NIFTY – Intraday Structure | Breakout from Bullish ConsolidationOn 5m, 15m and 1H timeframes, NIFTY formed a bearish trendline breakout around 2 PM, followed by a pullback and formation of a bullish intraday consolidation channel.

Price is currently consolidating inside this bullish channel, and a decisive break on either side can define the next intraday move.

🔹 Intraday Plan

Upside Scenario:

Break above bullish channel

Targets:

T1: 25,500

T2: 25,550

T3: 25,650

Stop Loss: 25,300 – 25,280

Downside Scenario:

Break below bullish channel

Targets:

T1: 25,150

T2: 25,000

T3: 24,900 – 24,920

Stop Loss: 25,360 – 25,380

This is a pure intraday range-break setup based on post-breakout bullish consolidation.

⚠️ Disclaimer

I am not a SEBI registered advisor or trader.

This analysis is shared only for educational purposes.

Please consult a registered financial advisor before taking any trading decisions.

Trend Analysis

HDFCBANK 4HR T/F ANALYSIS----

hdfcbank 4hr t/f analysis----- the top whole structure are bended both side which called structure is elips and it`s also dual direction in cans breakdown of elips into downside so we can measure elips of previous demand can measure body to body measure only green holding volume and interchange into supply so now we have a reversal area in this reversal zone wait for any bullish candle it`s help to confirmation to go with trend ok let`s see---

XRPUSD — Wave 4 Completion in a Fibonacci Confluence ZoneXRP is currently developing a complex Wave 4 correction within a larger impulsive structure.

The internal structure of Wave 4 is unfolding as a W–X–Y correction, where the final leg (Y) is forming as an A–B–C pattern, and the C-wave is nearing completion.

Key Technical Observations

Fibonacci Cluster Confluence

The retracement of Wave 1 → Wave 3 aligns with the 61.8%–78.2% Fibonacci zone, which also matches:

The W–X–Y termination area

A–C extension levels

Higher timeframe liquidity support

This confluence creates a high-probability reaction zone.

Impulse Structure Validation

According to Elliott Wave guidelines:

Wave 4 is allowed to form complex corrections (WXY).

A single liquidity sweep below the WXY low is acceptable.

Sustained price acceptance below the Fibonacci cluster would invalidate the impulsive structure.

Critical Price Level

The $1.50 region is the key decision zone:

Above $1.50 → Wave 4 remains valid, and Wave 5 expansion becomes probable.

Below $1.50 (with strong acceptance) → Impulse failure scenario, signaling a larger corrective cycle.

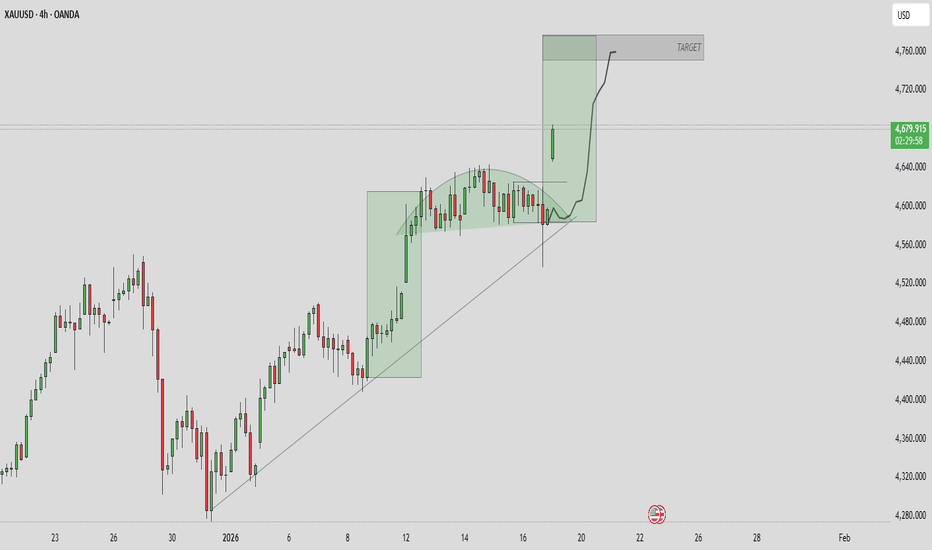

XAUUSD – ATH now normal, $5,000 target.Market Context – When ATH Is No Longer a Spike

Gold has entered a phase where every pullback is being aggressively bought, signaling strong institutional acceptance of higher prices. The market is no longer reacting emotionally to new highs — instead, ATHs are forming within structure, not as exhaustion.

With:

Persistent safe-haven demand

A cautious Fed outlook

Ongoing geopolitical and macro uncertainty

➡️ $5,000 is evolving from a psychological level into a realistic technical target.

Structure & Price Action (H1)

Bullish structure remains intact with Higher Highs and Higher Lows.

Current declines are corrective pullbacks, not reversals — no bearish CHoCH confirmed.

Price continues to respect the ascending channel and demand zones, confirming trend continuation.

Key takeaway:

👉 No distribution signs at the top — ATHs are being defended by structure.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Focus on buying pullbacks, not chasing ATH:

BUY Zone 1: 4,837 – 4,782 (Demand + trendline confluence)

BUY Zone 2: 4,713 (Deeper IP / demand zone)

➡️ Execute BUYs only after clear bullish reactions.

