Trend Analysis

NUVAMA: Back to the Launchpad?NUVAMA has just hit its Historical Support Zone at 1220. Historically, this level acted as a massive springboard, fueling a rally all the way to 1520.

The Current Setup: While we are back at the demand zone, the price structure has weakened. We are keeping a "Neutral" bias until major levels are reclaimed.

⚡️ Intraday/Short Term: If the stock holds above 1232, we expect a bounce toward 1360. (Stock not so bullish below 1440)

⚠️ The Danger Zone: A decisive trade below 1216 could open the doors for further downside toward 1135.

📈 Long-Term View: Bearish to Neutral (range bound) for now. We will only turn structurally Bullish once the stock sustains above 1440 as then it may reclaim 1520

XAUUSD – Brian | M45 Technical Analysis— Buyers Still in Control Above 5,200

Gold continues to trade firmly above the 5,000 milestone, with price action confirming strong bullish acceptance at higher levels. On the M45 timeframe, the market remains in an expansion phase, supported by aggressive buying volume and well-defended value areas.

Current conditions suggest that buyers are still in control, with pullbacks being absorbed rather than sold into. This behavior typically characterizes a strong trending environment rather than a distribution phase.

Macro Context (Brief Overview)

From a fundamental perspective, institutional positioning remains stable, with no signs of defensive de-risking despite gold trading at record highs. At the same time, the market remains sensitive to upcoming macro events, which may introduce short-term volatility but have not altered the broader bullish bias so far.

As long as uncertainty persists and risk appetite fluctuates, gold continues to benefit from its role as a strategic hedge.

Market Structure & Volume Context (M45)

The current structure on M45 remains constructive:

Price is holding above the rising trendline.

Buying volume remains elevated, indicating strong demand and reduced willingness to sell.

Pullbacks continue to develop in a corrective manner rather than impulsive declines.

In strong trends, high volume combined with shallow retracements often signals continuation rather than exhaustion.

Key Technical Zones to Watch

Based on the chart structure and volume profile, several zones stand out:

Upside Reaction Zone

5,385: A major resistance and extension area where price may pause, consolidate, or react before deciding the next directional leg.

Primary Value Support

POC + VAH: 5,243 – 5,347

This is the most critical zone for continuation. Acceptance and holding within this range would reinforce the bullish structure.

Secondary Support

VAL: 5,163 – 5,168

A deeper pullback into this zone would still be considered corrective as long as price stabilizes and reclaims value.

Deeper Structural Support

POC: 5,086 – 5,091

This level represents broader value and would likely come into play only during heightened volatility.

Forward Expectations & Bias

Primary bias: Bullish continuation while price holds above value zones

Pullbacks are currently viewed as opportunities for re-accumulation rather than trend reversal.

Short-term volatility is expected, but structure remains the key reference point rather than individual candles.

Strong trends rarely move in straight lines. The ability of gold to hold value during pauses continues to support the case for further upside.

Refer to the accompanying chart for a detailed view of value areas, trend structure, and projected paths.

Follow the TradingView channel to get early structure updates and join the discussion on key market levels.

Golds final meters coming upAs of my last Gold idea, which turned out to be correct, we now finished the big Wave 3 and also the Wave 4 pullback. On the 1hr Timeframe we just finished the internal Wave 5 meaning we will continue with a following ABC pattern. After that we will have the final push to bigger Wave 5.

This might happen today if a lot of bullish momentum shows up at NYS, however more likely we will finish the final target zone by next week.

SOLARINDS — Clean Trendline Breakout After Multiple RejectionsPrice respected the descending resistance trendline multiple times, showing strong selling pressure at higher levels.

Over time, buyers kept stepping in with higher lows, compressing price into a tight range — a classic sign of accumulation.

The recent strong breakout above the trendline confirms a shift in control from sellers to buyers.

This kind of simple structure-based breakout often leads to fresh momentum when followed by good volume and follow-through.

No indicators.

Just price doing what it always does.

