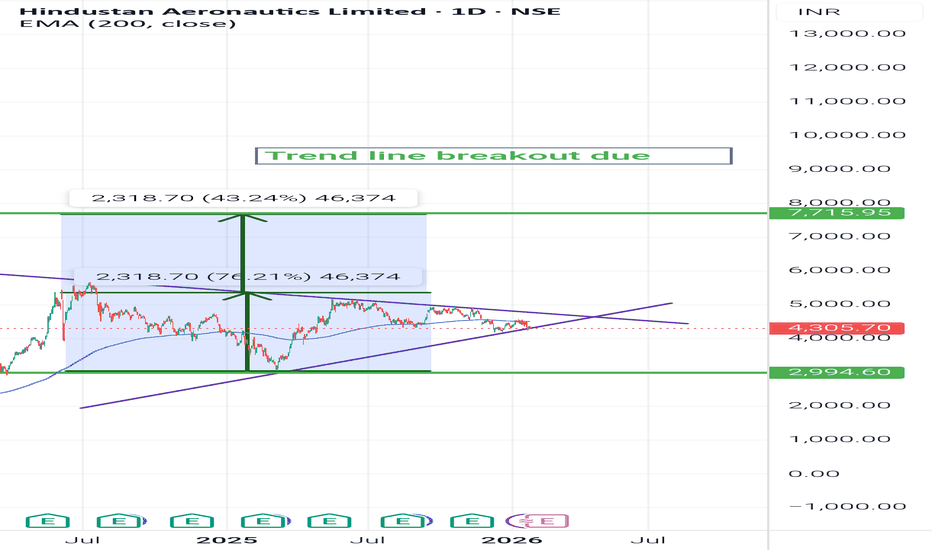

Hal view before budget 2026 24 jan day tf Hal isom sideways move after geo political tension was over with india and neighbourjmh countries.

But hal being a monopoly stock in aviation backed by govt a well known psu.

It's main performance is due because of delivery of tejas mk1 and other next gen planes.

Crash in Dubai was a major setback but having strong order book and work in progress it was somehow accepted.

Also has done deals with isro etc..

Coming to technicals if it crosses 200 dema and a diagonal trendline.

Pattern based target is around 7000.

#HAL

Value

Weekly Update for next week January 23, 2026, gold has reached a monumental peak. We are seeing a "once-in-a-decade" rally where domestic prices in India have crossed ₹1,59,000 per 10 grams, and global prices are knocking on the $5,000 per ounce door.

Here is the current state of the market and the essential terms you need for future trading or investing.

1. Live Market Snapshot (Jan 23, 2026)

MCX Gold (India): The February contract hit a lifetime high of ₹1,59,226 per 10 grams.

24K Spot Price: In major cities like Delhi and Mumbai, physical 24K gold is trading between ₹1,59,700 and ₹15,990 per 10 grams.

Global COMEX Gold: Prices are hovering around $4,953 per ounce.

Silver Correlation: Silver has exploded even more than gold, hitting a record ₹3,39,927 per kg on the MCX today.

2. Future Terms & Concepts to Know

To navigate this market, you must understand these high-level terms that professional traders are currently using:

A. Technical Terms

Overbought (RSI > 70): The Relative Strength Index (RSI) is currently very high. This means the price has moved up "too fast" and a temporary dip (correction) is likely as traders sell to book profits.

Psychological Resistance: The $5,000 mark for global gold and ₹1,60,000 for Indian gold. Prices often "stall" or bounce back when hitting these round numbers.

The "Greenland Premium": A new term referring to the price spike caused by the US-Europe tensions over Greenland. If this tension resolves, expect a "cool down" in prices.

B. Trading & Risk Terms

Trailing Stop-Loss: Instead of a fixed stop-loss, you move your exit point upward as the price rises.

Example: If you bought at ₹1,55,000, you might set a stop-loss at ₹1,53,000. Once gold hits ₹1,59,000, you move that stop-loss to ₹1,57,000 to lock in your gains.

Gap Up / Gap Down: Gold has been "gapping up" (opening much higher than it closed the previous day). This indicates extreme buying pressure but also increases the risk of a "gap fill" (a sudden drop to fill the empty space on the chart).

