Niftyprediction

NIFTY : Detailed Intraday Trading Plan | 30-Jan-2026

(Timeframe: 15-Min | Index: NIFTY 50 | Options Friendly)

🔑 Key Reference Levels (From Chart)

🔸 25,670 – Last Intraday Resistance (Major Supply Zone)

🔸 25,509 – 25,564 – Opening Resistance / Support Zone (Decision Area)

🔸 25,382 – 25,384 – Immediate Opening Support

🔸 25,273 – Gap-Down Opening Support

🔸 25,162 – Last Intraday Support (Demand Zone)

🧠 Market Context & Psychology

NIFTY has shown strong recovery with higher highs and higher lows, indicating bullish intent. However, price is approaching important intraday resistance zones, where profit booking and fresh selling pressure can emerge.

👉 Hence, reaction at opening zones will decide the day’s direction.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening above ~25,520–25,550)

🔹 Market Psychology

A big gap up shows overnight bullish sentiment, but smart money often waits near resistance to test buyers’ strength.

🔹 Trading Plan

🟢 If price holds above 25,550 on 15-min closing:

🟢 Expect trend continuation towards 25,670

🟢 Look for Call buying / Bull Call Spread

🔻 If price fails to sustain above 25,550:

🔻 Expect gap-fill or pullback towards 25,500 – 25,382

🔻 Avoid chasing calls at open

🔹 Why this works

🧠 Gap-up buyers are emotional; institutions wait for acceptance above resistance before pushing higher.

➖ Scenario 2: FLAT Opening

(Opening between 25,450 – 25,520)

🔹 Market Psychology

Flat opening indicates indecision. Market will first hunt liquidity on either side.

🔹 Trading Plan

🟢 Above 25,509–25,564 zone with volume:

🟢 Bias turns bullish → Targets 25,670

🟢 Prefer Call spreads or scalping calls

🔻 Below 25,382 support on 15-min close:

🔻 Expect short-term weakness towards 25,273

🔻 Consider Put buying / Bear Put Spread

🔹 Why this works

🧠 Flat opens usually expand after support or resistance breakdown — patience gives better risk-reward.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near or below ~25,273)

🔹 Market Psychology

Gap down triggers panic selling, but strong supports attract dip buyers.

🔹 Trading Plan

🟢 If 25,273 holds with rejection wicks:

🟢 Expect mean reversion bounce towards 25,382 – 25,509

🟢 Suitable for short-covering trades

🔻 If 25,273 breaks decisively:

🔻 Downside opens till 25,162

🔻 Favor Put buying with strict SL

🔹 Why this works

🧠 Big supports are watched by institutions; breakdown confirms supply dominance.

🛡️ Risk Management Tips for Options Traders

🟢 Trade only after first 15-min candle closes

🟢 Avoid over-trading near opening volatility

🟢 Use spreads instead of naked buying in high VIX

🟢 Risk max 1–2% capital per trade

🟢 Book partial profits near resistance/support levels

🟢 Avoid revenge trades ❌

🧾 Summary & Conclusion

📌 NIFTY remains structurally bullish, but approaching critical resistance zones

📌 Opening behavior around 25,509–25,564 will be the key trigger

📌 Trade reaction, not prediction

📌 Focus on price acceptance and 15-min confirmation

👉 Discipline + Patience = Consistency 💪📈

⚠️ Disclaimer

This analysis is for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trade.

Trading in the stock market involves risk.

NIFTY KEY LEVELS FOR 30.01.2026NIFTY KEY LEVELS FOR 30.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 29/01/2026Nifty is expected to open on a flat to mildly positive note, indicating stability after the recent recovery from lower levels. The index is currently trading around the 25340–25350 zone, which is an important intraday pivot. A flat opening near this level suggests that the market is waiting for fresh cues before committing to a directional move. Volatility may remain moderate in the initial phase, with price action largely driven by how Nifty behaves around key support and resistance zones.

From a technical structure point of view, Nifty has shown a decent pullback from the 25000 support area, where strong buying interest was seen earlier. This bounce indicates that buyers are still active at lower levels. However, the upside is capped near the 25450–25500 resistance zone, which has repeatedly acted as a supply area. Until this zone is decisively broken, the index may continue to trade in a defined range, offering selective intraday opportunities rather than trending moves.

On the bullish side, if Nifty manages to sustain above 25250 on a 15-minute closing basis, it would indicate strength and continuation of the short-term upmove. In this scenario, long positions can be considered above 25250 with an initial target of 25350. If momentum builds further, the index can move toward 25400 and then 25450+, where partial profit booking is advisable due to expected selling pressure. A strong close above 25450 would further improve the bullish outlook for the coming sessions.

