XAUUSD – Gold Awaits NFP Data: Will It Explode or Break Down from Range?

Gold remains in a consolidation phase, coiling tightly ahead of the highly anticipated Non-Farm Payrolls (NFP) report. With traders on edge, the market is poised for a breakout – but in which direction?

🌍 MACRO & FUNDAMENTAL INSIGHT

Donald Trump reignited pressure on the Federal Reserve, calling for an immediate rate cut, especially after the recent ADP Employment Report showed the weakest job growth in over two years.

Fed Chair Jerome Powell, however, maintains a cautious stance, emphasizing that “no rush” to cut rates unless inflation convincingly trends lower.

Meanwhile, U.S. national debt is projected to hit $55 trillion by 2034, with unchecked fiscal expansion. This is fueling a global central bank gold-buying spree, with many purchases not even officially reported.

💡 This confluence of macroeconomic stress, monetary uncertainty, and geopolitical tension is pushing gold into the spotlight as a safe haven.

🔍 MARKET POSITIONING & SHORT-TERM DRIVERS

Unemployment Claims released today: 236K vs previous 240K – slightly positive, but not strong enough to offset weak labor momentum.

Treasury yields remain high (10Y at 4.55%), suggesting that while inflation fears persist, risk appetite is fragile.

The NFP release will likely serve as the catalyst for gold's next directional move, especially as liquidity builds up in a narrowing technical structure.

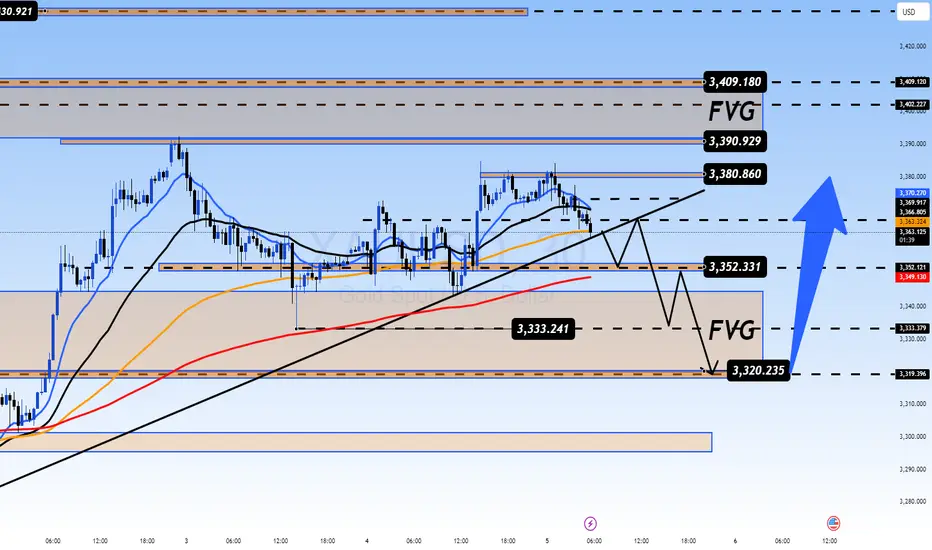

📈 TECHNICAL ANALYSIS (H1 – EMA 13/34/89/200)

Price is consolidating within a sideways range between 3333–3380, forming a classic liquidity trap just below key resistance.

The 3352–3333 zone is a critical structural support. A break below this level opens the door for a dip toward the FVG liquidity zone around 3320–3318.

On the upside, 3388–3400 remains a rejection zone. A clean breakout could target 3409 and even Fibonacci extension resistance at 3435–3445.

🔑 KEY TECHNICAL LEVELS

Resistance: 3388 – 3392 – 3400 – 3409

Support: 3355 – 3333 – 3320 – 3318

🧭 TRADING STRATEGY

🔵 BUY ZONE: 3320 – 3318

SL: 3314

TP: 3324 → 3328 → 3332 → 3336 → 3340 → 3350 → 3360 → ???

🔻 SELL ZONE: 3408 – 3410

SL: 3414

TP: 3404 → 3400 → 3396 → 3390 → 3386 → 3380 → 3370

✅ FINAL THOUGHTS

Gold is currently at the eye of the storm, with both fundamental and technical indicators aligned for volatility. The coming NFP release could tilt the balance sharply.

Stay disciplined: trade key zones only, wait for confirmation, and prioritize risk management. In markets like these, precision beats prediction.

Gold remains in a consolidation phase, coiling tightly ahead of the highly anticipated Non-Farm Payrolls (NFP) report. With traders on edge, the market is poised for a breakout – but in which direction?

🌍 MACRO & FUNDAMENTAL INSIGHT

Donald Trump reignited pressure on the Federal Reserve, calling for an immediate rate cut, especially after the recent ADP Employment Report showed the weakest job growth in over two years.

Fed Chair Jerome Powell, however, maintains a cautious stance, emphasizing that “no rush” to cut rates unless inflation convincingly trends lower.

Meanwhile, U.S. national debt is projected to hit $55 trillion by 2034, with unchecked fiscal expansion. This is fueling a global central bank gold-buying spree, with many purchases not even officially reported.

💡 This confluence of macroeconomic stress, monetary uncertainty, and geopolitical tension is pushing gold into the spotlight as a safe haven.

🔍 MARKET POSITIONING & SHORT-TERM DRIVERS

Unemployment Claims released today: 236K vs previous 240K – slightly positive, but not strong enough to offset weak labor momentum.

Treasury yields remain high (10Y at 4.55%), suggesting that while inflation fears persist, risk appetite is fragile.

The NFP release will likely serve as the catalyst for gold's next directional move, especially as liquidity builds up in a narrowing technical structure.

📈 TECHNICAL ANALYSIS (H1 – EMA 13/34/89/200)

Price is consolidating within a sideways range between 3333–3380, forming a classic liquidity trap just below key resistance.

The 3352–3333 zone is a critical structural support. A break below this level opens the door for a dip toward the FVG liquidity zone around 3320–3318.

On the upside, 3388–3400 remains a rejection zone. A clean breakout could target 3409 and even Fibonacci extension resistance at 3435–3445.

🔑 KEY TECHNICAL LEVELS

Resistance: 3388 – 3392 – 3400 – 3409

Support: 3355 – 3333 – 3320 – 3318

🧭 TRADING STRATEGY

🔵 BUY ZONE: 3320 – 3318

SL: 3314

TP: 3324 → 3328 → 3332 → 3336 → 3340 → 3350 → 3360 → ???

🔻 SELL ZONE: 3408 – 3410

SL: 3414

TP: 3404 → 3400 → 3396 → 3390 → 3386 → 3380 → 3370

✅ FINAL THOUGHTS

Gold is currently at the eye of the storm, with both fundamental and technical indicators aligned for volatility. The coming NFP release could tilt the balance sharply.

Stay disciplined: trade key zones only, wait for confirmation, and prioritize risk management. In markets like these, precision beats prediction.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.