#GBPUSD Present At Good Area For SellOnce the #GBPUSD closes below 1.2480 on the hourly chart, keep an eye for a retest of this level. If there's rejection on the retest on the M5/M15 timeframe, consider initiating a sell position with a 30-pip stop loss and a target of 70 pips down to 1.2400. There's substantial trendline liquidity beneath these levels.

Gbpusdforecast

FOMC Minutes in the Charts: EUR/USD & GBP/USD FOMC Minutes in the Charts: EUR/USD & GBP/USD

During their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

Resistance at 1.267: Key Level to Watch After BoE Rate Decision

The UK continues to struggle with high inflation, as demonstrated once again this morning when headline inflation exceeded expectations at 8.7%, surpassing the projected 8.4%. Core inflation also outperformed, registering a 7.1% figure compared to the expected 6.8%. This divergence emphasizes the contrast between the UK and its counterparts in the US and Europe.

Tomorrow, the Bank of England is set to announce its interest rate decision, and there are expectations of further tightening from the central bank. Given the elevated level of inflation, the bank may have little choice but to maintain a hawkish stance.

Last week, the GBPUSD initially tested the support level at the previous resistance of 1.250. However, that brief decline was followed by four consecutive days of significant gains, ultimately reaching a new high for the year.

There was a temporary resistance encountered at a critical level of 1.267. Following tomorrow's rate decision, this level could potentially act as a support area, particularly considering the slight pullback observed in recent days and the elevated RSI (Relative Strength Index).

On the other side of the trade, we have Federal Reserve Chair Jerome Powell's comments on the central bank's ongoing battle against inflation falling short of the market's more hawkish expectations.

During his testimony to lawmakers, Powell acknowledged that inflation remains significantly above the Fed's target and indicated that raising rates could still be a sensible course of action, albeit at a more moderate pace. Traders particularly took note of the term "moderate," which Powell used to qualify the potential rate increases. We still have one more day of testimony from Powell.

GBPUSD CAPITALCOM:GBPUSD

As you can see in GBPUSD pair is in consolidation since Dec 22 (long time ) and now it is near to the resistance, if it rejects the resistance level and come down then we can plan for sell side with the conformation of pull back entries. Plan your trade accordingly.... (4 HR time frame)

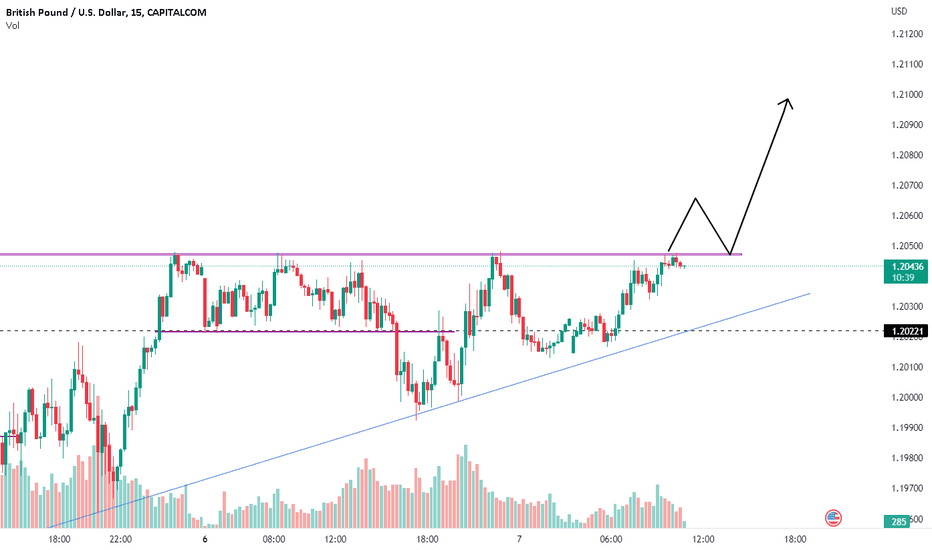

#GBPUSD Uptrend Movement With rish:reward=3.5#trading stratergy

#GBPUSD Uptrend Movemet

time frame 3 hours.

breakout from parallel channel.

Buy at 1.20718, Target 1.22331, SL 1.20257

HOPE our analysis is adding value to your site trading Journey.

If yes, Hit like button or boost our ideas. Thank you.

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

GBPUSD | Good Sell opportunityIf you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

GBPUSDDear traders,

As I have been accustomed to in recent months and this time my technical analysis had an accuracy rate of over 95% and I will try to continue to keep this percentage as long as possible

I said in the last weeks ...s you can see, the W pattern for a week is almost perfectly respected and GU has already reached level 1 that I proposed last week!

from here ... I expect a rejection and a small retracement move and after ... DOWN AGAIN to target 2

...even if it will remain in the range in this area because the volume in the market is extremely low in August ... my target for the next period remains the 1.35 area, continuing the idea I promoted in the last weeks

...GU went down and is fast approaching the 2nd target from 1.35 making the 700 pips that I have predicted since May

THIS WEEK...this week I will draw a parallel between the 1 week chart and the 1 month chart because the month has just ended and I would like to know what to expect ...

just like EURUSD, GU reached target 2 and made the 700 pips that I have been talking about in the last months and now it is time to do a new analysis ...

In the next period I think it will play more on economic factors taking into account the economic crisis in the UK but in the long run ... I think GU will start a new rise of 200-300 pips even if it can, it will test the 1.34500 area again

GU closed above the extremely strong 1.34500 area formed in the last 5 years and on the 1 month chart it rejected from the Fibonacci 0.5 area

but I repeat ... pay close attention to the economic news in the UK because the decline could be wider ... 200-250 pips and from there UP again to 1.37

NOTE: Please, give a LIKE if you find this idea useful!

GREAT ATTENTION:

*This information is not a Financial Advice.