➡️ Avoid FOMO at extended levels.

Upside Targets (ATH Continuation):

TP1: 4,919

TP2: 5,027 (Extension zone approaching the $5,000 milestone)

Alternative Scenario

If price holds above 4,919 without a meaningful pullback, wait for a break & retest before looking for continuation BUYs.

Invalidation

H1 close below 4,713 invalidates the bullish structure and requires a full reassessment.

Summary

Gold remains in ATH continuation mode. The optimal strategy is not trying to top-pick, but patiently buying pullbacks in alignment with higher-timeframe flow. At this stage, $5,000 is no longer a question of “if” — only “when.”

BPCL : Trading the Confluence of Price Action & Macro TailwindsThe stock has been consolidating within a defined range over the past few weeks and has recently started forming a solid base. While the breakout volume isn’t a classic “God-candle,” price action continues to hold firmly above key moving averages, which is a constructive sign. That said, the price is somewhat extended from the EMAs, increasing the probability of a mean-reversion move. Hence, the stop loss needs to be placed wider rather than just below the basing structure.

The conviction behind this trade comes largely from the current Goldilocks macro environment we’re witnessing in early 2026. With global crude prices remaining comfortably low, BPCL is benefiting from strong marketing margins across petrol and diesel, supporting near-term earnings visibility.

On the fundamental side, a major catalyst is the Government’s LPG compensation package. BPCL is expected to receive a significant share of the ₹30,000 crore payout allocated to OMCs, which materially improves cash flows in H2 FY26. This inflow also acts as a strong deleveraging trigger, further strengthening an already improving balance sheet that has seen a steady decline in debt-equity levels over recent quarters.

So took this position with 1% risk on the net capital.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

NIFTY – Multi-Timeframe Parallel Channel | Long-Term ViewOn Daily, 4H and 1H timeframes, NIFTY continues to trade inside a bullish parallel channel.

This consolidation has been active from April to December, with price repeatedly respecting both the lower and upper channel boundaries.

At the same time, the upper bullish trendline has been continuously extending from April till date, showing that the primary trend remains intact despite time-wise consolidation.

This reflects a time-based consolidation inside an ongoing uptrend, not a distribution structure.

🔹 Key Observations

Same parallel channel aligned on 1H, 4H and Daily

Consolidation range active from April to December

Upper bullish trendline continuing from April till date

Repeated rejections from both channel boundaries

RSI consistently rejects from oversold zones

Strong historical rejection zone near 24,900 – 24,500

🔹 Long-Term Plan (Positional)

Buy on Dips Zone: Around 25,000

Stop Loss (Invalidation): 24,700 – 24,600 (closing basis)

Targets:

T1: 26,000

T2: 26,400

T3: 26,500 – 26,700 (on trendline breakout)

🔹 Scenarios

Sustained breakout above 26,400 and above the upper channel can lead to further upside continuation.

Breakdown below 25,000 can turn the bias negative.

Historically, deep breakdowns have occurred only during extreme events.

Until any major impact news appears, channel continuation remains the higher-probability structure.

⚠️ Disclaimer

I am not a SEBI registered advisor or trader.

This analysis is shared only for educational purposes.

Please consult a registered financial advisor before taking any trading or investment decisions

Option Trading Strategies1. Covered Call – Best for Conservative Income Traders

Market view: Neutral to mildly bullish

Risk level: Low

Who it’s for: Long-term investors, swing traders, income seekers

A covered call involves owning the underlying stock and selling a call option against it. You earn option premium as income while holding the stock.

How it works:

Buy or hold shares

Sell an out-of-the-money (OTM) call

If price stays below strike → keep premium

If price rises above strike → shares get called away at a profit

Why it’s powerful:

Generates regular income

Lowers cost basis of stock

Works well in sideways markets

Risk: Limited upside if stock rallies strongly

Best use: Stable stocks, index ETFs (NIFTYBEES, BANKBEES)

2. Cash-Secured Put – Smart Way to Buy Stocks Lower

Market view: Neutral to bullish

Risk level: Low to moderate

Who it’s for: Investors who want to accumulate stocks

Here, you sell a put option while keeping enough cash to buy the stock if assigned.

How it works:

Sell OTM put

Collect premium

If price stays above strike → profit = premium

If price falls → you buy stock at lower effective price

Why traders love it:

You get paid to wait

Safer than blindly buying dips

Works best in high-IV markets

Risk: Downside if stock collapses

Best use: Quality stocks you actually want to own

3. Long Call – High Conviction Bullish Strategy

Market view: Strongly bullish

Risk level: Moderate

Who it’s for: Momentum traders, event traders

A long call gives you the right (not obligation) to buy at a fixed price.

How it works:

Buy call option

Risk limited to premium

Upside theoretically unlimited

Why it works:

Leverage with defined risk

Best during breakouts, earnings, trend reversals

Key risk: Time decay (theta)

Tip: Use when direction + timing are both strong

4. Long Put – Best for Market Crashes & Hedging

Market view: Strongly bearish

Risk level: Moderate

Who it’s for: Hedgers, short-term traders

A long put profits when prices fall.