Contango: A situation where the future price of gold is higher than the current spot price. This is currently the case, signaling that the market expects even higher prices by mid-2026.

3. Expert Forecasts for 2026

Major financial institutions have just revised their 2026 targets:

Goldman Sachs: Has raised its year-end target to $5,400 per ounce.

J.P. Morgan: Predicts an average of $5,055 by Q4 2026.

Indian Market: Some analysts (like GlobalData) suggest a domestic peak of ₹1,75,000–₹1,95,000 by late 2026 if the Rupee stays weak.

How Funds Actually Make Money From Bitcoin📰 I’ve followed financial markets long enough to notice a strange paradox:

spend more than five minutes scrolling Crypto TikTok (YouTube or X isn’t much different), and you’d think the entire crypto market is run by a few whale clicks and a handful of flashy headlines.

You’re constantly told that:

📉 Someone is “buying the dip”

📈 Someone else is “selling the top”

🐋 And a major institution is “deciding the fate of the market”

It sounds reasonable.

But in reality… it’s far more complex than that.

📣 I’ve watched hundreds of videos like these. The script is always the same.

Glossy thumbnails, rushed voices, and absolute statements:

“BlackRock is buying — PRICE IS GOING UP!”

“Whales are selling — THE MARKET IS ABOUT TO CRASH!”

“Institutional money is here!!!”

🎭 But beneath the drama, what’s really there?

No nuance. No structure. And almost no understanding of how institutions actually make money.

🔍 Here’s the truth I’ve learned after years of observing the markets:

Whether BlackRock buys or sells Bitcoin has very little to do with you.

Large funds don’t trade on emotion, nor do they survive by predicting direction like retail traders do.

They don’t need Bitcoin to go up.

They don’t need Bitcoin to go down.

🎯 What they need is volatility — calculated, measured, and modeled.

🧠 This is the part most TikTok content completely ignores.

A fund can buy Bitcoin and at the same time:

🛡️ Hedge 100% of its risk

⚖️ Stay delta-neutral

📊 Maintain a neutral market view

🔒 Be protected against both upside and downside moves

👉 For them, buying BTC is not a gamble.

It’s simply the first layer of a multi-leg trading structure.

What matters isn’t how much they buy,

but what comes next — the steps most retail traders have never even heard of.

📉📈 I often ask myself:

Why do so many “TikTok analysts” talk about institutions every day, yet never mention delta, gamma, hedging, or basis?

The answer is simple:

👉 Because they don’t understand it.

If someone:

screams “bullish” and “bearish” in every video

believes institutions are “pumping prices”

but can’t explain delta-neutral hedging

then their opinion on what BlackRock is “doing” has no analytical value.

📊 To really understand this, let’s look at how a fund actually makes money.

Assume Bitcoin is trading at $100,000.

The fund doesn’t care whether price goes up or down.

They deploy a neutral options structure, betting on volatility , not direction.

When price rises:

they sell part of the position to rebalance risk

profit comes from selling at higher levels

When price falls:

they buy back at lower prices

profit comes from buying cheaper

🔁 Price up → sell high

🔁 Price down → buy low

👉 Repeat. With discipline. Without emotion.

This is gamma scalping — the quiet, persistent profit engine behind institutional trading.

💰 So where does their real profit come from?

Not from news.

Not from influencers.

Not from ETF headlines.

It comes from:

continuous hedge adjustments

realized volatility exceeding expectations

direction-neutral structures

strict mathematical discipline

⛔ The rare moment they struggle?

When the market… doesn’t move at all.

🧭 And here’s what I want to say to you directly, as a market professional:

You are not BlackRock.

You don’t have their infrastructure.

You don’t have their capital, speed, or risk models.

👉 Trying to predict or mimic their actions won’t make you a better trader — it will only make you more confused.

✍️ My conclusion is very clear:

Watching what large funds do without understanding the structure behind it

is the fastest path to losses.

BlackRock doesn’t trade narratives.

They don’t trade emotions.

And they certainly don’t trade TikTok stories.

🎯 They trade structure.

And you?

Stop watching what they do.

Start understanding what you should do.

That’s the difference between surviva l and being washed out by the market.

PS: BlackRock and TikTok are used purely as illustrative examples.

