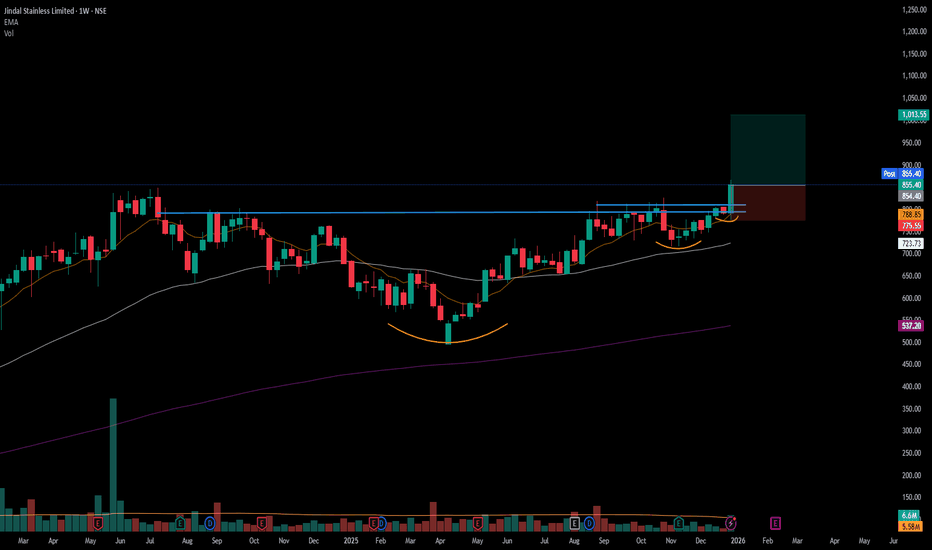

is this cup and handle breakout with Volume in JSL?Timeframe: Daily

Trend: Uptrend

Structure:

• Support: 715

• Resistance: 880,930,995,1110

• Key Level: 850

View:

If Price holding above 850 level. Below targets are achievable

Target1: 880

Target 2: 930

Target 3: 995

Target 4: 1110

Risk Note:

Invalidation below 715.

⚠️ Educational & analytical vi

Jindal Stainless Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

35.70 INR

25.05 B INR

392.31 B INR

260.19 M

About Jindal Stainless Limited

Sector

Industry

CEO

Tarun Kumar Khulbe

Website

Headquarters

New Delhi

Founded

1970

IPO date

Nov 17, 2003

Identifiers

2

ISIN INE220G01021

Jindal Stainless Ltd. operates as a holding company, which engages in the provision of stainless-steel flat products. Its products include ferro alloys, stainless steel slabs, hot rolled coils, plates and sheets, and cold rolled coils and sheets. The company was founded in 1970 by Om Prakash Jindal and is headquartered in New Delhi, India.

Related stocks

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed t

#JSL - VCP BO in WTFScript: JSL

⚡Key highlights: 💡

📈 VCP BO in WTF

📈 Volume spike seen during Breakout

📈 MACD Bounce

📈 RS Line making 52WH

📈 Sector is strong

If you have any doubts about the setup, drop a comment and I’ll reply.

✅Boost and follow to never miss a new idea! ✅

⚠️ Important: Always Exit the trade bef

Jindal Stainless (D): Strongly Bullish - Sector-Backed BreakoutTimeframe: Daily | Scale: Linear

The stock has confirmed a major "Blue Sky" breakout, clearing a confluence of resistance levels (Angular + Horizontal) to hit a new All-Time High. This move is powered by a sector-wide rally and strong institutional volume.

🚀 1. The Fundamental Catalyst (The "Why

is this cup and handle breakout with Volume in JSL?Timeframe: daily

Trend: Uptrend

Structure:

• Support: 715

• Resistance: 880,930,995,1110

• Key Level: 850

View:

If Price holding above 850 level. Below targets are achievable

Target1: 880

Target 2: 930

Target 3: 995

Target 4: 1110

Risk Note:

Invalidation below 715.

⚠️ Educational & analytical vi

JSL: Long Opportunity | Ready to Fire! ⚡️Price Analysis:

1️⃣ Price showing strength.

2️⃣ Price structure is bullish.

3️⃣ Good momentum is expected

✨ Key Observations:

➡️ RRR favourable at CMP.

➡️ Price did retest of the trendline confirming strength.

⚠️ Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learnin

JSL TECHNICAL ANALYSISStructure: Price is currently in a corrective phase after a strong bullish rally.

Support Zone: The chart highlights an unmitigated Fair Value Gap (FVG) in the discount zone (~₹700–₹720), which aligns with a strong previous resistance turned support area.

Current Price Action: Price is trading aro

Jindal Stailess LtdIf the stock breaks convincingly above ₹ 820 with good volume, it might trigger a stronger uptrend leg.

In absence of strong breakout, the stock may oscillate between support and resistance — suitable for range trading.

Disclaimer : - Above analysis for educational purpose only, no any buy or sel

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

EEDM

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Unhedged USDWeight

0.09%

Market value

9.33 M

USD

EDM2

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Accum Shs Unhedged USDWeight

0.09%

Market value

9.33 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of JSL is 763.05 INR — it has decreased by −2.40% in the past 24 hours. Watch Jindal Stainless Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Jindal Stainless Limited stocks are traded under the ticker JSL.

JSL stock has risen by 0.76% compared to the previous week, the last month showed zero change in price, over the last year Jindal Stainless Limited has showed a 26.51% increase.

We've gathered analysts' opinions on Jindal Stainless Limited future price: according to them, JSL price has a max estimate of 1,020.00 INR and a min estimate of 770.00 INR. Watch JSL chart and read a more detailed Jindal Stainless Limited stock forecast: see what analysts think of Jindal Stainless Limited and suggest that you do with its stocks.

JSL stock is 4.80% volatile and has beta coefficient of 1.51. Track Jindal Stainless Limited stock price on the chart and check out the list of the most volatile stocks — is Jindal Stainless Limited there?

Today Jindal Stainless Limited has the market capitalization of 659.45 B, it has decreased by −2.42% over the last week.

Yes, you can track Jindal Stainless Limited financials in yearly and quarterly reports right on TradingView.

Jindal Stainless Limited is going to release the next earnings report on May 30, 2026. Keep track of upcoming events with our Earnings Calendar.

Jindal Stainless Limited revenue for the last quarter amounts to 105.18 B INR, despite the estimated figure of 109.32 B INR. In the next quarter, revenue is expected to reach 112.30 B INR.

JSL net income for the last quarter is 8.29 B INR, while the quarter before that showed 8.07 B INR of net income which accounts for 2.71% change. Track more Jindal Stainless Limited financial stats to get the full picture.

Jindal Stainless Limited dividend yield was 0.52% in 2024, and payout ratio reached 9.86%. The year before the numbers were 0.43% and 9.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 13, 2026, the company has 19.43 K employees. See our rating of the largest employees — is Jindal Stainless Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Jindal Stainless Limited EBITDA is 51.66 B INR, and current EBITDA margin is 11.61%. See more stats in Jindal Stainless Limited financial statements.

Like other stocks, JSL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Jindal Stainless Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Jindal Stainless Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Jindal Stainless Limited stock shows the buy signal. See more of Jindal Stainless Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.