Why it’s important:

Portfolio insurance during crashes

Explosive profits in sharp sell-offs

Risk: Option expires worthless if market doesn’t fall

Best use: Breakdowns, global risk-off events, earnings disappointments

5. Bull Call Spread – Controlled Bullish Strategy

Market view: Moderately bullish

Risk level: Lower than long call

Who it’s for: Risk-aware traders

This involves:

Buying one call

Selling a higher strike call

Why it’s smart:

Lower cost than buying naked call

Defined risk and reward

Less affected by time decay

Downside: Limited profit

Best use: When you expect a limited upward move

6. Bear Put Spread – Structured Bearish Play

Market view: Moderately bearish

Risk level: Controlled

Who it’s for: Traders expecting slow declines

Similar to bull spread but on the downside.

Advantages:

Cheaper than long put

Reduced volatility risk

Better probability of success

Best use: Gradual downtrends, resistance breakdowns

7. Iron Condor – Best Sideways Market Strategy

Market view: Range-bound

Risk level: Moderate (defined)

Who it’s for: Experienced income traders

Iron condor combines:

Bull put spread

Bear call spread

Goal: Profit from time decay and low volatility

Why it’s popular:

High probability

Works well in indices

Non-directional

Risk: Big moves beyond range

Best use: Low-IV environments before expiry

8. Short Straddle / Strangle – Volatility Selling Strategy

Market view: Low volatility expected

Risk level: High

Who it’s for: Advanced traders only

You sell:

Straddle → ATM call + put

Strangle → OTM call + put

Profit comes from:

Time decay

Volatility crush

Major risk: Unlimited losses if market explodes

Best use: Indices with strict risk management (hedges mandatory)

9. Calendar Spread – Time Decay Exploitation

Market view: Neutral to mildly directional

Risk level: Moderate

Who it’s for: Volatility traders

You sell a near-expiry option and buy a far-expiry option at same strike.

Why it works:

Front-month options decay faster

Gains from IV expansion

Best use: Pre-event, slow-moving stocks

10. Protective Put – Portfolio Insurance Strategy

Market view: Long-term bullish, short-term uncertain

Risk level: Low

Who it’s for: Investors protecting large portfolios

How it works:

Hold stock

Buy put option

Benefit:

Caps downside risk

Allows peace of mind during volatility

Cost: Insurance premium

Best use: Elections, Fed meetings, earnings seasons

Final Thoughts: Which Strategy Is “Best”?

There is no single best option strategy—only the right strategy for the right market condition.

Market Condition Best Strategies

Strong bullish Long Call, Bull Call Spread

Mild bullish Covered Call, Cash-Secured Put

Sideways Iron Condor, Calendar Spread

Bearish Long Put, Bear Put Spread

High volatility Debit spreads

Low volatility Credit spreads, Condors

Professional option traders focus on:

Probability

Risk control

Volatility, not just direction

Index Rebalancing Impact — A Deep Dive1. What Is Index Rebalancing?

Index rebalancing is the periodic process by which an index provider adjusts the constituents and weightings of an index to ensure it continues to represent its stated objective. Most indices follow predefined rules based on market capitalization, liquidity, free float, sector classification, or fundamental criteria. Over time, stock prices move, companies grow or shrink, and new firms emerge while others decline. Rebalancing realigns the index with its methodology.

For example:

A market-cap-weighted index increases the weight of stocks that have risen in value and reduces those that have fallen.

A factor index (value, momentum, quality) updates its holdings based on changes in factor scores.

A benchmark like Nifty 50 or S&P 500 may add or remove companies based on eligibility rules.

Rebalancing typically occurs quarterly, semi-annually, or annually, depending on the index.

2. Why Rebalancing Has Market Impact

The real impact comes not from the index itself, but from the trillions of dollars benchmarked to indices. Passive funds—ETFs, index mutual funds, pension mandates—are forced buyers and sellers. When an index changes, these funds must trade, regardless of valuation or fundamentals.

This creates:

Predictable flows

Temporary demand–supply imbalances

Short-term price distortions

In markets like India, where ETF penetration is growing rapidly, index rebalancing effects have become increasingly visible.

3. Types of Index Rebalancing Effects

a) Weight Adjustment Effect

Even if no stock is added or removed, weights change. A stock whose market cap has increased will see higher demand from index funds, while a laggard may face selling pressure. This often leads to price drift in the days leading up to the rebalance.

b) Addition Effect

When a stock is added to a major index:

Index funds must buy it

Liquidity improves

Analyst coverage often increases

Empirically, additions tend to experience short-term price jumps around the announcement and effective date. This is known as the index inclusion premium.

c) Deletion Effect

Stocks removed from indices face forced selling, often resulting in:

Short-term price drops

Higher volatility

Reduced liquidity

Over the long term, many deleted stocks stabilize, but the immediate impact can be sharp.

4. Announcement Date vs. Effective Date

Index rebalancing impact typically unfolds in two phases:

Announcement Date

Index provider announces changes

Active traders and arbitrage funds position early

Prices often react immediately

Effective Date (Rebalance Day)

Passive funds execute trades, often at the close

Spikes in volume and volatility

Temporary price pressure peaks

In highly liquid markets, much of the impact is front-run before the effective date. In less liquid stocks, the bulk of the move can happen on the rebalance day itself.

