Chart Patterns

ETH/USD Daily — Support Bounce Setup in a Strong Downtrend

Chart Analysis:

Market Structure:

ETH is clearly in a bearish trend on the daily timeframe. Lower highs and lower lows are intact after a sharp rejection from the major supply zone around 3,300–3,400 (yellow zone).

Impulsive Sell-Off:

The recent move down is strong and aggressive, suggesting capitulation-style selling rather than a slow grind. This often precedes at least a technical relief bounce.

Key Support Zone (Red): ~1,900–2,000

Price has tapped into a well-defined demand/support area, where buyers previously stepped in. The long lower wicks here hint at buying interest and absorption.

Proposed Entry:

The marked entry is based on a support reaction, not a trend reversal. This is a counter-trend long, so it’s tactical, not positional.

Target Zone (Green): ~2,450–2,550

This zone aligns with:

Prior structure support → resistance flip

Likely liquidity resting above

Mean reversion after an extended drop

Bias & Expectations:

Short-term: Bullish relief bounce toward the green zone

Medium-term: Still bearish unless ETH reclaims and holds above ~2,600–2,700

Expect high volatility—clean V-shaped recoveries are rare in this context

Risk Note:

If price loses the 1,900 support decisively, the setup is invalidated and opens the door for continuation toward lower psychological levels.

📌 Summary:

This chart shows a high-risk, counter-trend bounce play off major daily support, targeting a logical resistance zone above. Good for disciplined traders, not for blind bottom-catching.

UNITDSPR: Long candidate SL 1351: TG 2046UNITDSPR, Weekly: 1) The bottom has been tested more than 3 times. This indicates good consolidation in a demand zone 1334.85 to 1237.00... 2) Breakout above IMR 1427.55 (IMR= Important Monthly Resistance), with volume + Subsequent Retest and Then after the confirmation of the up move can be the safe entry for Bulls... 3) Expected price movements are marked with blue arrows.... 4) Long candidate Entry: 1377; SL 1351: TG 2046.

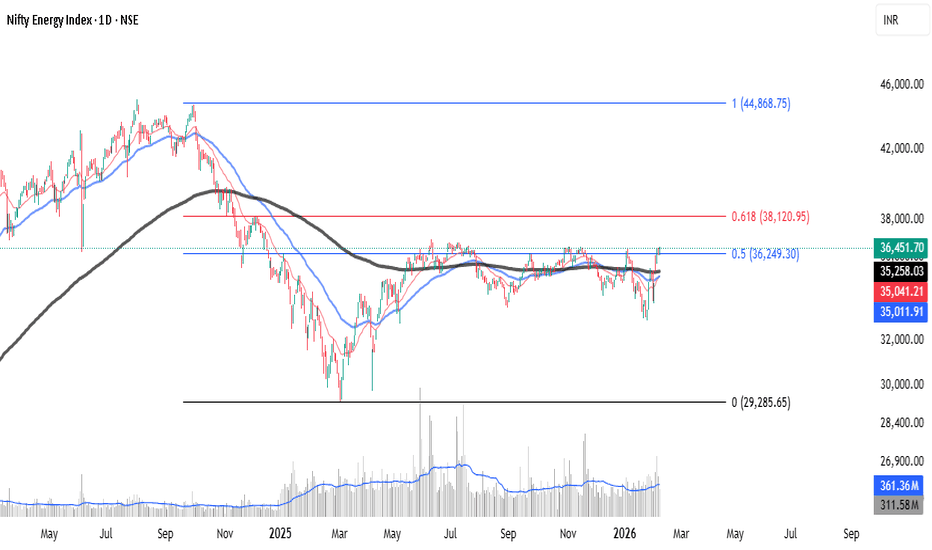

As per Fibonacci the Nifty ENERGY is weak !Based on recent market technical analysis, the view on the Nifty Energy index is mixed, with some indicators suggesting a corrective phase or weakness, while others point to underlying strength.

