Gold Price Awaits FOMC – Liquidity Levels in PlayGold price continued to slide into liquidity zones during the late US session yesterday and reacted perfectly at the MMFLOW BUY ZONE 3314 – 3316, delivering over +70 pips profit to traders ✅.

At present, on M5–M15, Gold is showing signs of a short-term recovery. However, for a strong upside move, buyers must break through the 3320 – 3322 resistance zone. A confirmed breakout here could trigger momentum towards higher KeyLevels, allowing price to retest important supply zones.

📈 Upside Targets (Intraday): 333x and 334x remain the key areas to watch for take-profits or potential reversal setups.

🔔 Why This Week Matters – The FOMC Decision

The highlight of the week is the FOMC meeting during the US session. Markets are awaiting clarity on the Fed’s next move. Any hint towards a September rate cut could trigger massive bullish momentum, breaking Gold out of its corrective channel.

👉 Asian & European sessions: Focus remains bullish toward 333x – 334x, with potential SELL setups at resistance.

⚠️ US session with FOMC: Expect extreme volatility – risk management is critical.

📉 MMFLOW Technical Trading Plan

🔹 BUY Scalp Setup

Entry: 3311 – 3309

SL: 3305

TP: 3315 → 3320 → 3325 → 3330 → 3340 → 3350 → 3360+

🔹 BUY Zone (FOMC Plan)

Entry: 3290 – 3288

SL: 3282

TP: 3295 → 3330 → 3335 → 3340 → 3350 → 3360 → 3370+

🔸 SELL Scalp Setup

Entry: 3342 – 3344

SL: 3348

TP: 3338 → 3332 → 3328 → 3324 → 3320

🔸 SELL Zone (FOMC Plan)

Entry: 3360 – 3362

SL: 3368

TP: 3355 → 3350 → 3345 → 3340 → 3330

⚠️ Key Notes for Indian Traders

FOMC = high volatility event – manage your exposure carefully.

Stick to strict TP/SL discipline to protect capital.

Smart traders know: KeyLevels = Profits ✅

🔥 Follow MMFLOW TRADING for daily Gold price analysis, liquidity maps, and Smart Money insights – designed for Forex & Gold traders in India.

Forexsignals

Gold Consolidates Ahead of FOMC Liquidity SweepGold is currently moving within a narrow range, with downside pressure becoming increasingly evident. With just over a day left before the FOMC meeting – an event that could shape the next major trend – the market seems to be preparing for a sharp liquidity sweep.

👉 At first glance, price action looks frustrating and unclear. But for traders following MMFLOW KeyLevels, this is actually the “golden range”, as key zones continue to hold with remarkable precision.

📉 Today’s Outlook

Main Trend: Ongoing corrective downside move.

Potential Scenario: A deep liquidity sweep towards the 331x zone before a strong bullish rebound.

🔑 Key Trading Levels

SELL Zone: 3340 – 3345 | Short SL: 4 – 5$

🎯 Targets: 3325 → 3317 → extended 3310

📌 Note: Manage risk tightly and watch reactions around KeyLevels – a single BreakOut move post-FOMC could unlock the next major opportunity.

✨ Once again: KeyLevels = Profits ✅

👉 Follow MMFLOW TRADING for daily KeyLevel strategies, liquidity maps & smart money insights

GOLD Waiting for the Big BreakOut after FOMC This WeekGold Sideway Compression | Waiting for the Big BreakOut after FOMC This Week

Gold is currently consolidating in a tight range, building up energy for a major BreakOut. After the liquidity sweep at the weekly open, price fluctuated strongly between the 332x – 335x zone, but on the H1 timeframe, the overall trend still remains within a descending channel.

Last week, CPI & PPI data failed to deliver a clear direction. This week, all eyes are on the FOMC meeting, expected to provide stronger signals for gold’s next move.

⏳ Early to mid-week: with limited impactful news, gold may continue to sideway within the narrow range or maintain downside pressure until FOMC is released.

🔑 Key Market Levels

Resistance: 3357 – 3369 – 3383 – 3398

Support: 3335 – 3317 – 3309

📌 Trading Setup

✅ BUY Zone: 3334 – 3332

SL: 3328

TP: 3338 – 3342 – 3346 – 3350 – 3355 – 3360 – 3370 – 3380

👉 If gold breaks the descending channel around 336x, expect a strong move towards 3383 – 3398.

✅ SELL Zone: 3383 – 3385

SL: 3390

TP: 3378 – 3374 – 3370 – 3360 – 3350

👉 If gold fails at higher resistance and reverses, liquidity may be swept back into 333x – 331x, with potential extension down to 329x.

⚠️ Summary

Gold is at a critical decision point: BreakOut or Breakdown.

Before FOMC: sideways / bearish bias within H1 channel.

After FOMC: expect a strong Pump or Dump to define the clear weekly trend.

🔥 Keep a close eye on reactions at KeyLevels (333x – 336x – 338x) to adjust trading strategy accordingly.

EUR/USD 1-Hour Rising Channel – Support Zone & Potential Upside!Chart Breakdown & Technical Insights

Rising Channel Structure

The chart clearly shows EUR/USD trading within a rising channel, marked by higher highs (red arrows) and higher lows (green arrows) forming parallel support and resistance trendlines.

