GARFIBRESGARWARE TECH FIBRES has formed a Bullish structure, made VCP pattern, volume is also visible.

Now it is at resistance, keep eyes on it as the breakout from here can give a good upside move.

Breaking ATH may boost it more. But definitely wait for the Re-test after the breakout.

📌 Re-test matters. Always!

Today I shared why waiting for a re-test is so important - with a real example.

Check out the chart and analysis on BLUEJET in my recent post.

It’ll make you rethink your entries.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

MARKSANSMARKSANS looks good, it's been facing resistance for a long time, and now constantly making HL and Equal highs.

✅ If you like my analysis, please follow me here as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Shyam Metalics! Multiple Indicators, Short term Idea. - Cup and Handle Formation

- Previous Inverse Head and Shoulder

- Target Last Fib Level since IPO

- Fundamentally Good Stock( ~75% Promoters, Debt Free, Increasing sales and Profit YoY etc)

- Levels are marked in the chart

This is not a buy/sell advice. Only for educational purposes.

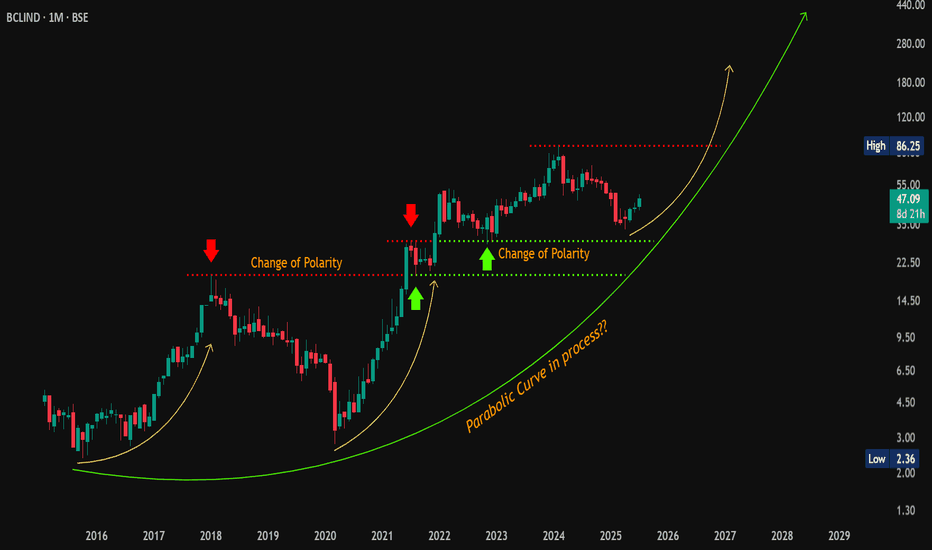

Parabolic Reload? Base 2 Brewing on BCLIND—Will History Repeat?#Update | 🔍 #OnRadar

#BclInd (BCL Industries Ltd.)

📈 Base 2 Brewing—Will History Repeat?

CMP: 47.09

📌 Previous Discussion Recap:

Previously highlighted #BCLIND around 32 with a support zone near 27. The stock made a low of 27.61 and then rallied up to 86.25 (pre-stock split 1:10) — a significant move.

Technical View — Monthly Chart (Educational Purpose Only):

BclInd is showing signs of continuation of the #ParabolicMove . Earlier, it broke out from #Base1 at 19.57 and rallied up to 52.50 — an impressive ~270% move in just 10 months .

Currently, it appears to be forming #Base2 structure.

📌 Confirmation Level: Monthly close above 86.25 (ATH) may validate the continuation of the move.

🧐 Will the parabolic momentum resume?

If the parabolic structure repeats, this could evolve into a strong long-term breakout — worth tracking closely.

⚠️ Disclaimer: This is not a buy/sell recommendation. Please consult your financial advisor before making any investment decisions. This post is purely for educational and observational purposes.

#TechnicalAnalysis | #PriceAction | #ParabolicCurve | #LongTerm

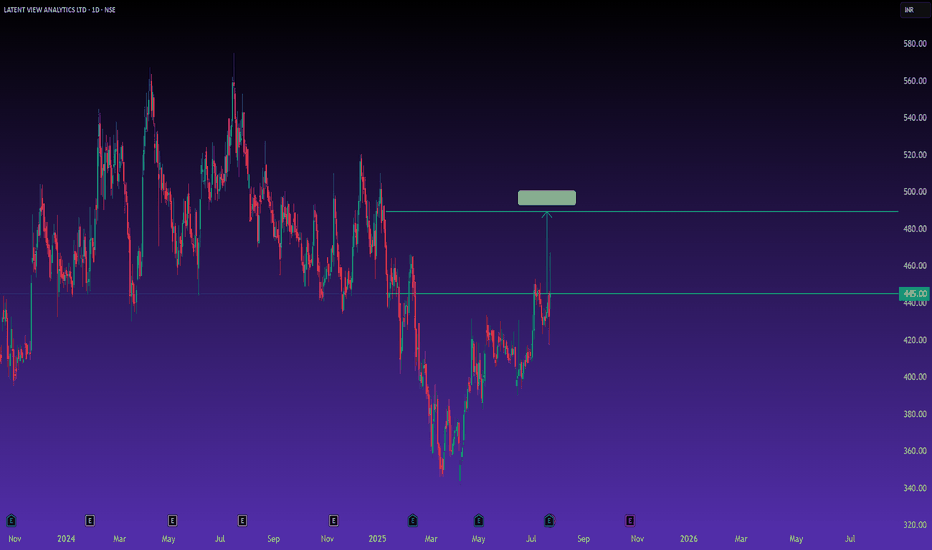

Latent View Analytics Ltd – Technical Setup (Daily Chart)📉 Latent View Analytics Ltd – Technical Setup (Daily Chart)

Latent View has shown a strong bullish reversal from its March–May 2025 lows and is currently trading at ₹445, with a sharp breakout attempt in recent sessions.

