BSE Sensex Ending Diagonal CAUTION!Attached: Sensex Daily Chart as of 19th June 2023

The Ending Diagonal is more evident and clean in BSE Sensex rather than NSE Nifty 50 (although you can observe in Nifty as well), which is why I have chosen to share the Sensex Chart

Observe:

- A well defined trend line with multiple touch points

- Presence of a Bearish RSI Divergence

- Daily MACD already in Sell mode

All that is needed is break of Today's Low and a Close below it (which would also give the Trend Line breakdown simultaneously) and then that would activate the Ending Diagonal/ Rising Wedge Breakdown

The First Downside Target for this pattern would be point b which comes to 62380🎯📉

Wedge

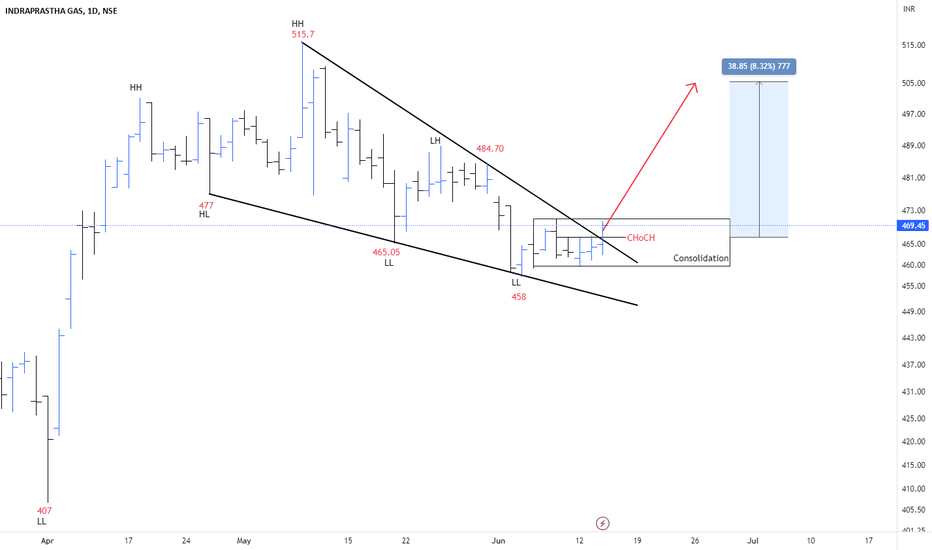

IGL: Bullish Falling Wedge Pattern IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs.

The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 .

Buyers have to break and stay above 504 to increase demand pressure.

Note: Do your own research / discuss it with your advisor

BITCOIN at Rising Wedge in BearishZoneBITCOIN 1-hr. Chart Analysis

As per present Scenario in BTC, its moving perfectly into Rising Wedge Pattern. So, it will be try once again a Uptrend cycle up to $31,950 and reverse back very fast into Downtrend cycle up to next 48 hrs. maximum.

While, as per FIB extension, BTC chart displays every retracement of down cycle towards FWB:27K

Always #DYOR before invest in Crypto

Trader's always use #StopLoss at this situation

Must, LIKE & SHARE

nifty near all time high but ...nifty cmp 18226

yesterday made 18864.70

previous all time high 18887.60

what next ?

technical setup :

rising wedge pattern

stochastic rsi at 100 weekly

highly overbought index

perfect rising wedge pattern in weekly setup with price near trend line resistance .

weekly stochastic rsi at 100 is indicating highly overbought indication too

its good setup to sell with minimum stop loss above trend line close

targets given are bold but as per pattern trade with minimal stop loss & to contra trade against over bullish sentiments , this technical can deliver

happy trading

trade set up :

weekly

sell in zone 18880 to 18920

keeping 19050 as closing basis stop loss

positional

sell in zone 1880 to 18950

keeping 19235 as closing basis stop loss

targets : 18535 / 18305 / 18045 / 17863 / 17553

BANKNIFTY -1H | NEXT EXPIRY VIEW?Hello Traders, Welcome to Oneshot Traders!

BankNifty given good movement as we expected and made good profit in today's expiry trades.

Now, What Next?

As BankNifty still holds the support level 43400, I Have 2 Interpretations in my mind for next movement in banknifty.

1. The pattern looks like a HEAD AND SHOULDER PATTERN. To complete this pattern it should break the 43400 level to complete this Pattern.

2. Forming a FALLING WEDGE PATTERN. Here also the same, the price should move down to the support 43400 level and reverse with a bullish candle in higher timeframe.

My Both setups are shown in the chart.

Now you may understand that this analysis is not just for next immediate move. So, please be stay tuned here and click on follow button . Receive further updates directly to your mail when we update here.

Thank you,

Happy Trading...

BANKNIFTY -1H | What Next?𝗛𝗲𝗹𝗹𝗼 𝗧𝗿𝗮𝗱𝗲𝗿𝘀, 𝗪𝗲𝗹𝗰𝗼𝗺𝗲 𝘁𝗼 𝗢𝗻𝗲𝘀𝗵𝗼𝘁 𝗧𝗿𝗮𝗱𝗲𝗿𝘀!

BankNifty given good movement to our levels posted yesterday. Made good profit in today's trades.

𝗡𝗼𝘄, 𝗪𝗵𝗮𝘁 𝗡𝗲𝘅𝘁?