Key Support Zone & Bounce Potential

The price is currently sitting near the ascending trendline support, highlighted by the shaded gray box and emphasized with a circled area. Many analysts note that this lower boundary—around the 1.1690 level—serves as crucial support on a broader time frame

.

Short-Term Momentum Indicators

According to recent technical calls, EUR/USD maintains a short-term bullish bias in the rising channel. However, some momentum indicators, such as RSI, hint at weakening strength—particularly when higher price highs are not matched with higher RSI peaks, suggesting a bearish divergence

.

Potential Upside Trajectory

Should the lower channel support hold, the chart suggests a rebound toward mid-channel or potentially up to the upper boundary. Analysts highlight the 1.1720–1.1750 area as a near-term resistance, with the upper channel boundary closer to 1.1850

.

Alternative Scenario – Breakdown Risk

If EUR/USD breaks below the channel (below ~1.1690), the bullish structure may falter. That could expose the pair to deeper pullbacks, possibly testing lower support levels around 1.1650 or lower

.

** Summary Table**

Scenario Likely Outcome

Bounce off support Move up toward mid-channel (~1.172) or channel top (~1.185)

Breakdown below support Decline toward lower support zones (1.1650 and below)

Conclusion & Strategy Snapshot

The price is positioned at a critical support within a well-defined rising channel.

The bullish favored path: a rebound from the lower trendline toward resistance levels.

The bearish risk: a breakdown would shift momentum, possibly leading to deeper retracements.

Monitor for price action signals (e.g. bounce, candlestick patterns), RSI behavior, and behavior around these key levels.

XAU/USD: Navigating the Uptrend and Key Support LevelsPrice Structure: Gold has been forming a series of higher highs and higher lows, indicative of a general uptrend. The chart labels a "high" and a "higher high," confirming this bullish structure.

Support and Resistance:

Two key support areas are identified:

Support area S1: A narrow zone around 3,320 USD. The price recently bounced off this area.

Support area S2: A broader, more significant zone around 3,290 USD, which appears to have been a strong support level in the past.

Several horizontal resistance levels are marked:

Immediate resistance: Around 3,351.231 USD and 3,366.029 USD.

Higher resistance: At 3,408.819 USD and 3,438.677 USD.

Channels and Trendlines:

The price has been moving within a series of ascending channels (highlighted in green rectangles), suggesting a stair-step upward movement.

A primary ascending trendline (black line) serves as a long-term support, with the price currently hovering just above it.

Recent Price Action and Projections:

The price recently broke out of a small downtrend and is showing signs of recovery from the "support area S1."

A potential price path is drawn with a red arrow, indicating a possible move towards the immediate resistance levels around 3,351 USD and 3,366 USD.

The chart highlights two specific price points, 3,360.604 USD and 3,350.685 USD, which likely represent a short-term trading range or target.

Volume: The volume spikes visible at key price points (e.g., at the low on July 30 and during the recent drop) indicate strong market activity.

XAUUSD Bullish Trend Continuation: Potential Move to $3,400!The price action shows a higher high ("high") and a higher low ("low"), which are characteristic of an uptrend. An upward trendline has been established, connecting a series of higher lows, which is acting as a dynamic support level. A significant horizontal support zone has also been identified around the $3,260 - $3,280 price range, where the price previously found support.

Recently, the price experienced a pullback and bounced off the upward trendline. The analysis anticipates a continuation of the upward momentum toward a key resistance zone. This resistance zone is located around the $3,400 - $3,420 level. A specific target price of $3,408.833 is highlighted within this zone, suggesting a potential area where the upward movement might pause or reverse.

The chart includes a potential corrective wave pattern labeled with "C"s, indicating a recent three-wave pullback within the larger trend. The current price is shown at $3,353.520, positioned above both the horizontal support and the upward trendline, reinforcing the bullish sentiment.

Fed Set to Cut 50bps: Gold Gains as the Bullish Wave Forms Again📌 Macro Overview

US Treasury Secretary Bessent gives the green light for a potential 50-basis-point rate cut by the Fed in September.

July CPI remains soft → USD weakens, bond yields fall, boosting gold’s bullish outlook.

Gold briefly touched $3,370/oz, closing at $3,355.9/oz (+0.24%).

Gains capped as US equities continue to break records and geopolitical tensions ease.

Market focus now shifts to PPI data, jobless claims, and the anticipated Trump–Putin meeting for the next directional cues.

🧐 Technical Outlook – MMFLOW Analysis

The bullish recovery wave is clearly re-emerging after a corrective phase, with price hunting liquidity zones left behind in the recent retracement.

Preferred strategy: Trade around key liquidity levels or continuation zones for SELL opportunities; BUY entries will be taken earlier to catch the recovery wave within the current price channel.

Price Structure & Observation Zones:

Short-term uptrend channel intact, primary support at 3336 – 3334 (Liquidity – OBS BUY Zone).

Major resistance at 3394 – 3396 (Liquidity Grab Zone + H1 Supply).

🎯 MMFLOW Trading Plan

🔹 BUY SCALP – Catch the recovery wave

Entry: 3336 – 3334

SL: 3330

TP: 3340 – 3345 – 3350 – 3355 – 3360 – 3365 – 3370 – 3380 – ???

