XAU/USD – Bullish Continuation Above Key POI, Targeting Range 🔍 Technical Analysis (45M)

🟢 Market Structure

After a strong bearish impulse, Gold formed a solid base and shifted structure to bullish.

A sequence of higher highs & higher lows is now respected along the upward trendline ✔️

Multiple pivot points confirm buyers are defending higher price levels.

📦 POI & Key Zones

Extreme POI Point (Demand Zone): Major accumulation area that triggered the reversal 🟩

High POI Point (Supply → Mitigation Zone): Price broke above and is now holding as support — bullish sign.

As long as price remains above this High POI zone, continuation is favored.

📈 Breakout & Price Action

Earlier bearish breakouts to the downside failed, followed by strong bullish displacement.

Current structure shows bullish consolidation above the High POI, suggesting continuation rather than reversal.

Pullbacks into the High POI / trendline area are viewed as buy-the-dip opportunities.

🎯 Targets

🎯 Primary Target:

5,120 – 5,150 (Range High / Liquidity Grab Zone)

🎯 Extended Target (if momentum accelerates):

5,180 – 5,220

🛑 Invalidation Level:

Sustained close below 4,950 would weaken the bullish continuation scenario.

✅ Conclusion

Gold remains structurally bullish, supported by strong demand and trendline respect. Holding above the High POI keeps the path open toward the range high target. Expect shallow pullbacks before continuation 📊✨XAU/USD – Bullish Continuation Above Key POI, Targeting Range High

X-indicator

When Broader Market Held the Gap… Why Is NiftyIT the Outlier?When Broader Market Held the Gap… Why Is NiftyIT the Outlier?

Headlines point to explanations like AI bubble fears, US tech weakness, or currency moves.

But are these the real drivers — or just narratives assigned after the move ?

Price leads. News follows.

The weekly price structure appears to have been signaling this divergence well in advance, as price continued to respect higher-timeframe supply while the broader market held firm.

At the same time, the daily Ichimoku structure reflects this conflict . It repeatedly toggled between kumo breakout and kumo breakdown highlighting unresolved higher-timeframe pressure

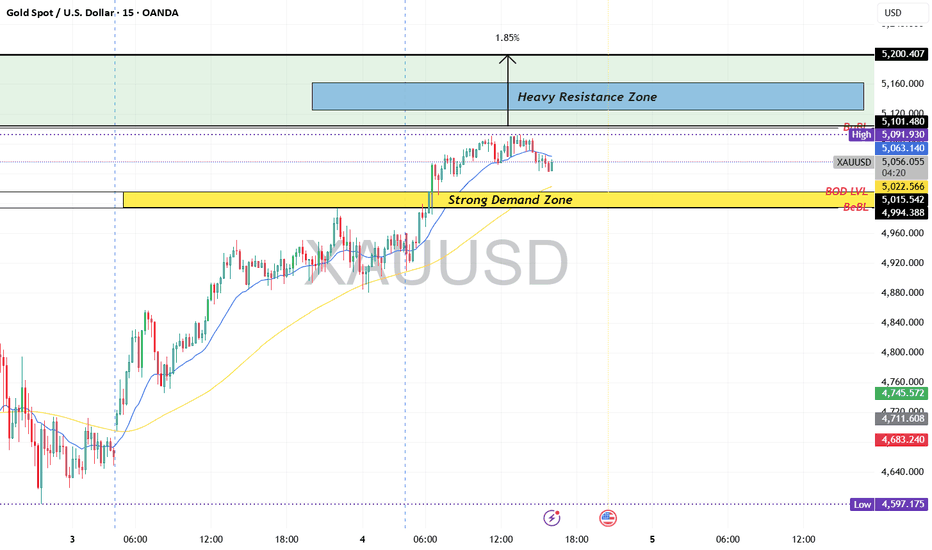

XAUUSD (Gold) | BULLISH VS BEARISH LEVEL | 4th Feb'2026Gold remains bullish above 5,015–4,995, which is the major demand zone and key trend support. Intraday pullbacks toward 5,030–5,050 can offer buy-on-dips opportunities as long as price holds above this base.

On the upside, 5,090–5,100 is the immediate supply zone. A sustained breakout above 5,100 can accelerate momentum toward 5,125–5,160 and further to 5,200. Only a decisive hourly close below 4,995 would weaken the bullish structure and open downside toward 4,960–4,920.

Market Bias: Bullish above 5,015 | Neutral 5,015–5,050 | Bearish below 4,995

Part 5 Advance Trading Strategies How Institutions Manipulate Premiums

Push underlying price to premium-rich zones.

IV crush after event.