🔍 Chart Observations:

✅ Breakout Zone: Price has convincingly reclaimed the ₹445 zone, which acted as strong resistance in the past.

🎯 Upside Target: The next key resistance lies at ₹489, marking a ~10% potential upside from the current levels.

📈 Trend Shift: The stock has formed a higher low and a breakout candle, suggesting renewed buying interest post-earnings.

🔋 Volume Confirmation Needed: While price action is promising, sustained volumes will be key to confirm this breakout.

⚠️ What to Watch For:

If it sustains above ₹445, it could move quickly toward ₹489.

A close below ₹430 might invalidate this bullish setup in the short term.

📌 Conclusion: After a long consolidation and downtrend, Latent View is attempting a comeback. With strong earnings support and a bullish breakout in play, the stock could see further upside in the near term.

🧠 Chart + Fundamentals = Conviction Trade

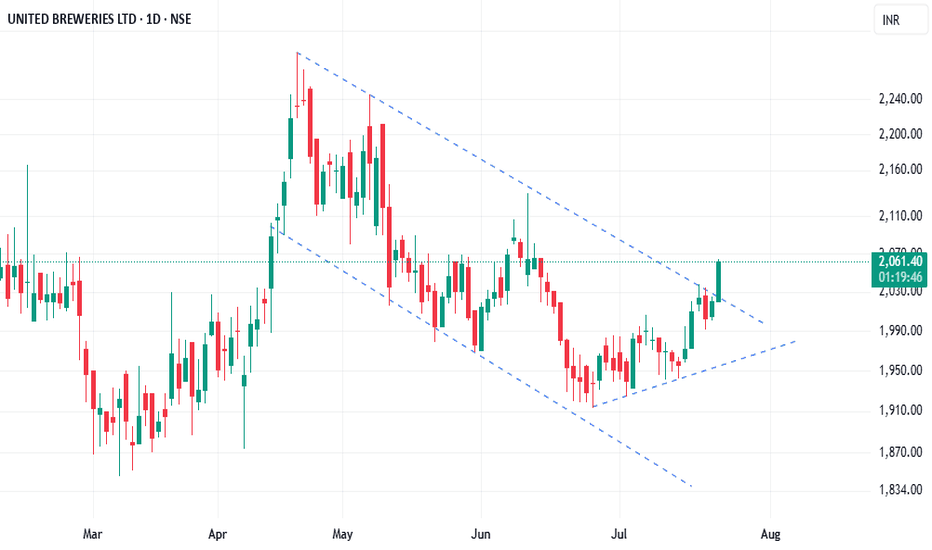

United Breweries Ltd (UBL) – NSEThe chart shows a descending channel pattern that began forming in early May 2025. This is characterized by:

Lower highs and lower lows within parallel trend lines.

🔍 Key Technical Indicators Based on Visual Chart Only:

Breakout Level: Near ₹2,050 (upper boundary of the descending channel)

Immediate Resistance: ₹2,110–₹2,120 (recent swing highs)

Support Level: ₹1,950 (recent base before breakout)

Trend Bias: Turning Bullish – Breakout from descending channel is a positive signal.

📈 Outlook & Strategy:

Bullish Scenario:

If the price sustains above ₹2,050 with good volume, it could indicate trend reversal with potential upside toward ₹2,110–₹2,160 in the short term.

Bearish Risk:

If the price falls back into the channel below ₹2,030–₹2,040, it may turn out to be a false breakout, and the stock could revisit lower support levels.

A stop-loss around ₹1972 would be prudent for new long positions.

🧾 Disclaimer:

This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any stock.

Market conditions are subject to change, and trading/investing involves risk. Please consult a SEBI-registered financial advisor before making any investment decisions.

Flag + W Pattern Combo on Monthly! | #SagCem On Radar🔍 #OnRadar

#SagCem (Sagar Cements Ltd.)

🚩 Flag + W Pattern Combo on Monthly!

📈 Chart Timeframe: Monthly & Quarterly (Educational Observation Only)

📊 Technical Structure Overview:

A rare confluence of bullish patterns spotted:

🚩 #FlagPattern — classic continuation structure

🔻🔻 #WPattern (Double Bottom) — bullish reversal signal

🔼 Both developing inside a long-term #AscendingChannel

🎯 Potential Pattern Projections:

Flag Target: 560+

W Pattern Target: 450+

🛡 Support Zones:

255

234–209 (Demand cluster)

❌ Pattern Invalidation:

Below 155 on Monthly Closing Basis (MCB)

🧠 Educational Note:

When multiple bullish structures align on higher timeframes, they often lead to explosive moves—if validated by breakout and volume.

