Part 1 Intraday Institutional Trading Hedging with Options

Options are widely used for risk management.

Examples:

Buying put options to protect long equity portfolios

Using collars to limit upside and downside

Index puts for market crash protection

Hedging reduces returns slightly but protects capital, which is crucial for long-term survival.

Trendchannels

Part 1 Technical Vs. Institutional Why Trade Options?

Option trading is preferred because it offers:

Leverage – Control large positions with small capital

Hedging – Protect portfolios against losses

Income Generation – Through option selling

Flexibility – Profit in bullish, bearish, and sideways markets

Defined Risk Strategies – With spreads and hedges

Part 2 Intraday Institutional TradingOption Trading: Terms and Conditions

- Strike Price: Price at which option can be exercised.

- Expiry Date: Last day option can be exercised.

- Premium: Price paid for option.

- Lot Size: Number of shares/contracts per lot.

- Margin: Required for selling options.

- Exercise: Buyer chooses to buy/sell underlying asset.

- Assignment: Seller obligated to buy/sell if option exercised.

STARHEALTH 1 Week View📌 Current Reference Price: ~₹469 (last session high ~₹478, low ~₹446) (not real‑time).

📊 Weekly Time Frame Levels (Support & Resistance)

🔺 Weekly Resistance Levels

These are areas where price may face selling pressure or pause on upward moves:

R1: ~₹478–₹480 zone — recent short‑term rejection area near high of week.

R2: ~₹492–₹495 — next weekly resistance from pivot projections.

R3: ~₹514–₹516 — extended weekly resistance from standard pivot/levels.

Key Breakout Level:

➡️ Weekly close above ~₹480–₹485 would signal stronger upside continuation on the weekly chart.

🔻 Weekly Support Levels

Important zones where buyers may step in on pullbacks:

S1: ~₹450–₹455 area — near pivot support & intermediate support.

S2: ~₹430–₹435 — broader weekly support cluster.

S3: ~₹408–₹420 — structural support from longer pivot zones.

Key Breakdown Level:

➡️ Weekly close below ~₹430–₹435 could open deeper correction toward the ₹408–₹420 area.

📈 Weekly Pivot Context (Classic/Fibonacci)

From wider pivot calculations for weekly timeframe:

Weekly Pivot (Center): ~₹454–₹460

Weekly Fibonacci Resistances: ~₹478 (R1), ~₹492 (R2)

Weekly Fibonacci Supports: ~₹431 (S2), ~₹393–₹408 range lower support.

This means the current weekly range is roughly ₹430–₹480, with the pivot/cycle zone around ₹454–₹460 providing a reference for bias (bullish above, bearish below).

📌 Weekly Technical Bias

Weekly momentum on some platforms shows mixed/neutral signals (RSI near neutral, price around pivot).

Shorter price action suggests recent rejection near higher levels (~₹478–₹480).

Interpretation:

📌 Bullish weekly view as long as price holds above ~₹450–₹455.

📌 Bearish weekly view if price closes below ~₹430 weekly, which could risk deeper support tests.

ACC 1 Month View 📈 1-Month Key Price Range

🔹 1-Month High: ~₹1,779 (late Jan 2026)

🔹 1-Month Low: ~₹1,626 (recent session low)

➡️ So the current 1-month trading range is roughly:

👉 ₹1,626 – ₹1,779

🔥 Short-Term Support & Resistance Levels

Support (Downside)

• S1: ~₹1,626 — recent intra-day low and current 52-week low area.

• S2: ~₹1,600 — psychological/support near multi-session lows (below recent range).

• S3: ~₹1,570 … deeper support if the range breaks down.

Resistance (Upside)

• R1: ~₹1,670–₹1,680 — immediate resistance around recent price reaction zone.

• R2: ~₹1,720 — short-term resistance near 20–30 day moving averages.

• R3: ~₹1,760–₹1,780 — recent 1-month highs.

📊 1-Month Technical Context

📉 Over the past 30 days, ACC has been in a modest downtrend/weak range, with 1-month returns in negative territory and prices sliding from the upper ₹1,700s toward mid-₹1,600s.

Technical indicators also point toward bearish/neutral momentum in the short term (e.g., RSI weak, MACD bearish) — aligning with the recent price pressures.

Part 2 Intraday Institutional TradingBest Practices for Retail Traders

1. Start with Buying Options

Risk is limited.

2. Prefer ATM or Slight ITM

Better stability, realistic probability.

3. Avoid Holding Overnight

Unless you understand IV, theta, and event risk.

4. Track Implied Volatility

Buy when IV is low, sell when IV is high.

5. Use a Trading Plan

Entry levels

Stop loss

Target

Position size

6. Don’t Chase Cheap OTM Options

They expire worthless most of the time.

Part 5 Advance Option Trading Strategies Risks in Option Trading

Options offer high rewards, but also involve risks if not used carefully.

1. For Option Buyers

High time decay (theta loss daily)

Need strong, fast movement

2. For Option Sellers

Unlimited risk (if naked selling)

High margin requirement

Volatility spikes kill profits

3. Liquidity Risk

Wide bid-ask spreads reduce profit potential.

4. Event Risk

News announcements can cause unpredictable moves.

Part 2 Institutional VS. TechnicalWhat Are Options?

Options are derivative contracts whose value is derived from an underlying asset—such as stocks, indices, commodities, currencies, or ETFs. There are two basic types of options:

1. Call Option

A call option gives you the right to buy the underlying asset at a fixed price (called the strike price) within a specified period.

Traders buy calls when they expect price to rise.

Profit increases as the underlying price moves above the strike price.

2. Put Option

A put option gives you the right to sell the underlying asset at the strike price within a specified period.

Traders buy puts when they expect price to fall.

Profit increases as the underlying price moves below the strike price.

Every option has two key components:

Strike Price: The price at which the asset can be bought/sold.

Expiration Date: When the option becomes invalid.

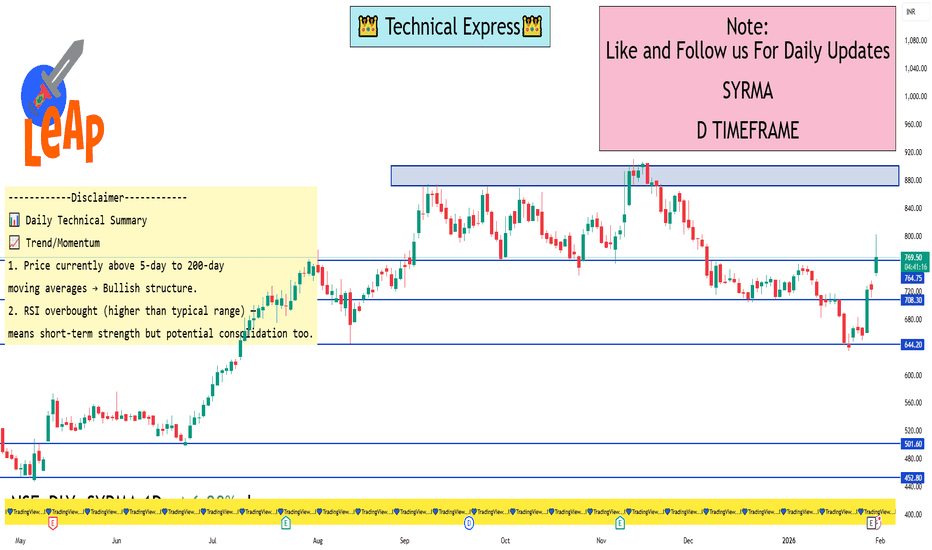

SYRMA 1 Day View 📍 Current Price (approx): ~₹760–₹770 (up strongly with gap‑up & volatility today) — trading above most MA’s signalling strong bullish bias.

🔁 Pivot & Key Levels (Daily Time‑Frame)

📌 Standard Daily Pivot Levels

🟡 Pivot Point: ~₹736–₹737 — central level for trend bias

🟢 Resistance 1 (R1): ~₹748–₹749

🟢 Resistance 2 (R2): ~₹761–₹762

🟢 Resistance 3 (R3): ~₹773–₹774

🔴 Support 1 (S1): ~₹698–₹700

🔴 Support 2 (S2): ~₹689–₹690

🔴 Support 3 (S3): ~₹685–₹686

👉 Interpretation: Trading above pivot & R1 suggests buyers are in control today. R2/R3 are key upside obstacles. S1/S2/S3 are important support zones in case of pullbacks.

🔑 Key Levels to Watch (for Today / Daily)

✅ Bullish breakout continuation levels:

Short‑term upside: ~₹748 → ₹762 → ₹774 (R1/ R2/ R3)

⚠️ Pullback / support levels:

Initial support: ~₹700–₹698 (S1)

Next support: ~₹690–₹686 (S2 / S3)

📊 Bias reference: Price above pivot → bullish bias today. A break below pivot could soften momentum.

🧠 How to Use These Levels

Bullish scenario:

Hold above ₹748 → higher targets: ₹761 / ₹773+.

Conservative traders:

Watch support at ₹700 / ₹690 for dips as potential trend continuation entry/stop‑loss areas.

Risk control:

If price drops below pivot (~₹737) decisively, momentum may weaken intraday.

Part 5 Best Trading Strategies Simple Example to Understand

Scenario

Nifty at 21500

You expect it to go to 21650.

Call Option Buy

Buy 21500 CE

If Nifty moves up → premium increases → profit

If Nifty falls → premium collapses → loss

Put Option Buy

Not useful in this scenario

Option Seller’s View

If seller expects market to remain sideways:

Seller sells 21600 CE

Seller sells 21400 PE

Both sides decay → seller profits

Part 1 Intraday Institutional Trading How Institutions Trade Options

Institutions use:

Delta hedging

Gamma scalping

Volatility Arbitrage

Neutral strategies

They focus more on:

Probability

Volatility cycles

Liquidity zones

Mean reversion

Understanding institutional behavior helps traders make better decisions, especially when reading volume profiles and OI shifts.

Candle Patterns in Technical AnalysisCandle patterns are formations created by Japanese candlesticks on a chart, indicating market sentiment and potential price movements. Here are some common ones:

Bullish Patterns- Hammer: Indicates potential reversal from bearish to bullish.

- Bullish Engulfing: Indicates reversal from bearish to bullish.

- Morning Star: Indicates reversal from bearish to bullish.

Bearish Patterns- Shooting Star: Indicates potential reversal from bullish to bearish.

- Bearish Engulfing: Indicates reversal from bullish to bearish.

- Evening Star: Indicates reversal from bullish to bearish.

Indecision Patterns- Doji: Indicates indecision in market.

- Spinning Top: Indicates indecision.

APLAPOLLO 1 Week View🔎 Current Price Snapshot

🟢 Last close: ₹2,000.10 (23 Jan 2026) — near a 52-week high zone.

📉 Weekly Technical Levels (1-Week Time Frame)

🧱 Support Levels (Key Floors)

These are levels where price is likely to find buying interest if the price pulls back:

S1: ~₹1,913 – ₹1,926 — first strong support band.

S2: ~₹1,890 – ₹1,911 — secondary support base from pivot structure.

S3: ~₹1,850+ — deeper support from broader weekly structure and previous pivot base.

Note: Above ~₹1,890 zone is a key defence level in weekly charts — losing this could signal short-term weakness.

📈 Resistance Levels (Key Ceilings)

These are weekly upside barriers where price may struggle initially:

R1: ~₹2,011 – ₹2,050 — first resistance cluster from weekly pivots.

R2: ~₹2,080 – ₹2,100 — next overhead resistance from extended levels.

R3: ~₹2,128 – ₹2,140+ — broader technical pivot resistance.

Bullish bias continues only above ~₹2,011–₹2,050.

📌 Weekly Trading Scenarios

🟢 Bullish Case (Upside)

Trigger: Sustained weekly close above ~₹2,011–₹2,050

Targets:

→ Short-term: ~₹2,080–₹2,100

→ Extended: ~₹2,120–₹2,140+

Outlook: Strength above R1 opens path to higher weekly highs.

🔵 Neutral / Range

Range: ₹1,890–₹2,050

Behavior: Price oscillates as buyers/sellers balance.

🔴 Bearish Case (Downside)

Trigger: Weekly close below ~₹1,890

Downside key support: ~₹1,850+

Outlook: Weekly momentum weakens if key support breaks.

Intraday Institutions Trading Option Pricing – How Premium Moves

Factors affecting premium

Underlying price movement.

Volatility levels (IV).

Time remaining for expiry.

Demand–supply and liquidity.

Strike price distance from spot.

How premium reacts

If underlying moves towards strike → premium increases.

If underlying moves away from strike → premium decreases.

Sharp move + low IV = huge premium expansion.

Sideways market = premium decay.

Before major events = IV rise → premium rise.

After events = IV crush → premium collapse.

Part 2 Techical Analysis Vs. Institutional Option Trading Key Terminologies in Option Trading

Strike Price – The pre-decided price at which you get the right to buy or sell.

Premium – Amount you pay to buy an option.

Spot Price – Current market price of the underlying.

Intrinsic Value – Actual value of an option if exercised now.

Time Value – Extra premium due to time left until expiry.

OTM (Out of The Money) – No intrinsic value; cheaper premiums.

ATM (At The Money) – Strike closest to current market price.

ITM (In The Money) – Has intrinsic value; expensive premiums.

Expiry – Last date on which the option is valid.

Lot Size – Minimum number of units per option contract.

Trading Breakouts and Fakeouts: Capturing Momentum Understanding Breakouts in Trading

A breakout occurs when price moves decisively beyond a well-defined support or resistance level with the potential to start a new trend or accelerate an existing one. These levels usually represent areas where price has previously struggled to move beyond due to a balance between buyers and sellers. When that balance shifts, price breaks out.

Breakouts are powerful because they often reflect a change in market sentiment. For example, when resistance is broken, sellers who were defending that level are overwhelmed, and new buyers enter the market expecting higher prices. At the same time, traders who were short may be forced to cover their positions, adding fuel to the move.

