22 Sep ’23 Post Mortem on BankNifty - Target 1 - 44451BankNifty Analysis

BankNifty was trying to recover from the fall yesterday and it got lucky with 2 news events. Firstly JP Morgan announced its adding India to its Emerging markets bond index - source. Catch the discussion in Trading QNA.

Secondly the news broke out that Govt’s commentary that I-CRR withdrawal will give ample liquidity with the banks - source

Both the news gave some thrust to Banknifty and thereby Nifty in the forenoon session and helped it avoid a big fall (according to me). BN rallied exactly 1% from the lows hit at 10.00 to a comfortable position by 12.05.

Both the news logically does not make sense for the bank nifty to rally. India’s bond markets meaning GOI bonds are serviced by RBI and the banks may choose to serve its debt - but not directly. Secondly the I-CRR withdrawal news was made on 1st Sep and the ATH hit by Nifty50 was due to this (Please refer to the post-mortems from 01 Sep to 15 Sep for more details).

My targets for BankNifty did not work out today, but I am still continuing the bearish stance for Monday. The first target being 44451 and the second - 44219. In case BankNifty is not breaking the current low in the opening 2 hours - I would prefer to change my stance to neutral.

Bonds

22 Sep ’23 Post Mortem on Nifty - still shows weakness 🐻🐻🐻Nifty Analysis

Recap from yesterday: “For tomorrow, I wish to maintain the bearish stance with the first target at 19672 and the second but strong target at 19589. Ideally the bears should be able to close the day below 19589 tomorrow and take out the 19310 early next week. One thing to remember is Nifty50 is still not bearish on the daily time frame whereas SPX is.”

I would say we had a flattish day today and a tight range. Nifty showed the tendency to fall but was eclipsed by BankNifty. There were 2 news events that took priority over the technical moves

JP Morgan adding India to emerging market’s bond market (GBI-EM Global Diversified)

Ministry of Finance - saying removal of I-CRR will give ample liquidity for banks

We will discuss both of them below in our BankNifty analysis. But most importantly - when there are news flows - it will always take precedence over the technical analysis. Thats because stock markets are mainly news driven - the element of greed/fear is amplified when news breaks out.

We discussed yesterday that the first target would be 19672, that was hit by 10.00 and things were looking quite promising for the bears. The pullback that started from there went on till 12.50 and would have given some respite for the bulls. However this did not last long and we came back to where it all started.

Nifty closed the day with a loss of 0.34% ~ 68pts on what should have been a strong down day.

Yesterday SPX closed at -1.64% loss and fell below the 2nd support line into a strong bearish territory. Compare that with India’s stock markets - we are still not there on the bearish scene. The major support is at 19310 which is another 1.8% away. Bears can still go into the weekend party seeing 3 red candles on the daily time frame.

For Monday I wish to continue my bearish stance with the first target being 19563 and second 19484. If the momentum fades and we are unable to pick a direction in the opening 2 hours - I wish to change my stance to neutral to a wait and watch mode.

XAUUSDHello dear traders.

Gold has given mixed signals. In my opinion it is still under bearish pressure but with lack of strong downtrend momentum right now.

10Y and 30Y yields and DXY are green, so this has already pushed prices down fomr the multiple times checked 1670 level. 1670 was great for 50 pips sell.

On the other hand there is the 4H ascending trendline and at the moment while price lies at the support. It could easily bounce back up.

But, my blue arrows indicate a weakness to form higher highs. In conjuction with long spike bullish candles, I see that insitutions have not initiated their real direction.

They do scalp and they do close their profits in a short period of time.

We can go long from 1660 to 1668-1670 with SL below the last support or we may enter long even better after the break & retest of the resistance level.

Try to avoid trading during today's high impact news of USA. Keep an eye of this data to be released, in order to decide which will be the most logical direction.

Otherwise,

If the support is broken, we go short accordingly.

GL!!

