EUR/USD – 1H EURUSD is trading at a discounted price area after a sharp impulsive sell-off, where price has swept sell-side liquidity (LA) and is now stabilizing near equal lows. The recent bearish leg looks exhaustive, suggesting downside momentum is weakening.

Price is currently holding above a key intraday demand / liquidity pocket, forming a base that favors a mean-reversion move rather than continuation lower.

Key Structure & Narrative

Sell-side liquidity taken below prior lows (LA)

Bearish impulse completed, followed by compression and basing

Discount zone respected, aligning with smart-money accumulation logic

Upside Scenario (Primary Bias)

A bullish displacement from current levels can open a path toward the prior H1 supply / imbalance zone (blue)

Acceptance above this zone may lead to a trend continuation toward the higher-timeframe premium area, with projected targets near the 1.2050–1.2080 region

Pullbacks during the move are expected to be corrective, not impulsive

Invalidation

Sustained acceptance below the liquidity sweep low would invalidate the bullish thesis and imply further downside exploration

📌 Bias: Bullish reversal from sell-side liquidity

📌 Framework: Liquidity sweep → accumulation → displacement → expansion

📌 Market State: Transition from markdown to re-accumulation

Ict

XAUUSD – Brian | H3 Technical AnalysisGold has officially broken above the 5,000 level for the first time, confirming a major structural shift on higher timeframes. The breakout reinforces the broader bullish narrative, with price now trading firmly in expansion mode rather than consolidation.

The move above 5,000 reflects sustained safe-haven demand amid elevated global uncertainty. While short-term volatility remains possible, the broader environment continues to favour gold as a defensive asset, supporting upside continuation scenarios.

Market Structure & Trend Context (H3)

On the H3 timeframe, XAUUSD remains well-contained within a rising price channel, with structure defined by higher highs and higher lows. The recent impulsive leg confirms continuation within the dominant trend rather than a terminal move.

Key structural observations from the chart:

Price is holding above the ascending trendline, which has acted as dynamic support throughout the advance.

A clean impulsive push above 5,000 followed by shallow pullbacks suggests strong buyer acceptance at higher prices.

The broader Elliott structure remains constructive, with price progressing through higher-wave extensions rather than showing signs of distribution.

Key Technical Zones to Monitor

Several important technical areas stand out:

5,000 – trendline retest zone: A potential area for price to stabilise if a technical pullback develops.

Strong liquidity zone around 4,787: A deeper support area where buy-side liquidity is concentrated, aligned with prior structure.

FVG zone below current price: Represents unfinished business in case volatility increases.

Upper resistance / extension zone near 5,315 (Fibonacci 1.618): A key upside reaction area where price may pause or consolidate before further expansion.

As long as price remains above the trendline and key liquidity supports, the bullish structure remains intact.

Liquidity & Forward Outlook

The breakout above 5,000 opens a new liquidity regime. With limited historical resistance overhead, price is now driven more by liquidity expansion and momentum than by traditional supply zones.

Short-term pullbacks should be viewed in the context of trend continuation rather than reversal, unless there is a clear breakdown in structure. Acceptance above 5,000 would further strengthen the case for continued upside toward higher Fibonacci extensions.

Trading Bias

Primary bias: Bullish continuation while structure holds

Key areas of interest:

Trendline / 5,000 retest zone

4,787 liquidity support

5,315 extension resistance

Preferred timeframe for confirmation: H1–H4

Strong trends rarely move in a straight line. Patience and alignment with structure remain critical in this phase of the market.

Refer to the accompanying chart for a detailed view of trend structure, liquidity zones, and Fibonacci extensions.

Follow the TradingView channel to get early access to structural updates and join the discussion.

XAUUSD – Brian | H3 Technical AnalysisGold continues to trade within a well-defined bullish structure on the H3 timeframe, supported by strong technical momentum. Price action remains orderly, with impulsive advances followed by controlled pullbacks — a characteristic of a healthy trending market.

From a macro standpoint, geopolitical uncertainty remains elevated after recent comments from President Trump regarding increased U.S. control over strategic military areas in Greenland. While not implying direct occupation, the development adds to broader risk sensitivity and continues to support gold’s role as a defensive asset.

Market Structure & Technical Context (H3)

On the H3 chart, XAUUSD remains firmly above its rising trendline, with market structure defined by higher highs and higher lows. A prior break of structure (BOS) confirmed bullish continuation and opened the door for further expansion.

Key technical areas highlighted on the chart:

A strong impulsive leg followed by corrective pullbacks, consistent with trend continuation.

Fibonacci expansion with the 2.618 extension near the 5005 zone, acting as a major reaction area.

A liquidity pullback zone around 4825, aligned with trendline support and suitable for continuation scenarios.

A lower POC / value area acting as deeper support if volatility increases.

As long as price holds above these demand zones, the broader bullish structure remains intact.

Liquidity & Forward Expectations

Upside liquidity remains available above recent highs, while short-term pullbacks are likely driven by profit-taking rather than structural weakness. The 5000–5005 area represents a key decision zone where price may pause or consolidate before the next directional move.

Trading Bias

Primary bias: Bullish continuation while structure holds

Key zones to monitor:

4825 – liquidity pullback / trend continuation

5000–5005 – major extension & reaction zone

Preferred timeframe: H1–H4

Risk management remains essential, particularly in a market sensitive to sudden news flows.

Refer to the accompanying chart for a detailed view of market structure, liquidity zones, and Fibonacci extensions.

Follow the TradingView channel to receive early updates and join the discussion on market structure and price action.

XAUUSD – H2 Technical AnalysisLiquidity Pullback Within a Strong Bullish Structure | Lana ✨

Gold continues to trade within a well-defined bullish structure on the H2 timeframe. The recent surge was impulsive, followed by a healthy retracement that appears to be rebalancing liquidity rather than signaling a trend reversal.

