USDSEK - SHORT ENTRYSymbol - USDSEK

USDSEK is currently trading at 10.96650

I'm seeing a trading opportunity on sell side.

Shorting USDSEK pair at CMP 10.96650

I will be adding more if 11.03000 comes & will hold with SL of 11.10000

Targets I'm expecting are 10.81000 - 10.73000 & beyond.

Disclaimer - Do not co

About U.S. Dollar / Swedish Krona

The U.S. Dollar vs. the Swedish Krona. At times of market stress the U.S. dollar can act as a safe-haven asset, but swings in broad-based investor trends can make the USD/SEK exchange rates very sensitive. The pair can also sensitive to relative monetary policy expectations for the Federal Reserve vs. the Riksbank, Sweden’s central bank.

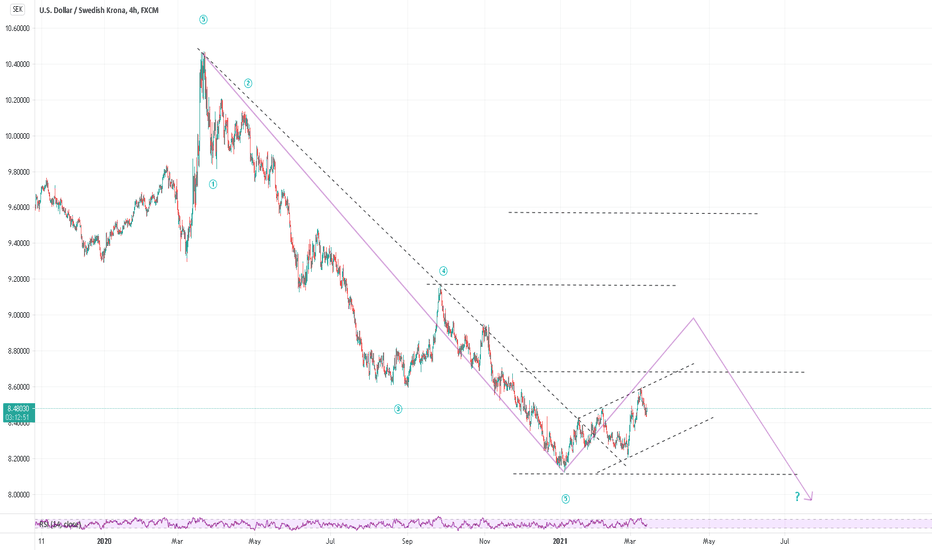

USDSEK - SMALL SL FOR BIG REWARD ?Symbol - USDSEK

USDSEK is currently trading at 10.80500

I'm seeing a trading opportunity on sell side.

Shorting USDSEK pair at CMP 10.80500

Holding with SL of 10.84000

Targets I'm expecting are 10.60000 & 10.48000

This is a high risk trade with small SL & big targets. Let's see what happens!

Strong Support!USDSEK 15 Minute TF

Feel Free to message me if You'd like to work or learn with me!

USDSEK Broke down from the supporting trendline a few hours ago and sustained the breakout as well

However it is back at a strong support once again and is expected to make a double bottom and give a strong rever

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDSEK is 10.95214 SEK — it has decreased by −0.11% in the past 24 hours. See more of USDSEK rate dynamics on the detailed chart.

The value of the USDSEK pair is quoted as 1 USD per x SEK. For example, if the pair is trading at 1.50, it means it takes 1.5 SEK to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDSEK has the volatility rating of 1.00%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDSEK showed a 1.57% rise over the past week, the month change is a 0.93% rise, and over the last year it has increased by 7.05%. Track live rate changes on the USDSEK chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDSEK right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDSEK technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDSEK shows the buy signal, and 1 month rating is buy. See more of USDSEK technicals for a more comprehensive analysis.