Quick whipsaws to trigger SL of retailers.

Short covering traps.

Events Affecting Options

Budget announcements.

RBI MPC.

Fed decisions.

US inflation & jobs data.

Elections.

Geopolitical events.

IPO listing days.

Multi Commodity Exchange of India Limited✔ Price trading above 20-day SMA, indicating short-term trend strength.

✔ Recent pullback has found support above breakout zone (~2550).

✔ Clear sequence of higher highs and higher lows.

Setup:

-Entry Zone: on pullback or consolidation above 2550–2575 (your chart’s breakout region).

-Stop-Loss: below recent support and 20-SMA area (~2380–2400).

-Primary Target: 2700 — aligns with near-term analyst targets.

-Extended Target: 2870+ on strong continuation.

Reason To Buy

Volume & Participation: Rising open interest and recent strong closes suggest conviction, not just short-covering.

Macro tailwinds: Elevated precious metals futures activity typically lifts exchange transaction volumes, benefiting MCX’s core business.

Sentiment improvement: Removal of a key legal overhang on MCX improves institutional and retail sentiment.

Risks to watch:

⚠ Broader market weakness or metal price collapses could dampen trading volumes.

⚠ Near–term resistance at 2704 may cap rallies if global risk appetite falters.

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

US100 | 15MNarrative Overview:

Following an aggressive sell-side liquidity raid, price delivered a reactive displacement from a higher-timeframe demand cluster, signaling the presence of institutional buy orders defending discount pricing. The rejection wick into the demand zone suggests a classic liquidity engineering event rather than genuine bearish continuation.

Market Structure:

The broader intraday flow remains rotational; however, the recent reaction establishes a potential short-term structure shift. The failure to achieve sustained acceptance below the demand zone implies seller exhaustion and the likelihood of a mean reversion toward premium.

Liquidity Map:

Sell-Side Liquidity: Resting below 25,250, now partially mitigated after the sweep.

Internal Liquidity: Compression above current price indicates stop accumulation from early longs.

Buy-Side Targets: 25,380 to 25,420 aligns with prior distribution and inefficient pricing.

Imbalance & Order Flow:

The impulsive bullish candle emerging from the zone created a micro fair value gap, reinforcing the probability of algorithmic repricing higher. When displacement originates from discount, it often signals smart money transitioning from accumulation to expansion.

Trade Logic:

The optimal execution model favors continuation toward premium, provided price maintains acceptance above the reclaimed demand.

Bullish Path:

A controlled retracement into the imbalance or the upper boundary of demand could offer refined entries targeting external liquidity. This would complete a discount-to-premium delivery cycle.

Risk Scenario:

A decisive break with displacement below the demand zone would invalidate the accumulation thesis and expose deeper sell-side liquidity, likely inviting bearish continuation.

Key Insight:

What appears to be a simple bounce is structurally more significant; institutions rarely defend a level without intent. Monitor how price behaves during pullbacks. Strong markets do not revisit deeply mitigated demand unless distribution is underway.

XAUUSD – Brian | H4 Technical AnalysisXAUUSD – Brian | H4 Technical Outlook – Selling Bias After Exhaustion Rally

Gold has completed a strong upside expansion and is now showing clear signs of trend exhaustion on the H4 timeframe. After printing a sharp impulse leg higher, price failed to sustain acceptance above the recent highs and quickly transitioned into a deep corrective move, signalling a shift in short-term market control.

From a structural perspective, the market has moved from impulse → distribution → correction, favouring a selling bias while price remains capped below key resistance.

Market Structure & Fibonacci Context

The recent rally stalled near the upper resistance zone, followed by an aggressive rejection.

Price has retraced deeply into the Fibonacci 0.618–0.75 area, confirming that the move lower is not a minor pullback but a meaningful correction.

Current price action suggests lower highs are forming, keeping selling pressure active on rebounds.

As long as price fails to reclaim and accept above the prior breakdown levels, the bearish structure remains valid.

Key Zones to Watch

Primary SELL Zone

5,716 – 5,866

This is the major supply and sell-liquidity zone on H4. Any corrective rally into this area is likely to attract sellers, especially if price shows hesitation or rejection.

Intermediate Reaction Zone

Around the 0.5–0.618 Fibonacci retracement area, where short-term rebounds may stall before continuation lower.

Downside Targets / Demand

The lower support zone near 4,800–4,850 remains the first key downside area to monitor.

Deeper continuation would expose the 4,600–4,500 region, where broader demand may attempt to absorb selling pressure.

Macro Context (Brief)

Fundamentally, gold is facing headwinds from persistent uncertainty around interest rate expectations. Recent central bank commentary continues to signal caution toward near-term rate cuts, keeping real yields supported and limiting gold’s upside in the short term. This backdrop aligns with the current technical correction and distribution phase.

Trading Outlook

Bias: Selling / sell-on-rallies

Focus: Selling corrective rebounds into resistance zones

Risk note: Avoid chasing price at lows; let structure and levels guide entries

In this phase, patience is key. Selling strength at predefined zones offers higher probability than predicting bottoms.

Refer to the chart for Fibonacci levels, structure shift, and highlighted sell zones.

✅ Follow the TradingView channel to receive early updates on market structure, liquidity shifts, and high-probability zones.

XAUUSD – Bullish Reversal from Demand Zone (H1)Gold (XAUUSD) was previously trading inside a well-defined ascending channel, indicating a strong bullish trend. After reaching the upper boundary, price faced a sharp bearish correction and broke down from the channel.

Following this drop, price found strong support near the 5,000 demand zone, where buyers entered aggressively. From this area, price formed a V-shaped / rounded bottom recovery, signaling a shift in momentum from bearish to bullish.

Currently, price has reclaimed and is holding above the demand zone, showing strong bullish continuation. As long as price remains above this zone, the upside bias remains intact.

Trade Bias: Bullish above the demand zone

Entry Zone: Demand zone retest or bullish continuation

Targets:

Target 1: 5,120

Target 2: 5,198

Invalidation:

A strong break and close below the demand zone would invalidate the bullish setup.

This setup aligns with demand–supply dynamics, trend continuation, and a momentum shift, favoring buyers in the near term.

IOCIOC

bullish trend is Showing on the chart.

buy signals in

technical indicators and

cup with handle & ascending triangle chart pattern.

BUYING RANGE 172/175

Watch for a breakout above 172/175 to sustain the bullish trend. If the resistance holds, there could be a retest towards 150/155 and an uptrend from here.

(Gold) 45-Minute Chart — Support Hold & Upside Retest Scenario

Chart Analysis:

Market Structure:

Gold is in a short-term corrective phase after a strong bearish impulse. Price made a lower low, then started forming higher lows, suggesting a potential short-term recovery within a broader downtrend.

Key Support Zone (Red):

The marked support around 4,850–4,900 has been respected multiple times. Buyers stepped in aggressively here, confirming it as a demand zone. The current price is consolidating just above this area, which is constructive.

Resistance Zone (Green):

The resistance around 5,150–5,200 aligns with a prior breakdown area and supply imbalance. This zone is the logical upside target if bullish momentum continues.

Price Behavior:

After bouncing from support, price is grinding higher with smaller candles, indicating controlled buying rather than impulsive selling. This favors a pullback-and-push scenario rather than immediate rejection.

Bullish Scenario (as drawn):

A successful hold above support, followed by a clean push, opens the door for a move toward the resistance zone (target). A brief dip into support with rejection wicks would strengthen this bias.

Invalidation:

A strong close below the support zone would invalidate the bullish setup and expose price to further downside continuation.

Bias:

🔹 Short-term bullish toward resistance

🔹 Medium-term still cautious / corrective

Chart Analysis — Rounded Bottom Reversal Toward Key ResistanceMarket Structure

Price formed a rounded bottom (cup-like reversal) after a sharp selloff, signaling exhaustion from sellers and a gradual shift to buyers.

The lowest point (circled) shows strong demand absorption, followed by higher lows → early trend reversal behavior.

Key Levels

Support zone: ~4,890–4,950

This area held firmly and acted as the base for the bounce. Buyers consistently defended it.

Entry zone: Just above support

The pullback into prior support + bullish reaction suggests a safe long entry on confirmation.

Mid resistance: ~5,100

Price already reclaimed this zone, flipping it from resistance into short-term support.

Major resistance / target: ~5,210–5,250

This is the next liquidity zone and logical profit target, aligned with previous supply.

Momentum & Price Action

The white projected path shows a bullish continuation scenario:

Break and hold above 5,100

Brief consolidation / retest

Push toward the upper resistance band

No immediate signs of distribution yet; momentum favors continuation unless price loses the support zone.

Bias

Bullish while above ~4,950

Invalidation if price accepts back below support with strong bearish candles.

Trade Idea Summary

Bias: 📈 Bullish continuation

Entry: Support retest / bullish confirmation

Target: 5,210–5,250

Risk: Breakdown below support

XAUUSD (Gold) – H1 Chart Idea & AnalysisGold previously printed a strong impulsive rally, followed by an aggressive sell-off that broke short-term structure. After the sharp drop, price formed a volatility spike and is now in a corrective phase, retracing into a key supply / resistance zone.