Based on the Fibonacci retracement levels applied to the Nifty Energy Index chart, "weak" might be a bit of an oversimplification. It is more accurate to say the index is in a state of consolidation with a bearish bias, as it is currently struggling to reclaim key structural levels.

1. The "Line in the Sand" (0.5 Retracement)

The index is currently hovering right at the 0.5 Fibonacci level (36,249.30).

The Good: It has successfully used this level as a floor (support) multiple times throughout late 2025 and early 2026.

The Bad : It hasn't been able to launch a meaningful rally from here. In technical analysis, the longer a price stays at a support level without bouncing strongly, the "weaker" that support becomes.

2. Resistance at the Golden Ratio (0.618)

The true sign of weakness isn't where the price is now, but where it failed to go.

The 0.618 level (38,120.95) is the "Golden Ratio." In a healthy bullish trend, you want to see the price stay above this or reclaim it quickly.

The Nifty Energy Index fell below this level in early 2025 and has consistently failed to even touch it since mid-2025. This indicates a lack of buying conviction.

3. Volume Confirmation

Looking at the volume bars at the bottom:

There was a massive spike in volume during the initial drop toward the 0 level (29,285.65).

The recent consolidation near the 0.5 level is happening on relatively lower/flat volume, suggesting that big institutional players aren't aggressively buying this dip yet.

The Verdict

It isn't "weak" in the sense that it's crashing, but it is technically stagnant. As long as it stays below 38,120, the bears have the upper hand. If it loses the 36,249 level on a closing basis, we could see a slide back toward the 2025 lows.

Nifty Auto IndexCurrent Technical Observation

Leve lSignificance

27,786 Major Resistance: The index has failed to sustain above this 1.0 Fibonacci level.

25,719 Immediate Support: The 0.786 retracement level where buyers might step in.

24,205 Golden Ratio (0.618): This is the "make or break" zone for the long-term uptrend.

The Verdict

The index is currently in a sideways consolidation phase after a massive bull run. While it has "flat" characteristics (moving horizontally), the failure at the 1.11 extension suggests a loss of momentum.

If the index breaks and closes below the 0.786 level (25,719), the "Flat" theory becomes more likely as a deep Wave C would be underway. If it holds, it's simply a high-level consolidation.

It doesn't perfectly fit the textbook definition of an Elliott Wave Flat Correction.

A Flat Correction is a 3-wave structure (labeled A-B-C) that moves sideways. Here is a breakdown of why the chart is slightly different and what the technicals are actually signaling:

Why it’s not a "Standard" Flat

In a standard Flat, the waves usually follow a 3-3-5 structure:

Wave A: 3 waves down.

Wave B: 3 waves up (retracting nearly 100% of Wave A).

Wave C: 5 waves down (ending near the bottom of Wave A).

Looking at the chart:

Over-extension: Your "Wave B" (the recent peak) actually pushed above the previous swing high (reaching the 1.11 Fibonacci extension at 28,912).

Expanded Flat Potential: If this is a flat, it would be an Expanded Flat. In this scenario, Wave B goes beyond the start of Wave A, and Wave C usually drops significantly below the end of Wave A.

Double Top Characteristics: The price has struggled at the 27,786 (1.0 Fib) level twice recently (noted by the red circles), which looks more like a Double Top distribution pattern than a simple flat correction.

Bearish Continuation Setup After Dead-Cat Bounce (1H)

What the chart is saying:

Clear bearish trend: Price has been making lower highs and lower lows. The broader structure is decisively bearish.

Range breakdown: The blue box shows a consolidation range that broke to the downside, confirming continuation rather than accumulation.

Strong sell-off into demand: Price aggressively dropped into the red support zone (~62k–64k), where buyers stepped in hard, creating a sharp bounce.

Relief rally, not reversal: The current move up is a retracement, not a trend change. Momentum looks corrective, not impulsive.