Price action remains constructive as long as the market respects key structural levels and the ascending trendline.

📈 Market Structure & Trend Context

The overall trend remains bullish, with higher highs and higher lows still intact.

Price continues to respect the ascending trendline, which has acted as reliable dynamic support throughout the uptrend.

The recent pullback occurred after an aggressive upside expansion, fitting the classic sequence:

Impulse → Pullback → Continuation

No clear distribution pattern is visible at this stage. As long as structural support holds, the bias remains BUY on pullbacks, not selling strength.

🔍 Key Technical Zones & Value Areas

Primary Buy POC Zone: 4764 – 4770

This area represents a high-volume node (POC) and aligns closely with the rising trendline.

It is a natural zone where price may rebalance before resuming the bullish trend.

Secondary Value Area (VAL–VAH): 4714 – 4718

A deeper liquidity zone that could act as support if sell pressure temporarily increases.

Near-term resistance: 4843

Acceptance above this level strengthens the continuation scenario.

Psychological reaction zone: 4900

Likely to generate short-term hesitation or profit-taking.

Higher-timeframe expansion targets:

5000 (psychological level)

2.618 Fibonacci extension, where major liquidity may be resting.

🎯 Trading Plan – H2 Structure-Based

✅ Primary Scenario: BUY the Pullback

Buy Entry:

👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, strong rejection of lower prices, or bullish follow-through).

Stop Loss:

👉 4756 – 4758

(Placed ~8–10 points below entry, beneath the POC zone and the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843

First resistance zone — partial profit-taking recommended.

TP2: 4900

Psychological level with potential short-term reactions.

TP3: 5000

Major psychological milestone and upside expansion target.

TP4 (extension): 5050 – 5080

Area aligned with the 2.618 Fibonacci extension and higher-timeframe liquidity.

The preferred approach is to scale out gradually and protect the position, adjusting risk as price confirms continuation.

🌍 Macro Context (Brief)

According to Goldman Sachs, central banks in emerging markets are expected to continue diversifying reserves away from traditional assets and into gold.

Average annual central bank gold purchases are projected to reach around 60 tons by 2026, reinforcing structural demand for gold.

This ongoing accumulation supports the idea that pullbacks are more likely driven by positioning and profit-taking, rather than a shift in long-term fundamentals.

🧠 Lana’s View

This remains a pullback within a bullish trend, not a bearish reversal.

The focus stays on buying value at key liquidity zones, not chasing price at highs.

Patience, structure, and disciplined execution remain the edge.

✨ Respect the trend, trade the structure, and let price come to your zone.

XAUUSD - Brian | H2 Technical AnalysisGold remains constructive and continues to hold a bullish structure despite last night’s sharp cross-market volatility. The main driver behind the larger moves was heavy selling pressure in U.S. equities, which briefly accelerated safe-haven demand and helped support gold.

On the macro side, tensions linked to Greenland and renewed tariff rhetoric have increased uncertainty across markets. The USD weakened in the short term, while the EUR appears more exposed to medium-term geopolitical and policy risks. This backdrop generally remains supportive for gold, especially on pullbacks into key support.

Technical Structure & Key Zones (H2)

On the H2 timeframe, XAUUSD is still trading within a clear uptrend: price respects the rising trendline and continues to print higher highs and higher lows, confirming buyers remain in control of the primary structure.

The latest impulse leg has left several important technical areas:

A Fair Value Gap (FVG) below current price, which may be revisited if a technical retracement develops.

The 0.618 Fibonacci retracement zone at 4750–4755, aligned with the rising trendline — a strong confluence support for a deeper pullback scenario.

A higher, near-term demand area around 4812, suitable for shallow pullbacks during strong momentum conditions.

As long as price holds above these demand zones, the medium-term bullish structure remains intact.

Liquidity & Forward Expectations

To the upside, the market still has room to expand toward prior highs and the ATH liquidity area. Any short-term pullback, if it occurs, may simply act as a reset before continuation — especially while macro volatility remains elevated.

Reminder: strong trends rarely move in a straight line. Pauses and retracements are normal and often offer better participation than chasing price at the highs.

Trading Bias

Primary bias: Buy pullbacks in line with the trend; avoid FOMO entries near the top.

Key zones to watch:

4812: shallow pullback / momentum continuation zone

4750–4755: deeper pullback into 0.618 + trendline confluence

Preferred monitoring timeframe: H1–H4 to reduce noise

Risk management remains critical given the market’s sensitivity to news flow and cross-asset swings.

Refer to the accompanying chart for a detailed view of the structure, FVG, and key pullback zones.

Follow the TradingView channel to get early updates and join the discussion on market structure and trade ideas.

XAUUSD (H4) – Liam PlanMacro tailwinds remain, but price is extended | Trade reactions, not emotions

Quick summary

Gold remains supported by a strong macro backdrop:

📌 Fed hold probability in January: 95% → USD/yields capped.

📌 Geopolitical tension (Kremlin praising Trump over Greenland, NATO cracks) adds safe-haven demand.

Technically, price has pushed aggressively into upper expansion territory. At this stage, the edge is reaction trading at key levels, not chasing strength.

Macro context (why volatility stays elevated)

With the Fed very likely holding rates in January, markets are highly sensitive to USD and yield shifts.

Rising geopolitical noise keeps gold bid, but also increases the risk of headline-driven spikes and liquidity sweeps.

➡️ Conclusion: directional bias is secondary to execution quality. Trade levels + confirmation only.

Technical view (H4 – based on the chart)

Gold is trading inside a rising channel, currently extended toward the upper Fibonacci expansion.

Key levels to focus on:

✅ Major sell Fibonacci / wave top: 4950 – 4960

✅ Sell wave B / reaction zone: 4825 – 4835

✅ Buy entry / structure support: 4730 – 4740

✅ Sell-side liquidity: 4520 – 4550 (below structure)

Price is stretched above the mid-channel — conditions where pullbacks and rotations are statistically more likely than clean continuation.

