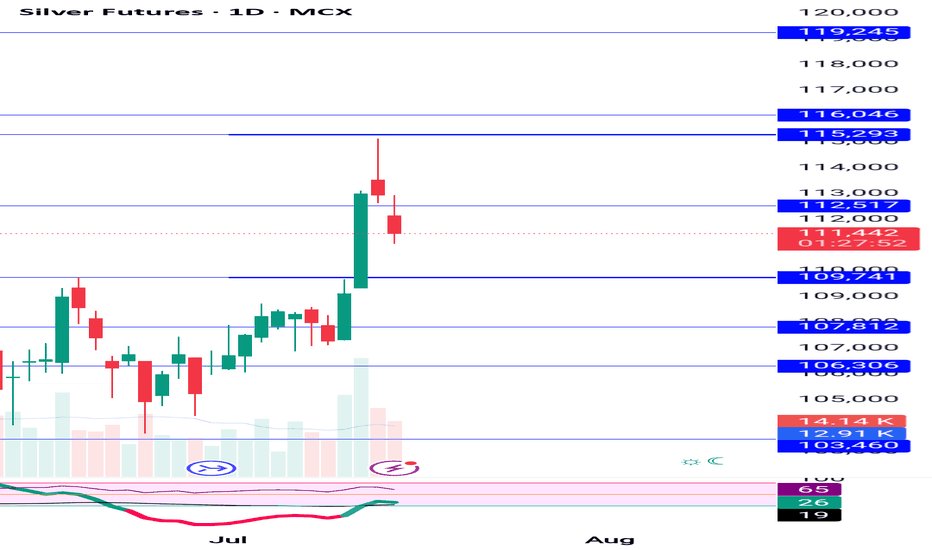

Silver yesterday sold at 114450 today booked at 111200 avoid buyHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Trade ideas

Silver 113k target done 115k and 116500 next target How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver updated levels if break High then 2-3% upmove next week How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

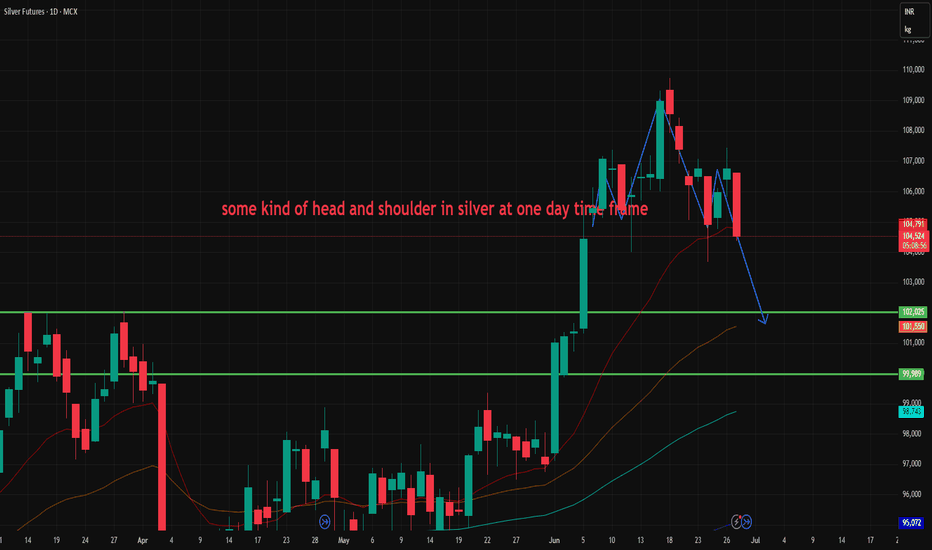

Bearish Harmonic in Play – Silver Sell Zone TriggeredBearish Harmonic in Play – MCX:SILVER1! Sell Zone Triggered 🔔

The pattern marked from X → A → B → C → D forms a Bearish Harmonic Structure , most likely a Bearish Butterfly , confirmed by key Fibonacci ratios:

* XA to AB retracement: 78.8%

* BC to CD extension: 1.543

This setup signals the formation of a Potential Reversal Zone (PRZ) near point D , where a bearish trend may initiate.