Key resistance zone (~71k–72k):

This green area is previous support turned resistance

It aligns with the breakdown level → classic short opportunity

Planned trade idea (as drawn):

Entry: Into resistance (green zone)

Invalidation: Clean acceptance above resistance

Target: Prior support / liquidity pool around 63k

R:R: Favorable if rejection confirms

Bias:

📉 Bearish below resistance

Only a strong breakout + hold above 72k would weaken the short thesis

What to watch next:

Rejection wicks, bearish engulfing, or momentum divergence at resistance

Volume drying up on the push into the green zone

Failure to reclaim broken structure

⚠️ This setup assumes trend continuation, not a bottom. Until structure flips, rallies are sell-the-rip candidates.

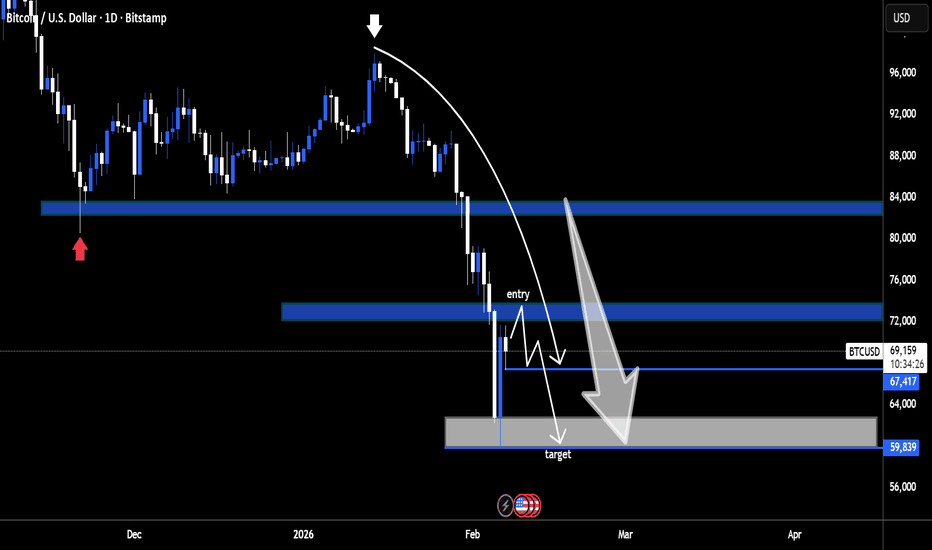

BTCUSD Daily – Bearish Breakdown & Sell-the-Retests Setup

Here’s what the chart is saying, clean and to the point:

Market Structure

Clear distribution → breakdown sequence on the daily.

Price topped near the mid-90Ks, rolled over, and lost the 83–84K demand zone (former support marked in blue).

That loss flipped market structure firmly bearish.

Key Levels

Major breakdown level: ~83–84K (prior demand → resistance)

Supply / entry zone: ~72–74K (blue zone labeled “entry”)

Current support: ~67.4K (thin blue line)

Primary target: ~60–62K (grey demand zone)

Price Action Logic

The vertical sell-off into ~67K suggests impulsive bearish strength, not exhaustion.

The projected path shows a dead-cat bounce / consolidation into ~72–74K.

That zone aligns with:

Prior consolidation

Bearish retest logic

Likely supply from trapped longs

Trade Thesis (as illustrated)

Bias: Short

Entry idea: Sell a rejection in the 72–74K zone

Invalidation: Strong daily close back above ~75K

Target: 60–62K demand (first meaningful higher-timeframe support)

Big Picture

Unless BTC reclaims the 80K+ region quickly, this chart favors continuation lower, not a V-shaped recovery. The structure says rallies are for selling, not buying.

POWERGRID: Trend Reversal Indicators & Key LevelsThe stock of POWERGRID is showing signs of a potential trend reversal after an extended downtrend. Several technical factors across multiple timeframes support this shift in momentum.

The stock has recently managed to close above the 200-day EMA, a level widely monitored for assessing long‑term trend shifts. A golden crossover—where a shorter‑term moving average crosses above a longer‑term one—has also taken place.

This movement has been supported by strong trading volume, adding weight to the possibility of a positive structural change.