Key Zones

Entry Zone (Sell Area): ~4,880 – 4,930

This zone aligns with prior consolidation and acts as a bearish order block where sellers previously stepped in.

Target Zone: ~5,000 – 5,060

This is the next major liquidity pool / imbalance zone above, marked as the profit target on the chart.

Trade Bias

Primary Bias: Short-term bullish retracement into resistance, followed by potential bearish reaction.

Price is currently testing the entry zone, suggesting a sell-from-resistance setup if bearish confirmation appears.

Technical Confluence

Retracement after an impulsive bearish move

Previous support flipped into resistance

Presence of imbalance / supply zone

Corrective structure rather than impulsive bullish continuation

Trade Plan

Entry: Sell within the marked resistance zone

Invalidation: Strong H1 close above the zone

Target: Upper marked target zone (partial or full, depending on risk management)

Summary

This setup is based on a corrective pullback into a strong resistance area after a sharp bearish displacement. As long as price remains below the resistance zone, the probability favors a rejection and continuation move. Wait for confirmation and manage risk strictly.

Gold is currently in a corrective phase after a sharp sell-off Price is now retracing and approaching the 61.8 Fibonacci retracement zone, which aligns with previous structure resistance and a descending trendline.

📌 I’m expecting price to:

Test the 61.8 retracement zone

Face short-term rejection

Rotate towards the next support/demand zone

This is a reaction-based setup, not a prediction.

How price behaves at 5125–5140 will decide the next move.

🎯 Key Levels

Resistance / Retracement: 5125 – 5140 (61.8)

Next Support / Demand: Below 5050 – 5000

Invalidation: Strong acceptance above 5140

Follow @arunmano_fx for clean XAUUSD structure-based analysis.

Also Please Go Through My Previous Analysis Also

👉👉👉 Full structure and levels shared on TradingView👉👉👉

#IndianTrader

#ForexIndia

#ArunManoFX

$XLM hints at a rebound after a sharp flushCRYPTOCAP:XLM hints at a rebound after a sharp flush.

Price has pushed into a major demand zone after a steep selloff, where downside momentum appears to be slowing.

Technical View:

• Pattern: Descending channel with a potential base forming at support

• Bias: Bullish-leaning, a relief bounce could develop if demand holds

• Key Level: Watch support around 0.16-0.17 and resistance near 0.20-0.21

Long Idea: Balkrishna Industries LTD Balkrishna Industries Ltd (BALKRISIND) successfully executed a significant breakout from a long-term descending parallel channel on February 3, 2026. The breakout was characterized by a massive 11.63% gap-up at the market open and was confirmed by a multi-fold surge in trading volume to 2.32 million shares, well above its typical average. This volume-backed move signalised strong institutional participation, effectively reclaiming all major moving averages, including the 200-day DMA.

Bullish Reversal: The stock recently broke a five-day losing streak with a significant gap-up.

India-US Trade Tailwinds: A landmark India-US trade deal is expected to directly benefit BALKRISIND, with its 14% US revenue exposure poised for growth following tariff reductions.

Domestic Infrastructure Push: The Union Budget 2026 increased public capital expenditure to ₹12.2 lakh crore, directly fueling demand for the company's core off-highway tires (OTR) in construction and mining.

Strategic Expansion: The company is expanding its Carbon Black capacity to 360,000 MTPA and is on track to launch Commercial Vehicle (CV) Radial tires in Q4 FY26.

The combination of a high volume channel breakout and structural tailwinds from the Union Budget 2026 makes BALKRISIND a high-conviction "Buy on Dips" candidate.

Entry Range: ₹2,570 – ₹2,590

Note: After the massive 11.63% gap-up on February 3, the stock is currently consolidating.

Entering near the current market price (CMP) or on minor intraday pullbacks is ideal to capture the next leg of the rally.

Stop Loss (SL): ₹2,380 (On a Daily Closing Basis)

Rationale: This level sits just below the 200-day DMA and the upper boundary of the broken descending channel. A slide below this would invalidate the breakout and suggest a "bull trap."

Target 1 (Short-term): ₹2,750

Rationale: This aligns with the recent intraday high and psychological resistance.

Target 2 (Medium-term): ₹2,920

Rationale: Based on the measured move projection of the parallel channel height, targeting the 2025 swing highs.

Risk-to-Reward Ratio: Approximately 1:1.7 at current levels, improving to 1:2.5 if entry is secured closer to ₹2,530.

USDJPY Pullback Explained: Trend Support in Focus!For me, USDJPY is still behaving like a healthy uptrend, not a market that is rolling over. Price has been respecting a clear rising channel structure, with buyers consistently defending higher lows.

