Market Overview:

Gold remains trapped in a tight range as traders weigh optimism from US–China trade progress against cautious expectations for the upcoming FOMC meeting.

The macro picture feels balanced: risk sentiment improves, yet the weaker USD and lingering Fed cut expectations quietly support the metal.

In essence, gold isn’t trending — it’s coiling.

Liquidity is being built, not lost.

Every test of 4,050–4,060 shows strong absorption, while short-term sellers are still defending the 4,186–4,260 region.

The market is waiting for a trigger,

and the FOMC might be the one that decides which side breaks first.

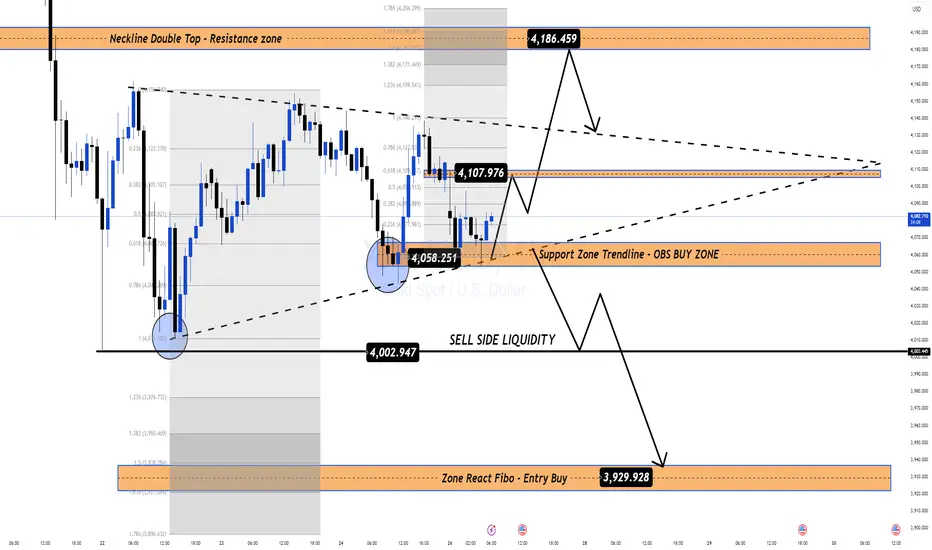

Technical Structure (H1)

Price continues to respect the ascending support trendline from 4,003 and the neckline resistance near 4,107.

This structure has the DNA of a compression model — narrowing volatility, thinning liquidity, preparing for expansion.

If the support at 4,050 holds, a retest of 4,107 → 4,186 remains likely before the next decision point.

Conversely, a liquidity sweep under 4,002 could form the last dip before a bigger rally unfolds.

Key Structural Levels:

Support / Accumulation Zone: 4,058 – 4,050

Mid-Level Pivot / Neckline: 4,107

Upper Supply Zone: 4,186 – 4,260

Deep Liquidity Pool: 4,002 – 3,930

MMFLOW Perspective:

For now, gold is accumulating energy — this is not a breakout market, it’s a build-up market.

Price action above 4,050 still favours the bulls, but conviction will only return once we see a clean break beyond 4,186.

Ahead of FOMC, patience is strategy.

The next wave won’t come from guessing policy —

it’ll come from reading the flow once volatility hits.

Summary:

Gold’s structure remains stable — liquidity is concentrated below 4,050, and compression continues within the 4,060–4,186 band.

Bias stays neutral-to-bullish as long as the liquidity base holds.

📊 What’s your take?

Will the FOMC spark the breakout, or is gold just reloading for the next wave?

👉 Follow MMFLOW TRADING for institutional flow analysis and smart money structure updates.

Gold remains trapped in a tight range as traders weigh optimism from US–China trade progress against cautious expectations for the upcoming FOMC meeting.

The macro picture feels balanced: risk sentiment improves, yet the weaker USD and lingering Fed cut expectations quietly support the metal.

In essence, gold isn’t trending — it’s coiling.

Liquidity is being built, not lost.

Every test of 4,050–4,060 shows strong absorption, while short-term sellers are still defending the 4,186–4,260 region.

The market is waiting for a trigger,

and the FOMC might be the one that decides which side breaks first.

Technical Structure (H1)

Price continues to respect the ascending support trendline from 4,003 and the neckline resistance near 4,107.

This structure has the DNA of a compression model — narrowing volatility, thinning liquidity, preparing for expansion.

If the support at 4,050 holds, a retest of 4,107 → 4,186 remains likely before the next decision point.

Conversely, a liquidity sweep under 4,002 could form the last dip before a bigger rally unfolds.

Key Structural Levels:

Support / Accumulation Zone: 4,058 – 4,050

Mid-Level Pivot / Neckline: 4,107

Upper Supply Zone: 4,186 – 4,260

Deep Liquidity Pool: 4,002 – 3,930

MMFLOW Perspective:

For now, gold is accumulating energy — this is not a breakout market, it’s a build-up market.

Price action above 4,050 still favours the bulls, but conviction will only return once we see a clean break beyond 4,186.

Ahead of FOMC, patience is strategy.

The next wave won’t come from guessing policy —

it’ll come from reading the flow once volatility hits.

Summary:

Gold’s structure remains stable — liquidity is concentrated below 4,050, and compression continues within the 4,060–4,186 band.

Bias stays neutral-to-bullish as long as the liquidity base holds.

📊 What’s your take?

Will the FOMC spark the breakout, or is gold just reloading for the next wave?

👉 Follow MMFLOW TRADING for institutional flow analysis and smart money structure updates.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.