A triangle breakout has been observed on the chart, indicating that price has moved decisively out of a prolonged consolidation pattern.

Breakouts supported by volume are often interpreted as signals of improving momentum.

On the weekly timeframe, a bullish MACD crossover has been confirmed.

Weekly MACD signals tend to carry stronger implications for medium‑term momentum, suggesting sustained upward interest.

The RSI has approached the upper band, reflecting strong momentum.

However, this positioning also indicates the possibility of a short‑term pullback or cooling phase.

A potential supply zone around ₹318 may act as an area of temporary resistance.

Key Levels to Monitor:

Possible Supply / Resistance Zone: ₹318

Major Resistance Level: ₹354 (may be tested after consolidation or a short‑term pullback)

Support Zone: Around ₹250 (critical reference level for this setup)

Disclaimer: This analysis is intended solely for educational and informational purposes. It does not constitute financial advice or a recommendation to buy, sell, or hold any security. Investors should conduct their own research and consult a licensed financial advisor before making investment decisions.

Bicoin Breaking all Supports - Something distrous happeningIf we see the Fisher, one by one all time frame has gone into sell mode.

At present 9Month 3Month 1Month 1Week Fisher are Negative. Gradual brutal fall is now what BTC is destined.

If this is the case, something dangerous brewing up in the Assets Class across the Board with virtually no safe heaven in view for shelter.

There may be occasions of rise. It can not go on falling daily and on occasions, it may strongly try to bounce except that it will eventually turn out as dead cat bounce.An example may be resent bounce from 61000 to 71000 within 2 days. But since all Fisher have now turned negative, every rise will be an opportunity for sell in the longer term perspective.

Things may change only when in the long term, these Fisher turn positive 1 by 1, but then also, it will be a prolonged process spanning years to gain the lost place.

If you see predictions of further fall, don't ignore them, rather ask your questions based on Fisher crossovers, which is extremely bearish at this time.

On the same principles, in my 3rd December 2025 analyzed that Gold Silver will blast to the Upside and they behaved in same manner as predicted. Again, I wrote about immediate exit from Silver for few weeks. Here, my reason was correct but it took 2 weeks to oblige reason being two important geopolitical issues namely Venezuela and Greenland that kept Silver buoyant for 2 weeks and these events were happening after my publish. But from 2nd week itself cracks appeared and were brutal. So Beware. These technical analysis on Longer term time frame not only rule the market but are also a challenge to AI based trades.

#LICHSGFIN at 506. Nicely poised for a good move. #LICHSGFIN at 506. Decent financials. FIIs/DIIs have a decent stake which is by and large stable. Quarterly results on 31st. Technically the stock has finished sub wave 4 and is now trying to wind up sub wave-2 of primary -5 and start sub -3 of primary -5 for tgt 891. WTF chart is almost identical. DTF chart clearly shows that the stock has completed sub -1 of primary-5 and has retraced more than 81% of sub-1 for sub-2 and is forming a neat a-b-c correction for this sub-2. 100% retracement comes to 495 with sub-3 tgt 781. 1 hr chart gives a near time picture where we can see sub-c of this sub-2 trying to make a 5-wave Diagonal to finish sub-2. Likely culmination of sub-2 is 490-500. Should reverse from 495-500 for sub-3 of Primary-5. STRICT STOP LOSS 485( though I think technically it should hold 494) Keep in WL. Risk reward is pretty decent.