5. Liquidity and Market Structure Matter

The magnitude of index rebalancing impact depends heavily on liquidity.

Large-cap, liquid stocks: Impact is usually modest and short-lived.

Mid-cap and small-cap stocks: Effects can be dramatic, with multi-day price swings.

Free-float adjustments: Changes in free float can trigger large reweights even if fundamentals are unchanged.

In India, small-cap index rebalancing often leads to outsized moves, because passive AUM is large relative to daily traded volumes.

6. Sector and Factor Index Rebalancing

Rebalancing isn’t limited to broad market indices.

Sector indices rebalance when sector classifications change or relative sizes shift.

Factor indices (momentum, low volatility, value) rebalance more frequently and aggressively.

Factor rebalancing can create crowded trades:

Momentum indices buy recent winners and sell losers, reinforcing trends.

Low-volatility indices may dump stocks that become volatile during market stress, worsening drawdowns.

This mechanical behavior can amplify market cycles.

7. Short-Term Distortions vs. Long-Term Reality

A crucial point: index rebalancing does not change fundamentals. Revenue, earnings, and cash flows remain the same. The price impact is largely technical.

Short term:

Prices may overshoot

Volatility rises

Correlations increase

Long term:

Prices often mean-revert

Fundamental performance reasserts itself

This creates opportunities for disciplined investors who can distinguish between flow-driven moves and genuine fundamental changes.

8. Strategies Around Index Rebalancing

Professional investors actively design strategies to exploit these effects:

Index inclusion arbitrage: Buy stocks likely to be added before the announcement.

Event-driven trading: Trade the announcement-to-effective date window.

Contrarian strategies: Buy deleted stocks after forced selling exhausts.

Liquidity provision: Provide liquidity to index funds on rebalance day at favorable prices.

However, these strategies are competitive and require precise execution and cost control.

9. Risks and Unintended Consequences

Index rebalancing also introduces systemic risks:

Price inefficiency: Mechanical flows override price discovery.

Crowding: Too much capital chasing the same index names.

Volatility spikes: Especially near market closes on rebalance days.

Feedback loops: Rising prices lead to higher weights, attracting more inflows.

In extreme cases, this can lead to index bubbles, where valuation becomes secondary to index membership.

10. Growing Importance in Modern Markets

As passive investing grows, index rebalancing impact is becoming more powerful. Markets are increasingly shaped not just by fundamentals, but by rules, calendars, and flows. For long-term investors, understanding rebalancing helps avoid emotional reactions to short-term noise. For active traders, it provides a repeatable, data-driven edge.

Conclusion

Index rebalancing is a mechanical process with very real market consequences. It drives predictable buying and selling, creates short-term distortions, and occasionally offers attractive trading opportunities. While the impact is usually temporary, its influence on liquidity, volatility, and price behavior is undeniable. In today’s markets, ignoring index rebalancing means missing a key piece of the puzzle that explains why prices sometimes move without any obvious fundamental reason.

How AI Predicts Market Moves1. Data: The Foundation of AI Market Prediction

AI does not “guess” market direction. It learns from data.

Types of Data Used

Price data: Open, high, low, close (OHLC), volume

Order-book data: Bid–ask spreads, depth, liquidity shifts

Technical indicators: RSI, MACD, moving averages, volatility

Fundamental data: Earnings, balance sheets, macro indicators

Alternative data: News, social media sentiment, Google trends

Cross-asset data: Bonds, commodities, currencies, crypto

AI models look at how these datasets interact across timeframes. For example, a sudden rise in bond yields combined with declining liquidity may historically precede equity sell-offs.

2. Pattern Recognition Beyond Human Ability

Traditional technical analysis relies on visual patterns like head-and-shoulders or support and resistance. AI goes much deeper.

What AI Finds

Micro-patterns invisible to the naked eye

Non-linear relationships (A affects B only when C is present)

Regime changes (bull, bear, sideways markets)

Probabilistic outcomes, not certainties

For example, AI might learn that when volatility compresses for 14–18 sessions and volume drops below a threshold, the probability of a sharp breakout increases by 62%.

3. Machine Learning Models Used in Markets

Different AI models specialize in different tasks.

a) Supervised Learning

Used when historical outcomes are known.

Predict next-day return

Classify market as bullish/bearish

Forecast volatility or drawdown risk

Common models:

Linear & Logistic Regression

Random Forests

Gradient Boosting (XGBoost, LightGBM)

These models are popular in swing trading and factor investing.

b) Unsupervised Learning

Used when patterns are unknown.

Market regime detection

Asset clustering

Correlation breakdown analysis

Examples:

K-Means Clustering

Principal Component Analysis (PCA)

This helps funds rotate strategies when market behavior changes.

c) Deep Learning

Used for complex, sequential data.

LSTM / GRU networks: Learn long-term price memory

CNNs: Treat charts like images

Transformers: Capture multi-timeframe dependencies

Deep learning excels in high-frequency trading and multi-asset forecasting.

d) Reinforcement Learning

AI learns by trial and error, similar to how a trader adapts.