On the downside, failure to hold above 25200 would weaken the immediate structure. If Nifty breaks and sustains below 25200, it may trigger a short-term correction. In such a case, downside targets of 25100 and 25050 come into play, followed by the psychological 25000 level. The 25000–25050 zone remains a crucial support area, where fresh buying or a reversal attempt can be expected. A clean breakdown below 25000 would increase bearish momentum and may lead to deeper correction, though that seems less likely without strong negative cues.

For intraday traders, the zone between 25200 and 25250 should be treated as a wait-and-watch area, as price action here can be choppy and directionless. The best trades are expected only after a clear breakout above resistance or a confirmed breakdown below support. Strict stop-loss, partial profit booking, and disciplined position sizing are essential, as the market is still in a consolidation-to-reversal phase rather than a strong trend.

Overall, Nifty is positioned at a crucial juncture. Holding above 25250 keeps the bias mildly positive, while a break below 25200 shifts the bias toward a short-term corrective move. The session is likely to reward traders who focus on levels, confirmation, and risk management rather than aggressive directional bets.

#BANKNIFTY PE & CE Levels(30/01/2026)Bank Nifty is expected to open on a flat note, indicating a pause after the recent sharp upside move. The index is currently hovering near the 59950–60000 zone, which is acting as an important decision-making area. A flat opening around this range suggests that the market is digesting recent gains and waiting for confirmation before choosing the next direction. Early session price action may remain range-bound, with whipsaws possible near key intraday levels.

From a technical perspective, Bank Nifty has shown strong bullish momentum over the last few sessions, recovering sharply from lower support zones near 59000–59200. This bounce reflects aggressive buying interest and short covering, which has helped the index reclaim crucial resistance levels. However, the zone around 60000–60050 remains a major supply area. Unless the index sustains above this level with strong volumes, upside continuation may face temporary hurdles.

On the bullish side, if Bank Nifty manages to hold above 59550–59600 and shows strength above 60050, fresh long positions can be considered. A sustained move above 60050 may open the path for upside targets of 60250, 60350, and potentially 60450+ in extension. Traders should look for a strong 15-minute close above resistance to avoid false breakouts. Partial profit booking near each target is advisable, given the recent sharp rally.

On the bearish or corrective side, rejection near the 60000–60050 zone can lead to profit booking. If Bank Nifty slips below 59950–59900, short-term weakness may emerge, dragging the index toward 59750 and 59650. Further breakdown below 59450 would indicate a deeper correction, with downside targets around 59250, 59150, and 59050. The 59000–59050 zone remains a strong support area, where buyers are expected to re-enter if the decline is gradual.

Overall, the structure remains bullish as long as Bank Nifty holds above 59500, but the current flat opening hints at consolidation rather than an immediate trending move. Traders should remain patient in the opening hour, avoid chasing prices, and focus on clear break-and-sustain setups. Strict stop-loss management and disciplined execution will be crucial, as volatility may increase once the range resolves in either direction.

NIFTY KEY LEVELS FOR 29.01.2026NIFTY KEY LEVELS FOR 29.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Vedl ltd 2nd Entry price 529 tgt 750 positionalVedanta Ltd (VEDL) – Technical View

VEDL has given a strong breakout above the ₹500 resistance zone, confirming bullish momentum on the charts. The breakout is supported by improved price structure and volume expansion, indicating further upside potential.

The medium-term target is ₹750, based on the breakout range and higher-timeframe resistance projections.

For positional investors, ₹529–₹535 is a favorable buy-on-dips zone, provided the stock sustains above the ₹500 breakout level.

Fresh entries should be considered only on retracements or consolidation above support, while maintaining strict risk management.

NIFTY - Trading levels and Plan for 29-Jan-2026📊 NIFTY Trading Plan for 29-Jan-2026

(Educational & Level-Based | For Index Options Traders)

Market Principle to Remember:

Price reacts at zones where maximum traders are trapped, hedged, or emotionally committed.

Our job is not prediction — it is structured reaction 🧠📈

🟢 Scenario 1: GAP UP Opening (100+ Points) 🚀

Market Psychology:

A big gap-up often comes from overnight short covering or positive global cues. Retail traders chase breakouts emotionally, while smart money waits to sell premium or buy only after acceptance.

📌 Trading Plan:

🔹 Avoid buying immediately at market open

🔹 Let the first 15–30 minutes define direction

🔹 Mark opening range high & VWAP

🔹 Bullish bias only if price sustains above VWAP

🔹 Look for pullback + hold before Call buying

🔹 Prefer Bull Call Spread if IV is elevated

🔹 If price shows rejection near resistance, expect gap-fill or consolidation

🔹 Consider Bear Call Spread near strong resistance

🔍 Educational Insight:

Gap-up buyers are usually emotional. If price fails to sustain, institutions sell into strength, leading to sharp reversals.

