Trade ideas

CADCHF Formed 4H chart Bullish Wolfe Wave Chart PatternCADCHF Formed 4H chart Bullish Wolfe Wave Chart Pattern

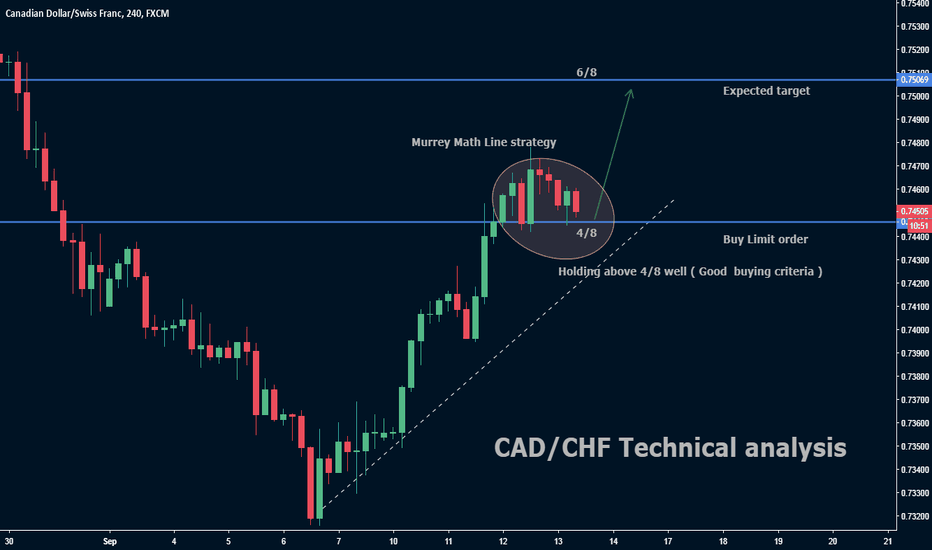

Technical Analysis:

We are expecting that 0.73345 is it took the support of trend line.

If hold that support then can lead 0.74500, so down side is limited and its opportunity for buy on dips

What looked like an almost free fall from 0.73982 to 0.73355 today for CADCHF is currently halted.

The price re-tested 23 Feb 2018 lows and bounced back being supported by really high stopping volume at point 5 of the grand Wolfe-wave.