🔹 SELL SCALP – Counter-trend at resistance

Entry: 3394 – 3396

SL: 3400

TP: 3390 – 3385 – 3380 – 3370 – 3360

📊 Key Levels

Resistance: 3365 – 3370 – 3395

Support: 3340 – 3336 – 3330

💡 MMFLOW Strategy Tip:

Wait for price to retest the 3336 – 3334 BUY ZONE for trend-following BUY positions.

Watch for liquidity absorption signals at 339x – a potential SELL reversal zone.

Gold Price Faces Key Resistance — Can Bulls Break $3,440?The XAU/USD (Gold vs. USD) 1-hour chart shows a strong bullish structure within an upward channel, supported by higher highs and a recent ATH (All-Time High) retest.

Resistance Zone: $3,410 – $3,440 is acting as a significant supply area. Price may face selling pressure here.

Support Levels: First support lies near $3,300 (supply zone), followed by the $3,225–$3,250 demand zone.

Trend: The price is respecting the upward trendline, but a break below could trigger a retest of the green supply zone.

Bullish Scenario: A breakout and close above $3,440 could lead to a continuation toward $3,475+.

Bearish Scenario: Rejection from the resistance zone with a break below $3,300 could push price toward the $3,225 support.

Overall, gold is currently in a bullish trend, but needs to overcome the $3,440 barrier for further upside momentum.

GOLD SURGES AFTER CPI – TARGETING 337x BEFORE SELL-OFF? MMFLOW TECHNICAL OUTLOOK

📌 Market Overview

Following the CPI release, gold reacted with strong buying momentum (FOMO BUY), pushing prices swiftly from the 333x area up to 335x.

The main driver here is the BUY side taking advantage of remaining liquidity gaps above, aiming to break through the critical 3358 resistance – the first major barrier before reaching 337x, a key equilibrium zone that previously acted as a strong price-holding area for SELL orders.

Current structure indicates:

Short-term trend: Bullish, but approaching key distribution levels.

Liquidity Hunt: A decisive break above 3358 with strong volume could trigger a rapid move towards 337x, activating SELL volume from pending limit orders.

Macro context: No major news events today, with expected daily range ~35–40 points, increasing the chance of range-bound traps before a breakout.

🧐 Technical Outlook – MMFLOW View

Market Structure: Gold has formed a Higher Low around 333x and is now testing short-term resistance.

Key Levels & Liquidity Zones:

Liquidity BUY ZONE at 3338–3336 has reacted well, confirming BUYers are still defending this zone.

Supply Zone / CP Zone at 3375–3377 aligns with an H1 Order Block, holding a high concentration of pending SELL orders.

Volume Flow: Increasing volume as price approaches resistance suggests a potential “last push” before a reversal.

🎯 MMFLOW Trading Plan

🔹 BUY SCALP – Following the main trend

Entry: 3338 – 3336

SL: 3332

TP: 3342 – 3346 – 3350 – 3355 – 3360 – 3370 – 3380

🔹 SELL SCALP – At the distribution zone

Entry: 3375 – 3377

SL: 3382

TP: 3370 – 3365 – 3360 – 3355 – 3350 – 3340

📊 Key Technical Levels

Resistance: 3358 – 3365 – 3376

Support: 3342 – 3337 – 3330 – 3310

💡 MMFLOW Insight: With the current setup, the optimal strategy is to wait for a BUY opportunity near early support (334x) to ride the short-term bullish momentum, then watch for price reaction at 337x to catch potential SELL entries once top-side liquidity is swept.

PROACHING LIQUIDITY ZONE – WAITING FOR CPI TO DECIDE NEXT MOVE📌 MARKET RECAP

Gold kicked off the week with a sharp $50 drop, breaking through key trendlines and nearby support zones.

The selling pressure came from:

Profit-taking after the recent strong rally.

USD strength expectations ahead of CPI data (forecast ~0.1% better than the previous reading).

Geopolitical factor: Ukraine–Russia ceasefire talks moving towards a conclusion, fueling risk-off sentiment.

🧐 WHAT’S NEXT?

If CPI beats expectations → USD strengthens → Gold could drop further into the Liquidity Zone 333x – 330x.

If CPI disappoints → USD weakens → Gold may quickly bounce back toward key level 337x (previous breakdown zone) for a retest before deciding direction.

🎯 MMFLOW GAME PLAN

1️⃣ BUY SCALP

📌 Entry: 3331 – 3329

📌 SL: 3325

📌 TP: 3335 – 3340 – 3345 – 3350 – 3360 – 3370 – 3380

2️⃣ BUY ZONE

📌 Entry: 3310 – 3308

📌 SL: 3304

📌 TP: 3314 – 3318 – 3322 – 3326 – 3330 – 3335 – 3340 – 3350 – 3360 – ???

3️⃣ SELL SCALP

📌 Entry: 3363 – 3365

📌 SL: 3370

📌 TP: 3360 – 3356 – 3352 – 3348 – 3344 – 3340

4️⃣ SELL ZONE

📌 Entry: 3376 – 3378

📌 SL: 3382

📌 TP: 3372 – 3368 – 3364 – 3360 – 3355 – 3350 – 3340

⚠️ RISK NOTE

CPI is the market’s dice roll – even a small deviation could trigger massive stop hunts.

