Explore the community

Crompton 52-Week Low Reversal Setup – Oversold Swing Trade1. Price Action

The stock is trading around ₹279–₹286, which is exactly at its 52-week low and a historical support zone from mid-2022.

Previous rebounds from this same area have led to 30–40% upside swings, indicating it’s a well-tested demand zone.

2. RSI (Relative Strength Index)

RSI at 23.8 → c

Aditya Birla Sun Life AMC-Built to Compound, Poised to BreakoutNSE:ABSLAMC

🔹 Fundamental Overview

Business Strength—One of India’s leading asset management companies, part of the Aditya Birla Group; operates across mutual funds, PMS, and AIF segments.

Financial Health – Debt-free balance sheet with excellent profitability and high cash reserves.

Profitab

VBL Looking Bearish??!!!VBL - On Weekly timeframe,

Inverted cup&handle pattern and a breakdown visible!!! (shown below)

On Dailytimeframe,

VBL is travelling inside a Descending channel pattern making highs and lowerhighs...lows and lowerlows...

SL & Target levels shown @ chart!!!

Let's wait & watch!!!

Thank you

PGEL: Suggest Momentum ShiftPG Electroplast Ltd. (PGEL) has recently shown signs of emerging strength after a prolonged phase of consolidation. Over the last two trading sessions, the stock has demonstrated upward momentum, suggesting a possible attempt to break out of its range-bound structure. This observation is supported

Ixigo (W) - At a Crossroad: Bullish Trend vs. Bearish PatternAfter a spectacular run-up, Ixigo (Le Travenues Technology Ltd) has entered a sideways consolidation phase. The current price action presents conflicting technical signals, placing the stock at a critical inflection point where it could either be pausing before another surge or forming a major top

SOUTH INDIAN BANK LTD ANALYSISFOR LEARNING PURPOSE

SOUTH INDIAN BANK LTD- The current price of SOUTH INDIAN BANK is 34.26 rupees

I am going to buy this stock because of the reasons as follows-

1. Its making 52W high with some good volume (sign of strength)

2. It got a great buying force and moved up by 440% in 2022-2023

ICICI Bank – Low-Risk Investment OpportunityFor positional investments , I prefer analyzing the weekly chart to filter out short-term noise and whipsaws.

The price has been consistently respecting the 50-week moving average (50 MA) since 2023 - a strong sign of trend stability.

The stock is currently trading near a demand zone, which

HINDUNILVR : Inverse Head & Shoulders + Order-Block setup Technical Analysis: Hindustan Unilever Ltd

Timeframe: 30-Minute

Pattern: Inverse Head & Shoulders with Order Block Confluence

Pattern Insight

The market has created a clear inverse head and shoulders structure —

showing potential trend reversal from a short-term downtrend to an uptrend.

The

See all editors' picks ideas

Only You can make you ProfitableThose who have been in the trading world for some time must have realized by now that Profitable trading isn’t just about charts and indicators, it’s mostly about Yourself.

We may have the cleanest setup, perfect RSI levels, and all your EMAs aligned like planets, and still lose money😢

Because cha

EMA 50 + RSI Divergence = Gold Reversal Setup!Hello Traders!

Gold often makes sharp one-sided moves, trapping traders who enter too late. But if you know how to combine a simple moving average with a momentum indicator, you can spot high-probability reversal setups.

One such method is using the EMA 50 together with RSI Divergence . Let’s br

EMA vs SMA vs WMA: Which Moving Average Should You Use?🔎 Intro / Overview

Moving Averages remain one of the most trusted tools in technical analysis. They smooth price action, highlight the trend, and often act as dynamic support or resistance.

In this post, we compare the 20-period SMA, EMA, and WMA on BTCUSD 4H to show how each reacts differentl

Small Account Challenge1. Introduction to the Small Account Challenge

The world of trading often fascinates people because of the possibility of turning small sums of money into significant wealth. But in reality, most aspiring traders don’t begin with huge capital. They usually start with a small account—sometimes $100,

Bullish Engulfing Pattern: Spotting Reversals with Discipline🔎 Intro / Overview

Managing risk is just as important as finding an entry. The Bullish Engulfing is one of the most effective candlestick patterns to identify potential reversals. When traded with discipline, it signals a shift from seller pressure to buyer control, helping traders time their ent

Commit to the Shift next week - focuse on becoming consistent

For the next week, we’re focusing on two powerful tasks that will move you closer to becoming a consistently profitable trader:

✅ Task 1: Deep self-reflection. Understand your strengths, demons, and bad habits—the things holding you back from consistency. Identify your triggers and write them down

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t

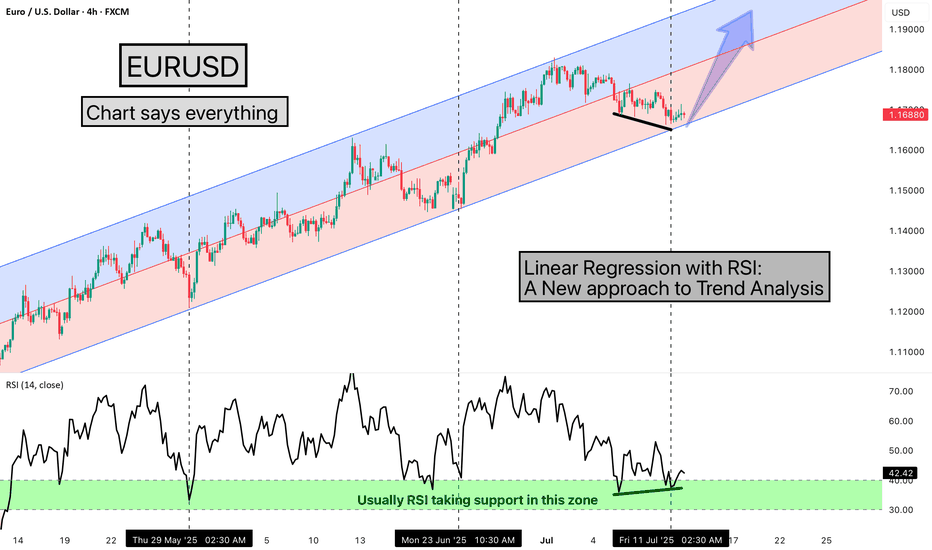

Linear Regression with RSI: A New approach to Trend AnalysisHello Friends,

Welcome to RK_Chaarts,

Today we are going to learn one Method of analysing the chart, here we are using EURUSD chart, and the method we're using is very simple & interesting, We are using the Linear Regression Trend Channel & Relative Strength Index (RSI), What happens in this metho

Who Should Avoid Trading? Is That You? Ask YourselfThere is no doubt that trading is the simplest business in the world. You just need to do a small paperwork which is online these days, need a laptop or PC and an internet connection. Besides that, all you need is time. But here the simplest should not be confused with the Easy. Although you just ne

Brain Hunts, Wallet Hurts!In this brief article, I aim to throw some light upon a typical trader's psychology, which is often swayed by greed and fear, and the constant battle between careful analysis and impulsive decisions.

Traders who actually trade and not just analyze understand that the stock market is not merely a ga

See all editors' picks ideas

Daily analysis for Nifty50: 29/09/25Nifty is still not bullish. A trendline support test is quite possible. That comes at around 24535-24520 range of price. If that is breaching it will test lower levels of 24560, 24405 and 24360 as downside fall.

On bounce it will rise till 24630 to 24740 as resistance.

bankniftyI feel that bank nifty and axis bank has shown good recovery in the past two weeks. With axis bank closing over 200 dma and with strong gains for last three days, the momemtum should continue. Good time to buy for investors and traders as one can go positionally long here with targets of 1140 and

Dow Theory Update and Nifty AnalysisIn this video, we have explained the following points -

* A new Dow Top "A1" has been created by Nifty50.