DABUR: a long term breakout candidatePros:

-Defensive sector i.e. FMCG and world’s largest ayurvedic and natural health care company

-P/E in February 2020 > P/E in November 2025

-Promoter holding at 66% & the retail holding is near an all time low

-Highest ever sales and EPS

-Increase in capex and reduction in debt

-RS has been negative for the last many years and such stocks generally give big upmove when RS becomes positive

Cons:

-PEG is negative implying slow growth

Disc: invested

BTCUSD ANALYSIS ON(14/08/2025)BTCUSD UPDATEDE

Buy Limited - (116000-115000)

If price stay above 113000,then next target 120000,122000,124000 and below that 109000

Plan; if price break 116000-115000 area and above that 116000 area,we will place buy oder in BTCUSD with target of 120000,122000 and 124000 & stop loss should be placed at 113000

ETH rise foreverMy advanced fibo technical analysis says that It has 6100 easy target in sometime. Then It can take bit of a break and then rise other levels. My ultimate target for Etherium is unbelievably 10k in coming time. It's currently undervalues. If BTC touch 100k mark this can easily double triple in no time.

Follow the targets given in the chart.

XAUUSD GOLD Analysis on (01/08/2025)#XAUUSD UPDATEDE

Sell Limited - (3298-3305)

If price stay below 3315, then next target 3282,3268 and above that 3335

Plan;If price break 3298-3305 area,and stay below 3295,we will place sell order in gold with target of 3282,3268 and 3250 & stop loss should be placed at 3315

Buy Opportunity in GoldI am watching it since 1 month. The Gold had taken its retracement.

On lower (1h and 4H) timeframe, It traded in strong trends' zones which were broken yesterday. Now the crocodile traders should wait for its resistance zone and get a signal on 1 h or 4h timeframe to buy above resistance zone, above 3360.

An H4 healthy candle closing above this resitance zone will pave the way into another test of 3422 area, not putting any TP though as my target is 5000 (fundamentaly).

Crazy illiquid stock for small investorsBack in those days where picking value stocks and value picks was the style, here is the illiquid name that takes me back to what real markets are for.

The Polymatech which is making waves in Unlisted space is the promoter of this company and Mr. Eswaran is also taking this up at ₹18

Cords Cables-Can it continue to be a multibagger?Cords Cables is a small cap company which is available at a perfect position technically.

Zone of 140-150 was a supply zone earlier which now should become a demand zone.

If stock manages to bounce from here with good volumes, it can continue its multibagger journey towards big targets.

However, if this zone is breached, stock can fall rapidly so it sis make or break level for stock technically.

Very risky. Keep in watchlist to study and learn.

Not a recommendation.

Elliot Wave study EMAMI LTDEmami Ltd., incorporated in the year 1983, is a Mid Cap company (having a market cap of Rs 27,316.17 Crore) operating in FMCG sector.

Emami Ltd. key Products/Revenue Segments include Personal Care and Other Operating Revenue for the year ending 31-Mar-2024.

For the quarter ended 31-12-2024, the company has reported a Consolidated Total Income of Rs 1,064.41 Crore, up 16.69 % from last quarter Total Income of Rs 912.15 Crore and up 5.07 % from last year same quarter Total Income of Rs 1,013.03 Crore. Company has reported net profit after tax of Rs 283.48 Crore in latest quarter.

GODFREY PHILLIPS THE BEST SECTOR OF ALL TIME Please consult your financial advisor before investing.This is only for learning purpose of chart.

We are NISM certified EQ and MCX trader but not SEBI register investment advisor.

THE 'OG STOCK " stock has given multibagger overthe past few years despite tax rise and uncertain govt policy on tobacco we firmly believe that stock will give infinite return from this level. Because you cannot not stop addict from smoking. Rather make money and be happy...

DELAY in Earning & Revenue Updates after Quarterly/Yearly ResultFrequently, it is observed that "Earning & Revenue details" are not updated on tradingview tool even on the day of quarterly results. Trading view team must work to ensure these results update ASAP to help tradingview traders. If user goes to other tools to get such details, tradingview may loose such customers in futures to tools.

Equinox India - Cup & Handle and Downward channel BOEquinox India has given a BO from downward channel and is also making an Cup & Handle pattern on weekly time frame. This looks quite positive and post breakout of Cup & Handle pattern it is heading for 3X returns. Other factors:

1. Recent accord of merger with Embassy group after 5 years makes Equinox is leading listed real estate company with one of the largest land bank.