The recent move lower looks more like a pullback into major trend support rather than a sign of weakness. This is exactly how strong trends usually behave, they pause, retrace, and then decide the next leg based on support reaction.

From a broader perspective:

On the fundamental side, currencies are currently adjusting to shifting rate expectations and global risk sentiment. In such phases, trends rarely reverse immediately. Instead, price often retraces into key levels before continuing or changing structure.

What I’m watching now:

As long as the rising channel and demand zone hold, the overall structure remains intact. The next move will largely depend on how price reacts at this support, not on short-term volatility.

This is not a trade call, it’s an observation of market behavior and structure.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Bullish Structure Rebuild as Precious Metals Surge | Lana ✨

Precious metals are back in focus as silver surges sharply, adding momentum to the broader metals complex. In this context, gold is showing signs of structure rebuilding after a healthy correction, setting the stage for potential continuation.

📈 Market Structure & Technical Context

After a strong impulsive drop, gold successfully defended the 4,420–4,450 strong support zone, where buyers stepped in decisively. Since then, price has been forming higher lows along an ascending trendline, signalling a shift from distribution into recovery.

The current price action suggests this move is corrective-to-bullish, not just a short-lived bounce.

🔍 Key Levels to Watch

Strong Support: 4,420 – 4,450

This zone remains the structural base. As long as price holds above it, bullish scenarios stay valid.

Mid Resistance / Reaction Zone: ~5,050 – 5,080

Price is currently consolidating here, absorbing supply after the rebound.

Next Resistance: ~5,135

A clean break and acceptance above this level would confirm continuation strength.

Upper Targets: ~5,300 – 5,350

Aligned with Fibonacci extensions and prior supply zones.

Higher Objective: ~5,580

Only in play if bullish momentum accelerates across the metals market.

🎯 Bullish Scenarios

If gold continues to respect the upper trendline and holds above the 5,000 psychological level:

A brief pullback into 5,000–5,050 could offer structure for continuation.

Acceptance above 5,135 opens the path toward 5,300+.

Strong momentum, supported by silver’s breakout, could extend moves toward 5,580.

Any pullbacks toward support are currently viewed as constructive corrections, not weakness.

🌍 Intermarket Insight

Silver’s sharp rally highlights renewed demand across precious metals, often acting as a leading signal for broader sector strength. This backdrop supports the idea that gold’s recent correction was a reset, not a reversal.

🧠 Lana’s View

Gold is rebuilding its bullish structure step by step. The focus is not on chasing price, but on how price reacts at key levels. As long as structure and momentum remain aligned, the broader trend stays constructive.

✨ Stay patient, respect the zones, and let the market confirm the next expansion.

Dollar Strength and Weakness in Trading MarketsUnderstanding the U.S. Dollar in Financial Markets

The U.S. dollar (USD) is the world’s primary reserve currency and plays a central role in global trade, finance, and investment. Its strength or weakness affects everything from international trade balances to commodity prices, equity markets, and currency pairs. In trading, understanding dollar movements is crucial because it impacts risk, profitability, and strategy across multiple asset classes.

What Does Dollar Strength Mean?

A strong dollar occurs when the USD appreciates relative to other currencies. In forex markets, this means it takes fewer dollars to buy another currency, such as the euro, yen, or pound. Strength in the dollar is typically reflected in major indices like the U.S. Dollar Index (DXY), which measures the dollar against a basket of six major currencies.

Key factors driving dollar strength include:

U.S. Interest Rates: Higher interest rates attract foreign capital, as investors seek better yields on U.S. assets. The Federal Reserve’s monetary policy plays a pivotal role; rate hikes often result in dollar appreciation.

Economic Data: Strong GDP growth, low unemployment, and robust manufacturing or services output boost confidence in the U.S. economy, strengthening the dollar.

Global Risk Aversion: During times of global uncertainty or crisis, investors flock to safe-haven assets. The U.S. dollar is considered the ultimate safe-haven currency, leading to demand-driven strength.

Trade Balance: A declining U.S. trade deficit can signal a stronger economy and support the dollar, though this is more complex when compared to other influencing factors.

Fiscal Policy: Government spending, tax policies, and debt levels influence investor perception of U.S. economic stability. Responsible fiscal policies tend to support the currency.

Implications of a Strong Dollar:

Forex Trading: Currencies like the euro, yen, or emerging market currencies tend to weaken when the dollar strengthens. Traders may short these currencies against the dollar.

Commodities: Most commodities, such as gold, oil, and silver, are priced in dollars. A strong dollar makes them more expensive for non-U.S. buyers, often leading to lower commodity prices.

