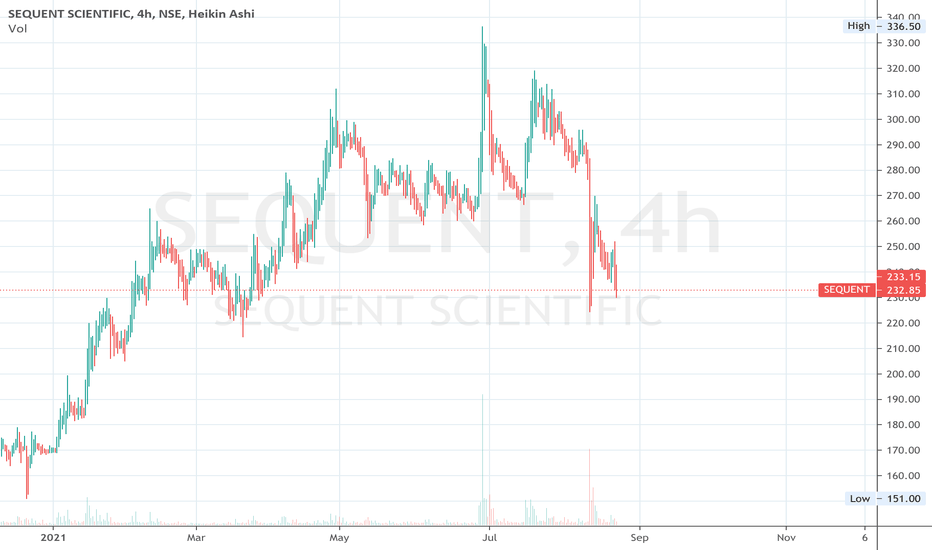

Long Sequent ScientificSequent Scientific

NSE:SEQUENT

Cmp - 232

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 500

T2 - Open, Review at 500

Expected Holding Period - 12 months or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Long-term

Long Greenply IndustriesGreenply Industries

NSE:GREENPLY

Cmp - 172

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 300

T2 - Open, Review at 300

Expected Holding Period - 18 months or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Support at 1065Best stock for Long Term.

OPM - 63%

ROE - 25%

ROCE - 32.4%

ROIC - 27.5%

SALES 3Y - 22%

PROFIT 3Y - 25%

At this point many investors are in panic because of this stock going into ASM list. Any stock goes into ASM list if there is an unusual price action in very short duration of time.

At this moment just have patience. And wait for a reversal.

LOOKS TOO GOOD TO ACCUMULATE AT THESE LEVELS!!!This simply looks too good, both, technically and fundamentally as well, the formations are good, stock seems to be retesting the breakout levels and this is considered to be one of the best times to get into any stock, a buy is strongly recommended in the bracket of 1010-1050 with a stop-loss of 980 for higher targets.

Happy Investing :)

STAR CEMENT GOING TO HIT AGAIN 131 SOONOn the weekly chart, the Share was near to an important resistance level on a closing basis. if he holds it and closes above 115 then it going to test the next level 131 in the near future as per the chart and diagram shown above.

Short term target is 121 from the current level

Long term target is 131/140 in 3 to 6 months.

Long RaymondRaymond Ltd

Cmp - 413

Stop - Nil

Expectation -

T1 - 1200

T2 - Open, Review at 1200

Expected Holding Period - 2 years or earlier for T1

View:- Positional/Investment

Can go for SEP mode

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

IOC LONG-TERM BET, PRICE-ACTION,VOLUME PROFILE 1WDisclaimer-:

1. Long-Term Bets can be solely made from technical analysis if done correctly. Nonetheless this can be used in combination with Fundamental Analysis. So readers feel free to comment fundamental ideas if any, either in support of long or short, both will be highly appreciated.

2. **FOR WHOM VOLUME PROFILE AND MY METHOD IS A LITTLE NEW OR BLURRY . I WILL SOON PUT UP AN EDUCATIONAL POST WITH DETAILS AND EXAMPLES. WE CAN HAVE A SERIES OF DISCUSSIONS THERE TOO. DO FOLLOW MY ACCOUNT TO GET NOTIFIED.

3. Do ask your questions in the comments if any.

Firstly

During the violet region IOC went up. Since this was a smooth up-move with almost no sideways region in-between the move until it reached the all time high 224 level. After which it stayed for a prolonged sideways (distribution) and then fell smoothly but very significantly for a long time.

Volume Profile -: can be used to identify potential support and resistance lines. So by using TRADINGVIEW PRO FIXED RANGE VOLUME PROFILE. I tried to identify all the important levels (resistance) while the stock was falling. Moreover when volume of historical price levels is compared to current ones we can identify probable accumulation or distribution regions and enter before the big move happens.

IMPORTANT OBSERVATIONS

1. Current Volume is very high compared to previous volume when the stock was falling. This signifies current region is important and breakout from this region will give a strong up-move. Moreover current movement is in the form of up-sloping channel so definitely an accumulation is taking place.