⚠️ Disclaimer:

This is not a buy/sell recommendation. Shared strictly for educational and technical study purposes. Always consult your financial advisor before acting on any market insights.

#PriceAction | #TechnicalAnalysis | #ChartPatterns | #FlagPattern | #Wpattern | #AscendingChannel | #InsideBar | #LongTerm

Bank Nifty and Nifty50 Scalping TechniquesWhat is Scalping in Index Trading?

Scalping is a high-frequency intraday trading style where a trader looks to capture small price movements multiple times throughout the day. In indices like Nifty50 and Bank Nifty, where price movement is fast and often sharp, scalping is a preferred strategy for many traders.

Scalpers don't aim to catch a ₹100 move. Even ₹20–₹30 on a Bank Nifty option, done 3–4 times a day with volume and discipline, can generate consistent returns.

Why Nifty50 & Bank Nifty for Scalping?

High Liquidity: Tight bid-ask spreads make it easier to enter and exit quickly.

Option Volatility: Options on these indices give quick 5–10% moves in minutes.

Trend & Momentum Friendly: These indices often move in clean intraday trends, giving plenty of scalping chances.

Institutional Interest: Nifty and Bank Nifty are tracked by institutions, so technical levels work well.

Tools Every Scalper Must Use

Before we dive into strategies, make sure you have these ready:

5-Minute / 3-Minute Candlestick Chart

VWAP (Volume Weighted Average Price)

CPR (Central Pivot Range)

Price Action Levels (Previous Day High/Low, Opening Range)

Option Chain Analysis (for OI build-up)

Volume & Momentum Indicators (e.g., RSI, MACD)

Top Scalping Techniques for Nifty & Bank Nifty

1. VWAP Bounce Strategy

Best Time: 9:30 AM to 11:00 AM or 1:30 PM to 3:00 PM

How it works:

Wait for price to test the VWAP line.

If trend is up, and price bounces from VWAP with a bullish candle → enter Call Option.

If trend is down, and price rejects VWAP with bearish candle → enter Put Option.

Entry: On confirmation candle after touching VWAP

Target: 15–25 points on option premium

Stop Loss: 5-minute candle close above/below VWAP

Why it works: Institutions use VWAP for entries; many intraday algos are VWAP-based.

2. CPR Breakout Scalping

Best Time: Opening hour or post-lunch (2:00 PM onwards)

How it works:

If the day’s CPR is narrow, expect trending moves.

Wait for a breakout above CPR high (for long) or below CPR low (for short).

Entry only after a strong 5-minute candle closes outside CPR.

Bonus Tip: Narrow CPR + gap-up = trend day; very scalper-friendly.

Targets: 1:1.5 or trailing stop loss

Risk: High if you trade before confirmation—wait for candle close.

3. Opening Range Breakout (ORB)

Best Time: 9:15 AM – 9:45 AM

How it works:

Mark high and low of first 15 minutes (Opening Range).

Wait for price to break above high or below low with volume.

Ride the momentum for a quick 20–30 point move.

Ideal with: Volume spike + option chain confirmation (OI buildup)

Setup Example:

Bank Nifty breaks above 15-min high, with strong buying in 44,000 CE option → go long.

4. Momentum Scalping with RSI + Candles

How it works:

Use 3-minute chart.

If RSI crosses 60 and a strong green candle forms → go long.

If RSI drops below 40 and red candle forms → go short.

Why this works: Combines price momentum with volume conviction.

Targets: Small, quick moves (10–20 points in Nifty, 20–40 in Bank Nifty options)

Stop Loss: Fixed SL or previous candle high/low

5. Option Chain Scalping – "Smart Money Footprint"

How it works:

Track OI build-up in real-time (especially at ATM or 1-step OTM strikes).

If you see heavy OI build-up + volume spike at 44,000 CE → momentum may build.

Enter on confirmation from price chart (ideally with VWAP or CPR confluence).

Bonus: Combine this with Live Change in OI (many brokers offer this now).

Tools to watch:

Strike Price OI Build-up

IV Rise (Implied Volatility)

Volume on Option Contracts

Important Scalping Do’s & Don'ts

Do’s:

Trade only when price structure + indicator + volume align.

Use limit orders to reduce slippage.

Cut losses fast. Scalping is risk-first.

Have fixed daily targets (e.g., ₹1,500/day)

Trade less when market is choppy

Don’ts:

Don’t chase after big moves already gone.

Don’t increase lot size without system consistency.

Don’t scalp in low volatility phases (e.g., between 12–1:30 PM).

Mindset of a Nifty/Bank Nifty Scalper

You are not a trend trader – you’re a sniper.

Profits come from repetition, not jackpot moves.

You must read the pulse of the market within the first 30 minutes.

No trade > bad trade.

Scalping is about control, discipline, and micro-decisions. Even 3–5 successful trades in a session can result in high accuracy days.

Example Live Scenario (Bank Nifty)

Date: Suppose Bank Nifty opens at 44,000

CPR Range: 43,940–44,060 (tight)

VWAP: At 44,020

Option Chain: 44,000 CE OI increasing rapidly, price trading above VWAP

Setup: CPR breakout + VWAP hold + OI build-up at CE

Trade: Buy 44,000 CE @ ₹120

Target: ₹140–₹160

SL: ₹110

Exit: Within 10–15 mins

Avoid trading just on gut feeling. Use structure.