Chooses actions: buy, sell, hold

Receives rewards or penalties

Optimizes trading policy over time

This is widely used in algorithmic execution and portfolio allocation.

4. Sentiment Analysis: Reading Market Psychology

Markets are driven by emotion as much as fundamentals.

AI processes:

News headlines

Earnings call transcripts

Social media posts

Analyst reports

Using Natural Language Processing (NLP), AI converts text into numerical sentiment scores:

Positive

Neutral

Negative

Fear vs greed intensity

For example, if sentiment turns sharply negative while prices hold support, AI may detect a potential contrarian bounce.

5. Timeframe Intelligence

AI does not rely on a single timeframe.

Short-term: milliseconds to minutes (HFT)

Medium-term: days to weeks (swing trading)

Long-term: months to years (asset allocation)

By stacking timeframes, AI avoids false signals. A short-term sell signal may be ignored if the long-term trend remains strongly positive.

6. Probability-Based Forecasting (Not Certainty)

AI does not predict exact prices. It predicts probabilities.

Example output:

65% probability market closes higher tomorrow

20% probability of range-bound movement

15% probability of sharp downside move

Professional traders use this to:

Size positions

Adjust stop-losses

Hedge tail risk

This probabilistic thinking is why AI performs better during volatile markets.

7. Risk Management and Drawdown Control

AI models focus as much on risk as on returns.

They monitor:

Volatility expansion

Correlation spikes

Liquidity stress

Tail-risk events

When risk rises, AI may:

Reduce exposure

Shift to defensive assets

Increase cash allocation

Trigger hedging strategies

This is a key reason AI funds often survive crashes better than discretionary traders.

8. Continuous Learning and Adaptation

Markets evolve. Strategies decay.

AI systems:

Retrain on new data

Detect performance degradation

Retire failing models

Combine multiple models into ensembles

This adaptability is crucial because patterns that worked last year may fail today.

9. Why AI Still Fails Sometimes

AI is powerful—but not magical.

Limitations include:

Black swan events (wars, pandemics)

Data bias or overfitting

Sudden regulatory changes

Market manipulation

That’s why the best systems combine AI + human oversight.

10. The Future of AI in Market Prediction

AI is moving toward:

Real-time macro interpretation

Cross-market reflexivity models

AI-driven portfolio construction

Personalized trading assistants

In the future, AI won’t just predict markets—it will design strategies dynamically based on each investor’s risk profile.

Conclusion

AI predicts market moves by learning from massive datasets, recognizing complex patterns, analyzing sentiment, and adapting to changing conditions. It does not replace human judgment but enhances it by removing emotion, bias, and speed limitations. In modern markets, AI is no longer optional—it is becoming the core engine behind trading, investing, and risk management.

Data Centre & Semiconductor Theme Trading A Deep-Dive for Market Participants

The data centre and semiconductor theme has emerged as one of the most powerful structural trades of the decade. It sits at the intersection of AI, cloud computing, digitalization, electrification, and geopolitics, making it a multi-year secular opportunity rather than a short-term cyclical play. For traders and investors, this theme offers momentum bursts, relative-value trades, and long-term compounding stories—if approached with the right framework.

1. Why This Theme Matters

At its core, every digital action—AI inference, cloud storage, video streaming, fintech transactions, autonomous driving—ultimately ends up in data centres powered by semiconductors.

Think of the chain as:

AI / Cloud Demand → Data Centres → Chips → Equipment → Power & Cooling

This creates a stacked value chain where multiple listed companies benefit simultaneously, but at different points in the cycle. Theme trading is about identifying which layer is leading and which is lagging.

2. Structural Demand Drivers

a) Artificial Intelligence Explosion

Generative AI, LLMs, and enterprise AI workloads are orders of magnitude more compute-intensive than traditional applications.

Training AI models requires high-end GPUs / accelerators

Inference workloads demand low latency, high bandwidth memory

AI data centres consume 2–4× more power than traditional centres

This directly fuels demand for:

Advanced semiconductors

Memory (HBM, DRAM)

Networking chips

Power management ICs

b) Cloud & Hyperscale Capex Cycles

Hyperscalers (AWS, Azure, Google, Meta) invest in multi-year capex waves. When capex accelerates:

Semiconductor orders surge first

Data centre construction follows

Cooling, power, and networking companies benefit later

Traders track capex guidance as a leading indicator.

c) Digital Sovereignty & Geopolitics

Governments want domestic chip manufacturing for security reasons:

US CHIPS Act

EU Chips Act

India Semiconductor Mission

This adds a policy-driven floor to semiconductor demand, even during economic slowdowns.

3. Key Segments Within the Theme

a) Semiconductor Designers (High Beta Leaders)

These companies design chips but outsource manufacturing.

Traits

Highest operating leverage

Strong momentum during AI upcycles

Sharp drawdowns during corrections

Trading View

Best for momentum and breakout strategies

Sensitive to earnings surprises and guidance

b) Foundries & Manufacturers

Companies that actually fabricate chips.