XAUUSD (H2) - Liam Plan (Jan 28)XAUUSD (H2) – Liam Plan (Jan 28)

New ATH, strong safe-haven flow | Follow trend, buy FVG pullbacks only

Quick summary

Gold continues to print new all-time highs as global capital rotates into safe-haven assets amid persistent economic and geopolitical uncertainty tied to recent US policy decisions. Additional support comes from concerns around Fed independence and expectations of lower US rates, keeping real yields capped.

Despite the bullish backdrop, price is now extended above equilibrium. The edge is not in chasing strength, but in waiting for pullbacks into imbalance and liquidity zones.

➡️ Bias stays bullish, execution stays patient.

Macro context (why gold stays bid, but volatile)

Ongoing geopolitical uncertainty keeps structural demand for gold intact.

Rate-cut expectations and doubts around Fed autonomy weaken the USD’s long-term appeal.

USD is attempting a technical bounce, but this has not shifted gold’s underlying bid.

➡️ Conclusion: macro supports higher prices, but short-term moves will likely rotate to rebalance inefficiencies.

Technical view (H2 – based on the chart)

Price is trending cleanly higher after multiple bullish BOS, riding an ascending structure and expanding into premium.

Key levels from the chart:

✅ Major extension / sell-side target: 5280 – 5320 (2.618 fib expansion)

✅ FVG / continuation buy zone: 5155 – 5170

✅ Structure support: 5000 – 5050

✅ Trend invalidation (deeper): below 4950

Current price action suggests a likely path of push → pullback → continuation, rather than straight-line expansion.

Trading scenarios (Liam style: trade the level)

1️⃣ BUY scenarios (priority – trend continuation)

A. BUY the FVG pullback (cleanest setup)

✅ Buy zone: 5155 – 5170

Condition: price taps FVG and shows bullish reaction (reclaim / HL / displacement on M15–H1)

SL (guide): below 5125 or below reaction low

TP1: recent high

TP2: 5280

TP3: 5320+ if momentum expands

Logic: This FVG aligns with prior buy-side liquidity and structure — a high-probability continuation zone.

B. BUY deeper structure support (only if volatility spikes)

✅ Buy zone: 5000 – 5050

Condition: liquidity sweep + strong rejection

TP: 5170 → 5280

Logic: This is value within trend. No interest in longs above premium if this level breaks.

2️⃣ SELL scenarios (secondary – reaction only)

SELL at extension (scalp / tactical only)

✅ Sell zone: 5280 – 5320

Condition: clear rejection / failure to hold highs on lower TF

TP: 5200 → 5170

Logic: Extension zones are for profit-taking and short-term mean rotation, not trend reversal calls.

Key notes

New ATHs invite FOMO — don’t be that liquidity.

Best trades come after pullbacks, not during impulse candles.

Reduce size around Fed headlines.

What’s your plan: buying the 5155–5170 FVG pullback, or waiting for a stretch into 5280–5320 to fade the reaction?

— Liam

AUDNZD just touched a sensitive areaThe AUDNZD pair is currently testing a highly sensitive zone that has historically acted as a powerful springboard for price action. We are at a "make or break" junction, watch these levels closely!

1. If the price successfully holds its ground and continues to trade above 1.1565, the historical demand will likely confirm a fresh leg up.

Target: 🎯 1.1620

Sentiment: Strong recovery potential as bulls defend the zone.

2. If the demand fails to hold and we see a slide below 1.1539, the structural narrative shifts. A breach here suggests the sellers have taken control of the trend.

Target: 🎯 1.1467

Sentiment: Potential for a rapid acceleration toward deeper support.

Confirm the move using volumes !

Gold retraces after surge – trend remains intact.Quick Context

Recent geopolitical uncertainty continues to support safe-haven flows. Gold has already delivered a strong bullish impulse, and the current move looks like a healthy correction, not a reversal.

Technical Snapshot (H1–H4)

Strong bullish impulse already completed

Current price action = controlled retracement

No bearish CHoCH, no structural breakdown

Market is resetting momentum after expansion

This is typical impulse → retrace → continuation behavior.

Key Levels to Watch

Buy Zone: 5,180 – 5,160

Invalidation: H1 close below 5,120

Upside continuation targets:

5,300

5,360

Extension toward 5,440+

If – Then Logic

If price holds above 5,160 → expect continuation higher

If price sweeps into 5,180–5,160 and reacts → buy-the-dip opportunity

Only if H1 closes below 5,120 → bullish bias weakens

Bottom Line

Gold is not reversing — it is reloading.