Global Markets: U.S. exports become more expensive, potentially impacting multinational companies’ revenues. Conversely, imports become cheaper.

Emerging Markets: Countries with debt denominated in USD face higher repayment costs, potentially creating financial stress and affecting currency stability.

What Does Dollar Weakness Mean?

A weak dollar occurs when the USD depreciates relative to other currencies. It takes more dollars to purchase foreign currencies. Dollar weakness often benefits commodities and global trade but can signal economic or monetary policy issues domestically.

Key factors driving dollar weakness include:

Lower Interest Rates: When U.S. rates fall relative to other economies, investors may move capital abroad seeking higher yields.

Economic Slowdown: Weak economic data, rising unemployment, or declining manufacturing output can reduce confidence in the USD.

Inflation Concerns: Persistent inflation erodes the purchasing power of the dollar, contributing to its weakness.

Fiscal Deficits: Expanding government debt without strong economic growth can undermine investor confidence in the currency.

Global Liquidity Needs: Central banks may inject liquidity into the market or devalue currencies to boost exports, indirectly weakening the dollar if the USD is compared to those currencies.

Implications of a Weak Dollar:

Forex Trading: Other currencies appreciate against the dollar. Traders may go long on EUR/USD, GBP/USD, or AUD/USD.

Commodities: Commodity prices often rise as a weak dollar makes them cheaper for non-U.S. buyers. Gold, oil, and agricultural products often benefit.

U.S. Exports: A weaker dollar makes U.S. goods more competitive abroad, potentially boosting corporate profits for exporters.

Emerging Markets: Dollar-denominated debt becomes easier to service for emerging economies, which can stabilize financial conditions.

Measuring Dollar Strength and Weakness

Traders use various tools to track the dollar:

U.S. Dollar Index (DXY): A weighted index of the dollar against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF). A rising DXY indicates strength; a falling DXY indicates weakness.

Forex Pairs: Monitoring pairs like EUR/USD, GBP/USD, USD/JPY, and USD/CHF gives traders insight into relative strength or weakness.

Commodity Prices: Inversely, commodities like gold and oil can act as indirect indicators of dollar strength.

Interest Rate Differentials: Comparing U.S. rates with other countries’ central banks helps traders anticipate dollar movements.

Economic Indicators: GDP, employment data, inflation, and consumer confidence provide signals for potential currency shifts.

Trading Strategies Based on Dollar Strength/Weakness

1. Forex Trading:

Strength: Shorting other currencies against USD (e.g., EUR/USD, GBP/USD) to capitalize on appreciation.

Weakness: Going long on foreign currencies against USD to benefit from depreciation.

2. Commodity Trading:

Strength: Caution on commodities as prices may drop due to a strong USD.

Weakness: Consider buying commodities or commodity ETFs as a hedge or profit strategy.

3. Stock Market Implications:

Strength: U.S. multinational companies may face export headwinds; domestic-focused companies may benefit from lower import costs.

Weakness: Exporters gain competitiveness abroad, boosting earnings potential.

4. Emerging Market Trading:

Strength: Monitor for potential stress in countries with USD debt. Currency carry trades may be riskier.

Weakness: Investors may enter emerging market equities and bonds, as debt servicing costs decrease.

Interconnectedness with Global Markets

The dollar does not exist in isolation. Its movement impacts global capital flows:

Capital Flows: A strong dollar attracts investment in U.S. treasuries and equities, while a weak dollar can encourage global investment elsewhere.

Interest Rate Arbitrage: Traders exploit differences in rates between countries, magnifying dollar movements.

Geopolitical Risks: Crises or conflicts often trigger a flight to the dollar, temporarily boosting its value.

Conclusion

Understanding dollar strength and weakness is vital for traders across forex, commodities, equities, and emerging markets. A strong dollar can depress commodities, pressure global exporters, and stress emerging markets. Conversely, a weak dollar can lift commodity prices, enhance U.S. export competitiveness, and reduce debt servicing burdens abroad.

For traders, tracking economic indicators, interest rate differentials, and geopolitical events is essential for predicting dollar movements. Effective strategies require adapting to the dollar’s direction, whether through currency trading, hedging commodities, or evaluating global equity exposure.

In essence, the dollar’s strength or weakness is not just a number on a chart—it reflects the global balance of trade, capital flows, and investor confidence, making it one of the most influential variables in the financial markets.