Conclusion

Scalping in Nifty and Bank Nifty is not gambling—it's calculated, quick decision-making with small but consistent profits. Whether you’re using VWAP, CPR, or live option data, your edge comes from preparation and discipline, not prediction.

If you're just starting, begin with paper trading or small lots, and gradually scale up once your win-rate improves. With time, you'll find the setup that fits your personality best—whether it’s breakout-based, pullback scalping, or OI-driven.

Global Factors Impacting Indian MarketsIntroduction

The Indian stock market, like any other major market, is deeply interconnected with global events. While domestic news like RBI policy, election results, or monsoons do influence our stocks, global factors often act as the real drivers behind sharp up-moves or crashes.

Whether you're an investor, trader, or analyst, understanding how global cues influence Nifty, Bank Nifty, Midcaps, and even commodities is essential for smart decision-making.

In this explanation, we’ll break down the major global factors, how they affect Indian markets, and what traders should watch daily and weekly.

1. U.S. Federal Reserve & Interest Rates (Fed Policy)

Why it matters:

The U.S. Federal Reserve’s interest rate decisions directly impact global liquidity. When the Fed raises rates, money becomes costlier. Foreign investors often pull out from emerging markets like India to invest in safer U.S. bonds.

Impact on India:

Rising U.S. interest rates = FII selling in India

Weakens rupee, inflates import costs (e.g., crude oil)

Tech & high-growth sectors take a hit (especially those sensitive to valuations)

2. Crude Oil Prices

India is a major oil importer—more than 80% of our crude is imported. Crude price volatility has massive ripple effects across inflation, currency, fiscal deficit, and stock market sectors.

Impact on India:

High crude = inflation + weak rupee + fiscal stress

Negatively affects oil-dependent sectors like aviation, paints, logistics, autos

Boosts oil marketing companies' revenue (but hits margins if subsidies increase)

Example:

If Brent Crude moves from $70 to $95 in a month, expect:

Nifty to correct

INR to weaken vs USD

Stocks like Indigo, Asian Paints, Maruti to face pressure

💰 3. Foreign Institutional Investors (FII) Flow

FIIs bring in billions of dollars into Indian equity and debt markets. Their buying or selling behavior is often influenced by:

Global risk appetite

Currency trends

Interest rate differentials

Geopolitical tensions

When do FIIs sell?

When the dollar strengthens

When there’s fear in global markets (e.g., war, U.S. recession)

When India underperforms vs peers

When do FIIs buy?

When global liquidity is high

India shows growth resilience vs China or other EMs

Post-election clarity, reform hopes, etc.

Daily Tip:

Watch FII cash market activity—daily inflows/outflows often decide Nifty’s intraday trend.

🏦 4. U.S. Economic Data (CPI, Jobs, GDP, PCE)

Every month, the U.S. releases:

CPI (inflation data)

Jobs Report (NFP)

GDP numbers

PCE (Personal Consumption Expenditures)

These influence Fed decisions, hence impacting global markets.

Example:

A hot U.S. inflation print → Fear of more rate hikes → Nasdaq crashes → Nifty follows

A weak U.S. jobs report → Rate cut hopes → Global rally → Bank Nifty surges

Keep an eye on U.S. calendar events, especially the first Friday of every month (NFP Jobs) and mid-month (CPI release).

🌏 5. Geopolitical Tensions & Wars

Markets hate uncertainty. Global conflicts often lead to panic selling, flight to safety, and surge in gold/crude prices.

Key global risk zones:

Russia-Ukraine

Middle East (Israel-Iran, Saudi-Yemen)

China-Taiwan-U.S. tensions

Impact on India:

Spike in gold and crude

Selloff in equity markets

Rise in defensive sectors (FMCG, Pharma, IT)

Surge in defence stocks (BEL, HAL, BDL)

💱 6. Dollar Index (DXY) & USD-INR Movement

The Dollar Index (DXY) measures the dollar's strength vs other currencies.

Rising DXY = Stronger dollar = FII outflows from India = Nifty weakens

Falling DXY = More risk-on = Money flows into emerging markets = Nifty rallies

Rupee’s role:

A weak INR/USD makes imports costly → impacts inflation

A strong INR/USD helps improve trade balance → attracts investors

💹 7. Global Equity Markets (Dow Jones, Nasdaq, Asian Peers)

The Indian market is heavily influenced by:

Dow Jones, Nasdaq (overnight sentiment)

SGX/GIFT Nifty (pre-market cues)

Asian Markets (Nikkei, Hang Seng, Shanghai)

How it affects us:

Strong global cues = Nifty opens gap-up

Weak Nasdaq = IT stocks sell off at open

Mixed Asian markets = Rangebound Nifty till clarity

Pro Tip: Always check Nasdaq futures and GIFT Nifty levels before the market opens.

🧭 8. China’s Economic Health

As a large global player in manufacturing, China’s growth (or lack of it) sends signals across the world.

