Coromandel International Limited

2,204.00INRD

−5.95−0.27%

At close at Nov 14, 10:52 GMT

INR

No trades

Trade ideas

COROMANDAL INTERNTL. LTDAs of May 15, 2025, Coromandel International Ltd. (NSE: COROMANDEL) is trading at ₹2,403.30. Analyzing the 30-minute timeframe provides insights into short-term price movements and potential trading opportunities.

📊 30-Minute Technical Overview

Price Action:

Current Price: ₹2,403.30

Day's Range: ₹2,320.60 – ₹2,452.30

52-Week Range: ₹1,195.85 – ₹2,498.00

Technical Indicators:

Moving Averages: The stock is trading above its short-term moving averages, indicating a bullish trend.

Relative Strength Index (RSI): The RSI is in the neutral zone, suggesting neither overbought nor oversold conditions.

MACD: The MACD line is above the signal line, supporting a positive momentum.

Trend Analysis:

The 30-minute chart shows higher highs and higher lows, characteristic of an uptrend.

Volume analysis indicates increased buying interest during upward price movements.

🔍 Analyst Insights

Technical Rating: Based on multiple indicators, the stock has a "Strong Buy" rating in the 30-minute timeframe.

Volatility: The stock exhibits moderate volatility, suitable for intraday trading strategies.

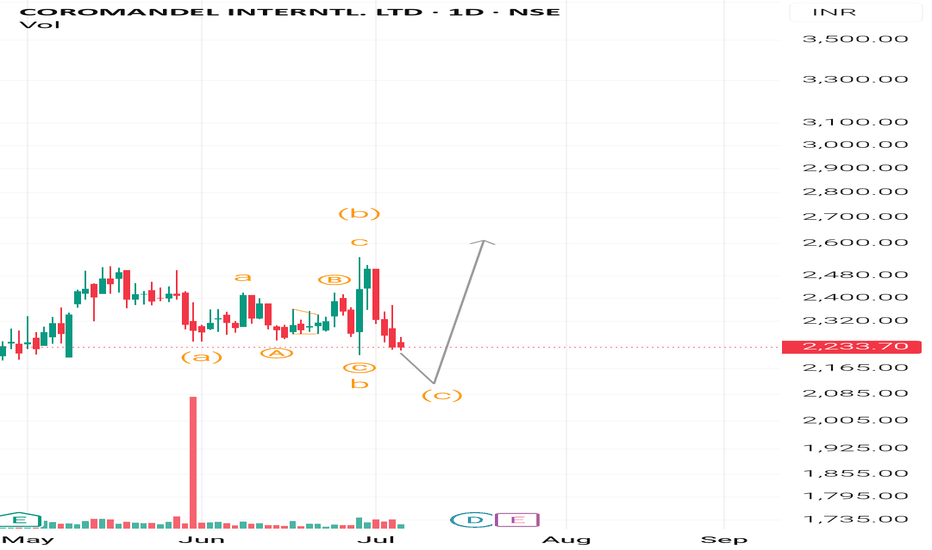

Coromandel International - Short Trade on ChartsNSE:COROMANDEL Coromandel International Ltd.

Elliot wave reading (Monthly) suggests that that the Wave-3 is completed at Higher High 1971.60; now corrective wave-4 should take over the various projecting end point corrective wave-4 are suggested below.

A short trade opportunity is seen on chart

• Entry at: 1701 (on closing basis)

• Stop- Loss: 1850

• Target-1: 1490

• Target-2: 1380

• Extended Traget-3: 1150

For More Trading Ideas, LIKE SHARE & FOLLOW My Idea Stream

COROMANDELCOROMANDEL :- The stock has given a breakout with a strong candle and has also formed a cup and handle pattern

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Coromandel International - A clear winner Even in the current scenario, Stock has got all the strength it needed

Currently stock is following Diagonal support Resistance pattern as can be seen from the chart

Possible change of directions can be seen on the charts

Lower time frame compulsion will be necessary as the volatility is at its peak

Still if it holds the current area of 1710 - 1680 it has an easy chance of making new highs in coming days

COROMANDEL - NEXT Candidate for 10% move?Daily chart with internal counts is shared here..

Looks like the impulse 5 wave move is complete now. A pullback to 1500 is on the cards.

I believe that the price is still in it's 3rd wave (Primary count) On Weekly TF. But will wait for the specific levels to confirm..

Here is the chart on weekly counts.

I am not a SEBI registered Analyst. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views.

Coromandel International - Breakout Setup, Move is ON...#COROMANDEL trading above Resistance of 1938

Next Resistance is at 2310

Support is at 1545

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Coromandel International - Breakout Setup, Move is ON...#COROMANDEL trading above Resistance of 1680

Next Resistance is at 1938

Support is at 1456

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

coromandel - swing tradeCoromandel International Ltd.

Pattern: Ascending Triangle Breakout

Current Price: 1,839.30 INR

Entry Point: Enter the trade at the breakout level, which is around 1,839.30 INR.

Stop Loss: Place your stop loss slightly below the lower trendline of the ascending triangle, around 1,780.00 INR, to manage risk.

Target 1: Set your first profit target at 2,058.80 INR.

Target 2: If the price continues to rise, set your second profit target at 2,305.40 INR.

Volume: The significant increase in trading volume supports the breakout, indicating strong buying interest.

Summary

Entry Point: 1,839.30 INR

Stop Loss: 1,780.00 INR

Target 1: 2,058.80 INR

Target 2: 2,305.40 INR

17th december intraday coromandelcoromandel has shown a daily breakout on chart on moving towards all time hight

simple reaason is positioning before budget as it deals in fertilizerss.

for intraday buy in range 1810-1822 with sl at 1790

for tgt 1845-1665-1880++

targets are high as it is breakingits all time high risk to reward is good

Coromandel International (COROMANDEL) - A Swing Trade SetupBullish Flag Pattern 🚩

Potential for a strong upmove 📈

Strong support from key moving averages 🚀

Accumulating buying interest 💰

Trading Plan:

Entry: Buy above ₹1,795 on a breakout with strong volume 🟢

Target 1: ₹1,950 🎯

Target 2: ₹2,000 🎯

Stop-Loss: ₹1,733 🛑

Risk-Reward: Favorable 1:2

COROMANDEL break outcoromandel break out at - 1800

buy - 1813

sl - 1765

target 1 - 1990

follow risk reward

Disclaimer -

videos, presentations, and writing are only for educational purposes and are not intended for investment advice. I can't promise the accuracy of any information provided. please consult with your financial advisor.

Coromandel goodChart -> Coromandel Daily

Same chart like Supriya.

CMP: 1805

Good range to buy: 1770 to 1800

Targets: 1940, 2030

SL: 1735 Daily Close

Disclaimer: This is for educational purposes only, not any recommendations to buy or sell. As I am not SEBI registered, please consult your financial advisor before taking any action.

Coromandel International Ltd.Coromandel International Ltd. is currently consolidating within a bullish ascending triangle pattern, with key resistance at ₹1918-1920 and strong support at ₹1710 (50-day MA). Indicators like RSI and MACD signal growing bullish momentum, suggesting a potential breakout above ₹1920, which could lead to targets of ₹2000-2050. However, a breakdown below ₹1710 could shift sentiment bearish, with downside targets at ₹1660-1550. Traders are advised to wait for a decisive move outside this range, entering long above ₹1920 or short below ₹1710, while using tight stop-loss levels to manage risk effectively.