As BankNifty moving to our previous supply zone (43912 - 43976).

Here are the both side Important Levels:

RESISTANCE: 43976 | Reversal Zone: 43926-44100

SUPPORT: 43815, 43700, 43500

As per open interest Biggest resistance at 44000 and biggest support at 43500

I'm still stick to my previous 3 Interpretations which I posting from Monday. Check my previous posts.

𝟭. The pattern looks like its going to form a 𝗛𝗘𝗔𝗗 𝗔𝗡𝗗 𝗦𝗛𝗢𝗨𝗟𝗗𝗘𝗥 𝗣𝗔𝗧𝗧𝗘𝗥𝗡. To complete this pattern it should move up to the 44000 level and then have to reverse.

𝟮. Forming a 𝗙𝗔𝗟𝗟𝗜𝗡𝗚 𝗪𝗘𝗗𝗚𝗘 𝗣𝗔𝗧𝗧𝗘𝗥𝗡. Here also the same, the price should move up from the support 43400 level.

𝟯. Putting all these pattern aside, the red zone which I drawn on chart is 𝗙𝗶𝗯𝗼𝗻𝗮𝗰𝗰𝗶 𝗥𝗲𝘁𝗿𝗮𝗰𝗲𝗺𝗲𝗻𝘁 𝗟𝗲𝘃𝗲𝗹. If market moves up and forms a 𝗕𝗲𝗮𝗿𝗶𝘀𝗵 𝗖𝗮𝗻𝗱𝗹𝗲 at this zone, I'll update the targets in below comments after confirmation.

Now you may understand that my previous analysis is still active. So, please be stay tuned here and click on follow button.

𝗧𝗵𝗮𝗻𝗸 𝘆𝗼𝘂,

𝗛𝗮𝗽𝗽𝘆 𝗧𝗿𝗮𝗱𝗶𝗻𝗴...

⚠⚠⚠DISCLAIMER⚠⚠⚠

Please note that trading and investing in the stock market involves risk and may not be suitable for everyone. The information provided in this video is based on my personal experience and educational purpose. You are responsible for your own investment decisions and that I shall not be liable for any direct, indirect, incidental, or consequential damages arising from your reliance on the information provided.

NIFTY50 - 1H | RISING WEDGE!!!𝗛𝗲𝗹𝗹𝗼 𝗧𝗿𝗮𝗱𝗲𝗿𝘀, 𝗪𝗲𝗹𝗰𝗼𝗺𝗲 𝘁𝗼 𝗢𝗻𝗲𝘀𝗵𝗼𝘁 𝗧𝗿𝗮𝗱𝗲𝗿𝘀!

I'm waiting for this day from long time, I feel it's time NIFTY50 Formed a Rising Wedge Pattern In Higher Time Frames. But, Its not confirmed at.

Here the Important levels which decides nifty50 for coming days.

If Market moves ABOVE 18798 it is still in buying zone and the Target is 18879

If market breaks 18719 and trades below it we can confirm the break down from rising wedge and can go for selling. Targets for selling side are 18672, 18627, 18556.

Before Taking any positions observe our chart and take decisions if your own analysis also supporting our levels.

This Analysis is not just for one 1 day, Its our overall opinion on Nifty50. We'll update this analysis in live market please be stay tuned here by following us.

Thank you,

Happy Trading...

APT moves in FALLING Wedge PatternAPT 1-day Chart Analysis

As per daily basis chart Analysis of APTOS is moving into Falling Wedge Pattern, from January after launching of this Token, means continue in Downtrend, but as par falling wedge bullish signals, after July it will be start moving again in Bullish mode, before that it will goes under Bearish Zone in July with Last Lower-Low Cut-off point at $3.8 to $4.2 approx.

Always #DYOR before investing in Crypto.

Trade Wisely with using of #StopLoss always.

also must LIKE, COMMENT &SHARE

HEMIPROPHEMIPROP:- The stock has formed a falling wedge pattern, which has given a breakout, if the stock sustains above 101.50, we may see a movement to the upside.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

MEDPLUS LOOKS GOOD WITH A BREAKOUT OVER RESISTANCE LINE WITH VOLMEDPLUS has price action has given a Breakout over a long term resistance line at 781.35 on 26-May-23 and this happend the day after the Financial results for FY.

Taking the length of the Wedge (about 200) and the past Resistance/ Support Levels, there is a potencial for

Entry Above 781 for a long trade

StopLoss: below 720

Target 1: 858

Target 2: 948

Note: I am not a professional trader or advisor. This is just to share my study/ analysis. Any actions by you should be based on your independent analysis.

GLENMARKGLENMARK:- Stock has given breakout, if you want to plan something then let the price come back to 620 then 621, do it after that, till then keep an eye on the stock

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

TVS MOTOR ASCENDING WEDGE BREAKOUT TRADE - BUY

TVS Motors have formed an ascending wedge pattern on the daily timeframe with 2 contact points above and 3 contact points below

Yesterday it has broken out of the pattern with gap-up which acts as a very strong confirmation of the success of the trade

Although no volume surge is present but RSI is present in OVERBOUGHT zone indicating that the momentum is very strong for the stock right now which in turn is a boon for the stock which would give the push for the stock to rise

TP is set as the width of the chart pattern at the place of the first contact point