Pullbacks are part of trend strength.

Wait for reaction, not confirmation at the highs.

BANKNIFTY at Channel Resistance Ahead of Budget — Volatility BankNifty is moving inside a well-defined downward channel and has once again reached the upper resistance trendline.

Historically, every touch of this zone has either triggered a sharp rejection or a strong breakout with momentum — making this a high-impact reaction area.

With the Union Budget approaching, volatility is expected to expand.

Price may attempt a brief push higher, but as long as the channel resistance holds, the broader structure still favors pullbacks toward the lower boundary.

👉 This is not a prediction zone — it’s a reaction zone.

The direction will be decided by how price behaves near resistance during the event-driven volatility.

XAUUSD – M45 Tech AnalysisXAUUSD – M45 Technical Outlook: Strong Momentum, Now Watch Liquidity Reactions | Lana ✨

Gold has surged above $5,250, extending its buying position with strong momentum. Price action remains constructive, but as the market pushes deeper into premium territory, liquidity reactions become more important than raw momentum.

📈 Market Structure & Price Action

Gold continues to trade inside a well-defined ascending channel, confirming a strong bullish structure.

Multiple BOS (Break of Structure) points on the chart highlight persistent buyer control.

The recent leg higher was aggressive, indicating momentum-driven buying, but also increasing the likelihood of short-term reactions.

At current levels, the market is extended above value, which often precedes either consolidation or a controlled pullback.

🔍 Key Technical Zones on M45

Upper Supply / Reaction Zone: 5280 – 5310

This area represents a premium zone where price may face profit-taking or liquidity sweeps before choosing direction.

Immediate Support (Channel Mid / Retest Zone): 5200 – 5220

A key area where price could pull back and attempt to hold structure.

Strong Sell-Side Liquidity Zone: around 5050

Marked clearly on the chart, this is a deeper level where liquidity is resting and where stronger buyer reactions could emerge if the pullback extends.

As long as price remains inside the channel, the broader bullish bias stays intact.

🎯 Trading Scenarios

Scenario 1 – Extension With Caution:

If price continues higher into the 5280–5310 zone, expect increased volatility and potential short-term rejection. This area is better suited for risk management and observation, not aggressive chasing.

Scenario 2 – Healthy Pullback (Preferred):

A pullback toward 5200–5220 would allow price to rebalance liquidity while maintaining structure. Holding this zone supports continuation within the channel.

Scenario 3 – Deeper Liquidity Sweep:

If volatility expands, a move toward the ~5050 sell-side liquidity zone could occur before a stronger continuation leg develops.

🌍 Market Context (Brief)

Gold’s sharp move above $5,250 reflects ongoing demand for safe-haven assets amid persistent macro and geopolitical uncertainty. Strong daily gains reinforce bullish sentiment, but such vertical moves also tend to attract short-term profit-taking, making structure and liquidity levels critical.

🧠 Lana’s View

The trend is bullish, but not every bullish move is a buy.

At extended levels, Lana focuses on how price reacts at liquidity zones, not on chasing momentum.

✨ Respect the structure, stay patient near extremes, and let the market come to your levels.

NIFTY- Intraday Levels - 29th Jan 2026Budget date is coming closer !! Watch for volatility.

**Intermediate levels are marked on chart

If NIFTY sustain above 25280 above this bullish above this wait

If NIFTY sustain below 25164 below this bearis then around 25095/63 then strong level below this more bearish, below this wait more levels marked on chart

My view :-

"My viewpoint, offered purely for analytical consideration, The trading thesis is: Nifty (bearish tactical approach: sell on rise)

This analysis is highly speculative and is not guaranteed to be accurate; therefore, the implementation of stringent risk controls is non-negotiable for mitigating trade risk."

Consider some buffer points in above levels.

Please do your due diligence before trading or investment.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

Part 2 Institutional vs. TechnicalOption trading involves buying and selling contracts that give the right, but not the obligation, to buy or sell an underlying asset at a set price (strike price) before a certain date (expiry).

- Call Option: Right to buy the asset.