If China slows down:

Commodities fall (good for India)

Asian currencies weaken

Global markets get jittery

If China shows strong stimulus:

Metal stocks rally globally (Tata Steel, Hindalco benefit)

Global optimism lifts all EMs

🏦 9. Global Banking or Financial Crises

Remember the Silicon Valley Bank collapse (2023)? Or the 2008 Lehman crisis?

Global financial stress always triggers:

A sell-off in Indian banks

Panic across all indices

Shift toward safe havens (gold, USD)

Traders should monitor:

Global bond yields

Credit Default Swaps (CDS spreads rising = trouble)

Bank stress signals in Europe/U.S.

🌾 10. Global Commodity Cycles (Metals, Energy, Agri)

India, being resource-dependent, reacts to global commodity moves.

Rally in metals = Tata Steel, Hindalco, JSW Steel surge

Rally in coal, oil = Uptrend in ONGC, Coal India, Oil India

Rally in agri = FMCG and consumer food stocks affected

Keep a watch on:

LME (London Metal Exchange) prices

Global wheat/rice/cocoa/sugar trends

🛑 Final Thoughts

Global factors are not just background noise. They are active triggers that move Indian markets every single day.

A smart trader or investor should:

Track global cues as seriously as domestic ones

Prepare for overnight risks using hedges or stop losses

Read market behavior through global context, not just stock-level news

By staying connected to the world, you can stay one step ahead of the market.

Reliance 1D Timeframe📊 Reliance Industries – Intraday Overview

Previous Close: ₹1,428.6

Opening Price: Opened slightly lower around ₹1,427–₹1,431.

Intraday High: Approximately ₹1,432 during early session.

Intraday Low: Dropped towards ₹1,410 during the mid-session.

Current Trading Price: Trading near ₹1,415, showing around 0.9% to 1% decline from the previous close.

🔍 Key Reasons for Movement Today

Post-Earnings Pressure: After recent earnings, Reliance faced profit booking as some investors booked gains following a previous rally.

Sector Weakness: Energy and telecom segments showed subdued strength while retail remained flat.

Heavy Volume: Trading volume remained above average, suggesting active participation from institutions and retail traders.

📈 Technical Snapshot

Immediate Support Zone: ₹1,410–₹1,412. If this breaks, next support could be near ₹1,400.

Immediate Resistance Zone: ₹1,430–₹1,432. A breakout above this may lead towards ₹1,440–₹1,450.

Trend Positioning: Reliance is currently below its short-term (20-day) moving average, indicating mild short-term weakness but no major breakdown.

💡 Intraday Strategy Levels

Scenario Trigger Point Expected Move

Bullish Reversal Above ₹1,432 Potential upside towards ₹1,445–₹1,450

Neutral/Bearish Between ₹1,410–₹1,430 Consolidation zone with limited moves

Breakdown Risk Below ₹1,410 Could slide to ₹1,400 or even ₹1,390 short-term

✅ Summary Conclusion

Reliance is trading with a mild negative bias, with price action holding between ₹1,410–₹1,432. The overall short-term structure remains weak after intraday profit booking, but key support is holding near ₹1,410. Watch for recovery above ₹1,432 for any bullish reversal or break below ₹1,410 for further downside.

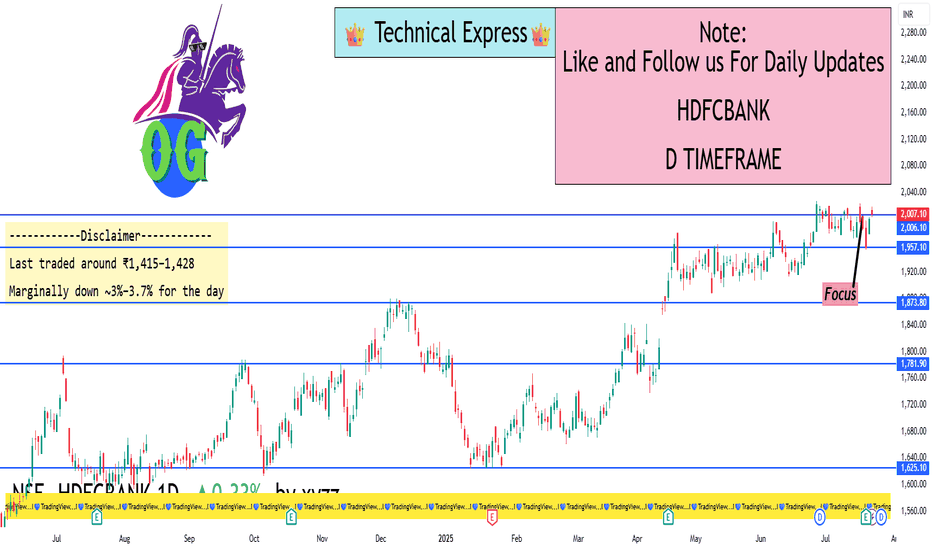

HDFCBANK 1D Timeframe📈 HDFC Bank – Intraday Overview

Opening Price: Opened strong around ₹2,005–₹2,010.

Intraday High: Touched approximately ₹2,018 during early trading.

Intraday Low: Maintained support around ₹2,000.

Current Price: Trading near ₹2,016, showing a gain of around +0.8% to +0.9%.

Previous Close: ₹2,005.