Stock Market Trading (Equities)Introduction

Stock market trading, often referred to as equity trading, is the buying and selling of shares of publicly listed companies through a regulated marketplace known as a stock exchange. Equities represent ownership in a company, and shareholders are entitled to a portion of the company's profits in the form of dividends and capital gains. Stock trading serves as a fundamental component of financial markets, providing liquidity, capital formation, and investment opportunities for individuals, institutions, and corporations alike.

The stock market is often perceived as a barometer of the economy, reflecting investor sentiment, corporate performance, and broader macroeconomic trends. Trading in equities is both an art and a science, combining analytical rigor, strategy, and psychological discipline.

Key Participants in Stock Market Trading

Retail Investors: Individual traders who buy and sell stocks for personal investment or short-term trading profits. Retail investors account for a significant portion of trading volume in major stock exchanges.

Institutional Investors: Entities such as mutual funds, hedge funds, insurance companies, and pension funds that invest large sums of money in equities. Their trades can significantly impact stock prices due to the size of their transactions.

Market Makers & Brokers: Market makers provide liquidity by quoting both buy and sell prices, facilitating smoother trading. Brokers act as intermediaries between investors and the exchange, executing orders on behalf of clients.

Regulators: Regulatory authorities like the Securities and Exchange Board of India (SEBI) in India or the U.S. Securities and Exchange Commission (SEC) ensure fair practices, transparency, and protection for investors.

Types of Equity Trading

Equity trading can broadly be categorized into long-term investing and short-term trading, each with distinct objectives and strategies.

Long-Term Investing:

Investors hold stocks for an extended period, usually years, aiming to benefit from dividends and capital appreciation. This strategy is based on fundamental analysis, which evaluates a company's financial health, growth potential, and market position. Long-term investors are less concerned with short-term price fluctuations and focus on the company's intrinsic value.

Short-Term Trading:

Traders aim to profit from price volatility within short periods, ranging from seconds (high-frequency trading) to days or weeks. This category includes:

Day Trading: Buying and selling stocks within the same trading session.

Swing Trading: Holding stocks for several days or weeks to capture intermediate-term trends.

Scalping: Executing multiple trades in a day to profit from small price movements.

Fundamental Analysis

Fundamental analysis involves evaluating a company's underlying financial health and growth potential to estimate its intrinsic value. Key aspects include:

Financial Statements:

Income Statement: Evaluates profitability through revenue, expenses, and net profit.

Balance Sheet: Assesses the company's assets, liabilities, and equity.

Cash Flow Statement: Analyzes liquidity and operational efficiency.

Ratios & Metrics:

Price-to-Earnings (P/E) Ratio: Measures stock valuation relative to earnings.

Return on Equity (ROE): Indicates profitability for shareholders.

Debt-to-Equity Ratio: Shows financial leverage and risk.

Macro & Industry Analysis:

Economic indicators like GDP growth, interest rates, and inflation impact stock performance.

Industry trends, competitive landscape, and regulatory policies influence individual company prospects.

Fundamental analysis is particularly favored by long-term investors seeking stable returns based on sound business fundamentals.

Technical Analysis

Technical analysis focuses on stock price movements and trading volume to predict future price trends. Traders use historical data and chart patterns to identify entry and exit points. Key tools include:

Charts: Line charts, candlestick charts, and bar charts provide visual representations of price movements.

Indicators:

Moving Averages: Identify trends by smoothing out price fluctuations.

Relative Strength Index (RSI): Measures overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Helps detect trend reversals.

Patterns: Head-and-shoulders, double tops/bottoms, and trendlines are common patterns used to anticipate price behavior.

Technical analysis is commonly applied by short-term traders and those seeking to exploit market psychology and price momentum.

Stock Market Orders

Traders and investors execute trades through different types of orders:

Market Order: Executes immediately at the current market price.

Limit Order: Executes only at a specified price or better.

Stop-Loss Order: Automatically sells a stock when it reaches a predetermined price to limit losses.

Stop-Limit Order: Combines stop-loss and limit orders for controlled execution.

Choosing the right type of order is crucial for managing risk and optimizing profits.

Risk Management in Equity Trading

Equity trading carries inherent risks, including market risk, company-specific risk, and liquidity risk. Effective risk management strategies include:

Diversification: Spreading investments across sectors, industries, and asset classes to reduce exposure to a single stock.

Position Sizing: Allocating a fixed portion of capital to each trade based on risk tolerance.

Stop-Loss Strategies: Limiting losses by setting predefined exit points.

Hedging: Using derivatives like options and futures to protect against adverse price movements.

Risk management is essential to survive in volatile markets and preserve capital.

Stock Market Strategies

Traders and investors employ various strategies depending on their objectives:

Value Investing: Buying undervalued stocks with strong fundamentals, aiming for long-term growth.

