On the other hand, Bloomberg also reported on Wednesday (August 20) that as gold prices have soared, the illegal gold trade has become one of the largest and fastest-growing illicit economies in the Western Hemisphere, and the U.S. government is facing pressure to step up its crackdown.

According to a report released by the Financial and Corporate Transparency Alliance (FACT) on Wednesday, the boom in illegal gold mining and trading in some South American countries has become a crisis that the United States cannot ignore.

In Colombia and Peru, two major cocaine-producing countries, illegal gold is estimated to generate more revenue for organized crime than the drug trade itself.

The Washington-based financial advocacy group has called on Congress to pass legislation to address the environmental and social impacts of illegal gold mining.

The rise of the illegal gold trade is due to a tripling of gold prices over the past decade and weak law enforcement as authorities remain focused on fighting drug trafficking.

In terms of the day’s data highlights

S&P Global will release preliminary figures for the US manufacturing and services Purchasing Managers’ Index (PMI) for August today (Thursday). This important report could have a significant impact on the direction of gold prices.

Economists expect the preliminary US S&P Global Manufacturing PMI for August to be 49.5, compared to a final reading of 49.8 in July.

In addition, the preliminary reading of the US S&P Global Services PMI for August is expected to be 54.2, compared to a final reading of 55.7 in July.

The July services PMI was 55.7, and if August data shows a sharp decline, the US Dollar could be negatively affected immediately.

On the other hand, if the manufacturing PMI recovers above 50 and the services PMI approaches July levels, the US Dollar could remain strong against other currencies, making it difficult for gold to regain its upward momentum.

Technical Outlook Analysis

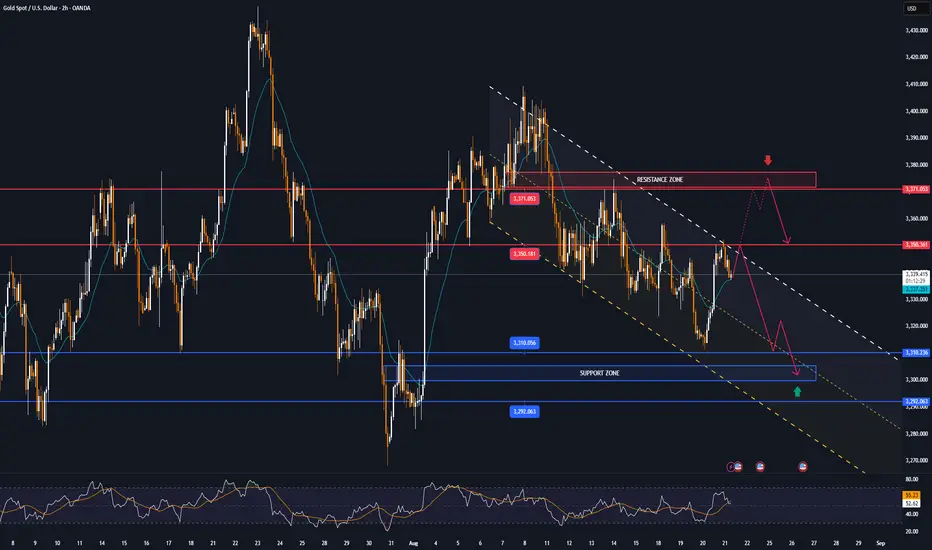

After receiving support from the $3,310 level, which is the support that readers have been paying attention to throughout the publications during this time, gold has recovered but the upside momentum has also been limited after testing the EMA21 line. Gold is under pressure from the EMA21, temporarily falling slightly but it may retest the $3,310 level in the short term as there is no more notable support than this level at present, followed by the full price point of $3,300.

Personally, I still maintain the view that gold will continue to move sideways and wait for a strong enough fundamental impact to change the overall technical structure.

The factors that show that gold is neutral are that it has not yet achieved the conditions for a long-term trend line, the sideways state is depicted by the green rectangle. Next is the price action clinging to the 21-day moving average, followed by the RSI moving around the 50 level, showing that the market sentiment is also hesitantly neutral without leaning to any particular side.

During the day, the technical outlook of gold price accumulation sideways will be noticed by the positions listed below.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,350 – 3,371 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Note

Gold prices edged lower as the dollar rose to a two-week high, as investors focused on Federal Reserve Chairman Powell's speech at the Jackson Hole conference.Trade active

Plan SELL HIT TP1 +90pips. Heading to TP2 😵😵😵Note

The world's largest gold ETF, SPDR Gold Trust, kept its holdings unchanged.Trade closed: target reached

Plan SELL Hit Full TP2 + 140pips🤕🤕🤕. Congratulations everyoneNote

▫️Spot gold hit $3,370 an ounce, up 0.13% on the day.Note

Trump's surprise decision to fire Fed Governor Cook raised concerns about the Fed's independence, fueling demand for havens and pushing gold prices to a two-week high above $3,393 an ounce.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.