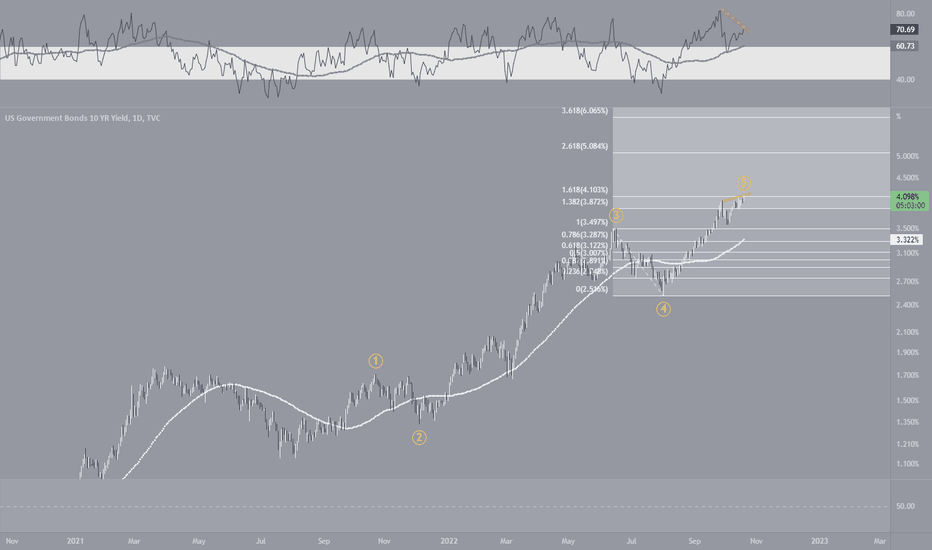

US10Y - Looks like a high is completedUS10Y could be in at its peak in current wave cycle to stary a ABC correction.

RSI on daily is also showing divergence indicating topping out sign. The correction in US10 will be good for equities.

View will be invalid if the high 4.123 is broken and wave 5 might get extended.

User discretion!

Rounding bottom (Cup & Handle) formation breakout?? #US10YCharts show breakout of rounding bottom formation on Weekly/Monthly charts of US 10year yields. Already got monthly closing above the breakout line.

If sustains above the breakout line minimum target for 10y yield will be around 5.5/6.5 pc. If so, there will bloodbath across all asset classes. Only below 3.4/3.3 negates the idea.

Brace! Brace! Brace! If true, difficult times ahead.

Hope I'm wrong.

Happy trading

Recession Incoming? Here is what the technicals say

US10Y-TVC:US02Y

Economists: Recession incoming!

World Leaders: Recession is out of the books.

Whom to believe? Here is my analysis from a technical standpoint👇

As someone who believes in data driven decision making, the technicals point towards a recession. How so?

When the difference between the 10 year bond yield and 2 year bond yield becomes negative, it is known as an 'Inversion in bond yield curve' and this inversion has been a strong indicator in predicting recession.

Since this chart (US10Y-US02Y) started back in 1976, whenever the curve went into the negative zone, we experienced a recession shortly after.

So the question now is, are we in the negative zone? YES!

Recession incoming? Most likely yes!

To all my connections in the field of finance especially, I'd love to know your thoughts on the same below in the comments 👇

Follow AVZ_Trades for more such content

#finance #data #recession #bonds

BUY OPPORTUNITY TLT is a fund that reflects the price of bonds with a maturity of 20 years. It reflects the price of the bonds but not the yield which is inversely proportional to the price. When the interest rate increases the price decreases while when the interest rate decreases the price increases in value.

It is a highly protective asset that helps diversify portfolio risk. It has a long-term bullish statistical bias and is particularly tempting to place in a portfolio. By statistically analyzing the price history (2003 - today) we can consider ourselves in a position of extreme advantage at this moment. During the entire life cycle of the product we can see how the historical maximum drawdown has never exceeded -28% in 800 days. On average, during each drawdown this asset loses 22% of its value in 650 days (approximately). The recovery period (period during which the market recovers the lost ground) is equal to 0.45. This means that on average it takes half the time to recover its losses compared to the time it takes to depreciate. From March 2020 to today it has been within a maximum distance of -25% from the maximum price, exceeding 500 days in drawdown.

Statistically we are in a situation where the chances of further loss of value are very low (in your entire life you have never lost more than 28%). Following the statistical model, it is likely that it will recover its value in less than a year.

If we assume that we are close to a minimum level and that the long term is characterized by a strong upward statistical bias, combined with the fact that the world economic situation is still far from an official recovery and that it will have to wait a little longer before to raise rates, positioning on $TLT is an excellent medium / long term opportunity for part of the core structure of my portfolio.