Always watch the KeyLevels marked on the chart before entering trades.

XAU/USD Bullish Bounce from Demand Zone !Gold (XAU/USD) on the 4H chart is showing a potential bullish reversal setup. Price has pulled back into a Fair Value Gap (FVG) and high supply/demand zone near 3,329–3,315, aligning with the 0.382–0.5 Fibonacci retracement.

Key Points:

Support Zone: 3,329–3,315 (demand + FVG).

Bullish Rejection Expected: Price may bounce from this zone, targeting upper resistance levels.

Upside Targets:

TP1: 3,356

TP2: 3,375

TP3: 3,440–3,459 (major resistance)

Invalidation: A daily close below 3,315 could open room for deeper downside toward 3,278–3,245.

Indicators: EMA(9) and Ichimoku showing potential for trend resumption if price closes above 3,362.

Overall, the chart suggests a buy setup on bullish confirmation, aiming for the 3,375–3,459 zone.

Awaiting the BreakDown or a Snap Back to Resistance?XAUUSD – Game of Patience: Awaiting the BreakDown or a Snap Back to Resistance? | MMFlow Trading

1. Market Context

The week opened with a sharp sell-off in Gold — driven by profit-taking and stop-loss hunting on late-week FOMO BUY positions.

Buying momentum is fading, while sellers are lurking at the ascending channel’s support.

Price is currently reacting at KeyLevel 336x–337x, with H1 candles showing lower wicks → signs of indecision.

2. Technical Outlook

Overall structure: Still within an H1-H4 uptrend channel, but BUY momentum is weakening.

No clear SELL confirmation yet → need a BreakDown from the channel to confirm seller dominance.

Scenario 1: Break the channel → target 335x & 333x zones.

Scenario 2: No break → price may rebound to retest 339x – 340x – 342x resistance levels.

3. Fundamental & Macro View

This week brings major USD economic data: CPI & PPI.

Forecasts lean positive for USD, which could increase downward pressure on Gold.

However, expect false breakouts before/after news releases — risk management is key.

4. MMFlow Trading Plan

BUY SCALP

Entry: 3353 – 3351

SL: 3345

TP: 3358 – 3362 – 3366 – 3370 – 3375 – 3380

BUY ZONE

Entry: 3332 – 3330

SL: 3325

TP: 3336 – 3340 – 3345 – 3350 – 3360 – 3370 – 3380

SELL SCALP

Entry: 3394 – 3396

SL: 3400

TP: 3390 – 3385 – 3380 – 3370 – 3360

SELL ZONE

Entry: 3425 – 3427

SL: 3430

TP: 3420 – 3415 – 3410 – 3405 – 3400 – 3390 – 3380

5. Risk Management

Avoid FOMO — wait for clear candle confirmations before entering.

Reduce position size ahead of CPI/PPI events.

Focus on pre-defined key levels, avoid trading in noise zones.

GBPCHF – Could This Be the Start of a Bullish Comeback?Looking at GBPCHF right now, it feels like the market is finally speaking my language.

After an extended downtrend, price has landed on a major support zone visible on the higher timeframes — a zone that’s been tested and respected multiple times before. We're now seeing early signs of rejection from that area, and I’m eyeing a potential move back up toward 1.1000.

What makes this setup stand out isn’t just the technicals — it’s the patience behind the play. I waited for the sell-off to complete, for price to return to a proven zone, and now I’m watching for signs of strength to kick in. This type of setup? I’ve seen it play out time and time again in my previous chart work.

Drop your thoughts in the comments — do you see the same potential, or are you taking a different side of the trade?

Gold (XAU/USD) in Symmetrical Triangle – Short‑Term Squeeze,Price Structure & Technical Setup

Gold is consolidating within a symmetrical triangle, showing lower highs and higher lows—a classic precursor to breakout in either direction

Fxglory Ltd

+5

TradingView

+5

Babypips.com

+5

TradingView

+2

Babypips.com

+2

TradingView

+2

.

Trendlines converge tightly around $3,326–$3,334, hinting at imminent directional acceleration

Investopedia

+4

TradingView

+4

TradingView

+4

.

🎯 Key Levels & Targets

Scenario Trigger Confirm Area Targets Stop Loss

Bullish Breakout above $3,344–$3,350 $3,369 → $3,396 → $3,422–$3,550 ~$3,340

Bearish Breakdown below ~$3,326–$3,320 $3,320 → $3,300 → $3,297 → $3,255 ~$3,335–$3,340

A breakout above $3,344–$3,350 validated with volume may drive prices toward $3,400+, with extended targets up to $3,550 or higher in bullish conditions

Traders Union

Time Price Research

.

A drop below $3,326–$3,320 risks further decline, targeting $3,300, $3,297, and eventually $3,255 if breakdown momentum builds .

📉 Market Context & Drivers

U.S. dollar strength, easing safe-haven demand, and optimistic trade sentiment are constraining gold’s upside unless breakout forces emerge .