Trading scenarios (Liam style: trade the level) 1️⃣ SELL scenarios (priority – reaction trading)

A. SELL at Fibonacci extension (primary idea) ✅ Sell zone: 4950 – 4960 SL: above the high / fib extension TP1: 4830 TP2: 4740 TP3: 4550 (if momentum accelerates)

Logic: This is an exhaustion area aligned with wave completion and fib extension — ideal for profit-taking and mean rotation, not trend chasing.

B. SELL wave B reaction ✅ Sell: 4825 – 4835 Condition: clear rejection / bearish structure on M15–H1 TP: 4740 → 4550

Logic: Classic corrective wave zone. Good for tactical shorts within a broader volatile structure.

2️⃣ BUY scenario (secondary – only on reaction)

BUY at structural support ✅ Buy zone: 4730 – 4740 Condition: hold + bullish reaction (HL / rejection / MSS on lower TF) TP: 4825 → 4950 (scale out)

Logic: This is a key flip zone inside the rising channel. BUY only if price proves acceptance — no blind dip buying.

Key notes (risk control)

Market is extended → expect fake breaks and sharp pullbacks.

Avoid mid-range entries between levels.

Reduce size during geopolitical headlines.

Confirmation > prediction.

What’s your play: selling the 4950 fib extension, or waiting for a clean reaction at 4730–4740 before reassessing?

— Liam

XAUUSD H1 – Range Bound MarketSideways Consolidation, Waiting for a Range Break

Gold on the H1 timeframe is currently trading inside a clear sideways range near the ATH, showing signs of balance after the recent impulsive move. At this stage, the market is not trending — it is building liquidity and waiting for a breakout.

MARKET STRUCTURE

Price is consolidating inside a wide sideways box after failing to continue higher from the ATH.

Multiple rejections on both sides of the range confirm that neither buyers nor sellers have full control yet.

This behaviour typically appears before a volatility expansion.

KEY ZONES & LIQUIDITY

Upper range – Resistance / Breakout trigger:

~4620 – 4640

Acceptance above this zone would signal renewed bullish strength and open the path toward new highs.

Mid-range equilibrium:

Current price is hovering around the balance area, where false signals are common. Patience is required here.

Lower range – High liquidity support:

~4580 – 4590

This zone has absorbed selling pressure multiple times. A clean reaction here could support a bounce back into the range.

Deeper liquidity support:

~4515 – 4520

If the range breaks to the downside, this is where strong demand and liquidity are likely to sit.

SCENARIOS TO WATCH

Bullish breakout scenario:

Price holds above the lower range and breaks cleanly above 4620–4640.

Acceptance above the range confirms continuation toward new ATH levels.

Bearish liquidity sweep scenario:

Price sweeps below 4580–4590, tapping deeper liquidity.

A failure to reclaim the range would shift short-term bias to the downside.

SUMMARY

Current state: Sideways / consolidation

Market is compressing and building liquidity

Best trades come after the range breaks, not inside it

Let price show direction before committing

In this environment, discipline matters more than activity — wait for the breakout, and trade the reaction, not the noise.

BTCUSD · 15M · SMC BiasPrice is currently compressing inside a higher-timeframe premium discount equilibrium, respecting a clear range structure.

HTF Context

Equal highs / liquidity resting above the range highs.

Premium zone overhead aligned with prior supply + inducement.

Discount zone below marked by clean HTF demand.

LTF Narrative

Market already delivered a strong impulsive leg up.

Current consolidation suggests liquidity engineering, not continuation.

Upside push toward the equal highs is likely a liquidity grab, not acceptance.

Expectation

Sweep of buy-side liquidity into the premium zone.

Immediate reaction from supply.

Sharp displacement to the downside targeting:

Range low

Discount imbalance

HTF demand below

Execution Plan

No chasing longs in premium.

Wait for:

Liquidity sweep above highs

Bearish displacement

LTF MSS confirmation

Shorts favored post confirmation.

Targets trail into discount until opposing demand shows intent.

XAUUSD (M30) – Trading slightly below resistance level⚡️ Weekly plan using Volume Profile + Liquidity (Liam)

Quick summary:

Gold has just delivered a strong impulsive push and is now consolidating right beneath the highs, which is classic “compression” behavior before the next expansion. With macro conditions still sensitive (USD, yields, Fed expectations + geopolitical headlines), the best approach this week is don’t chase — trade liquidity zones and value areas (POC/VAL) instead.

1) Macro context (why price behaves like this)

When headlines are heavy, gold often moves in two phases:

run to buy-side liquidity → pull back to value → then decide whether to trend or range.

That’s why this week I’m focused on:

selling reactions in premium, and

buying dips into value (POC/VAL)

rather than buying mid-range candles.

2) What Volume Profile is showing on your chart

Your M30 chart highlights the key “money zones” very clearly:

🔴 SELL Liquidity (premium reaction)

4577 – 4579: a sell-liquidity / reaction area (good for scalp or short swing if rejection prints).

🟢 BUY Liquidity (shallow pullback)

4552 – 4555: the clean pullback zone to stay aligned with the bullish structure.

🟦 POC zones (value – where the market does the most business)

Buy POC 4505 – 4508: a major value magnet; price often revisits this area.

Buy POC 4474 – 4477: deeper value / reset zone if we get a sharper liquidity sweep.

➡️ Simple VP logic: POC = price magnet. When price is in premium, the probability of a rotation back into value is always on the table.

3) Trading scenarios for the week (Liam style: trade the level)

✅ Scenario A (priority): BUY the pullback into 4552–4555

Buy: 4552 – 4555

SL: below 4546

TP1: 4577 – 4579

TP2: continuation towards the highs if we break and hold above 4580 cleanly

Best “trend-following” entry if the pullback stays shallow.