2. After 2008, it has given breakout out of downward channel.

3. Cup & Handle is in making on a higher time frame so on breakout it can move 3X.

4. Volumes are also building

5. Price-Book ratio (1.7x) is lowest among other real estate players

Do keep this stock in your radar!!

Keep following @Cleaneasycharts as we provide Right Stock at Right Time at Right Price.

Cheers!!!

JAICORP "OVER"? what about other real estate stocks ?This post is regarding Real estate in india also , so kindly read completely for the effort i kept into writing this article

jaicorp

sold their sez zone at very discount price

its is a real estate company and its main asset was sez almost entire business

so investors lost trust in this company in future also we dont know what they will do to other sales if any,they might never show real value for any other sales also like many unlisted real estate companies

there is a saying

"once a crook is always a crook"

i dont know why sebi is not taking any action or how is it even legal , may sebi need to bring laws for real estate companies in such a way that investors evote in case of low value sale etc

////////////////////////

now the real dilema is that what if same practices are done by other real estate companies

/////////////

we know in india others see a guy doing illegal things and they also start doing thoes things or others will also start to exploit those loop holes

so others are also risky which have land bank stories

i.e is why land value is never included in book value in stocks and are traded at discount

//////////////////(and this is different topic about real estate in india, is real estate going to crash?)

however in india land prices are inflated in such a way that in USA , Europe, Canada, Australia,germany, etc have cheaper prices and better ROI

but why in india land prices are hyped ?

for example if you buy an acre of land for 2CR (crore) and give it to development

for 1 acre i take minimum count ,atleast you will get 30 2bhk apartments

lets say each sold for 30 lakhs

30*30=900 lakhs which is 9cr

construction cost say 4cr atmost still left with 5 cr , after land cost is taken off it will be about 3 cr profit still , so people assume this and are saying 1 acre here cost around 2cr ,

and all real eastate guys marketed people into buying apartments saying you can take house loan , or instead of paying rent you can buy on loan and can pay interest , this went so hype that people started to buy houses as investment than to live in that house ,

soon people started over construction apartments are build too much ,

people who thought apartment as investment thinking later it will appreciate the problem is when years pass on for the same price any guy who want to buy will buy a new apartment that to some what far from the city center as cities are expanding , and there will be lesspollution and they also think city will expand later and our land price will appreciate,

and however they will get it much cheaper so they prefer some what outside and people who bought as investments remains unsold and their value will keep depreciating with time

any country in world you go and look everyone prefers individual house only in india they are promoting apartments so that they get huge profits , but individual house are the best we do not lack land but people over hype prices that are costlier than USA, and greater fool theory is going on thinking someone will buy it for much higher prices

simply an agricultural land they say 2cr per 1acre but if you buy it 2cr and do agriculture you hardly get 20,000 rupees over 2cr so is the prices justified ?

road side lands are a different thing as they can be used to develop commercial real estate like you build a showroom and rent it ,so roi will be good

but in villages people are saying 2cr is so stupid they are assuming apartments case and are saying those prices so best thing is prefer individual house ,

unless its commercial real estate land value will not appreciate. so i think already realestate is overhyped do not when people will start to realize individal is house is better just like in other countries

////////////////////////////////

Here are list of some companies where like jaicorp people think they have land banks

and we dont know they might also do just like jaicorp did to their investors

if you know any please mention in comments if i missed any

BF Utilites

Bf Investments

Nesco

BBTC

Maharastra scooters

bombay dyeing

BDH

KCP

empire industries etc if you know any other please mention

Disclaimer- Just my view and opinion trade at your own risk not an investment advice

these are only for educational purposes

IRCTC-A monopoly stock available at discount!Technically, IRCTC has been in an uptrend since its listing in 2019.

Stock has taken support multiple times at trendline visible on chart.

If stock breaks this trendline due to bearish broader market, we can see a swift move towards 660 levels which is yet another demand zone.

Levels given on chart.

As most of us know, it is a monopoly PSU stock and has big potential in long term given the expansion of rail networks in India. It is not a recommendation but my personal opinion. I am a NISM Certified research analyst and not SEBI registered.