clear rounding bottom breakout Glenmark PharmaRounding Bottom breakout alongwith the volume

Deliveries > 55%

Strong Fundamentals

All time high breakout

Price could be go straight away but RSI is in overbought zone and price could re-test the breakout level than fly in blue sky.

This is only for educational purpose no any trade recommendation.

Trend Lines

Trendline broken Buying pressure continuous and flooding Gold is gaining from strength to strength

After breaking the falling trendline It is trading above the opening range.

As long as above this. More upside towards 3366 and more could follow

Comfortably above weekly support 3300

Tp remaining same as before

STRONG REJECTION exactly as analysed!!As we can see NIFTY showed directional downward move exactly as analysed. Now that NIFTY has closed again at important demand zone from where it got rejected previously, but now the formation of this candle shows the strength of bear over bulls, Hence any closing below 25300 should lead to another strong downfall so plan your trades accordingly and keep watching everyone.

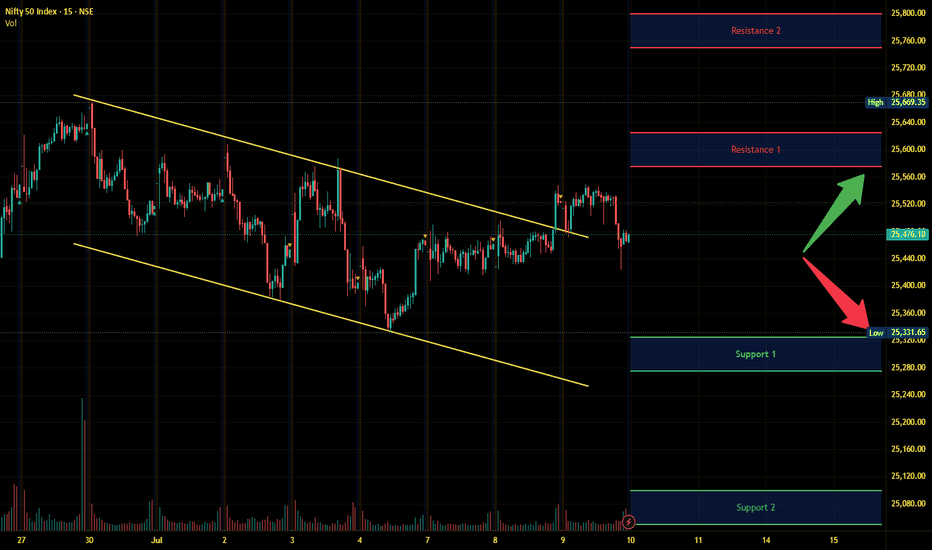

Nifty Intraday Analysis for 10th July 2025NSE:NIFTY

Index has resistance near 25575 – 25625 range and if index crosses and sustains above this level then may reach near 25750 – 25800 range.

Nifty has immediate support near 25325 – 25275 range and if this support is broken then index may tank near 25100 – 25050 range.

Any positive news on India US trade deal will lift the market otherwise the same sideways market is expected.