📉 Bearish Price Outlook

The dotted projection lines and red arrow illustrate the anticipated downward move:

* Price is likely to face resistance and reverse from the PRZ between ₹108,771 and ₹109,850

* A break below ₹106,899 could trigger further decline toward key support levels at ₹103,904 and ₹98,810

Silver sell on rise until 109k not break making bearish M paternHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver mcx updated levels buy on dip at support avoid sell tradeHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver buy given at 106300 near book profit 107600 nearHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver making poll&flag pattern , ready for fresh ATH buy dipHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver Futures (MCX) – Gap Filling in ProgressSilver is showing signs of weakness after a recent rally and is now hovering near a key gap zone, hinting at a potential gap fill move in the short term.

🔻 Chart Insight:

Price is stalling just below the previous resistance zone.

A visible gap exists between 106,674 and 105,358, which the market is likely to fill.

The price has already started rejecting higher levels, indicating profit booking and bearish pressure.

📉 Outlook:

Silver futures are expected to fill the gap down to the 105,358 level before any sustainable bounce. If the price breaks below 106,582, the gap-fill probability increases significantly.

📌 Conclusion:

Gap-filling action is likely on the cards. Traders should watch price behavior near 106,500–105,350 for potential bounce zones or continuation signals.

Silver .. IN distribution test Phase.. Bearish trendSilver 106474 is in UTAD phase.

UTAD- shakeout in the accumulation It occurs in the latter stages and provides a definitive test of new demand after a breakout above the resistance.

Silver has resistance at 108686.

Currently it is trading below 106900

As long as it trade below 106900, Nifty will be in bearish trend and possibility for falling down to 97633

Silver holding buy trade avg 105700 , upside Target on chartHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver holding buy trade avg 105700 upmove will continue, How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver mcx holding buy from 107600, 108700,109500 Target How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

MCX Silver Analysis – Technical OutlookHere’s my latest view on MCX Silver📃

🎯 Silver recently broke out and has given a great move for the bulls above ₹1,00,000, giving almost a 9,000 points rally, confirming a strong bullish structure for the time being.

🎯 After hitting a local top range around ₹1,08,000 to ₹1,09,500 range, price is now pulling back toward a key liquidity zone (~₹98,000 to ₹99,000).

🎯 This demand zone also aligns with a high-volume zone — giving a strong indication that buyers may look to accumulate here.

🎯 RSI is cooling off into neutral territory, allowing for more upside potential.

Plan:

If Silver retraces into the ₹98,000-99,000 zone and holds, I’ll look for long setups targeting a move toward ₹1,20,000 in the coming months.

💡Always wait for bullish confirmation near the demand zone before entering.

Silver mcx updated levels buy on dip near Friday lowHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Silver at Strong Support Level: Ideal Buy with Targets up to 12Silver has a level that is a strong potential support. Personally, I have been waiting for a retest of this level (87580) for quite some time. It is advisable to buy at this level.

From here, potential targets appear to be 96400, 100900, 102700, 106500, 120000, and 125000.

Silver’s Got Cold Feet at $37 – Time to Short the ShineTimeframe: Daily

Duration: 7–10 days

CMP: $36.36

⸻

Rationale:

• Price failed to break convincingly above $37 – classic fake breakout.

• Strong red candle with volume signals sellers are back in charge.

• Multiple rejections near the top suggest bulls are exhausted.

⸻

Trade Setup:

• Sell Zone: $36.35 – $36.40

• Stop Loss: $37.05

• Target 1: $35.20

• Target 2: $34.40

• Extended Target: $33.50 (if panic sets in)

Silver currently at support buy on dip avoid sell tradeHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early traders can make fresh reversals trade after breaking 1st D 15.1% safe traders can reversal trade after breaking Point D 22.5.4% to 24.5% range

Targets :

Target T1 : 36.1% to 38.3%

Target T3 : 49.1% to 52.5%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection ).

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 15.1% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance