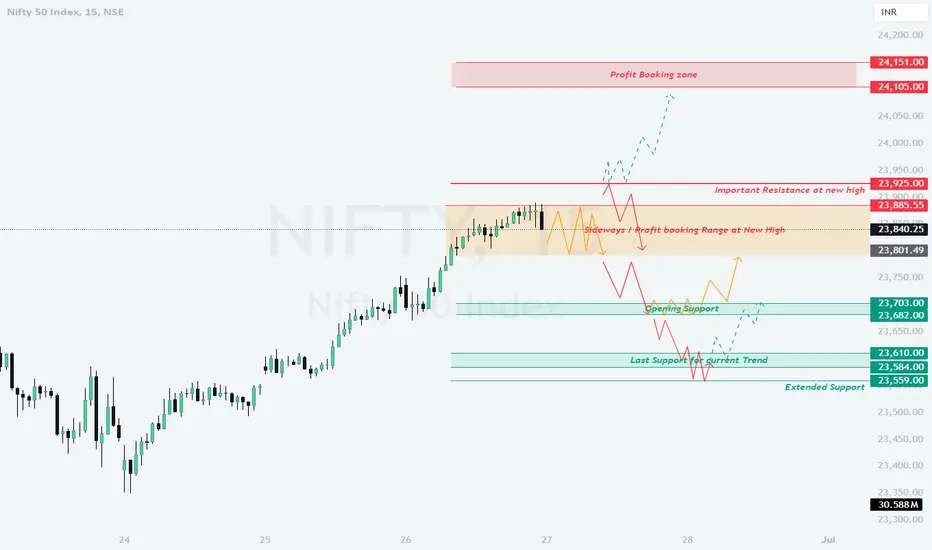

Here is a detailed trading plan for NIFTY Index on 27-Jun-2024 considering various opening scenarios. The plan includes steps for Gap Up, Flat, and Gap Down openings.

**Scenario 1: Gap Up Opening (100+ points)**

**Scenario 2: Flat Opening**

**Scenario 3: Gap Down Opening (100+ points)**

**Summary and Conclusion**

For 24-Jun-2024, closely monitor the key levels and price action for potential trading opportunities. In case of a gap up opening, watch the resistance zone and look for profit booking opportunities. For a flat opening, trade within the sideways range and look for breakout or breakdown signals. In the event of a gap down opening, focus on the support levels for potential reversals or continuation patterns.

**Disclaimer:** I am not a SEBI registered analyst. This plan is for educational purposes only and not an investment advice. Always conduct your own research and consult with a professional financial advisor before making any trading decisions.

Good luck with your trading on 27-Jun-2024!

**Scenario 1: Gap Up Opening (100+ points)**

- **Initial Action:** Monitor the price action and volume around the important resistance zone at 23,925.00 - 23,885.55.

- **Profit Booking Zone:** If the price sustains above 24,105.00, look for opportunities to book profits.

- **Resistance Rejection:** If the price faces rejection from the resistance zone (23,925.00 - 23,885.55), expect a pullback towards the opening support at 23,703.00 - 23,682.00.

- **Support Confirmation:** If the price holds above the opening support zone, consider entering long positions with a target towards the resistance zone again.

- **Breakdown:** If the price breaks below 23,682.00, expect a further decline towards the last support of the current trend at 23,610.00 - 23,584.00.

**Scenario 2: Flat Opening**

- **Initial Action:** Observe the price action and volume in the sideways and profit booking range (23,885.55 - 23,801.49).

- **Breakout Entry:** If the price breaks above 23,925.00 with strong volume, enter long positions targeting the profit booking zone (24,105.00 - 24,151.00).

- **Range Trading:** If the price remains in the sideways range (23,885.55 - 23,801.49), consider scalping opportunities within this range.

- **Support Test:** If the price drops towards the opening support (23,703.00 - 23,682.00), look for a reversal signal to enter long positions.

- **Breakdown:** If the price falls below 23,682.00, expect a move towards the last support of the current trend at 23,610.00 - 23,584.00.

**Scenario 3: Gap Down Opening (100+ points)**

- **Initial Action:** Evaluate the price action and volume around the opening support at 23,703.00 - 23,682.00.

- **Support Reversal:** If the price finds support and reverses from this zone, consider entering long positions targeting the sideways range at 23,801.49.

- **Breakdown Continuation:** If the price fails to hold the support and breaks below 23,682.00, prepare for a further decline towards the last support of the current trend at 23,610.00 - 23,584.00.

- **Extended Support:** In case of further weakness, watch the extended support zone at 23,559.00 for potential reversal opportunities.

- **Recovery Signal:** If a recovery signal appears above the last support zone, consider entering long positions targeting the opening support again.

**Summary and Conclusion**

For 24-Jun-2024, closely monitor the key levels and price action for potential trading opportunities. In case of a gap up opening, watch the resistance zone and look for profit booking opportunities. For a flat opening, trade within the sideways range and look for breakout or breakdown signals. In the event of a gap down opening, focus on the support levels for potential reversals or continuation patterns.

**Disclaimer:** I am not a SEBI registered analyst. This plan is for educational purposes only and not an investment advice. Always conduct your own research and consult with a professional financial advisor before making any trading decisions.

Good luck with your trading on 27-Jun-2024!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.