✅ Scenario B (best VP entry): BUY at POC 4505–4508

Buy: 4505 – 4508

SL: below 4495

TP: 4552 → 4577 → higher if momentum returns

If the market runs liquidity and drops back into value, this is the area I want most.

✅ Scenario C (deep sweep): BUY POC 4474–4477

Buy: 4474 – 4477

SL: below 4462

TP: 4505 → 4552 → 4577

This is the “panic wick” setup — not frequent, but high quality when it appears.

⚠️ Scenario D (scalp): SELL reaction at 4577–4579

Sell (scalp): 4577 – 4579 (only with a clear rejection/weak close)

SL: above 4586

TP: 4560 → 4552

This is a short-term reaction sell, not a long-term bearish call while structure remains supported.

4) Execution checklist (to avoid getting swept)

No entries in the middle of the range — only at the zones.

Wait for M15–M30 confirmation: rejection / engulf / MSS.

Scale out in layers — highs often deliver fast up-sweeps and sharp pullbacks.

If I had to pick one “clean” setup this week: BUY the 4552–4555 pullback, and if we get a deeper reset, I’ll be waiting at POC 4505–4508.

xauusd gold tradingplan volumeprofile poc liquidity priceaction marketstructure intraday swingtrading

XAUUSD H3 – Liquidity Dominates Near ATHGold is trading in a sensitive zone just below all-time highs, where liquidity, Fibonacci extensions, and trend structure are converging. Price action suggests a controlled rotation rather than a clean breakout, with clear reaction levels on both sides.

TECHNICAL STRUCTURE

Gold remains in a broader bullish structure, with higher lows supported by an ascending trendline.

The recent impulse confirmed bullish intent, but price is now stalling near premium liquidity, signaling potential short-term distribution.

Market behavior shows buy-the-dip dynamics, while upside extensions are being tested selectively.

KEY LEVELS FROM THE CHART

Upper liquidity / extension zone:

Fibonacci 2.618 extension near the top band

This area represents profit-taking and sell-side liquidity, especially if price reaches it with weak momentum.

Sell reaction zone:

4412 – 4415 (Fibonacci 1.618 + prior ATH reaction)

A classic area for short-term rejection if price fails to break and hold above.

Buy-side focus:

4480

This level acts as a buy-on-pullback zone, aligned with trendline support and prior bullish structure.

Expected flow:

Price holds above 4480 → attempts to push toward ATH → potential extension into the 2.618 zone.

Failure to hold 4480 → rotation back toward lower structure for liquidity rebalance.

MARKET BEHAVIOR & LIQUIDITY LOGIC

Current structure favors reaction-based trading, not chasing breakouts.

Liquidity above ATH is attractive, but the market may need multiple attempts or a deeper pullback before a sustained breakout.

As long as higher lows are respected, pullbacks remain corrective.

MACRO CONTEXT – DXY BACK ABOVE 99

The US Dollar Index (DXY) has climbed above 99 for the first time since December 10, gaining 0.14% on the day.

A firmer USD can slow gold’s upside momentum in the short term.

However, gold’s ability to hold structure despite a stronger dollar highlights underlying demand and strong positioning.

This divergence suggests gold is not purely trading off USD weakness, but also off liquidity, positioning, and risk hedging flows.

SUMMARY VIEW

Gold remains structurally bullish on H3

Short-term price action is driven by liquidity near ATH

4480 is the key level defining bullish continuation

Upside extensions may require consolidation or pullbacks before a clean break

In this environment, patience and level-based execution matter more than directional bias.

XAUUSD liquidity changes amid 2026 Black Swan risksXAUUSD H1 – Liquidity Rotation Under Black Swan Risks in 2026

Gold is once again being driven by liquidity and macro uncertainty. While short-term price action is rotating around key Volume Profile levels, the broader backdrop for 2026 is increasingly shaped by underestimated systemic risks, often ignored during periods of market optimism.

TECHNICAL STRUCTURE

On H1, gold has completed a sharp downside liquidity sweep followed by a strong rebound, signalling aggressive absorption from buyers at lower levels.

Price is now rotating inside a short-term recovery structure, with liquidity clusters clearly defining where reactions are likely to occur.

The market is currently trading between sell-side liquidity above and buy-side liquidity below, favouring range-based execution rather than chasing momentum.

KEY LIQUIDITY ZONES

Sell-side liquidity / resistance:

4513 – POC sell zone

4487 – VAL sell scalping area

These zones represent heavy historical volume where sellers previously defended price. Reactions here may trigger short-term pullbacks before continuation.

Buy-side liquidity / support:

4445 – Buy POC

4409 – Major buy zone and liquidity support

These levels align with value areas where demand has stepped in strongly, making them critical zones for price stabilisation.

EXPECTED PRICE BEHAVIOUR

Short term: price is likely to continue rotating between buy and sell liquidity, creating two-way opportunities.

A sustained hold above buy-side liquidity keeps the bullish structure intact.

A clean break and acceptance above sell-side liquidity would open the path toward a retest of ATH levels.

MACRO & BLACK SWAN CONTEXT – WHY 2026 MATTERS

2026 is shaping up to be a year of hidden tail risks, including:

Increasing political pressure from President Trump on the Federal Reserve

Key elections in the US and multiple emerging markets

Elevated risk of an AI-driven technology stock bubble due to excessive valuations

Historically, environments marked by political stress, central bank credibility concerns, and asset bubbles tend to strengthen demand for hard assets, particularly gold.

BIG PICTURE VIEW

Gold remains structurally supported by liquidity and macro uncertainty

Short-term price action is tactical and level-driven

Long-term, gold continues to act as insurance against systemic and political risk

When markets underestimate risk, liquidity quietly shifts. Gold tends to move first.

XAUUSD H1 - Liquidity reaction post-geopolitical spikeGold surged strongly at the start of the week as escalating geopolitical tensions boosted safe-haven demand, while expectations of further Fed rate cuts continued to support the broader bullish narrative. From a technical perspective, price is now reacting around key liquidity and Fibonacci zones rather than trending impulsively.