- Put Option: Right to sell the asset.

- Buying Options: Limited risk, potential for high returns.

- Selling Options: Higher risk, potential for income.

PHOENIXLTD 1 Week Time Frame📌 Current weekly reference price: ~₹1,730–₹1,740 on NSE (updated latest).

📊 Weekly Pivot & Key Levels (Most Recent)

▶️ Weekly Pivot Point

Weekly Pivot (Standard): ₹1,768.93 (central reference for the week)

📈 Weekly Resistance Levels

(Upside levels where price may face selling pressure)

1. R1: ~₹1,818.67 – first major resistance zone this week

2. R2: ~₹1,910.83 – secondary resistance on extended upside

3. R3: ~₹1,960.57 – deep stretch resistance if bullish momentum builds

Interpretation:

A weekly close above ₹1,818–₹1,820 would suggest strength and bullish continuation into higher zones.

Strong upside momentum could target tier‑2 and tier‑3 resistance levels above ₹1,900.

📉 Weekly Support Levels

(Key downside levels where price may find buying interest)

1. S1: ~₹1,676.77 – immediate support if price dips from current levels

2. S2: ~₹1,627.03 – deeper zone of support below S1

3. S3: ~₹1,534.87 – medium‑term support zone, stronger base area

Interpretation:

If price confirms a break below weekly support ₹1,676–₹1,680, it increases the likelihood of further correction toward ₹1,627 and then ~₹1,535.

📌 Summary — Weekly Price Action Framework

Bullish Scenario (weekly view):

Price sustains above pivot ~₹1,768–₹1,770

Breaks ₹1,818–₹1,820 weekly resistance

➡️ Upside target zones: ₹1,910 → ₹1,960+

Bearish/Neutral Scenario (weekly view):

Weekly close below ₹1,676–₹1,680 support

➡️ Downside zones: ₹1,627 → ₹1,535

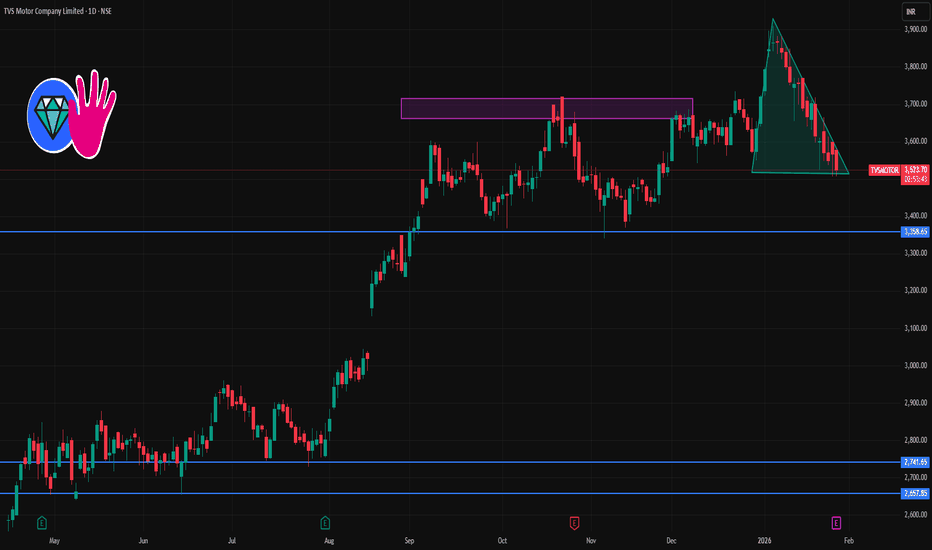

TVSMOTOR 1 Day Time Frame 📊 Current Approx Price Range (recent trading): ~₹3,525 – ₹3,560 area according to community chart insights.

🔑 1‑Day Timeframe — Key Levels

📈 Resistance Levels (Upside Targets)

₹3,550 – ₹3,560: near‑term resistance zone — a breakout above this may indicate bullish continuation.

₹3,600: psychological resistance.

₹3,640 – ₹3,650: stronger resistance above.

📉 Support Levels (Downside)

₹3,510 – ₹3,520: immediate support zone — watches trade reaction here intraday.