🔍 What’s Driving HDFC Bank Today

Positive Earnings Effect: Strong Q1 earnings with around 12% year-on-year profit growth, bonus share announcements, and dividends have boosted buying interest.

Sector Leadership: Among the strongest performers in the banking sector, helping to support indices like Nifty50 and Bank Nifty.

Consistent Volume: Healthy trading volumes indicate sustained institutional participation.

Strong Sentiment: Momentum remains high with overall positive cues from private banking space.

📊 Technical Summary

Support Level: Strong support exists around ₹2,000–₹2,005.

Resistance Level: Intraday resistance at ₹2,018 with major resistance near ₹2,027 (recent all-time high).

Trend Direction: Bullish trend, as it is making higher lows and maintaining strength above the psychological ₹2,000 mark

✅ Summary Conclusion

HDFC Bank is trading positively today with sustained momentum after strong earnings and corporate actions. Intraday action shows bullish strength above ₹2,000, with the possibility of new highs if it crosses ₹2,018–₹2,027 levels. Technical trend remains positive to bullish for the day.

Mahindra and Mahindra Leverage TradeFor the very first time I am publishing this idea that I recorded today. M&M has been consolidating for a while, it made a high if 3222 in September 2024 and has been consolidating for 11 months. Has tried to breach the level many times, but failed. Had been tracking this recent move. I mostly take the leveraged trades so the stock fits the pick. Started picking up around 3180 when it bounced back from the lows of 3152. I bought 3200 calls, with an Avg price of 65. Scaled up with 3300 Calls at an avg price of 31. All journaled and recorded live today. Not a rocket science, just tracking the simple candlestick patterns. Also had HDFC Life 740 calls which I squared off today and made some profits, which gave me additional leverage to carry on additional risk of 3300 call. Also bought some position in MTF at an avg price of 3210. As of now trade seems safe. Would post as we go along and close the trade. Hope for the best.

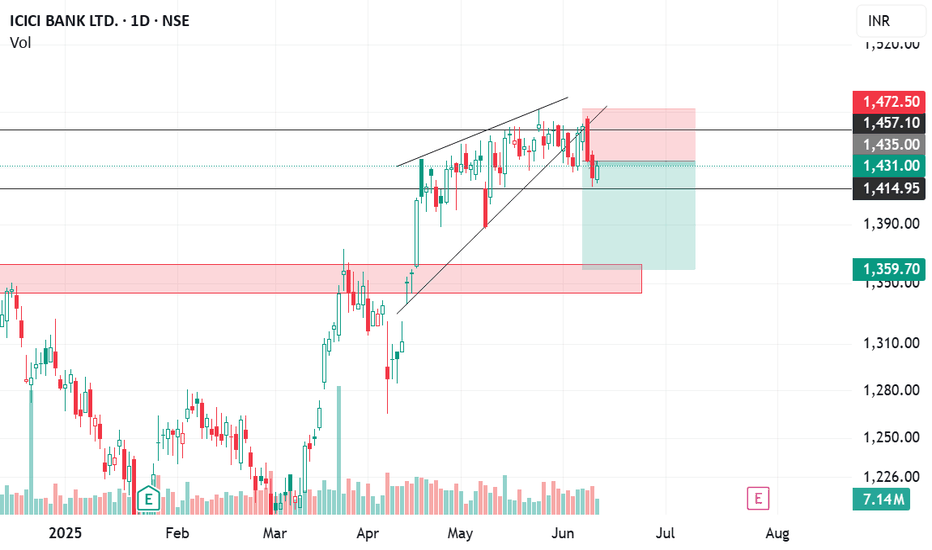

ICICI bank Good short CandidateICICI Bank has formed an Ending Diagonal Pattern near its recent highs, typically signaling a potential reversal in trend. This pattern is often observed in the final stages of an uptrend and suggests exhaustion in bullish momentum.

Following the completion of the diagonal, the stock has broken down below the lower trendline, confirming the bearish setup. Furthermore, it has already completed a retest of the breakdown level, which strengthens the validity of the reversal signal.

From a trading perspective, this setup offers a favorable risk-reward ratio for initiating short positions, especially with a clearly defined invalidation level (above the retest zone) and a potential downside target aligned with prior support levels or Fibonacci retracement zones.

Summary:

Pattern: Ending Diagonal (Bearish)

Status: Breakdown and retest completed

Outlook: Short bias with favorable risk-reward

Watch levels: Retest zone (resistance), key support for profit booking

Angel One Struggles to Recover After Weak Earnings, Stuck in DowTopic Statement:

AngelOne remains under pressure after a sharp profit decline, trading within a downtrending channel as it struggles to regain bullish momentum.

Key Points:

* The stock is moving in a clearly marked downtrending channel, allowing for structured channel-based trading

* It received strong support at the 50% Fibonacci retracement level around 2000, helping limit further downside

* Price generally faces resistance above the 100-day EMA, which continues to cap any rebound attempts

* A breakout above the channel could signal a trend reversal, but the poor quarterly results may delay any significant upside move

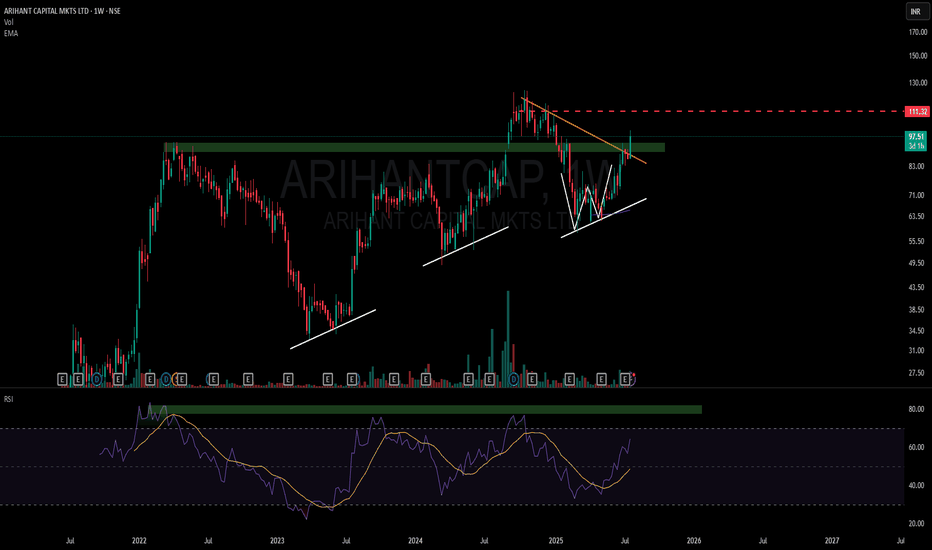

A Story of Structure, Strength, Supply Becomes Demand & RSI🔍 Key Observations:

- Supply ➡️ Demand Flip: The green zone previously acted as a supply region but was recently respected as demand, showcasing a classic SD conversion

- Double Bottom + Higher Lows (Structure): A W-bottom has formed on the weekly timeframe (WTF), with rising higher lows (marked in white)

- Weekly RSI Momentum: RSI has broken out of a local resistance, historically sensitive 76-80 band — a region that previously capped upside

📎 Why this matters (Learning Focus):

This chart provides a neat case study on how multiple timeframe resistance (red dotted) and structural clues such as higher lows, SD flips, and clean RSI zones

📘 Remember:

This is not a prediction — it's a framework for thinking. The goal here is to observe price behavior around critical levels, not a call or tip.

Institution Option Trading📈 Institutional Option Trading – Complete Detailed Guide

Institutional Option Trading refers to how big financial institutions, such as banks, hedge funds, and proprietary trading firms, use options strategically in the market to manage risk, maximize profits, and control large positions with precision. This approach is highly systematic, data-driven, and based on volume, volatility, and liquidity analysis — very different from how retail traders trade options.

💡 What is Institutional Option Trading?

Institutions don’t gamble with options — they use options for:

✅ Hedging — Protecting big portfolios from market drops.

✅ Income Generation — Earning regular profits through premium selling.

✅ Directional Bets — Placing large directional trades with minimal risk.

✅ Volatility Trading — Making profits from changes in volatility without caring about market direction.

📚 Key Features of Institutional Option Trading

1. Focus on Liquidity

Institutions trade highly liquid options, usually:

Index Options (NIFTY, BANKNIFTY, SPX)

Blue-Chip Stocks (Apple, Reliance, TCS, Infosys)

Commodity Options (Gold, Crude Oil)

They avoid low-volume contracts and always trade in markets where they can enter and exit positions without slippage.

2. Use of Option Greeks

Institutions are masters of Option Greeks:

Delta for direction,

Theta for time decay profits,

Vega for volatility play,

Gamma for adjusting positions dynamically.

They don’t trade blindly but monitor how their positions react to price, time, and volatility changes.

3. Premium Selling Bias

Most institutional setups involve selling options (not just buying).

✅ Credit Spreads, Iron Condors, and Covered Calls are preferred.

Why? Because time decay works in their favor, giving consistent income.

4. Hedging Big Positions

Institutions always hedge their trades.

✅ Example: They may hold large stock positions and sell Covered Calls or buy Protective Puts to reduce risk.

✅ This creates balanced portfolios, minimizing market shocks.

✅ Institutional Trading Tools

Open Interest Analysis

Option Chain Data

IV (Implied Volatility) charts

Volume Profile & Market Profile

Real-time Greeks exposure tools

Delta-neutral hedging platforms

📝 Example of Institutional Option Trade

Scenario: NIFTY at 22,000, sideways expectation for next week.

✅ Strategy: Sell 22,500 Call, Sell 21,500 Put (Iron Condor).

✅ Buy hedges: 23,000 Call, 21,000 Put.

✅ Profit Range: If NIFTY stays between 21,500-22,500 → Max Profit.

✅ Risk Managed: Losses capped, steady time decay profit.

🚀 Benefits of Learning Institutional Option Trading

✅ Consistent income instead of gambling

✅ Risk protection using proper hedging

✅ Trade size management for scalability

✅ Ability to handle big accounts with steady growth

✅ Professional market understanding

Option Trading📈 Option Trading – Complete Beginner to Advanced Guide

Option Trading is a powerful method used in stock, forex, commodity, and index markets where you trade contracts (options) instead of buying the actual stock or asset. With options, you get the right, but not the obligation, to buy or sell an asset at a specific price within a specific time. This allows traders to profit in bullish, bearish, and sideways markets — with controlled risk and higher flexibility.