Let's analyze the data:

- Standard Deviation 10Y = 0.90%

- Standard Deviation 5Y = 0.87%

- Standard Deviation 3Y = 0.83%

The riskiness of the product decreased by about 10% from 2010 to today.

- 10Y yield = + 7%

- 5Y yield = + 3%

- 3Y yield = + 8%

- YTD yield = - 10%

The returns are positive in the medium / long term and negative in the short term (-10% from the beginning of the year).

Correlation: Instrument inversely correlated with the unemployment rate. As the unemployment rate increases, the value of the instrument decreases and vice versa. If we assume that the US is slowly returning to pre-employment at the pre-Covid19 level (thus the unemployment rate is decreasing over time) then we can assume that our tool will appreciate in the medium / long term.

- 3Y Expected Return: + 21%

- Max loss (with hedging): 5%

- Max portfolio loss (in the event that the outcome of this core transaction does not go according to estimates): -0,75%

- % of equity to be dedicated to this operation: 15% of the total portfolio + 7.5% for any hedging = 22.5% of the total portfolio

- Risk /Return = 1:4

Over time, three different situations can arise:

A) Closing the long trade at a loss and closing the hedge in profit, then:

- Potential loss% on the portfolio: - 0.75%

B) Closing the hedging at a loss and profit of the long operation, then:

- Potential gain% on the portfolio: + 2.25%

C) There is no need for the hedging strategy and the instrument meets expectations, then:

- Potential gain% on the portfolio: + 3%

Remember that this is my market vision and should not be interpreted in any way as an investment advice!

NIFTY - NEXT MOVESIts been quite a volatile last few days - too may GAP UP / GAP DOWN , decisive bars but still no clarity on direction. Let us look at global markets to understand this in a better way

Dollar Index on important levels - can breakout or breakdown - chances of breakout quite high

US treasure bonds rising again - Though personally, I feel last time it was an over-reaction of the global market due to rise in bond yields but yet, the fact remains global markets are reacting promptly on rise of bond yields

US DOW futures are facing a good amount of downside pressure.

NASDAQ composite also showing weakness

what do we make out of this - my take is - global markets have started retracing from higher levels, definitely some weakness but early to say its a reversal from the top for a short term. we may see some downward pressure on NIFTY in the coming days, so maybe it will fall or consolidate for a while

watch out for the levels mentioned in chart and that GAP zone. Nifty behaving around those levels will give a decent idea

Happy Trading

MSK

Gold teases key support-zone amid global bond routWith the fears of reflation propelling global Treasury yields and the US dollar, gold remains depressed near the three-month-old horizontal support. With the bond rout less likely to fade soon, coupled with the US dollar’s expected run-up on recently welcome fundamentals, gold is up for extra south-run. However, a clear downside break of $1,760 becomes necessary for the yellow metal to eye the mid-2020 lows near $1,670. However, the $1,745-40 has multiple supports to challenge the downside move.

Meanwhile, the corrective pullback may eye to regain the $1,800 threshold. Though, bulls will have less confidence until witnessing a break of the yearly resistance line, at $1,805 now. It should, however, be noted a confluence of 100-day and 200-day SMA offers a tough nut to crack for the gold buyers, currently around $1,860, before they retake controls.

Money Continues To Flow Into BondsMonthly Charts force us to take a step back and give us no choice but to identify the direction of the primary trends. We use these charts to put shorter-term trends into context and this exercise is particularly useful when the market is experiencing heightened volatility. This chart is the US 10-Year Note Futures making its highest monthly close, ever. New all-time highs are evidence of an uptrend, not a downtrend. It's clear that money continues to flow into the Bond market despite the strong rebound in stocks over the last month. This is evidence of risk aversion, not risk appetite among market participants. US Rates set the tone for Interest Rates around the world, so the trend we're witnessing here is indicative of the strength we're seeing in Bonds all around the globe.

FINANCIAL MARKETS AND BUSINESS CYCLEIt is important to understand that primary trends of stocks, bonds, and commodities are determined by the attitude of investors during unfolding of events in the business cycle. An understanding of the interrelationship of credit, equity, and commodity markets provides a useful framework for identifying major reversals in each.

MARKET MOVEMENTS AND BUSINESS CYCLE

The bond market is the first financial market to begin a bull phase. This usually occurs after the growth rate in the economy has slowed down considerably from its peak rate, and quite often is delayed until...CONTINUE READING: tradersworld.co.in