Growth Investing: Focusing on companies with high growth potential, even if currently overvalued.

Momentum Trading: Capitalizing on strong trends, buying rising stocks and selling before a reversal.

Dividend Investing: Targeting stocks that provide regular income through dividends.

Algorithmic Trading: Using automated systems and algorithms to execute trades at high speed and efficiency.

Behavioral Aspects of Trading

Psychology plays a crucial role in stock trading. Emotional biases such as fear, greed, overconfidence, and herd mentality can impact decision-making. Successful traders cultivate discipline, patience, and emotional control to make rational decisions.

Regulation and Compliance

Stock markets operate under strict regulations to ensure transparency and investor protection. Key regulatory practices include:

Listing Requirements: Companies must meet financial and disclosure standards to be listed on exchanges.

Insider Trading Regulations: Prevent individuals with non-public information from exploiting unfair advantages.

Market Surveillance: Exchanges monitor trading activity to detect manipulation and fraud.

Disclosure Norms: Companies must regularly disclose financial results, material events, and corporate governance practices.

In India, SEBI oversees the functioning of stock exchanges, brokers, and listed companies to maintain a fair and efficient market.

Technological Impact

Modern equity trading is heavily technology-driven. Online trading platforms, mobile apps, and algorithmic trading systems have democratized access, enabling retail investors to participate with ease. Artificial intelligence, machine learning, and data analytics are increasingly used to identify patterns, forecast trends, and automate trading strategies.

Conclusion

Stock market trading in equities is a dynamic and multifaceted activity, offering opportunities for wealth creation and capital growth. Success in trading requires a blend of analytical skills, strategic planning, risk management, and psychological discipline. Understanding fundamental and technical factors, along with macroeconomic and behavioral elements, equips traders and investors to navigate market volatility effectively.

While trading involves risks, disciplined approaches, continuous learning, and adherence to regulatory norms can significantly enhance the probability of long-term success. Whether one aims for long-term investment growth or short-term trading profits, equities remain a cornerstone of financial markets, providing avenues for participation in the wealth generated by companies and economies.

In essence, stock market trading is not merely about buying low and selling high; it is an intricate process of research, analysis, timing, and emotional control, offering immense learning opportunities and financial rewards for those who approach it with knowledge, patience, and strategy.

XAUUSD (H3) – Liam PlanXAUUSD (H3) – Liam Plan

Safe-haven bid is back, but structure is still corrective | Trade the zones, not the headlines

Quick summary

Gold is up for a second day as US–Iran tensions revive safe-haven demand. At the same time, expectations for Fed rate cuts keep the USD on the defensive, which typically supports non-yielding assets like gold. However, with ADP and ISM Services PMI ahead, short-term volatility can spike fast — and that’s exactly where gold tends to run liquidity before choosing direction.

My approach: respect the macro tailwind, but execute based on structure.

Macro context

Gold usually benefits when:

geopolitical risk rises (risk-off flows),

rate-cut expectations increase (lower real yields),

the USD weakens or struggles to sustain a bounce.

That said, pre-data sessions often produce fake moves. The market will likely “test” both sides before committing.

Technical view (H3 – based on the chart)

Price rebounded sharply from the recent low, but the overall swing structure is still in a correction / rebalancing phase after a major impulse down.

Key zones on the chart:

Major supply / premium target: 5570 – 5580 This is the clear “sell reaction” zone if price expands higher.

Current decision area: around 5050 – 5100 Price is pushing back into a key mid-range level — where continuation must prove acceptance.

Deep demand / liquidity base: 4408, then 4329 If the market fails to hold higher supports, these are the next magnets for sell-side liquidity.

This is a classic: bounce → retest → decide environment.

Trading scenarios (Liam style: trade the level) Scenario A: Continuation bounce

If price holds above the current base and continues to reclaim levels:

Upside rotation can extend toward 5200 → 5400 → 5570–5580

Expect reactions near each resistance band, especially approaching premium.

Logic: safe-haven flows + softer USD can fuel continuation, but only if price accepts above the mid-range.

Scenario B: Rejection and rotation lower

If price fails to hold above 5050–5100 and prints rejection:

Expect a pullback back into prior demand

Deeper continuation opens toward 4408, then 4329

Logic: corrective rallies often redistribute before the next leg lower, especially around major data.

Execution notes

With ADP + ISM ahead, avoid chasing candles.

Wait for price to tag the zone and show a clear reaction.

Trade smaller if spreads widen.

My focus: If price accepts above the mid-range, I’ll respect the bounce. If it rejects, I’ll treat the move as a corrective rally and look for rotation lower. Either way, I’m trading levels — not headlines.

— Liam