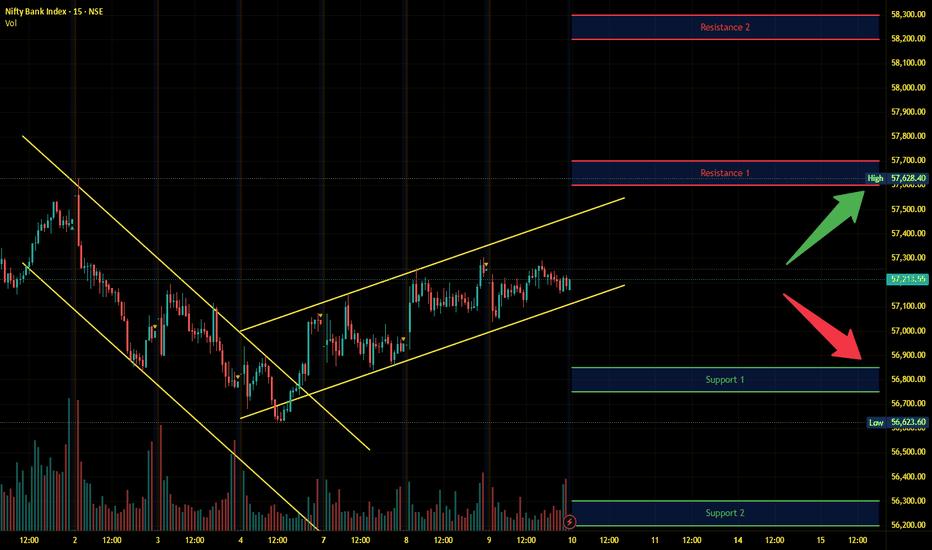

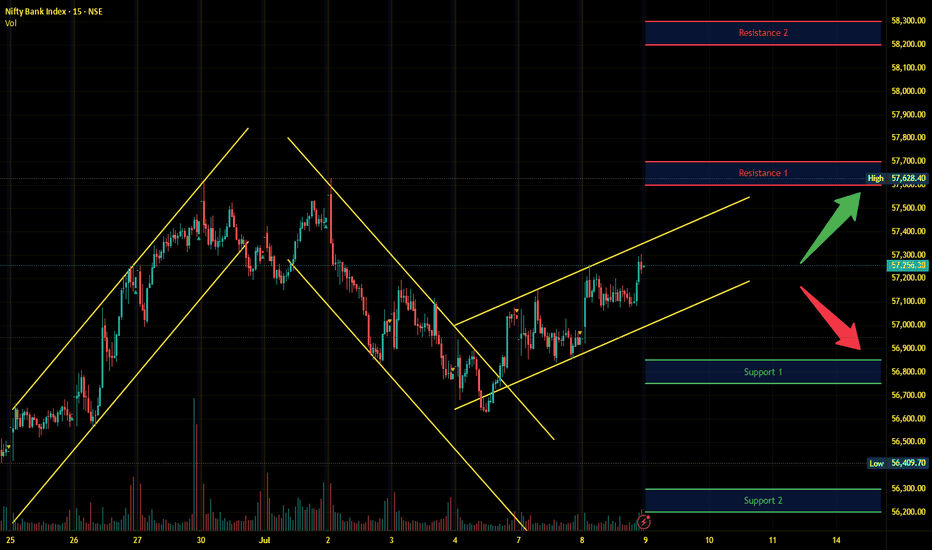

Banknifty Intraday Analysis for 10th July 2025NSE:BANKNIFTY

Index has resistance near 57600 – 57700 range and if index crosses and sustains above this level then may reach near 58200 – 58300 range.

Banknifty has immediate support near 56850 - 56750 range and if this support is broken then index may tank near 56300 - 56200 range.

Any positive news on India US trade deal will lift the market otherwise the same sideways market is expected.

Finnifty Intraday Analysis for 10th July 2025NSE:CNXFINANCE

Index has resistance near 27250 - 27300 range and if index crosses and sustains above this level then may reach near 27450 - 27500 range.

Finnifty has immediate support near 26850 – 26800 range and if this support is broken then index may tank near 26600 – 26550 range.

Any positive news on India US trade deal will lift the market otherwise the same sideways market is expected.