* The significance of the new Dow Top has been explained.

* The current structure of Nifty has been discussed.

* The importance of waiting for the next candle and the current key support lev

Commit to the Shift next week - focuse on becoming consistent

For the next week, we’re focusing on two powerful tasks that will move you closer to becoming a consistently profitable trader:

✅ Task 1: Deep self-reflection. Understand your strengths, demons, and bad habits—the things holding you back from consistency. Identify your triggers and write them down

Market Analysis and Nifty AnalysisIn this video, I have provided an overall market analysis. :

Although the market is green today, it's important to stay cautious.

Small caps are forming range-bound bullish engulfing candles, but we need to wait for the closing.

Nifty continues to form lower lows on the lower time frame. A

Nifty 50 Analysis and Dow theory LevelNifty 50 Analysis:

Points discussed in the video-

How we should observe structure when there is a big gap.

Importance of current gap up on major resistance.

Importance of today's closing.

Dow Theory Level:

As per Dow theory, we are heading towards trend change and uptrend will be there.

O

What is Object Tree and it's UsesHi mates kindly watch the video for understanding the Object tree and it's uses in technical analysis as i feel the new entrants to technical analysis still might not know about it, I hope you will like this publication,

Thanks for watching and giving your time.

Best regards- Amit

See all editors' picks ideas

Dynamic Equity Allocation Model"Cash is Trash"? Not Always. Here's Why Science Beats Guesswork.

Every retail trader knows the frustration: you draw support and resistance lines, you spot patterns, you follow market gurus on social media—and still, when the next bear market hits, your portfolio bleeds red. Meanwhile, institution

First Passage Time - Distribution AnalysisThe First Passage Time (FPT) Distribution Analysis indicator is a sophisticated probabilistic tool that answers one of the most critical questions in trading: "How long will it take for price to reach my target, and what are the odds of getting there first?"

Unlike traditional technical indicators

Options Max Pain Calculator [BackQuant]Options Max Pain Calculator

A visualization tool that models option expiry dynamics by calculating "max pain" levels, displaying synthetic open interest curves, gamma exposure profiles, and pin-risk zones to help identify where market makers have the least payout exposure.

What is Max Pain?

Max

Volume Profile 3D (Zeiierman)█ Overview

Volume Profile 3D (Zeiierman) is a next-generation volume profile that renders market participation as a 3D-style profile directly on your chart. Instead of flat histograms, you get a depth-aware profile with parallax, gradient transparency, and bull/bear separation, so you can see w

RiskMetrics█ OVERVIEW

This library is a tool for Pine programmers that provides functions for calculating risk-adjusted performance metrics on periodic price returns. The calculations used by this library's functions closely mirror those the Broker Emulator uses to calculate strategy performance metrics (

Simple Decesion Matrix Classification Algorithm [SS]Hello everyone,

It has been a while since I posted an indicator, so thought I would share this project I did for fun.

This indicator is an attempt to develop a pseudo Random Forest classification decision matrix model for Pinescript.

This is not a full, robust Random Forest model by any stretch o

Tick CVD [Kioseff Trading]Hello!

This script "Tick CVD" employs live tick data to calculate CVD and volume delta! No tick chart required.

Features

Live price ticks are recorded

CVD calculated using live ticks

Delta calculated using live ticks

Tick-based HMA, WMA, EMA, or SMA for CVD and price

Key tick levels (S

analytics_tablesLibrary "analytics_tables"

📝 Description

This library provides the implementation of several performance-related statistics and metrics, presented in the form of tables.

The metrics shown in the afforementioned tables where developed during the past years of my in-depth analalysis of various str

Adaptive Trend Classification: Moving Averages [InvestorUnknown]Adaptive Trend Classification: Moving Averages

Overview

The Adaptive Trend Classification (ATC) Moving Averages indicator is a robust and adaptable investing tool designed to provide dynamic signals based on various types of moving averages and their lengths. This indicator incorporates multipl

See all editors' picks scripts