Key upcoming catalysts: FOMC guidance, U.S. macro data (GDP, inflation), and geopolitical developments—their tone could tip the bias direction .

⚙️ Trade Rules & Risk Management

Wait for a confirmed breakout or breakdown—do not trade mid-range.

Confirm break with at least one close outside the triangle and rising volume .

Position sizing: Risk 1–2% per trade, adjust stop-loss to price structure ($8–$15 depending on volatility).

Take profits in stages: scale out at minor milestones (first targets), trail stop for extended targets.

Avoid chasing price within the middle of the triangle—risk/reward is unfavorable.

🧠 Why This Plan?

Follows textbook symmetrical triangle trading methodology: entry on breakout, stop beyond pattern opposite side, projection based on triangle height .

Aligns with broader outlook: bearish unless convincing upside breakout appears, consistent with analyst consensus hedging current bull exhaustion and wait‑and‑see on policy signals .

✅ Summary

Gold is coiling inside a tight triangle range near $3,326–$3,334, with breakout potential identified to either side:

Bullish breakout over $3,344–$3,350 targets up to $3,550 or beyond.

Bearish breakdown under $3,326–$3,320 risks slide towards $3,300–$3,255.

Wait for confirmation, apply disciplined risk controls, and let volume validate the move.

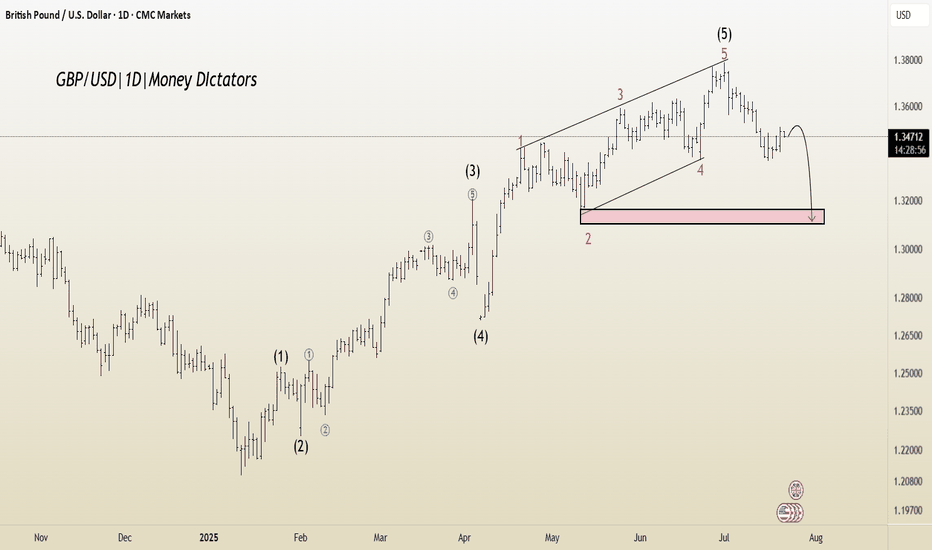

GBP/USD: Post-Impulse Sell Setup from Ending DiagonalThe chart depicts a completed 5-wave impulsive structure, culminating at the top of wave (5). The internal wave structure of the final fifth wave forms a classic ending diagonal pattern, typically signaling a trend reversal or deep correction.

After this extended fifth wave, the price has started rolling over, confirming the start of a corrective decline. The wave count now expects an ABC correction targeting the previous wave 4/2 demand zone, highlighted in red.

Target 1 (T1): 1.33608

Target 2 (T2): 1.32436

Stop Loss (SL): 1.35988

Ending diagonal at the top of wave (5) signals exhaustion of bullish momentum.

Clear bearish divergence (not shown here) is commonly seen with this pattern.

The price has broken the short-term structure and is now forming lower highs.

Target zone aligns with previous wave 2 consolidation – a typical retracement zone for post-impulse corrections.

Liquidity Sweep Complete – Bullish Continuation Ahead?GOLD ANALYSIS 31/07: Liquidity Sweep Complete – Bullish Continuation Ahead?

🔍 Technical View | XAUUSD | 2H Chart | End of Month Setup

Gold has completed a final liquidity sweep around the 3269–3271 zone and has since rebounded strongly, in line with the prevailing bullish structure. The sharp drop yesterday during the FOMC rate statement appears to have served its purpose: grabbing final sell-side liquidity before preparing for the next bullish leg.

As of now, price is reacting at the 3295 zone, which coincides with the M30 CP (Change of Character) Zone, showing minor intraday retracement. A healthy pullback is likely before a potential bullish breakout of the descending trendline that has been holding price down over recent sessions.

🔵 BUY Strategy: Trend Continuation Setup

We’re watching for potential re-entries on a dip toward the OBS Buy Zone (3286–3284), created after the recent bullish move. This could be the last opportunity to catch the next impulsive leg higher.

Buy Zone: 3286–3284

Stop Loss: 3278

Targets: 3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → ???

Key breakout confirmation will come if price closes strongly above 3313 (first key resistance). If broken, this opens the door toward the VPOC zone at 3328–3330, where a high-volume cluster awaits.

🔴 SELL Strategy: Short-Term Rejection Levels

Shorts only become favorable below the VPOC Sell Zone (3328–3330). If price closes above this area, bearish pressure is likely to fade, and bulls will dominate the next leg.