TECHNICAL OVERVIEW

On H1, gold experienced a sharp sell-off followed by a recovery, forming a V-shaped reaction that suggests aggressive liquidity clearing.

Price is currently trading below prior breakdown zones, indicating that supply remains active at higher levels.

The market structure favors selling on rallies in the short term, while deeper pullbacks may attract fresh buyers.

KEY LEVELS & MARKET BEHAVIOR

Upper sell zones (supply & Fibonacci confluence):

4497 – 4500 (FVG sell zone, premium area)

4431 – 4435 (Fibonacci + former support turned resistance)

These zones represent areas where sellers previously stepped in aggressively, making them important reaction levels if price rebounds.

Lower buy-side liquidity:

4345 – 4350 (Value Low / buy-side liquidity zone)

This area aligns with trendline support and prior accumulation, making it a key level to monitor for a bullish reaction if price rotates lower.

EXPECTED PRICE FLOW

Short term: price may continue to consolidate and rotate between resistance and liquidity below, with choppy price action likely.

A rejection from the upper resistance zones could lead to another leg lower toward buy-side liquidity.

If buy-side liquidity is absorbed and defended, the market may attempt another recovery move.

FUNDAMENTAL CONTEXT

Gold’s strength is underpinned by two major factors:

Rising geopolitical risk, which increases demand for safe-haven assets.

Dovish expectations from the Federal Reserve, as markets continue to price in additional rate cuts, reducing the opportunity cost of holding non-yielding assets like gold.

These fundamentals support gold on higher timeframes, even as short-term technical corrections play out.

BIG PICTURE VIEW

Medium-term bias remains constructive due to macro and geopolitical support.

Short-term price action is driven by liquidity and reaction zones rather than trend continuation.

Patience is key—allow price to interact with major levels before committing to the next directional move.

Let the market show its hand at liquidity.

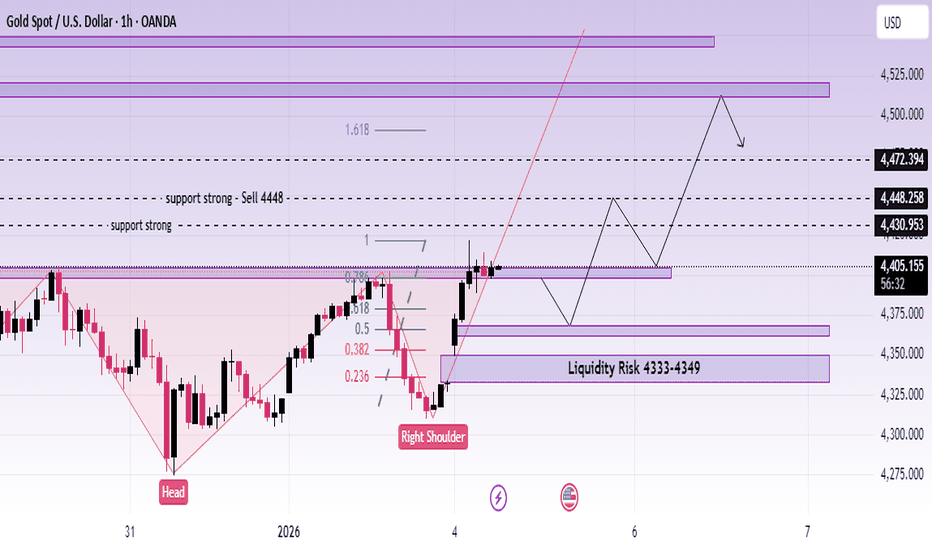

XAUUSD (H1) – Inverse Head & Shoulders formingLana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head & Shoulders

On H1, gold has completed a clean Inverse Head & Shoulders structure:

Left shoulder: Formed after the first sharp sell-off

Head: Deeper liquidity sweep, followed by strong rejection

Right shoulder: Higher low, showing weakening selling pressure

Neckline: Around the 4030–4040 resistance zone (now being tested)

The recent breakout and strong follow-through suggest buyers have regained control. As long as price holds above the neckline, the structure favors continuation to the upside.

Key levels Lana is watching

Primary buy zone – Pullback entry

Buy: 4363 – 4367

This area aligns with prior structure support and sits inside a healthy pullback zone. If price revisits and shows acceptance, it offers a good risk-to-reward buy.

Liquidity risk zone – Deeper pullback

Liquidity risk: 4333 – 4349

If volatility increases and price sweeps deeper liquidity, this zone becomes the secondary area to watch for bullish absorption.

Upside targets & resistance

High liquidity area: 4512 – 4517

ATH zone: Above the previous all-time high

These zones are expected to attract profit-taking or short-term reactions, so Lana avoids chasing price near these levels.

Fundamental context (market drivers)

Geopolitics: Rising tension after comments about potential military intervention in Colombia adds background support for gold as a safe haven.

Goldman Sachs: Views Venezuela-related developments as having limited impact on oil, keeping broader commodity sentiment stable.

ISM Manufacturing PMI (US): Any sign of slowing manufacturing can pressure USD and indirectly support gold.

Overall, fundamentals remain supportive for gold, reinforcing the bullish technical structure.

Trading plan (Lana’s approach)

Prefer buying pullbacks into 4363–4367 while structure holds.

Be patient if price dips into 4333–4349 and wait for confirmation before entering.

If price falls back below the neckline and fails to reclaim it, Lana steps aside and reassesses.

This is Lana’s personal market view and not financial advice. Please manage your own risk before trading. 💛

XAUUSD D1 – Liquidity Rotation in Bullish ChannelLiquidity Rotation Inside a Strong Bullish Channel

Gold remains in a clear long-term uptrend on the daily timeframe, trading inside a well-defined ascending channel. Recent volatility, however, suggests the market is entering a liquidity-driven correction phase rather than a trend reversal.