₹3,480 – ₹3,490: short‑term support below.

₹3,400 – ₹3,450: deeper support zone if weakness extends.

📌 Intraday & Pivot‑style Levels

Some classic pivot/levels from historical pivot calculations (may be slightly outdated but useful as reference):

R1 ~ ₹3,594, R2 ~ ₹3,622, R3 ~ ₹3,647 (classic pivot levels).

S1 ~ ₹3,541, S2 ~ ₹3,516, S3 ~ ₹3,488 (support pivots).

📊 How to Interpret These Levels

Bullish scenario: Maintaining above ₹3,520‑₹3,530 and breaking above ₹3,560‑₹3,600 could signal continuation higher.

Bearish scenario: Failure to hold ₹3,510 and drop below ₹3,480 may increase downside risk toward ₹3,400‑₹3,450.

JLHL 1 Day Time Frame 📌 Current Live Price (1‑Day)

Last traded price: ~₹1,305–₹1,322 range today on NSE/BSE.

Day’s range: ~₹1,301–₹1,359.

📊 Intraday Technical Levels (1‑Day Time Frame)

🔹 Pivot & Reference

No concrete official pivot published for today across many free data sites, but general intraday pivot technique (based on brokers’ short‑term screens) focuses around mid‑range prices near ₹1,310–₹1,320 as neutral area.

🔼 Resistance Levels (Upside)

These are zones where the price may face selling pressure on the same trading day:

1️. ₹1,350–₹1,360 — initial resistance zone (recent intraday high area).

2️. ₹1,375–₹1,390 — secondary resistance if price clears the initial zone.

🔽 Support Levels (Downside)

These are zones where buyers may step in intraday:

1️. ₹1,290–₹1,300 — nearest support band (recent intraday low).

2️. ₹1,270–₹1,280 — next lower support cluster (near the 52‑week low region).

🧠 Intraday Trading Interpretation

Bullish bias intraday if:

Price breaks above ₹1,350–₹1,360 with volume → could test higher around ₹1,375–₹1,390.

Bearish bias intraday if:

Price loses ₹1,290 support → risk of slide toward ₹1,270+ zone.

Range‑bound scenario:

Price oscillates between ₹1,290–₹1,350 if participation stays muted.

BTC/USD 1 Month Time Frame 📈 Real‑Time BTC/USD Snapshot

Bitcoin live price (BTC → USD):

≈ $89,200 – $89,300 USD based on recent aggregated market data.

Over the past month, Bitcoin’s price has fluctuated between:

High ≈ $97,759

Low ≈ $86,181

with a net mild upside in the 30‑day range.

📊 Key 1‑Month Support & Resistance Levels

🚧 Resistance Levels

These are ceilings where price has historically struggled to rise above:

$95,800 – $97,800 — upper resistance band near recent 1‑month highs.

$100,000 psychological level — big round‑number resistance, important if price approaches it again.

$103,500+ — longer technical resistance above $100K (higher timeframe).

Short‑term focus: a close above $96K–$97K could signal short‑term bullish momentum.

🛟 Support Levels

These are floors where price finds buying interest:

$88,900 – $89,000 — current intermediate support around today’s price band.

$86,000 – $87,000 — stronger support range near recent lows.

$84,000 – $84,200 — volatility support zone (lower boundary).

Bearish risk: if price drops below $86K, the next deeper support is near $84K–$83K.

🧠 How to Use These Levels

Traders: Use $88,000, $86,000 as potential swing supports; $95,000 and above as breakout targets.

Long‑term holders: These levels help understand volatility zones, but long‑term trends require larger time frame analysis.

Bank Nifty 1 Week Time Frame 📊 Current Approx Level

Bank Nifty (NSEBANK): ~59,595 on 28 Jan 2026.

📈 Weekly Resistance Levels

1. Near-term resistance: ~₹59,600–59,700

– This zone has acted as a supply/resistance band on weekly charts.

2. Immediate overhead resistances: ~₹59,800–60,000

– Breaking and closing above this would signal stronger weekly bullish momentum.

3. Higher resistance cluster: ~₹60,000+

– Psychological/all‑time high areas — strong supply if price approaches.

📉 Weekly Support Levels

1. Key support band: ~₹58,300–58,100

– A critical weekly support zone aligned with trendlines/EMA zones.

2. Secondary support: ~₹57,000–57,500

– Important weekly structure support on pullbacks.

3. Deeper support zone: ~₹56,000 – major structure support

– Very strong demand area if broader correction deepens.

📌 Weekly Pivot Zones (Technical Reference)

From pivot analysis (classic/Fibonacci levels):

Support (S1): ~₹57,124–57,970 (depending on method)

Pivot middle: ~₹58,953

Resistance (R1−R3): ~₹59,627 – 60,780+

These can be used as reference points within the broader weekly structure.

🧠 Summary – Weekly Context

Bullish above: ~₹59,800–60,000 — breakout signals strength.

Neutral/consolidation range: ~₹57,500–59,600 — sideways trend.

Bearish below key support: <₹58,100 — risk of deeper pullback.

Nifty 50 1 Week Time Frame 📊 Current Level (approx)

Nifty 50 ~ 25,200–25,350 area as of the last trading sessions (January 27–28, 2026).

📈 Key Weekly Levels to Watch

🔹 Immediate Resistance

1. ~25,300–25,350 — short‑term upside barrier (recent highs around these levels).

2. ~25,500–25,700+ — next major resistance zone (from prior weekly technical analysis, a breakout above ~26,100 historically signalled stronger bullish control).

🔻 Support Zones

1. ~24,900–25,000 — key short‑term support defended in recent sessions and noted by traders as a pivot area.

2. ~24,500–24,700 — broader weekly support zone (buffer from intermediate trend lines / moving averages).

3. ~24,200–24,300 — deeper weekly support; breach here could imply stronger correction risk.

📌 Weekly Trading Range (Probable)

Based on recent technical ranges and previous weekly outlooks:

➡️ Bullish bias above ~25,000 with resistance towards 25,500–25,700+.

➡️ Bearish/mixed bias if breaks below ~24,900, with support down to 24,500 and 24,200 zones.

⚠️ Important Notes

These levels are technical references used by traders — not investment advice.

Weekly support/resistance can shift quickly with strong market moves or macro events (especially around global policy news or earnings).

Always use stop losses and proper risk management if trading off these levels.

Copper Copper

ज़रूर 👍

नीचे Copper (तांबा) पर आधारित Stock Market Article हिंदी में लिख रहा हूँ — जो ट्रेडिंग, इन्वेस्टमेंट और इंडस्ट्री तीनों एंगल से काम आए।

⸻

📌 Copper (तांबा) और Stock Market: एक पूरा विश्लेषण

Copper यानी तांबा को stock market में “Dr. Copper” भी कहा जाता है, क्योंकि यह दुनिया की आर्थिक सेहत का अच्छा संकेतक माना जाता है। जब अर्थव्यवस्था बढ़ती है, तो Copper की मांग बढ़ती है, और जब मंदी आती है, तो इसकी मांग घटती है।

⸻

🔹 Copper की Demand क्यों बढ़ती है?

Copper का इस्तेमाल कई अहम सेक्टर्स में होता है:

• 🏗️ Construction & Real Estate

• ⚡ Power & Electrical Industry

• 🚗 Electric Vehicles (EV)

• 🔋 Renewable Energy (Solar, Wind)

• 📱 Electronics & Technology

EV और Green Energy Revolution के कारण आने वाले समय में Copper की demand और तेज़ होने की उम्मीद है।

⸻

🔹 Copper Price किन फैक्टर्स पर निर्भर करती है?

1. Global Economic Growth – चीन, अमेरिका और यूरोप की डिमांड

2. US Dollar Index – डॉलर कमजोर = Copper तेज

3. Supply Disruptions – Mining strikes, geopolitical issues

4. Inflation & Interest Rates

5. EV और Infrastructure Spending

⸻

🔹 India में Copper से जुड़े प्रमुख Stocks

भारतीय stock market में Copper से जुड़े कुछ अहम शेयर:

• Hindustan Copper Ltd

👉 Government-backed company, mining + refining

• Vedanta Ltd

👉 Copper + Zinc + Aluminium exposure

• Hindalco Industries

👉 Indirect benefit through metals demand

• Sterlite Technologies

👉 Copper cables & telecom infra

📌 Note: Hindustan Copper pure-play copper stock माना जाता है।

⸻

🔹 Copper: Trading vs Investment

Short-Term Traders के लिए:

• MCX Copper Futures

• Global cues + USD movement पर focus

Long-Term Investors के लिए:

• EV, Infra और Renewable Energy theme

• Copper stocks accumulation on dips

⸻

🔹 Risk Factors ⚠️

• Global recession

• China demand slowdown

• Commodity price volatility

• Government policies & environmental norms

⸻

🔹 निष्कर्ष (Conclusion)

Copper आने वाले समय में Future Metal माना जा रहा है।

जो निवेशक EV, Green Energy और Infrastructure growth पर भरोसा रखते हैं, उनके portfolio में Copper stocks एक अच्छा diversification दे सकते हैं।

📈 “जब दुनिया बनती है, तब Copper चमकता है।”

⸻

अगर चाहो तो मैं:

• इसी पर YouTube वीडियो का script

• Thumbnail text

• या Hindustan Copper का detailed stock analysis

भी बना दूँ 😊

CUMMINSIND 1 Hour Frame 📌 Current Price Snapshot (Indicative, ~28 Jan 2026 mid‑session)

Approx Price: ₹4,004 – ₹4,016 on NSE (delayed/real‑time range)

📍 1‑Hour Time Frame / Intraday Pivot Levels

Pivot levels help identify key zones where price may react during the current session.

Central Pivot (CP)

CP (Pivot): ~₹3,928 – ₹3,929 (hourly reference)

🔼 Resistance Levels (Upside)

R1: ~₹4,020 – ₹4,021 — first major upside cap above pivot

R2: ~₹4,066 – ₹4,067 — next resistance zone from pivot calculations

R3: ~₹4,100 – ₹4,110 — broader extension resistance (calculated range)

🔽 Support Levels (Downside)

S1: ~₹3,902 – ₹3,903 — immediate support below pivot

S2: ~₹3,882 – ₹3,883 — secondary support zone

S3: ~₹3,790 – ₹3,791 — deeper support if price drops sharply

📈 Notes

🔹 These pivot levels are derived from intraday pivot calculations (Standard / Fibonacci / Camarilla methods) updated recently for the current session.

🔹 The current price is indicative and may be slightly delayed vs live feed – for ultra‑precise trading, use your broker chart with 1‑hour timeframe.

🔹 Support/resistance bands change as price moves; always verify on live charts.

Gold at ATH before FOMC shakeout first or straight breakout?🧭 Macro Snapshot

Donald Trump maintains a hardline stance, increasing military presence in the Middle East → geopolitical risk remains elevated.

Tonight’s key focus: Federal Reserve

Political pressure and questions around Fed independence.

DXY continues to weaken, retesting major historical support (2020–2022) → supportive for gold.

👉 Conclusion: Geopolitics + a weaker USD set the bullish bias, while the Fed determines short-term volatility.

📊 Intraday Range to Watch

Upper range: 5,280 – 5,305

Lower range: 5,190 – 5,160

→ High probability of range trading and liquidity absorption ahead of the Fed decision.

🟢 Support

5,220–5,225 | 5,150–5,165 | 5,080–5,085 | 5,050–5,060

🔴 Resistance

5,280–5,294 | 5,300 | 5,315 | 5,380–5,385

⚠️ Strategy Notes

Expect possible fake moves / stop hunts within the range.

Avoid chasing highs or catching tops without confirmation.

Focus on price reaction at key levels and stay disciplined.

Summary: Gold is fundamentally supported, but today the key is how price reacts within 5,160–5,305.

Be patient — wait for confirmation — trade the reaction.

Part 1 Institutional vs. Technical What Is an Option?

An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price before a specific time.

There are two types:

• Call Options

A call gives you the right to buy the asset at a predetermined price.

You buy calls when you expect the market to go up.

• Put Options

A put gives you the right to sell the asset at a predetermined price.

You buy puts when you expect the market to go down.

The price at which the transaction occurs is called the strike price, and the last date the option is valid is the expiry.