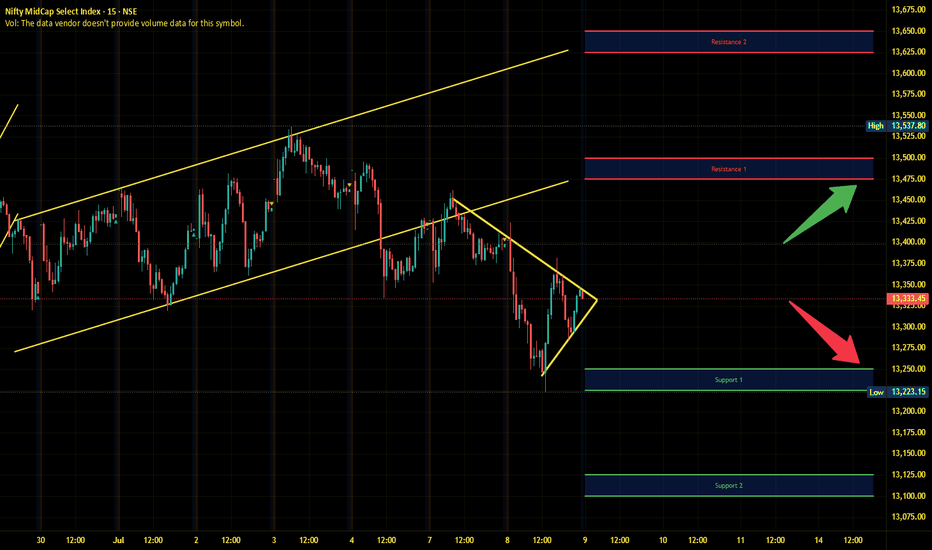

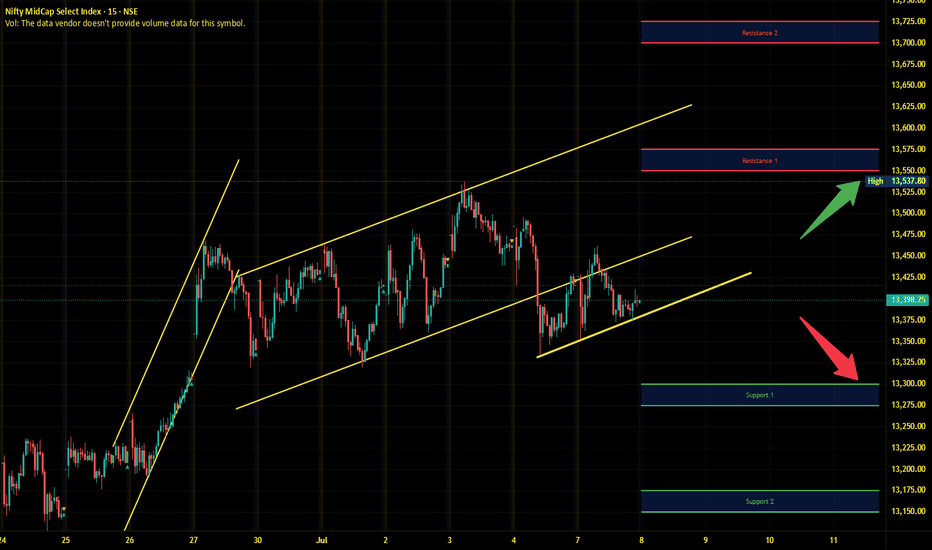

Midnifty Intraday Analysis for 10th July 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13450 – 13475 range and if index crosses and sustains above this level then may reach 13625 – 13650 range.

Midnifty has immediate support near 13175 – 13150 range and if this support is broken then index may tank near 13025 – 13000 range.

Any positive news on India US trade deal will lift the market otherwise the same sideways market is expected.

Glenmark - Will mark a higher zone?!The stock which lifted pharma index today was Glenmark. Though nifty was falling, pharma sector managed to sustain and Glenmark rocked.

So what we can expect in the coming days?

Daily chart shows a steady uptrend.

In gap up scenario, buy level is above 1922 - 1926 with the stop loss of 1906 for the targets 1944, 1958, 1972, 1988 and 2002.

Flat opening scenario means we can buy above 1902 - 1905 with the stop loss of 1885 for the targets 1920, 1944, 1972, 1988 and 2002.

Price is bullish as long as it sustains above 1870 - 1880.

2000 zone is a psychological zone and some profit booking can happen. And sustaining above that can make price to move towards 2080 and 2160.

Always do your own analysis before taking any trade.

HSCL to Fly Very Sooon!So here's another chart that’s quietly showing signs of strength — NSE:HSCL just kissed its falling trendline drawn from September 2024 highs.

After almost 10 months of lower highs, the stock is now trying to push above the trendline with volume backing it. That giant green candle on June 27 with a volume burst was the sign of Smart Money stepping in. And now it’s consolidating just below the breakout point — classic pre-breakout structure.

This is what we call a volatility contraction near resistance, where price tightens and sets up for an impulsive move. Earnings season is around the corner, and this might just be forming its Earning Pivot.

Don't rush. But if price takes out that 525–530 zone cleanly with volume, it's ready to fly.

#Entry above: 530

#Stoploss: 498

#Target 1: 565

#Target 2: 598

#Extended: 630 (if volume sustains above 600 zone)

Be ready but not greedy.

Let confirmation guide your move. No front running.

Also — this is a stock with explosive history, so manage risk wisely.

Avoid impulse. Trade plans, not predictions.

Have a focused and profitable day ahead.

BEARISH till now! View might change above 25550!!As expected NIFTY got rejected exactly from our given trendline resistance but since it tried breaking the trednline, its candle high is of immense importance. Any break and sustainment above 25550 can result in strong unidirectional upmove, but below the trendline, it can remain sideways to negative so plan your trades accordingly and keep watching everyone.

Rossari Biotech Long setup 1:5 RR (Textile chemical sector)

Buy Rossari Biotech long setup

Between 700-710

Stop loss: 665

Target 1: 765

Target 2: 830

Target 3: 862

Trade as per your risk-taking capacity.

Triangle Pattern and trend line breakout with volume

They are among the largest manufacturers of textile specialty chemicals in India.

If US-India trade deal benefits textile sector, this will start running.

Rashi Peripherals Long Setup channel pattern 1:2 RRRashi peripherals following channel pattern and forming HH and HL.

Swing Trade

Buy Rashi Peripherals

Above: 306

add few quantities near 300-302

Stop Loss: 292

Target 1 : 325

Target 2 : 340

Trade as per your risk-taking capacity.

Stock has broken trendline with volume also form W pattern on channel support ready for up move to touch upper channel resistance.

Buying at 300 will give 1:4 RR

Nifty Intraday Analysis for 09th July 2025NSE:NIFTY

Index has resistance near 25675 – 25725 range and if index crosses and sustains above this level then may reach near 25900 – 25950 range.