TECHNICAL STRUCTURE

On D1, price is still respecting the rising channel, with higher highs and higher lows intact.

The rejection from the upper channel highlights profit-taking and sell-side liquidity absorption near premium levels.

Current price action suggests a rotation between upper liquidity (distribution) and lower value zones (accumulation).

KEY LIQUIDITY ZONES TO WATCH

Sell-side liquidity (premium zone):

4480 – 4485

This area represents a strong liquidity cluster near the upper channel and prior expansion highs, where price has shown clear rejection.

Buy-side liquidity (value zones):

4180 – 4185

A psychological level and mid-channel support where buyers may re-enter if price rotates lower.

4000 – 4005

Major long-term liquidity and Fibonacci confluence near the lower channel boundary, acting as a key structural support.

EXPECTED PRICE BEHAVIOUR

Short term: price may continue to fluctuate and rebalance between liquidity pools, with choppy conditions likely.

Medium term: as long as price holds above the lower channel, pullbacks are considered corrective within the broader bullish trend.

A clean rejection from sell liquidity followed by a move into buy liquidity would be a healthy reset for continuation later.

FUNDAMENTAL & GEOPOLITICAL BACKDROP

Geopolitical risk has sharply increased after former President Trump announced a large-scale US operation against Venezuela, including the arrest of President Maduro. This event adds a new layer of uncertainty to global markets and reinforces safe-haven demand.

Historically, rising geopolitical tensions, combined with a softer US dollar environment, tend to support gold prices, especially on higher timeframes.

BIG PICTURE VIEW

Gold’s long-term bullish narrative remains intact

Current moves are driven by liquidity rotation, not weakness

Geopolitical risk could accelerate upside once the corrective phase completes

Patience remains key. Let price move between liquidity zones before committing to the next directional leg.

XAUUSD H1 - Liquidity Drives PullbackLiquidity-Driven Correction Inside a Broader Bullish Narrative

Gold is entering a technically sensitive phase after an explosive rally. While the long-term narrative remains bullish, short-term price action suggests the market is rotating around liquidity and Fibonacci extension levels rather than trending cleanly.

TECHNICAL OVERVIEW

On H1, price has transitioned from an ascending channel into a corrective structure, indicating distribution after a strong impulsive leg.

The recent sell-off broke short-term support, but downside momentum is now slowing as price approaches liquidity clusters.

Current behaviour favours range rotation and liquidity hunts instead of straight-line continuation.

PRIORITY SCENARIO – SELL ON RALLIES

Focus on selling into strong liquidity and Fibonacci extensions.

Primary sell zone: 4505 – 4510

Confluence of strong liquidity and Fibonacci 2.618 extension.

Secondary sell zone: 4230 – 4235

Fibonacci 1.618 extension and prior reaction zone.

Expected behaviour:

Price rebounds into these upper liquidity areas, fails to reclaim structure, and rotates lower as sellers defend premium levels.

ALTERNATIVE SCENARIO – BUY FROM LIQUIDITY SUPPORT

If downside liquidity is fully absorbed, look for selective buying setups.

Buy liquidity zone: 4347 – 4350

This area represents short-term value where price may stabilize and attempt a corrective bounce before the next directional decision.

KEY TECHNICAL INSIGHTS

The current move is best viewed as a technical correction, not a long-term trend reversal.

Liquidity zones and Fibonacci extensions are acting as the primary decision points.

Chasing price between zones offers poor risk-to-reward; execution should be level-based.

MACRO CONTEXT – WHY GOLD REMAINS SUPPORTED

The surge in gold prices throughout 2025 revealed what markets increasingly suspect:

Rising geopolitical instability.

A structurally weaker US dollar.

Persistent safe-haven demand.

Gold posted its strongest annual gain in 46 years, echoing the late-1970s bull market. While central banks may avoid highlighting these pressures, price action continues to reflect growing systemic uncertainty.

This macro backdrop supports gold in the medium to long term, even as short-term corrections unfold to rebalance positioning.

SUMMARY VIEW

Short term: trade the correction via liquidity and Fibonacci zones.

Medium to long term: bullish narrative remains intact.

Best edge comes from patience and execution at key levels, not directional bias alone.

Let price come to liquidity — that’s where decisions are made.

XAUUSD (H2) – Liam Plan (Jan 02)Price is compressing in a structure, wait for the trendline break to choose direction 🎯

Quick summary

After the strong bearish BOS, gold is rebounding and compressing inside a diagonal structure (triangle/flag-like). Today the clean approach is confirmation trading:

SELL only after a confirmed break of the trendline (4348–4350) as marked on your chart.

SELL reactions at the upper supply / VAL zones (4460–4463 and 4513–4518).

BUY is secondary — only if price holds the 4400–4405 key support and shows a clear reaction on lower timeframes.

Macro backdrop (CME FedWatch)

Probability Fed holds rates in January: 85.1%

Probability of a 25 bps cut in January: 14.9%

By March: probability of 25 bps cumulative cut: 51.2%, hold 42.8%, 50 bps cut 5.9%

👉 This keeps markets sensitive to USD / yields expectations. Gold can bounce technically, but volatility spikes are likely — so we stick to levels + confirmation.

Key Levels (from your chart)

✅ Sell zone 1: 4513 – 4518

✅ Sell VAL: 4460 – 4463

✅ Reaction / flip zone: 4400 – 4405

✅ Breakdown trigger: 4348 – 4350 (sell upon confirmed trendline breakout)

Trading scenarios (Liam style: trade the level)

1) SELL scenarios (priority)

A. SELL on trendline breakdown confirmation

Trigger: clean break + close below 4348–4350

Entry: sell the retest back into the broken trendline

TP1: 4320–4305

TP2: 4260–4240

TP3: deeper extension (towards the 41xx area) if momentum expands

Logic: This is the clearest “trend confirmation” on your chart. No chasing — let price confirm first.

