that I have shared in the video.

Happy Learniing, Investing & Money Making!

Umesh

2-10-21

WHY SHOULD YOU INVEST IN THE UPCOMING IPO OF ADITYA BSL AMC IPO?WHY SHOULD YOU INVEST IN THE UPCOMING IPO OF ADITYA BIRLA SUN LIFE AMC IPO ?

HDFC AMC IPO Details

IPO Opening Date

Jul 25, 2018

IPO Closing Date

Jul 27, 2018

Issue Type

Book Built Issue IPO

Face Value

₹5 per equity share

IPO Price

₹1095 to ₹1100 per equity share

Market Lot

13 Shares

Min Order Quantity

13 Shares

HDFC AMC lists at 58% premium over issue price

SECTIONS

HDFC AMC lists at 58% premium over issue price

52 Week High 3365

52 Week Low 2270

Listed at 1738

So an initial investment of 13*1100 shares would have meant investing INR 14,300.

At its CMP on 27-9-21 EOD, it would have been worth INR41,171

Or 2.61 times your investment!!

Do you need any more explanations?

Why invest in HDFC MF schemes when you can invest in transparent and tradeable shares of the same company that give better ROI!

Note --

I am not a SEBI regd. Analyst or advisor. All information and experiences shared here are for awareness and educational purposes only.

27-9-21

RELIANCE Don't take long position still......Hii this is trader Kanishk

This is the analysis of RELIANCE

Here the phase is very volatile and we don't have to took long position in RELIANCE without confirmation .

Reliance is an uptrend stock of=n each and every time frame.

we can take our long positional trade in RELIANCE but after confirmation.

Watch this complete video i've discussed everything.

this is a bear market phase and this is not the recovery this is the bullish trap .

so please avoid yourself to put the long positional trade at this time without any confirmation.

Please watch this video complete and follow all the steps .

Please do the multi timeframe analysis during these type of phases .

Guys let me know you that i am a trader and a trader have a winning probability of 50-65% no any trader is there who have a winning ratio more than this . Who says you that i am having a 100% winning strategy then F**k these type of people and try to be correct only 50 - 60 % of time which will give you a lot of money if you properly follow the risk reward ratio .

DISCLAIMER

I am not recommending you to buy or sell any stock, i am just sharing my analysis here.

Maintain your risk reward ratio and then trade.

Guys you can also follow me on twitter for any queries.

BEST TRADING STRATEGY ON TRADING VIEW BIND BACK TESTEDThis video is about blind testing the world's best script on TV and see if it still generates the net profit of 4000-15000% of net profit in just 1.5 years . This means 40 to 150 times of initial investment in just 1.5 years. You can ofcourse deduct the fee/commission part of platforms and some more but still, this is too much. What I have done here is developed a pine script which when I applied to any market pair on cryptocurrency market generates staggering profits in just 1.5 years. Today, to make it purely blind I have used a mobile application to generate random numbers first and then with that number I select the market pair and apply my script to see the back testing results. Results are still the same as we saw in my first video about the script. Also, I discussed various ways people can take advantage of the script. People can either buy it and apply it own their own on any number of charts on any market and generate signals/calls for trading automatically or they can chose to go for Copy Trading Service where they don't have to do anything but just subscribe to my Copy Trading Services and grow with me and relax while my script does the job for both of us. For details you can message me or email me.

Nifty - Century (100+) Before Batsman Cypher ! Trading Strategy

Selling only between 12340-12360 as suggested yesterday with strict stops above 12375. Traders can be cautious & avoid sell if it is moving above 12350 as early warning! - I mean don't take sell if moves above 12350- fulcrum level.

Targets

12280

12200-12220

Video Idea on Indusind Bank

Thanks for all support

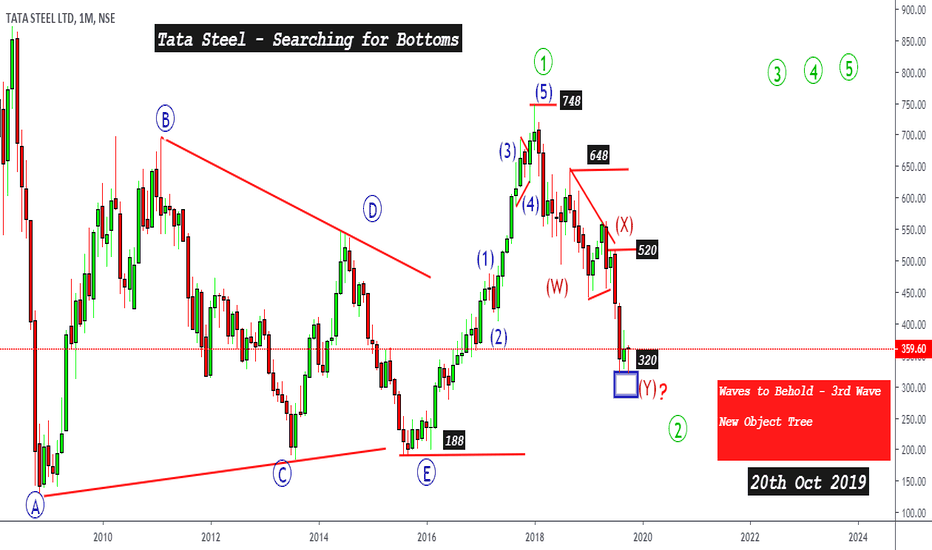

Tata Steel - Searching for Bottoms from 280-320Correction Stock is trading in 100's -have wrongly used 11000+ in the video (11000 is for Benchmark Index -Nifty)- should be taken as 1000+

Disclaimer

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Trading Strategy

Possible dip below 320 can support at 280's -300 - getting dip & bouncing above psychological level of 300 shall be next clue for upside beyond 1000+

Plan A

Buying in 280-290 Strict stops below 280 for Target 400-410 & Above 400 for 510-520

Plan B

Buying above 520 for 645-650

Plan C

Buying above 650 for 750 & 1000+

Plan D

Buying from 280-300 if holds above 280 (should not move below 280) expect 1150-1200 as the explosive target upside which wave 3 distance -normally travels 161.8% of wave 1 -

Current case :

Wave ((1)) Distance = 748 - 188 = 560

161.8% of 560 points = 560 * 1.618 = 907 approx

Measuring 907 from yet to bottom Wave ((2)) which could be 320 or close to 280 downside so ... (907 + approx 280/320 = 1150 to 1200 zone) which gives upside objective of 1150-1200 target mentioned in Plan D above- which is minimum Wave 3 Distance it can travel next as per the books.

Thanks for watching the video & your support.

Nifty - The Culmination Point for 13500-14000Disclaimer

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

---------------------------------------------------------------------------------------------------------------------------------------------

Trading Strategy

Plan A

Buy Above 11362 – Target: 11550-11580

Plan B

Buy Above 11620 – Target: 11690-11710 / Buy above 11710 – Target: 11980-12000 & Above 12000-Target: 12100

Plan C

Sell in 11550-11580 if holds below 11620 for downside Target 1: 11350-11360, Target 2: 11080-11100,

Target 3: Below 11080 – 10950-10975 Target 4: Below 10950- 10750-10800.

Plan D

Buy Above 12105 – Target : 13500-14000

Plan E

Buy in 10725-10750 Holding above 10670 for target : 11650-11700 / target: 13500-14000

Last Ideas

Budget 2019 - Careful at 11975

Is 11461 -Bottoms -The Accumulation Wedge

Head & Shoulder Pattern - How I cracked 11141 to 10665

E-wave or Extradition Bill(HongKong) - Is it too late

E-wave shock at 11085 for 10750