Traits

Capital intensive

Long-term contracts

Less volatile than designers

Trading View

Suitable for swing trades around utilization rates

React strongly to capex and yield improvement news

c) Semiconductor Equipment & Materials

They supply lithography, etching, deposition, chemicals, and wafers.

Traits

Benefit before chips are sold

Orders lead end-market demand by 2–4 quarters

Trading View

Ideal for early-cycle positioning

Strong relative performance when capex cycles turn up

d) Data Centre Infrastructure & REITs

Includes:

Data centre builders

Power distribution

Cooling systems

Data centre REITs

Traits

More stable cash flows

Yield + growth combination

Trading View

Better for positional and defensive thematic trades

Outperform during rate cuts or stable macro environments

4. How Theme Trading Actually Works

a) Momentum Phase Trading

When AI or cloud narratives dominate headlines:

Leaders break out of long consolidations

Volume expansion confirms institutional participation

Indicators used

Relative strength vs index

20/50-DMA trend alignment

Sectoral ETF flows

b) Rotation Trades Inside the Theme

Not all sub-segments lead together.

Typical rotation:

Chip designers lead

Equipment stocks catch up

Data centre infra plays follow

Power & cooling benefit last

Advanced traders rotate capital within the theme, not out of it.

c) Mean Reversion & Pullback Buying

Even strong secular themes correct 20–30%.

High-probability setups:

Pullbacks to rising 50-DMA

RSI reset without trend break

Volume contraction during corrections

5. Valuation vs Growth: The Constant Debate

Semiconductor and data centre stocks often look expensive on traditional metrics.

Key point:

In secular tech cycles, earnings catch up to price, not the other way around.

Smart traders:

Focus on forward earnings revisions

Track order backlog growth

Watch capex-to-revenue ratios

Overvaluation becomes a risk only when growth decelerates.

6. Macro Risks to Watch

a) Interest Rates

Data centres are capital-intensive

Higher rates compress valuations, especially REITs

b) Cyclical Slowdowns

Consumer electronics downturns affect legacy chip demand

AI demand may offset but not fully eliminate cyclicality

c) Supply Chain Bottlenecks

Advanced nodes depend on few suppliers

Delays can cause earnings volatility

7. India Angle in This Theme

India is becoming relevant in:

Data centre construction (cloud, fintech, OTT demand)

Semiconductor assembly, testing, and packaging (ATMP)

Power infrastructure and cooling solutions

Indian traders often use:

Global semiconductor indices as trend indicators

Domestic infra & power plays as satellite trades

This creates cross-market correlation opportunities.

8. Portfolio Construction for Theme Traders

A balanced approach:

40% Momentum Leaders – High beta semiconductor names

30% Enablers – Equipment, power, cooling

20% Stability – Data centre REITs / infra

10% Tactical Cash – For sharp corrections

Risk management is critical because these stocks move together during risk-off phases.

9. Why This Is a Multi-Year Trade

Unlike past tech cycles, this theme is supported by:

AI workload explosion

Government policy support

Long-duration capex visibility

Structural digital dependency

This makes the data centre & semiconductor trade closer to an “infrastructure cycle” than a traditional tech boom.

10. Final Takeaway

Data centre and semiconductor theme trading is not about picking one stock—it’s about understanding the ecosystem and riding capital flows. The biggest edge comes from:

Identifying which layer is leading

Entering during healthy pullbacks

Rotating within the theme rather than abandoning it

For traders who respect trend structure and manage risk, this theme remains one of the cleanest, most powerful opportunities of the current decade.

Renewable Energy Certificates (RECs) and Carbon Credits1. Introduction: Why RECs and Carbon Credits Matter

As countries, corporations, and investors push toward net-zero emissions, two market-based instruments have become central to climate policy and sustainable finance: Renewable Energy Certificates (RECs) and Carbon Credits.

Both aim to reduce greenhouse gas (GHG) emissions, but they operate in different markets, address different problems, and serve different compliance and voluntary needs. Understanding their structure, pricing, and role is critical for policymakers, power producers, corporates, and traders—especially in fast-growing markets like India.

2. Renewable Energy Certificates (RECs): Core Concept

A Renewable Energy Certificate (REC) represents proof that 1 megawatt-hour (MWh) of electricity has been generated from a renewable energy source such as solar, wind, hydro, biomass, or geothermal.

When a renewable power producer generates electricity:

The physical electricity flows into the grid

The environmental attribute is unbundled and issued as a REC

This separation allows electricity consumers to claim renewable usage even if the physical power they consume is from the conventional grid mix.

3. Purpose of RECs

The primary objectives of RECs are:

Regulatory Compliance

In many countries, utilities and large power consumers must meet Renewable Purchase Obligations (RPOs). RECs allow entities that cannot physically procure green power to meet these obligations financially.

Market-Based Incentives

RECs provide additional revenue to renewable generators, improving project viability without direct subsidies.

Corporate Sustainability Claims

Corporates use RECs to meet ESG targets, claim renewable sourcing, and comply with Scope 2 emission accounting under GHG Protocols.