Sell Zone: 3328–3330

Stop Loss: 3335

Targets: 3324 → 3320 → 3315 → 3310 → 3305 → 3300

⚠️ Important: Selling inside a bullish breakout structure is high-risk unless the market gives clear rejection at major supply. Always wait for price action confirmation.

🕯️ Monthly Candle Insight (July Close)

Today marks the final trading day of July. Notably, the last two monthly candles have closed as Doji with long wicks, reflecting deep indecision and ongoing liquidity grabs. This aligns with the upcoming interest rate cut discussions at the next FOMC, which could ignite significant volatility.

📌 Summary:

Liquidity sweep at 3269–3271 is likely complete.

Price now retracing after strong bullish rebound from OBS Buy Zone.

Watch for confirmation above 3313, then 3328–3330 for breakout toward higher zones (335x–337x).

End-of-month close + macro narrative (FOMC) will be crucial to confirm direction.

💡 Pro Tip: Avoid entering late into reactive moves. Wait for retests of clean liquidity zones and use volume-based confluences to validate bias.

📲 Follow us @MMFlowTrading for real-time updates, macro analysis, and market structure insights on gold & major pairs.

GOLD: Is This a Bottom or the Calm Before the Storm?🌐 Fundamental & Macro Landscape

The recent US–EU trade and defense pact has temporarily reduced gold’s appeal as a safe haven.

The US Dollar and stock markets remain strong thanks to positive macroeconomic data.

Current sentiment is risk-on, which typically shifts capital away from metals and into riskier assets.

But the real volatility could come later this week:

📅 High-Impact Events to Watch:

US ADP Employment Report

FOMC Statement + Nonfarm Payrolls (NFP)

These will likely decide whether gold resumes its uptrend or continues sliding lower.

📊 Technical Outlook (H1–H4)

Gold is currently trading within a parallel bullish channel after rebounding from local lows.

However, price is now approaching a key resistance zone around 3342, where we might see either a breakout or a rejection, depending on market sentiment during the upcoming data releases.

🔍 Key Price Zones

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + FVG + Fib 0.5–0.618)

🔻 High-Liquidity Demand Area: 3293–3290

🔻 Deep Demand Zone (FVG): 3275–3273

🔺 Long-Term Resistance Target: 3416

📈 Trade Plan – Based on Price Reaction, Not Prediction

The best trades come from waiting for the right reaction at key zones. No chasing. No guessing.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Works well in high-liquidity zones for quick short-term gains.

✅ Scenario 2 – Buy from Deeper Support (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great setup if price absorbs selling pressure and reverses from FVG demand.

❌ Scenario 3 – Short from Short-Term Resistance

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Valid only if price fails to reclaim above 3342.

❌ Scenario 4 – Short from Major Supply Zone

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher risk – only act after confirmation (e.g., rejection wicks or bearish candle pattern).

⚠️ Risk Management Tips

Avoid entering right at London or New York opens – too much volatility and false breakouts.

Always wait for confirmation (candle rejection, pin bars, engulfing, etc.).

Use strict stop-loss rules – FOMC + NFP can spike price in both directions.

💡 Final Tips for Indian Traders

Trade with patience – the best setups often appear when others are panicking.

Respect your capital – don’t overleverage during high-volatility news events.

Focus on price action – not emotions or fixed bias.

📌 If you found this gold analysis helpful, feel free to drop your thoughts in the comments or follow for daily updates on XAU/USD.

Let’s grow and trade smarter, one setup at a time.

Namaste 🙏 | Trade safe, trade with clarity.

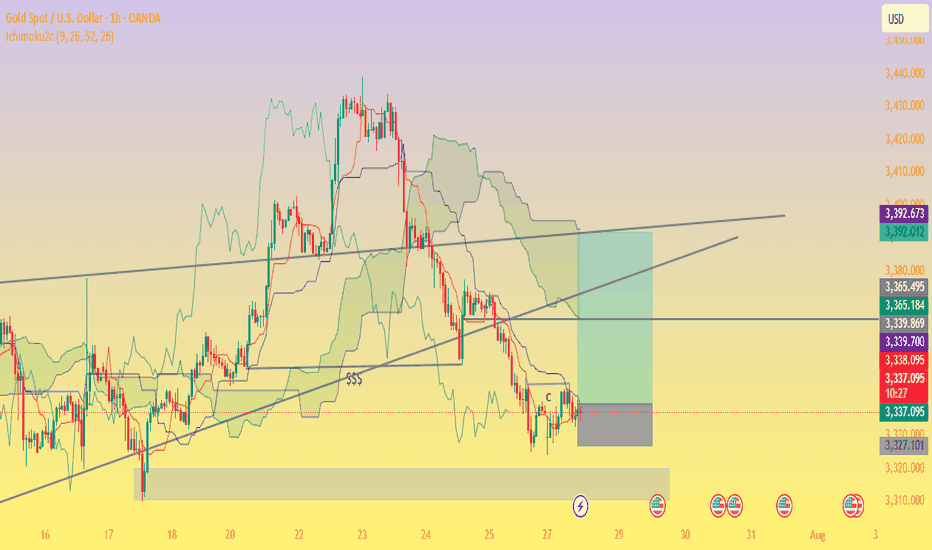

XAU/USD 1H – Range Consolidation Below Ichimoku Cloud. Chart Review & Technical Insight

1. Ichimoku Cloud & Overall Structure

Price is below the Ichimoku Cloud, with the cloud ahead sloping downward—indicative of bearish short‑term momentum and resistance overhead as long as the cloud holds above price.