B. SELL reaction at supply

Sell: 4460–4463 (VAL)

Stronger sell: 4513–4518 (premium supply)

Only sell with visible weakness / rejection on M15–H1.

2) BUY scenario (secondary – reaction only)

Buy zone: 4400–4405

Condition: hold the zone + print higher lows on lower TF

TP: 4460 → 4513 (scale out)

Logic: This is a key support/flip area. If it holds, price can rotate up to test supply above before the next decision.

Key notes

Compression often creates false breaks — don’t trade mid-range.

Two clean plays only: break 4348–4350 to sell with confirmation, or retrace to 4460/4513 to sell the reaction.

What’s your bias today: selling the 4348 breakdown, or waiting for 4460–4463 for a cleaner pullback sell?

XAUUSD (H1) – Early 2026 ForecastShort-term recovery inside a larger bullish cycle 💛

Quick market recap

2025 performance: Gold surged ~64%, the strongest annual gain since 1979

Recent move: Sharp year-end correction driven by profit-taking and margin adjustments, not trend reversal

Big picture: The multi-year bull market in precious metals remains intact

Fundamental context (why the trend still matters)

Despite the late-2025 pullback, the broader precious metals complex remains structurally strong. Gold, silver, platinum, and palladium all benefited from:

Fed rate-cut cycle expectations

Persistent geopolitical tensions

Strong central bank buying

Industrial demand and supply constraints (especially for silver and platinum)

Most analysts agree the recent correction was technical in nature. The long-term outlook still points toward gold potentially testing 5,000 USD/oz and silver approaching 100 USD/oz in 2026, although short-term volatility is expected to remain high.

Technical view (H1) – Based on the chart

After failing to hold above the ATH, gold experienced a sharp bearish displacement, followed by a stabilization phase near a strong support zone. Price is now attempting a recovery, but the structure suggests this is still a corrective move within a broader range.

Key observations:

Strong sell-off broke short-term bullish structure

Price is rebounding from major support, forming a potential higher low

Overhead liquidity and Fibonacci zones remain key reaction areas

Key levels Lana is watching

Buy zone – Strong liquidity support

Buy: 4345 – 4350

This is a strong liquidity zone where price already reacted. If price revisits this area and holds structure, it offers a favorable risk-to-reward buy aligned with the larger bullish cycle.

Sell zone – Short-term resistance (scalping)

Sell scalping: 4332 – 4336

This zone aligns with short-term resistance and Fibonacci reaction levels. If price fails here, a brief pullback toward support is possible.

Important overhead liquidity

Key liquidity: 4404 area

A clean break and hold above this level would signal stronger bullish continuation toward higher targets.

Scenarios to consider

Scenario 1 – Range correction continues

Price reacts at short-term resistance, rotates back into liquidity, and builds a base before the next directional move.

Scenario 2 – Bullish continuation resumes

A break above overhead liquidity opens the path toward higher levels, potentially retesting prior highs as the new year unfolds.

Lana’s approach 🌿

Trade zones, not headlines

Focus on price reaction at liquidity levels

Accept short-term volatility while respecting the long-term bullish structure

This analysis reflects Lana’s personal market view and is not financial advice. Please manage risk carefully and trade responsibly 💛

XAUUSD (H1) – Short-term Correction After ATH Lana focuses on sell rallies, waiting for a deeper buy zone 💛

Quick overview

Market state: Sharp sell-off after failing to hold above ATH

Timeframe: H1

Current structure: Strong bearish impulse → corrective rebound in progress

Intraday bias: Sell on pullbacks, buy only at major support

Technical picture (based on the chart)

Gold printed a clear distribution top near ATH, followed by a strong bearish displacement. This move broke the short-term bullish structure and shifted momentum to the downside.

Price is now attempting a technical rebound, but so far this looks corrective rather than impulsive. As long as price stays below key resistance, Lana treats this as a sell-the-rally environment.

Key observations:

Strong bearish candle confirms loss of bullish control

Current rebound is moving into prior liquidity + Fibonacci reaction zone

Market is likely building a lower high before the next move

Key levels to trade

Sell zone – priority setup

Sell: 4392 – 4395

This zone aligns with:

Prior structure resistance

Fibonacci retracement area

Liquidity resting above current price

If price reaches this zone and shows rejection, Lana will look for sell continuation.

Buy zone – only at strong support

Buy: 4275 – 4278

This is a higher-timeframe support zone and the first area where buyers may attempt to step back in. Lana only considers buys here if price shows clear reaction and stabilization.

Intraday scenarios

Scenario 1 – Rejection at resistance (preferred)

Price retraces into 4392–4395, fails to break higher, and rolls over → continuation to the downside, targeting deeper liquidity.

Scenario 2 – Deeper correction then recovery

If selling pressure extends, price may sweep liquidity into 4275–4278 before forming a base for a larger rebound into the new year.

Market tone

The recent move reflects profit-taking and risk reduction after an extended rally. With year-end liquidity thinning out, price action can remain volatile and deceptive, making zone-based trading essential.

This analysis reflects Lana’s technical view and is not financial advice. Always manage your own risk and wait for confirmation before entering trades 💛

XAUUSD (H1) – Liam View: Strong Bullish Breakout→ short-term bearish shift, prefer selling the pullback | Quick reaction buy at 4330–4333

Quick summary

Gold just printed a very aggressive dump with clear BOS (Break of Structure) — a short-term bearish shift is now in play. Price is currently in a technical rebound, so the cleaner plan is:

Don’t chase shorts at the lows

Wait for a pullback into 4458–4462 to sell from a premium supply zone

If price sweeps back down, look for a quick reaction buy at 4330–4333

1) Technical view (based on your chart)

The sell-off looks like a classic liquidity dump: large bearish candles, multiple supports broken → confirms bearish pressure intraday.

After a dump, the market often retraces into supply (re-distribution) before the next leg.