Breakouts commonly occur from chart structures such as consolidation ranges, triangles, flags, head-and-shoulders patterns, and channels. The longer the price consolidates and the more times a level is tested, the more significant the breakout tends to be. Volume often plays a critical role here; a true breakout is usually accompanied by an expansion in volume, signaling strong participation.

Types of Breakouts

Breakouts can be classified in several ways. Range breakouts happen when price moves above resistance or below support after trading sideways for a period. Trendline breakouts occur when price breaks a downward or upward sloping trendline, often indicating a trend reversal or acceleration. Volatility breakouts happen when price exits a low-volatility environment, often after a squeeze, leading to sharp directional moves.

Another important distinction is time-frame based breakouts. Intraday traders focus on breakouts of previous day highs/lows or key intraday levels, while swing and positional traders look for breakouts on daily, weekly, or even monthly charts. Higher time-frame breakouts generally carry more reliability, but they also require wider stop losses and patience.

What Are Fakeouts and Why They Happen

A fakeout, also known as a false breakout, occurs when price briefly moves beyond a key level but fails to sustain the move and quickly reverses back into the prior range. Fakeouts are common because markets are driven by liquidity. Large participants often push price beyond obvious levels to trigger stop losses and breakout orders, then reverse price once sufficient liquidity is collected.

Fakeouts happen for several reasons. One major reason is lack of follow-through buying or selling. Price may break a level, but if volume is weak and broader market sentiment does not support the move, the breakout fails. News-driven volatility can also cause fakeouts, where price reacts sharply to an announcement but then retraces once emotions cool down.

Retail trader behavior plays a role as well. Many traders place stops just beyond obvious support or resistance. When price reaches these areas, stop orders get triggered, causing a brief surge that looks like a breakout. Once those stops are absorbed, price reverses, trapping late breakout traders.

Identifying High-Probability Breakouts

Not all breakouts are equal. High-probability breakouts usually have a few common characteristics. First, the level being broken should be clearly visible and respected in the past. Second, price action before the breakout often shows contraction, such as lower volatility or tighter ranges, indicating pressure buildup. Third, confirmation through volume expansion, strong candle closes, or alignment with the higher-time-frame trend increases reliability.

Context is critical. A breakout in the direction of the broader trend has a much higher success rate than a counter-trend breakout. For example, an upside breakout in a strong bullish market is more likely to succeed than the same breakout during a choppy or bearish environment.

Recognizing and Trading Fakeouts

Fakeouts are frustrating, but experienced traders learn to identify and even trade them. Common signs of a fakeout include weak candle closes beyond the level, long wicks showing rejection, low volume on the breakout attempt, and immediate failure to hold above or below the key level.

One effective approach is the “break and retest” method. Instead of entering immediately on the breakout, traders wait for price to break the level and then retest it from the other side. If the level holds during the retest, the breakout is more likely to be genuine. If price fails quickly and moves back into the range, it signals a potential fakeout.

Some advanced traders deliberately trade fakeouts by entering in the opposite direction once price reclaims the broken level. These trades can be powerful because trapped breakout traders are forced to exit, accelerating the reversal move.

Risk Management in Breakout and Fakeout Trading

Risk management is the backbone of trading breakouts and fakeouts. Breakout trades should have clearly defined stop losses, usually just inside the broken level or below the breakout candle’s low in bullish setups. Because fakeouts are common, position sizing should be conservative, especially in volatile markets.

For fakeout trades, stops are typically placed beyond the extreme of the false breakout. Since reversals can be sharp, reward-to-risk ratios are often favorable, but discipline is essential. Overtrading every breakout or fakeout leads to emotional decisions and inconsistent results.

Psychology and Discipline

The psychology of breakout trading is intense. Fear of missing out (FOMO) often pushes traders to chase breakouts late, increasing the chance of getting trapped in a fakeout. Successful traders stay patient, wait for confirmation, and accept that missing a trade is better than taking a low-quality setup.

Equally important is accepting losses. Even the best breakout traders experience fakeouts regularly. The key is to keep losses small and let successful breakouts run. Over time, consistency and discipline matter more than predicting every move correctly.

Conclusion

Trading breakouts and fakeouts is about understanding market structure, liquidity, and trader behavior. Breakouts offer opportunities to ride strong momentum, while fakeouts remind traders of the market’s deceptive nature. By combining technical analysis with volume, context, and disciplined risk management, traders can improve their ability to capture genuine breakouts and avoid or even profit from fakeouts. Mastery of this approach does not come from avoiding losses entirely, but from managing them wisely while staying aligned with high-probability market conditions.

Part 12 Trading Master Class With Experts Why Traders Use Options

Options allow traders to benefit from multiple market views:

Directional trading (up or down)

Non-directional trading (markets stay range-bound)

Volatility trading (IV expansion/contraction)

Hedging (protect portfolios)

Income generation (selling options)

This flexibility makes options superior to normal equity trading.