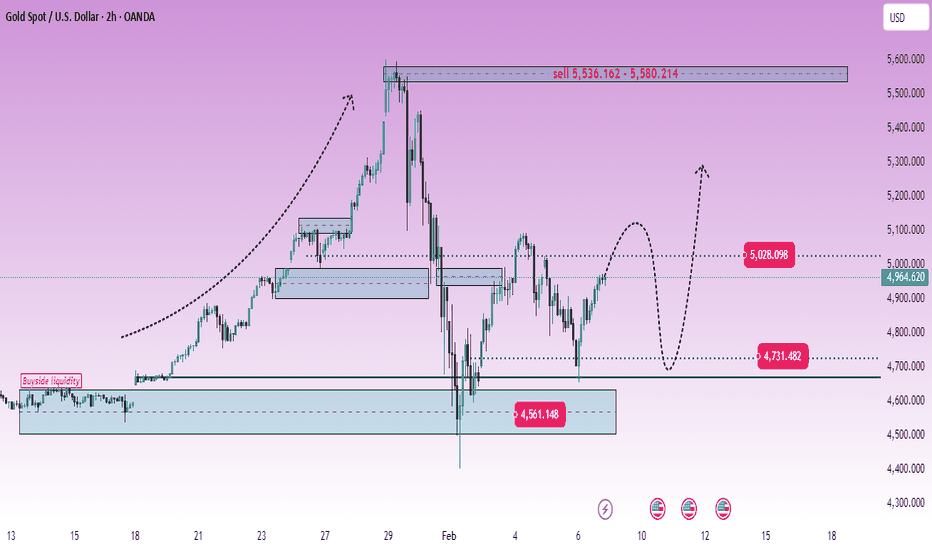

XAUUSD (H2) – Liam's AnalysisXAUUSD (H2) – Liam View

Rally into supply | Volatility risk rising

Gold is rebounding from the 4550–4600 demand base, but the broader H2 structure still points to a selling environment. The current move higher looks corrective, driven by short covering and liquidity rotation rather than a confirmed trend reversal.

From the chart, price is rotating back toward 4900–5030, a zone where previous distribution and liquidity rest. Unless price can accept above this area, rallies should be treated as selling opportunities, not breakout confirmation.

Key technical zones

Major selling zone: 5536 – 5580 (HTF supply)

Near-term reaction zone: 5000 – 5030

Key demand / base: 4550 – 4600

Intraday support: ~4730

Market context

Recent US political headlines and institutional reviews add another layer of headline-driven volatility, increasing the risk of sharp swings and liquidity sweeps. In such conditions, gold often reacts erratically intraday, but higher-timeframe structure tends to reassert itself once the noise fades.

Outlook

As long as price stays below 5030, the bias remains sell-side dominant.

Failure to hold above 4730 would reopen downside risk toward the demand base.

Only a clean H2 acceptance above 5030 → 5100 would neutralize the bearish structure.

Execution note

Avoid chasing momentum in news-driven sessions.

Let price come to levels. Trade the reaction, not the headlines.

— Liam

DABUR – Rising Channel Support | Low Risk, High Clarity SetupPrice is trading inside a well-defined rising channel and has now pulled back to the lower boundary of the structure.

This area has repeatedly acted as dynamic support, making risk clearly visible and controllable.

No prediction here — only structure and location.

As long as price holds above channel support, the broader trend remains intact.

A breakdown below this level would invalidate the setup and keep me out.

This is what a low-risk setup looks like:

clear trend, clear support, clear invalidation.

Good trades start with good location, not excitement.

Part 1 Intraday Institutional Trading ITM, ATM, OTM Options

These describe where the current price is compared to strike price.

a) ITM – In The Money

Call: Current price > Strike

Put: Current price < Strike

ITM options cost more.

b) ATM – At The Money

Current price ≈ Strike price

Most volatile and liquid.

c) OTM – Out of The Money

Call: Current price < Strike

Put: Current price > Strike

OTM is cheaper but risky; goes to zero quickly on expiry.

TORNTPOWER – Symmetrical TrianglePrice has moved into a clear compression phase, forming a symmetrical triangle.

Lower highs show sellers are active, but they are losing strength.

Higher lows show buyers are stepping in earlier each time.

This structure tells us one thing clearly:

The market is not trending right now — it is preparing.

Volatility is shrinking, emotions are cooling, and both sides are waiting for confirmation.

A decisive move will come only after price accepts outside this structure.

Until then, this is not a prediction zone, but a reaction zone.

Patience here matters more than bias.