The Kijun-sen (blue) line is above the Tenkan-sen (red), reinforcing the bearish bias on this timeframe.

2. Price Action & Key Zones

A support zone around 3,327–3,330 USD/oz is visible, underpinned by multiple rejection taps and price consolidation (“$$$” zone). A clean break below could open the path toward the 3,320’s or lower imbalance region.

On the upside, resistance lies near 3,339–3,340, backed by the cloud’s lower boundary and the Kijun-sen level.

The highlighted green rectangle appears to signal a potential bullish breakout target zone toward 3,365–3,392, contingent on recovery above the cloud.

3. Momentum & Trade Considerations

Momentum is weak, with price moving sideways inside a low‑volatility rectangle on diminishing volume and few directional impulses.

Possible ABC corrective structure is forming as marked, suggesting price may oscillate sideways or continue correcting within established bounds.

A bullish scenario would require clearing the Ichimoku Cloud and resistance at 3,340–3,360 USD.

Conversely, a bearish breakdown below ~3,327 could confirm continuation deeper into the 3,320s or toward the next significant demand zone near 3,300 USD.

✅ Summary

Bias: Slightly bearish to neutral until price can clear the Ichimoku Cloud.

Key Levels to Watch:

Support: 3,327–3,330 (immediate), then 3,320–3,300.

Resistance: 3,339–3,365, cloud top near 3,365, further target zone 3,392.

Scenarios:

Bullish breakout: Close above cloud → potential rally toward 3,365–3,392.

Bearish breakdown: Close below 3,327 → deeper correction toward 3,320 and lower imbalance areas.

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

Critical Breakdown: BTC/USD Poised to Fall — Waiting on H4 CloseAnalysis of the BTC/USD 4‑Hour Chart

From the chart you provided, here's how the technical situation looks:

Ascending trendline support has been tested multiple times and was recently breached this afternoon, signaling a possible shift from the bullish setup to a bearish continuation.

The price is now trapped within a descending triangle formation beneath a well‑defined swing high resistance zone. This reflects indecision in the market, with neither buyers nor sellers in clear control

Business Insider

+15

Fxglory Ltd

+15

Bitcoin News

+15

.

Key levels to monitor:

Support zone: ~$115,500, extending down to ~$111,300 and ~$105,600 as deeper targets if bearish momentum strengthens.

Resistance zone: ~$119,000–120,000 area, forming strong overhead supply

Economies.com

DailyForex

Bitcoin News

.

The chart’s annotations align with a classic breakout strategy—with the caveat: wait for a confirmed close below the trendline before considering short positions (as noted in your “wait for this candle to close in red” comment).

Breakout confirmation would likely pave the way toward your indicated profit zones near ~$111k and ~$105k, with a larger potential down to ~$99.8k if further downside pressure builds.

🔍 What the Broader Market Signals

Technical sentiment from sources covering today’s analysis shows BTC/USD hovering just under $120,000, stuck within the defined range of $115.5k support to $120k resistance

Economies.com

.

While there’s still neutral momentum in indicators like RSI and MACD, the short-term direction leans bearish if the breakdown is confirmed on the H4 timeframe

Fxglory Ltd

.

Analysts emphasize that sustained movement above $116.5k could retarget resistance near $119–120k. A failure there and a move below $115.5k may thrust price deeper toward your downside zones

DailyForex

.

✅ Trading Strategy Overview

Scenario Trigger Target Levels

Bearish Breakdown H4 candle closes below trendline ~$115.5k $111.3k → $105.6k → possible $99.8k zone

Bullish Rejection Bounce back above ~$116.5k and trending above resistance $119k–120k retest, potential breakout if sustained

Neutral / Wait-and-see No decisive candle close yet Hold for confirmation

⛳ Final Thoughts

chart highlights a critical point: don’t act prematurely. Wait for a decisive H4 candle close below the trendline before committing to shorts. Confirmed bearish action around the breakout could open the path to the lower targets you identified. However, if price rebounds above support and climbs above $116.5k, a short-term retest of $119k–120k is still in range.

Traders should maintain prudent risk management—watching the unfolding price action around these pivot points without overreaching. Let me know if you'd like help crafting entry/exit zones or risk profiles for this setup!

Gold Tests Key Support – Time to Buy or More Downside Ahead?🌐 Market Overview

Gold remains under pressure following yesterday’s sharp sell-off, driven largely by macro-political tensions and profit-taking at recent highs.

🔻 On July 24th, former President Trump made a surprise visit to the Federal Reserve headquarters — a move interpreted by markets as subtle pressure on the Fed to start cutting rates.

While the Fed hasn’t signaled any immediate easing, short-term bond yields have dipped slightly — reflecting growing rate-cut expectations.

The US Dollar, however, remains firm, showing markets are still hesitant to fully price in a Fed pivot after strong economic data.