The 4330–4333 area is marked as a support that already “tested liquidity” — it can still provide a bounce, but it’s more of a scalp zone, not a full reversal yet.

2) Key Levels

✅ Sell zone: 4458 – 4462 (supply / pullback short)

✅ Buy zone: 4330 – 4333 (support / quick reaction)

3) Trading scenarios (Liam style: trade the level)

Scenario A (priority): SELL the pullback

✅ Sell: 4458 – 4462

SL guide: 4470 (or above the most recent lower-TF swing high)

TP1: 4400 – 4390

TP2: 4333

TP3: extension lower if structure continues to break down

Logic: After a strong BOS, 4458–4462 is where you get a better short entry — avoid selling late.

Scenario B: BUY reaction at support (scalp only)

✅ Buy: 4330 – 4333

SL guide: 4322–4325

TP: 4370 → 4400 (scale out)

Logic: This zone can spark a technical bounce. Only buy with clear holding signals on lower timeframes (M5–M15) — no catching falling knives.

4) Confirmation rules (avoid noise)

If price reaches 4458–4462 and fails to reclaim above → SELL bias stays strong.

If 4330 breaks and closes below → stop looking for buys and focus on pullback sells.

5) Risk notes

No mid-range entries — only act at 4330–4333 or 4458–4462.

Risk per trade: max 1–2%.

After a dump, spreads and wicks can expand — reduce size.

Which side are you leaning today: selling 4458–4462, or waiting for 4330–4333 to buy the reaction bounce?

XAUUSD (H1) – Bearish Correction After ATHLana focuses on selling rallies, waiting for a deeper buying zone 💛

Quick overview

Market state: Sharp sell-off after failing to hold above ATH

Timeframe: H1

Current structure: Strong bearish impulse → corrective rebound in progress

Intraday bias: Sell on pullbacks, buy only at major support

Technical picture (based on the chart)

Gold printed a clear distribution top near ATH, followed by a strong bearish displacement. This move broke the short-term bullish structure and shifted momentum to the downside.

Price is now attempting a technical rebound, but so far this looks corrective rather than impulsive. As long as price stays below key resistance, Lana treats this as a sell-the-rally environment.

Key observations:

Strong bearish candle confirms loss of bullish control

Current rebound is moving into prior liquidity + Fibonacci reaction zone

Market is likely building a lower high before the next move

Key levels to trade

Sell zone – priority setup

Sell: 4392 – 4395

This zone aligns with:

Prior structure resistance

Fibonacci retracement area

Liquidity resting above current price

If price reaches this zone and shows rejection, Lana will look for sell continuation.

Buy zone – only at strong support

Buy: 4275 – 4278

This is a higher-timeframe support zone and the first area where buyers may attempt to step back in. Lana only considers buys here if price shows clear reaction and stabilization.

Intraday scenarios

Scenario 1 – Rejection at resistance (preferred)

Price retraces into 4392–4395, fails to break higher, and rolls over → continuation to the downside, targeting deeper liquidity.

Scenario 2 – Deeper correction then recovery

If selling pressure extends, price may sweep liquidity into 4275–4278 before forming a base for a larger rebound into the new year.

Market tone

The recent move reflects profit-taking and risk reduction after an extended rally. With year-end liquidity thinning out, price action can remain volatile and deceptive, making zone-based trading essential.

This analysis reflects Lana’s technical view and is not financial advice. Always manage your own risk and wait for confirmation before entering trades 💛

Weekly Analysis Nifty....Here is the weekly analysis of nifty.. please try to learn from the various topics discussed in it..

Please do follow me if you liked the idea💡...

Disclaimer ⚠️: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions ⚠️⚠️.

Weekly analysis of XAUUS/Gold with buy and sell scenarios...Last week gold moved in a range, as we analyzed and closed below the high of previous week. Weekly candle is indecision candle and now price is near to all time high level. Coming week, we may see a range bound market crating both buy and sell side scenario till price break all time high with volume and conviction. We should track price movement cautiously within the range.

We may also witness a breakout of all time high if market and global events/news support it….

1. Price has created higher highs in lower time frames and created micro structures.

2. Now it is choppy till breakout the all-time high or support level.

3. Price is continuously running above EMAs confirming up move for now.

4. There is a POI nesting multiple PD arrays including daily FVG. We may see reversal from this level.

5. Most probably price will take liquidity of FVG/RDRB level and create MSS/CISD/TS/iFVG in LTF.

6. Price should show rejection/reversal in respective LTF (1h/15m) at FVG zone.

7. Take the trade only once clear entry model i.e. turtle soup. iFVG break, CDS or MSS happens on LTF

All these combinations are signaling a high probability and ~8R trade scenario.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.

Weekly Analysis of BTC with Buy/Sell scenarios...BTC prediction of last week just worked perfectly well and market kept in consolidation mode itself. BTC is still in consolidation zone and may spend some more days. It may develop ABC pattern or reversal at identified daily FVG level, if price has to change its delivery and take turn from here. This zone is kind of make or break. If price is not able to sustain and breakdown, then it may witness ~65-70K levels as well.

We hope for reversal from this level as price is developing the pattern at higher time frame.

1. Price has taken liquidity or 82K and almost touched 80K.

2. It has inversed 1Day FVG and now price is consolidating in the range between EMAs.

3. We may expect price retracement till 1D iFVG and then reversal.

4. Before to that we may see sweep of 92900 (1D CISD) level and then a retracement short trade till 1D FVG

5. Most probably price will take liquidity of FVG/RDRB level and create MSS/CISD/TS/iFVG in LTF.

6. Price should show rejection/reversal in respective LTF (5m/15m) at FVG zone.

7. Take the trade only once clear entry model i.e. turtle soup. iFVG break, CDS or MSS happens on LTF

All these combinations are signaling a high probability and ~6R trade scenario.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Join me on live stream for real time update.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.