2. Above 108 level the volume at prices is relatively low which means there are insignificant or weak resistance levels. That means once NSE:IOC breaks out of 108 or 148 level we should expect a strong rally with less and weak obstacles(resistance).

3. We need to consider the volume from only 24Apr-17 to 9Mar-20 because thats the time when stock was falling.

TARGET WITH LOGIC

1. Since the all the time high level, 224-230, stock has been falling with very low volume . While now the volume of accumulation is too high, so there is a high chance it can reach the all-time high. Moreover it might even go more than that, but it depends what happens after the breakout.

ENTRY

1. Entry above 108 level at CMP is good enough since 108 was one of the resistance levels. But in this case stop-loss should be placed conservatively at around 71 level.

Since it is a long-term bet, placing tight stop-loss is like deliberately inviting failure. So a conservative and wide stop-loss will be better.

2. Another way is to enter after 140/148 level breakout for those who want extra confirmation.

3. Third and always the best way is position sizing. Enter partially now and add more with confirmation.

*STOP-LOSS should be trailed as per your strategy. One of the best is to trail with Moving Average in 1D timeframe with ATR( Average True Range ) as a buffer.

EXIT

Sometimes we have to exit before target is reached if there is bearishness. Following can be the clues of bearishness-:

1. If there is bearish candlestick pattern in 1W timeframe, stop-loss can be trailed to a nearby support level .(Like Candle Low)

2. If there is RSI Divergence in 1W timeframe, better to exit at close of 1W since afterwards there can be long consolidation or reversal.

3. If the trailing stop-loss is hit, please exit

**I WILL POST NECESSARY , SIGNIFICANT CHANGES IN THIS THREAD LIKE ADDITION TO POSITION, EXIT SIGNALS ETC.

TO AVOID MISSING OUT ON UPDATES PLEASE REMEMBER TO LIKE AND FOLLOW THE POST AND MY ACCOUNT.

**YOU CAN TURN ON NOTIFICATION TO BE UPDATED OF CHANGES

**ANY COMMENT ON THE ANALYSIS WILL BE HIGHLY APPRECIATED.

NSE:IOC

ETHERIUM/USD ( educational purpose only)Etherium is in a bullish trend after a long time , it have given clearly a breakouts in resistances zones in 1 day time frame and also a breakout in a parallel channel in one hour time frame , volumes are increasing day by day , getting ready soon for another all time high

Emami Paper Mills - Long Time Frame Analysis Levels are marked on the chart

Stock has been following 50 ema and 100 ema is acting as amazing support.

If you like the analysis, do leave a like and follow for more such content coming up.

The analysis is my POV , hope you got bucks in your pocket to consult a financial advisor before investing :P :)

HAPPY TRADING!!!

GAIL - Long1. One year time frame, the stock is uptrend.

2. Formed ascending channel.

3. FIIs has increased 8.5% their holding in June 2021 Quarter.

4. Company excepted to give good returns near quarters.

Disclaimer : This is NOT investment advice. This post is meant for learning and educational purposes only.

RELIANCE Short. Trying to get back into the long term channel. Reliance is moving in a cyclical pattern since it made ATH. What must be done? I'll answer few of the queries regarding this stock.

From 2009 till 2017, this stock was flat, trading inside a horizontal channel (not visible in the chart). After 8 years, it made a move, and from 2017 till 2020 it followed an ascending channel (shown in the chart). In 2020, it broke this channel twice on both sides. Currently, after making the exceptional up-move, due to continues news flow (and excess liquidity, of-course), it has been testing and bouncing form the upper-band of the long term ascending channel. It has tried twice to break and get inside the channel. Rest of the things, the stock itself is telling the story.

Long Term View:

For all those who missed and waiting to enter for long term investment, the best price and time will be when it will test the lower band of the ascending channel. Will that happen? In my opinion, yes, it will break the upper band and come inside the channel when it will test it again for the third time. Generally (not always true), any support or resistance is broken on the odd attempt. This is an ideal scenario, when there is no new flow, else it might again bounce from the upper band of the channel.

Short Term View:

In short term (4-12 weeks), this seems bearish, not only because of all the reasons I explained above, but also because of the depleting RSI on the weekly time frame. The exuberant mood has pushed it to trade at current level, but we know everything gets normalized with time.

Very Short Term View:

It should come to 2005, if the weekly candle closes below 2070 this week. The two recent downfall, and the Fibonacci extension suggest that 2000 level shall be tested in 1-3 weeks, if that breaks, then 1960-80 (the variation is because of unknown time factor) will act as a support (upper band of ascending channel), if that also breaks, then 1930 will act as a support. This short term idea shall be considered invalidated, if weekly candle closes above 2120.

Disclaimer: The information provided herein is for educational purpose. Please consult your financial advisor before making any decision.

If you like the idea, be generous to like it, and share it with others. Comments and Criticism are welcome.