💡 What is Option Trading?

In simple words:

You buy or sell a contract, not the stock itself.

You can control big positions with less money (leverage).

You can make money even if the market goes up, down, or stays sideways.

🎁 Advantages of Option Trading

✅ Small capital, high profits with leverage

✅ Limited risk, especially in buying options

✅ Opportunity to earn in any market direction

✅ Flexible strategies for income, hedging, or speculation

✅ Ideal for short-term trades (1 day to a few weeks)

Simple Example:

You think NIFTY will rise from 20,000 to 20,500 in a week.

You buy a NIFTY Call Option (Strike Price: 20,000).

Pay premium ₹50.

If NIFTY moves to 20,500, your option value increases (maybe ₹200).

Profit = ₹150 per unit (₹200 - ₹50).

With small investment, you earn bigger returns.

✅ Basic Rules for Successful Option Trading

Trade with trend direction (use technical analysis).

Always check Open Interest & Volume.

Avoid holding close to expiry to avoid time decay (theta loss).

Start with single-leg options, move to spreads later.

Risk only 1-2% of your capital per trade.

🎯 Benefits of Mastering Option Trading

✅ Higher returns with lower capital

✅ Master multiple market conditions

✅ Ideal for intraday, swing, and positional trades

✅ Opportunity to hedge existing investments

✅ Fast skill growth in financial markets

Technical Class📊 Technical Class — Complete Guide for Technical Trading

A Technical Class is focused on teaching traders how to analyze price action, chart patterns, indicators, and market behavior using technical analysis. This class is ideal for beginners and intermediate traders who want to understand how to make trading decisions based purely on market charts — without needing insider news or fundamentals.

✅ What is Technical Trading?

Technical trading means you:

Read the charts to find trading opportunities.

Use price history, patterns, and indicators to predict future price moves.

Do not rely on news, instead focus on what the market shows through charts.

Big traders (institutions) also use technical setups, combined with liquidity and order flow, making technical analysis an essential skill.

📚 What You Will Learn in a Technical Class

1. Chart Basics

Candlestick chart vs Line chart vs Bar chart

Timeframes: from 1 minute to monthly

Volume and market sessions

2. Candlestick Patterns

Reversal Patterns: Pin Bar, Engulfing, Morning Star, Evening Star

Continuation Patterns: Inside Bar, Flags, Pennants

Indecision Candles: Doji, Spinning Top

3. Support & Resistance

How to draw key support/resistance levels

Identifying key zones where price reacts

Turning resistance into support (flip zones)

4. Trend Trading Techniques

Recognizing Higher Highs and Higher Lows (uptrend)

Spotting Lower Highs and Lower Lows (downtrend)

Using Trendlines effectively

5. Indicators Used by Pros

Moving Averages (MA) — 50 EMA, 200 EMA for trend

RSI — Overbought/Oversold zones

MACD — Trend and momentum detection

Fibonacci Retracement — Spotting pullback levels

Volume Profile — Finding high-volume zones

6. Chart Patterns

Double Top/Bottom, Head & Shoulders, Triangles

Breakout Strategies — entering after confirmation

Fakeouts and Trap Patterns

7. Risk Management & Psychology

Setting proper Stop Loss (SL) and Take Profit (TP)

Position sizing: how much to risk per trade

Building discipline and patience like a pro trader.

🎯 Benefits of Learning Technical Trading

✅ Trade any market: Forex, Stocks, Crypto, Commodities

✅ Become an independent trader — no reliance on signals

✅ Combine with institutional concepts for Smart Money Trading

✅ Understand why market moves and avoid beginner mistakes

✅ Build a professional mindset with proper risk management

🎓 After Completing Technical Class You Will Be Able To:

Analyze any chart professionally

Trade with higher win-rate setups

Control risk like institutional traders

Identify market traps and avoid fakeouts

Grow your account safely with discipline + strategy.

Tata Chemicals Ltd (TATACHEM) – NSE🔍 Chart Pattern Analysis:

Pattern Formed:

A symmetrical triangle consolidation pattern can be observed on the chart, with:

A downward sloping resistance line (from mid-June highs),

A flat support level near ₹900,

Today’s breakout candle closing above the triangle’s resistance zone.

This pattern suggests price compression with declining volatility and sets up for a potential strong directional breakout.

✅ Bullish Breakout Confirmation:

Today's price action indicates a breakout above the resistance trendline with a strong bullish candle.

If followed by higher volumes in the coming sessions, this move can confirm the breakout and signal trend continuation.

Immediate Resistance >>> 970–980

Next Major Resistance >>>1,000–1,020

Breakout Support Zone >>>930–940

Key Stop-loss Level >>> 900

Trader Strategy:

Positional Traders: May consider entering near ₹950–₹955 with stop-loss below ₹930.

Target Range: ₹980–1,020 in the short term.

Risk Management: Avoid entries if the stock closes back below ₹940 in the next few sessions.

Trend Bias: Bullish, with breakout leading to possible continuation of the prior uptrend.

🧾 Disclaimer:

This analysis is provided for educational and informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instrument.

Stock markets are subject to risk. Please consult a SEBI-registered investment advisor before making any trading or investment decisions. Past performance is not indicative of future results.