4. REC Markets: Compliance vs Voluntary

Compliance REC Markets

Mandated by government regulation

Prices often volatile and policy-driven

Examples:

India (Solar & Non-Solar RECs)

US state-level Renewable Portfolio Standards (RPS)

Voluntary REC Markets

Purchased by corporates or individuals

Focus on brand value, ESG disclosure, and carbon neutrality

Examples:

International Renewable Energy Certificates (I-RECs)

Guarantees of Origin (EU)

5. India’s REC Framework

India’s REC mechanism is overseen by CERC and operated via power exchanges like IEX and PXIL.

Key features:

Solar RECs and Non-Solar RECs

Issued by the National Load Despatch Centre (NLDC)

Traded through exchange-based auctions

Used for RPO compliance by DISCOMs, open-access consumers, and captive users

India’s REC prices have historically been:

Highly cyclical

Influenced by RPO enforcement

Sensitive to supply-demand mismatches

6. Carbon Credits: Core Concept

A Carbon Credit represents the reduction or removal of 1 metric tonne of CO₂ equivalent (tCO₂e) from the atmosphere.

Unlike RECs (which are linked to energy generation), carbon credits are linked directly to emission reductions, regardless of the sector.

Carbon credits are generated through projects such as:

Renewable energy installations

Afforestation and reforestation

Methane capture

Energy efficiency upgrades

Industrial process improvements

7. Carbon Markets: Compliance vs Voluntary

Compliance Carbon Markets

Created under international or national regulation.

Examples:

EU Emissions Trading System (EU ETS)

China National ETS

California Cap-and-Trade

Key traits:

Mandatory caps on emissions

Allowances traded among regulated entities

Prices often reflect marginal abatement cost

Voluntary Carbon Markets (VCM)

Used by corporates to offset emissions beyond regulatory requirements.

Standards include:

Verra (VCS)

Gold Standard

American Carbon Registry (ACR)

VCM prices vary widely depending on:

Project type

Vintage year

Verification quality

Co-benefits (biodiversity, social impact)

8. Key Differences: RECs vs Carbon Credits

Aspect RECs Carbon Credits

Unit 1 MWh renewable power 1 tonne CO₂e

Purpose Renewable sourcing Emission offset

Scope Electricity only Multi-sector

Accounting Scope 2 Scope 1, 2, or 3

Market Power & ESG Climate finance

Permanence Linked to generation Linked to reduction/removal

9. Corporate Use Cases

Corporates often use both instruments together:

RECs → Claim renewable electricity usage

Carbon credits → Offset residual emissions

For example:

A data center uses RECs to claim 100% renewable power

It then purchases carbon credits to offset diesel backup, logistics, and Scope 3 emissions

10. Price Dynamics and Risks

REC Price Drivers

RPO targets and enforcement

Renewable capacity additions

Regulatory changes

DISCOM financial health

Carbon Credit Price Drivers

Climate policy ambition

Corporate net-zero commitments

Quality and credibility of credits

Supply constraints for nature-based projects

Key Risks

Double counting

Greenwashing

Policy reversals

Low-quality offsets undermining credibility

11. Emerging Trends

Article 6 of Paris Agreement

Enables cross-border carbon trading and international credit transfers.

High-Integrity Carbon Credits

Shift toward removal-based credits (DAC, biochar).

India’s Carbon Market (ICM)

India is transitioning from PAT & REC mechanisms toward a unified Indian Carbon Credit Trading Scheme (CCTS).

Tokenization & Digital MRV

Blockchain-based tracking for transparency and trust.

12. Investment and Trading Perspective

For investors and traders:

RECs offer policy-driven cyclical trades

Carbon credits represent a long-term structural decarbonization play

Quality differentiation will drive price dispersion

Carbon markets may become a new asset class, similar to power and gas

13. Conclusion

Renewable Energy Certificates and Carbon Credits are cornerstones of market-based climate action. RECs accelerate renewable adoption by monetizing clean energy attributes, while carbon credits provide flexibility in achieving emission reduction targets across the economy.

As climate regulation tightens and ESG scrutiny deepens, these instruments will evolve from niche compliance tools into strategic financial assets, shaping energy markets, corporate strategy, and global capital flows.

GIFTNIFTY Feb 2026 Fut Roll-Over Swing Levels For 23rd JAN 2026Roll-Over: GIFTNIFTY Feb 2026 Fut ntraSwing Levels For 23rd JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

🚀Follow GIFTNIFTY Post for NF levels

Sometime Opposite Direction Found in NIFTY Spot, NIFTY Jan EXO & NIFTY FEB Exp. better tp long at that juncture.

^^^^^^^^^^^^_______________^^^^^^^^^^^^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

SILVER (XAGUSD) 1HRsWING TRADE

- EARN WITH ME DAILY 10K-20K –

SILVER (XAGUSD) Looking good for upside..

When it break level 93053 and sustain.. it will go upside...

BUY@ 93053

Target

1st 96004

2nd 98886

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome to join the ride ..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

Bullish Ascending Triangle Spotted in Coforge LimitedCoforge Limited, formerly known as NIIT Technologies, is a promising stock in the future segment and is currently forming a bullish ascending triangle on the charts. Since May 2024, the stock has remained range-bound, characterized by higher lows and a flat resistance zone, which is a classic bullish continuation structure.