📊 Technical Outlook

On the H2 timeframe, gold continues to trade within a broader bullish structure, but price action is now hovering near a critical Keylevel at 3338, aligned with a rising trendline and VPOC zone. A breakdown below this level could open the door for deeper liquidity grabs toward 332x and even 329x.

Volatility is high, and price is moving in wide ranges — ideal conditions for short-term scalp setups.

🎯 Trading Strategy

🔽 Scalp Buy (Short-Term Bounce Opportunity)

Entry: 3338 – 3336

Stop Loss: 3332

Targets: 3342 – 3346 – 3350 – 3354 – 3360 – 3365 – 3370 – 3380

🟢 Buy Zone (Deeper Pullback, Reversal Potential)

Entry: 3312 – 3310

Stop Loss: 3305

Targets: 3316 – 3320 – 3325 – 3330 – 3340 – 3350 – 3360 – 3370 – 3380

🔻 Sell Zone (If Price Retests Resistance)

Entry: 3374 – 3376

Stop Loss: 3380

Targets: 3370 – 3366 – 3360 – 3355 – 3350 – 3340 – 3330

🧭 Key Price Levels

Support: 3350 – 3338 – 3325 – 3310 – 3294

Resistance: 3374 – 3390 – 3400 – 3421

⚠️ Risk Management & Notes

As we head into the weekend, the market is prone to unexpected liquidity sweeps and sharp reversals.

Only consider short-term BUY positions for today. Avoid holding long-term buys until there's confirmation that the lower liquidity zones have been fully swept.

Strictly follow TP/SL discipline to protect capital — especially in volatile, low-news sessions like this.

💬 Enjoying these detailed trade plans?

📈 Follow the MMF TradingView channel for daily market updates, high-probability trade setups, and pro-level insights designed for serious traders.

Watch for a Potential Pullback (July 23) - GOLD PLAN XAUUSD – Is the Bullish Wave Losing Steam? Watch for a Potential Pullback (July 23)

📰 Market Overview

Gold made a strong rally last night, fueled by:

Fed Chair Powell’s speech, which avoided any controversial remarks or hints about stepping down.

Rising geopolitical tensions between the US, China, and the EU, with August 1st looming as a critical deadline.

A dip in US bond yields and the dollar, giving risk assets — including gold — room to rise.

While there’s no major news on today’s calendar, the market could remain volatile within a wide range.

📉 Technical Outlook

Gold seems to be wrapping up its bullish wave as seen on the H4 chart. On the H1 and M30 timeframes, reversal candles are starting to form — an early signal of potential correction.

The short-term support at 3412 – 3410 is the key zone to watch. If that breaks and we get a clean breakdown from the trendline, a deeper pullback could be underway — possibly heading toward liquidity zones lower down.

Two main Fair Value Gap (FVG) areas on H1 are also in play as high-probability liquidity targets.

Down at the 335x region, we have a confluence of FIB 0.618 retracement and historical buying interest — making it an attractive zone for long setups if the price reacts properly.

📌 Trade Setups for Today

🔻 SELL ZONE: 3469 – 3471

Stop Loss: 3475

Take Profits: 3465, 3460, 3455, 3450, 3445, 3440, 3430, 3420

→ Ideal zone to look for bearish setups after a retest.

🔸 BUY SCALP: 3385 – 3383

Stop Loss: 3379

Take Profits: 3390, 3394, 3398, 3402, 3406, 3410

→ Short-term buy for intraday traders catching the pullback.

🔹 LONG-TERM BUY ZONE: 3356 – 3354

Stop Loss: 3350

Take Profits: 3360, 3364, 3368, 3372, 3376, 3380, 3390, 3400

→ This is the deep liquidity zone worth watching for high-conviction buy entries.

⚠️ Risk Reminder

With fewer news catalysts, gold may trap traders by sweeping liquidity in both directions.

Stick to your plan, follow TP/SL strictly, and avoid chasing price. Let the market come to you.

💬 Sometimes the best trade is waiting for the right level. Stay patient, stay sharp.

institutional Nifty-50 option tradingInstitutional Nifty-50 option trading refers to the strategic use of Nifty-50 options (CE & PE) by FIIs, DIIs, Hedge Funds, and Banks to hedge, speculate, or manage risk on large capital positions. Unlike retail, their trades are data-driven and volume-heavy.

Key Institutional Strategies:

Delta-Neutral Strategies – Like Long Straddles or Strangles, where institutions profit from volatility.

Covered Call / Protective Puts – To hedge large Nifty portfolios.

Bull/Bear Spreads – Deployed when directional conviction is strong but limited in risk appetite.

Option Writing – Writing options at OI resistance/support to generate premiums.

Calendar Spreads – Leveraging time decay while anticipating movement.

📈 How to Track Institutional Activity:

Option Chain Analysis: Spot high OI shifts with unusual volumes.

OI + Volume + IV: Use combined data to infer institutional positioning.

Change in PCR (Put Call Ratio): Signals sentiment shift at index levels.

FII-DII Daily Derivative Data: Published by NSE after market hours.

Strike-wise Open Interest Heatmaps: Help identify resistance/support zones built by institutions.