Nifty has immediate support near 25375 – 25325 range and if this support is broken then index may tank near 25150 – 25100 range.

India US trade deal is still undecided and any positive news from the US will lift the market.

Banknifty Intraday Analysis for 09th July 2025NSE:BANKNIFTY

Index has resistance near 57600 – 57700 range and if index crosses and sustains above this level then may reach near 58200 – 58300 range.

Banknifty has immediate support near 56850 - 56750 range and if this support is broken then index may tank near 56300 - 56200 range.

India US trade deal is still undecided and any positive news from the US will lift the market.

Finnifty Intraday Analysis for 09th July 2025NSE:CNXFINANCE

Index has resistance near 27200 - 27250 range and if index crosses and sustains above this level then may reach near 27400 - 27450 range.

Finnifty has immediate support near 26800 – 26750 range and if this support is broken then index may tank near 26550 – 26500 range.

India US trade deal is still undecided and any positive news from the US will lift the market.

Midnifty Intraday Analysis for 09th July 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13475 – 13500 range and if index crosses and sustains above this level then may reach 13625 – 13650 range.

Midnifty has immediate support near 13250 – 13225 range and if this support is broken then index may tank near 13125 – 13100 range.

India US trade deal is still undecided and any positive news from the US will lift the market.

PCBL – Breakout from Symmetrical TriangleNSE:PCBL

📈 PCBL – Breakout from Symmetrical Triangle | Bullish Momentum Building 🚀

📌 Symbol: PCBL CHEMICAL LTD – NSE

🕒 Timeframe: Daily

💰 CMP: ₹431.85 (+6.80%)

📆 Date: July 9, 2025

🔷 Technical Summary:

PCBL has given a strong breakout above a well-formed *symmetrical triangle* with significant volume support. Price action indicates trend reversal from a long-term falling channel.

✅ Key Bullish Signals:

• Symmetrical triangle breakout above ₹425

• Bullish engulfing candle with 271% spike in volume

• RSI at 65 – strong but not overbought

• Price trading above all major EMAs (20/50/100/200)

• Vol Run Rate: 390% – confirms strong market participation

📊 Support & Resistance Levels:

• Support: ₹408 / ₹393.70 / ₹362

• Resistance: ₹444.15 / ₹471.30 / ₹498.40

📈 Trade Setup (Positional):

• Buy Zone: ₹425–₹432 (on dips or sustained close above ₹432)

• Target 1: ₹444

• Target 2: ₹471

• Target 3: ₹498

• Stop Loss: ₹408 (below breakout zone)

🧠 Analyst Note:

This breakout comes after months of consolidation and offers a favorable risk-reward ratio. Watch for follow-through above ₹444–₹448 for confirmation of a larger uptrend.

📢 Disclaimer: This is not investment advice. Please consult your financial advisor before making any trading decisions.

A minor RESPITE!? will it sustain?As we can see NIFTY finally showed some volume after being sideways for couple of days which could be a result of consolidation's break. Moreover, we can see NIFTY closed itself at the trendline resistance which is cautionary. Hence unless NIFTY breaks and sustain itself above the trendline, every rise can be shorted so plan your trades accordingly and keep watching everyone.

Nifty Intraday Analysis for 08th July 2025NSE:NIFTY

Index has resistance near 25600 – 25650 range and if index crosses and sustains above this level then may reach near 25800 – 25850 range.

Nifty has immediate support near 25300 – 25250 range and if this support is broken then index may tank near 25100 – 25050 range.

Clarity on India US trade deal will pave the path for fresh movement on either side.

Banknifty Intraday Analysis for 08th July 2025NSE:BANKNIFTY

Index has resistance near 57400 – 57500 range and if index crosses and sustains above this level then may reach near 57900 – 58000 range.

Banknifty has immediate support near 56500 - 56400 range and if this support is broken then index may tank near 56000 - 55900 range.

Clarity on India US trade deal will pave the path for fresh movement on either side.

Finnifty Intraday Analysis for 08th July 2025NSE:CNXFINANCE

Index has resistance near 27050 - 27100 range and if index crosses and sustains above this level then may reach near 27300 - 27350 range.

Finnifty has immediate support near 26650 – 26600 range and if this support is broken then index may tank near 26400 – 26350 range.

Clarity on India US trade deal will pave the path for fresh movement on either side.

Midnifty Intraday Analysis for 08th July 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13550 – 13575 range and if index crosses and sustains above this level then may reach 13700 – 13725 range.

Midnifty has immediate support near 13300 – 13275 range and if this support is broken then index may tank near 13175 – 13150 range.

Clarity on India US trade deal will pave the path for fresh movement on either side.