Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.47 USD

100.12 B USD

349.81 B USD

5.04 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

ISIN

US02079K1079

FIGI

BBG012QVVDT3

Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

Multi-EMA Toggle Indicator A clean and versatile Exponential Moving Average (EMA) indicator featuring 5 fully customizable EMAs with individual toggle controls. Perfect for traders who want flexibility in their moving average analysis without cluttering their charts.

Key Features

✅ 5 Independent EMAs - Each with its own setti

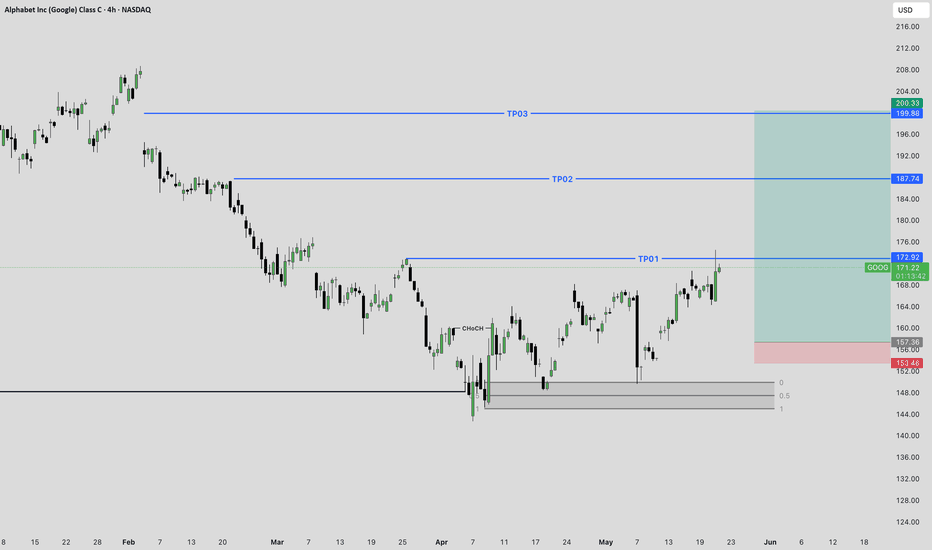

GOOG: Don't Miss This Potential Reversal!GOOG Long Idea

Chart Analysis:

The chart shows Alphabet Inc. (GOOG) on a 4-hour timeframe. After a period of decline from its highs, GOOG appears to be finding support around the "Weekly Liquidity" level. There's also a recent bullish impulse from this area, breaking above some minor resistance

Google: A compelling buy at the current priceHello,

As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." This mindset is particularly relevant right now with Alphabet Inc.

Despite being a company whose products we use daily—and will likely rely on even more in the future—Alphabet's stock r

GOOGL - Elliott Wave Final ShowdownGOOGL has dropped over 27.28% , reaching a minor profit-booking zone. The $150 level serves as a key demand zone, where a potential price reversal could occur. The formation is either expanded flat or a running flat on the daily timeframe chart.

Confirmation is best observed near the lower trend

I believe GOOGL will be $260 around June2025This chart looks bullish if ES and SPY continue to chug steadily higher.

I said last year that we were entering a 3-4 year bull market, but most still worried about the "impending crash" - which never happened.

Japan wasn't even really a crash either and we recovered all that in weeks.

So that

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

—

Maturity date

May 15, 2065

GOOG6065580

Alphabet Inc. 4.0% 15-MAY-2030Yield to maturity

—

Maturity date

May 15, 2030

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

—

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

—

Maturity date

May 15, 2035

XS306442546

Alphabet Inc. 3.375% 06-MAY-2037Yield to maturity

—

Maturity date

May 6, 2037

US2079KAJ6

Alphabet Inc. 0.8% 15-AUG-2027Yield to maturity

—

Maturity date

Aug 15, 2027

XS306442783

Alphabet Inc. 3.875% 06-MAY-2045Yield to maturity

—

Maturity date

May 6, 2045

XS306441868

Alphabet Inc. 2.5% 06-MAY-2029Yield to maturity

—

Maturity date

May 6, 2029

US2079KAG2

Alphabet Inc. 2.25% 15-AUG-2060Yield to maturity

—

Maturity date

Aug 15, 2060

US2079KAF4

Alphabet Inc. 2.05% 15-AUG-2050Yield to maturity

—

Maturity date

Aug 15, 2050

US2079KAE7

Alphabet Inc. 1.9% 15-AUG-2040Yield to maturity

—

Maturity date

Aug 15, 2040

See all GOOGN bonds

Curated watchlists where GOOGN is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on TURQUOISE exchange Alphabet Inc. Class C stocks are traded under the ticker GOOGN.

We've gathered analysts' opinions on Alphabet Inc. Class C future price: according to them, GOOGN price has a max estimate of 300.00 USD and a min estimate of 187.00 USD. Watch GOOGN chart and read a more detailed Alphabet Inc. Class C stock forecast: see what analysts think of Alphabet Inc. Class C and suggest that you do with its stocks.

Yes, you can track Alphabet Inc. Class C financials in yearly and quarterly reports right on TradingView.

Alphabet Inc. Class C is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

GOOGN earnings for the last quarter are 2.31 USD per share, whereas the estimation was 2.18 USD resulting in a 5.82% surprise. The estimated earnings for the next quarter are 2.33 USD per share. See more details about Alphabet Inc. Class C earnings.

Alphabet Inc. Class C revenue for the last quarter amounts to 96.43 B USD, despite the estimated figure of 94.04 B USD. In the next quarter, revenue is expected to reach 99.60 B USD.

GOOGN net income for the last quarter is 28.20 B USD, while the quarter before that showed 34.54 B USD of net income which accounts for −18.37% change. Track more Alphabet Inc. Class C financial stats to get the full picture.

Yes, GOOGN dividends are paid quarterly. The last dividend per share was 0.21 USD. As of today, Dividend Yield (TTM)% is 0.34%. Tracking Alphabet Inc. Class C dividends might help you take more informed decisions.

Alphabet Inc. Class C dividend yield was 0.32% in 2024, and payout ratio reached 7.46%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 9, 2025, the company has 183.32 K employees. See our rating of the largest employees — is Alphabet Inc. Class C on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alphabet Inc. Class C EBITDA is 138.86 B USD, and current EBITDA margin is 36.45%. See more stats in Alphabet Inc. Class C financial statements.

Like other stocks, GOOGN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alphabet Inc. Class C stock right from TradingView charts — choose your broker and connect to your account.