A key positive visible on the chart is the presence of a Law Of Polarity zone coinciding with the support area. This confluence significantly increases the probability of a valid and strong support, reinforcing the bullish bias. Additionally, clear volume spikes near each higher low indicate healthy accumulation and confirm the strength of the reversals at support levels.

From this structure, the stock has the potential to move upward, and upon a decisive breakout, it may deliver three upside targets:

First target: around 2400

Second target: around 3150

Final target: around 4500

However, it is important to note that the entire bullish setup will be invalidated if the price breaks and closes decisively below 1520.

Stock will take time to complete targets, all the patterns look awesome on chart but there are 100 of other possibilities, always give priority to capital protection and apply logical stoploss.

Understanding Long-Term Breakouts: Lessons from JINDALSTEL📈 Understanding Long-Term Breakouts: Lessons from JINDALSTEL

1. Long-Term Breakout: Why It Matters

A long-term breakout occurs when a stock surpasses a major resistance level that has held for years.

In JINDALSTEL’s case, the August 2010 high of ₹796 was finally breached in March 2024, after nearly 14 years.

Such breakouts are significant because they often mark a shift in market perception—investors are willing to pay higher prices than ever before, signaling confidence in the company’s future.

Key Insight: The longer the resistance holds, the more powerful the breakout tends to be, as it represents years of accumulated supply being absorbed.

2. Resistance Turned Support: The Golden Rule

Once a resistance level is broken, it often becomes a new support level.

JINDALSTEL pulled back to this zone (around ₹796–₹800), tested it, and then reversed upward.

This behavior shows that buyers defended the level, confirming its importance.

Why It Matters:

Respecting resistance-turned-support validates the breakout.

It reassures traders that the move wasn’t a false breakout but a genuine shift in demand.

3. Latest High Breakout: Continuation of Buying Interest

After the pullback, the stock began breaching its latest weekly highs.

This indicates follow-up buying—new participants are entering, and existing holders are adding positions.

A breakout after a successful retest of support is often seen as a high-probability continuation pattern.

Takeaway:

Breakouts after pullbacks are stronger than straight-line moves because they show healthy consolidation and renewed demand.

4. Risk Management: The Unsung Hero

Even the strongest chart setups require disciplined risk management:

Stop-loss placement: Below the new support (₹796–₹800 zone in this case).

Position sizing: Avoid overexposure; allocate capital wisely.

Trend awareness: Long-term breakouts can be powerful, but corrections are inevitable.

Avoid chasing: Enter near support or on confirmed breakouts, not in the middle of volatile moves.

5. Investor & Trader Takeaways

For Investors:

Long-term breakouts often signal a new growth phase.

Sustaining above old highs shows structural strength in the company.

For Traders:

Respect resistance-turned-support zones—they are ideal entry points.

Breakouts after pullbacks are high conviction trades.

Always pair technical setups with risk management discipline.

✨ Final Thoughts

JINDALSTEL’s chart is a textbook example of how markets reward patience.

A 14-year breakout signals a major shift.

The pullback to support and reversal confirms strength.

The latest high breakout shows continued buying interest.

For both investors and traders, this case highlights the importance of respecting technical levels, waiting for confirmation, and managing risk effectively.

Biocon: Range to Trend Expansion in ProgressBiocon’s weekly chart highlights a well-structured range-bound consolidation transitioning into a rising trend. Over the past several quarters, the stock has repeatedly faced supply near the upper resistance zone around 400–420, as marked by multiple rejections. This clearly establishes a strong overhead resistance where sellers have historically dominated.

On the downside, price action has respected a rising support trendline, forming higher lows over time. Each dip toward this support zone has attracted fresh buying interest, indicating accumulation at lower levels. This combination of flat-to-rising resistance and rising support reflects improving demand strength and a gradual tightening of price structure.

The recent pullback toward the support area near 360–370 is technically healthy rather than bearish. Such retracements often act as retest phases, allowing the market to absorb supply before attempting the next directional move. As long as Biocon holds above this rising support, the broader bullish structure remains intact.

A decisive weekly close above the resistance band (420+) would confirm a breakout from this prolonged consolidation. Post-breakout, the chart opens room for a strong upside expansion, with projected targets gradually extending toward the 460–500 zone based on the height of the prior range and trend continuation principles.

From a risk perspective, the setup stays valid while price sustains above the rising trendline. A breakdown below this support would delay the bullish thesis and could push the stock back into consolidation. Until then, Biocon remains in a favorable positional structure, where patience around support and confirmation near resistance can offer high-quality risk–reward opportunities for medium- to long-term traders and investors.

AUDCAD 4HR T/F ANALYSIS----

audcad 4hr t/f analysis---- red highlighted portion is a arc so it`s dual direction if breakout above breakout line then we can sure previous whole demand can repeat , trend are bullish so we can go with trend | if we want enter in trend then wait for after breakout and retesting then we can plane a trade on retesting point let`s see----

NIFTY KEY LEVELS FOR 23.01.2026NIFTY KEY LEVELS FOR 23.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

GIFTNIFTY IntraSwing Levels for 23rd JAN 2026GIFTNIFTY IntraSwing Levels for 23rd JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

____________^^^^^^^^^^^^________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.