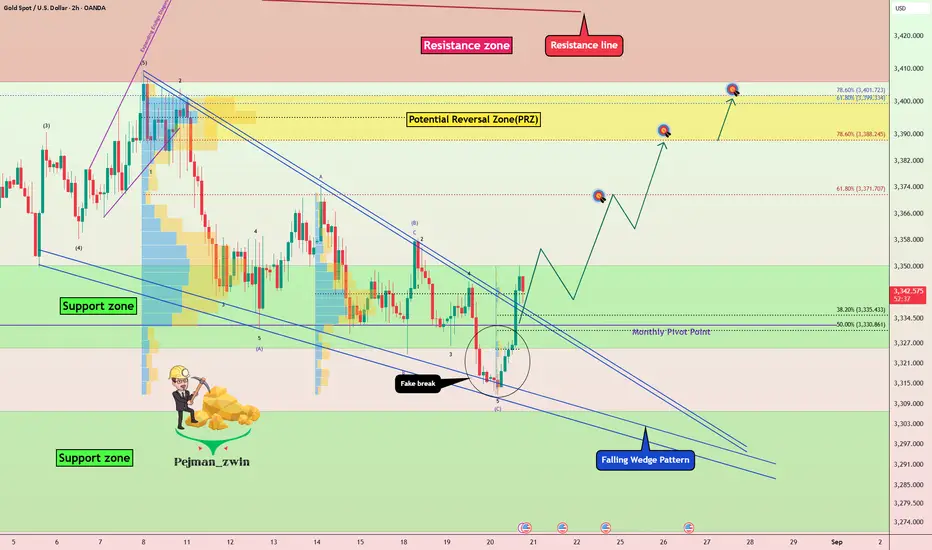

After creating a fake break below the Support zone($3,350-$3,326), Gold( XAUUSD) rose again above this zone and the Monthly Pivot Point.

XAUUSD) rose again above this zone and the Monthly Pivot Point.

If we look at the Gold chart on the 2-hour time frame from a Classic Technical Analysis perspective, we can see a falling reversal pattern, with Gold currently breaking the upper line of this pattern.

In terms of Elliott Wave theory, it seems that Gold is completing a corrective wave, and we should wait for the next impulse wave.

I expect Gold to start rising from the Support zone($3,350-$3,326) and rise to at least $3,369.

Second Target: Potential Reversal Zone(PRZ) = $3,402-$3,388

Note: Stop Loss (SL) = $3,320

Note: From today until Friday, important indexes will be released from the US, which can create excitement in financial markets, especially Gold, and even change the market trend when released.

FOMC Meeting Minutes = Today

Unemployment Claims = Tomorrow

Flash Manufacturing /Services PMI = Tomorrow

Fed Chair Powell Speaks = Friday

Gold Analyze (XAUUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

If we look at the Gold chart on the 2-hour time frame from a Classic Technical Analysis perspective, we can see a falling reversal pattern, with Gold currently breaking the upper line of this pattern.

In terms of Elliott Wave theory, it seems that Gold is completing a corrective wave, and we should wait for the next impulse wave.

I expect Gold to start rising from the Support zone($3,350-$3,326) and rise to at least $3,369.

Second Target: Potential Reversal Zone(PRZ) = $3,402-$3,388

Note: Stop Loss (SL) = $3,320

Note: From today until Friday, important indexes will be released from the US, which can create excitement in financial markets, especially Gold, and even change the market trend when released.

FOMC Meeting Minutes = Today

Unemployment Claims = Tomorrow

Flash Manufacturing /Services PMI = Tomorrow

Fed Chair Powell Speaks = Friday

Gold Analyze (XAUUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Position was activated.Gold appears to have completed a pullback to the upper lines of the wedge pattern.

Considering the U.S. indexes that will be released today.

Unemployment Claims

Flash Manufacturing /Services PMI

Note

Please Transfer Stop Loss(SL) 3351.381 USD 🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.