🟡 Scenario 2: FLAT / RANGE Opening 😐

Market Psychology:

A flat open signals indecision. Big players wait for retail participation before initiating the real move.

📌 Trading Plan:

🔹 Mark Previous Day High (PDH) & Low (PDL)

🔹 First 30 minutes define the battle zone

🔹 Breakout with volume suggests directional move

🔹 Weak breakout often turns into a false trap

🔹 Use Straddle / Strangle near range boundaries

🔹 Deploy Iron Condor if price stays range-bound

🔹 Enter directional trade only after close + retest

🔍 Educational Insight:

Markets punish impatience. Flat opens reward traders who wait for confirmation, not anticipation.

🔴 Scenario 3: GAP DOWN Opening (100+ Points) 📉

Market Psychology:

Gap-down opens trigger panic selling. Weak hands exit early, while smart money waits for selling exhaustion.

📌 Trading Plan:

🔹 Do not sell Puts immediately at open

🔹 Observe opening candle size and volume spike

🔹 Watch how price behaves near key support zones

🔹 If support holds, expect a pullback or bounce

🔹 Buy Calls only after higher-low formation

🔹 If support breaks with volume, expect trend day down

🔹 Buy Puts on pullback toward resistance

🔹 Prefer Bear Put Spread for controlled risk

🔹 Use Call Credit Spread near resistance

🔍 Educational Insight:

Most gap-down moves start with fear but continue only when institutional selling confirms.

⚠️ Risk Management Tips for Options Traders 🛡️

🔹 Risk only 1–2% of total capital per trade

🔹 Avoid revenge trading after stop-loss hits

🔹 No fresh trades after 2:30 PM

🔹 Avoid naked option selling on event-driven days

🔹 Always check IV, Theta decay, and liquidity

🔹 Maintain minimum risk–reward of 1:2

🔹 Journal every trade — process > profits

🧠 Summary & Conclusion ✨

🔹 Gap openings offer opportunity but demand discipline

🔹 Structured trading beats emotional decisions

🔹 Price acceptance matters more than candle color

🔹 Options trading is a probability game, not prediction

🔹 Consistency comes from process, patience, and risk control

Trade like a risk manager first, trader second 💼📊

📜 Disclaimer ⚠️

This trading plan is shared strictly for educational purposes only.

I am not a SEBI registered analyst.

Trading in the stock market involves risk.

Please consult a certified financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 28.01.2026NIFTY KEY LEVELS FOR 28.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 28/01/2026A gap-up opening in Nifty 50 reflects a positive overnight sentiment, likely driven by global cues or short-covering from lower levels. However, even after the gap-up, the index is still trading within a well-defined range, which means today’s move will be highly level-based rather than a straight trending day unless a strong breakout is seen.

Market Structure & Key Zones

The 25200–25250 zone is acting as a crucial pivot area for the session. This zone has repeatedly worked as both support and resistance in the recent past, making it a decisive region for intraday direction.

If Nifty holds above 25250, it signals strength and confirms that buyers are willing to defend higher levels.

Failure to sustain above this zone may drag the index back into the lower support band.

Bullish Scenario (Above 25250)

If price sustains above 25250, long positions can be considered with a bullish bias.

Upside targets are placed at:

25350 – first resistance and intraday booking zone

25400 – minor supply area

25450+ – strong resistance and previous rejection zone

A clean break and sustain above 25450 can further strengthen bullish momentum, but near these levels, profit booking is expected. Hence, partial exits and trailing stop-loss are advised.

Bearish Scenario (Below 25200)

If the index rejects the 25250–25200 zone and slips below 25200, bearish momentum can build up quickly. In such a case, short positions become favorable with downside targets at:

25100 – first support

25050 – intraday demand zone

25000 – major psychological and technical support

A decisive breakdown below 25000 would weaken the structure further and may invite panic selling, though bounce attempts can also emerge from this level due to its psychological importance.

Trading Approach for the Day

Despite the gap-up opening, Nifty is still not in a clear trend. The index needs price acceptance above resistance to continue upward. Until then, expect volatile, two-way moves around key levels.

Best approach for today:

Avoid chasing the gap

Trade only after confirmation near support/resistance

Book partial profits at each target

Keep strict stop-losses due to whipsaw risk

Overall, the bias remains cautiously positive above 25250, while below 25200 the tone turns weak. Discipline and level-based execution will be the key to navigating today’s session successfully.

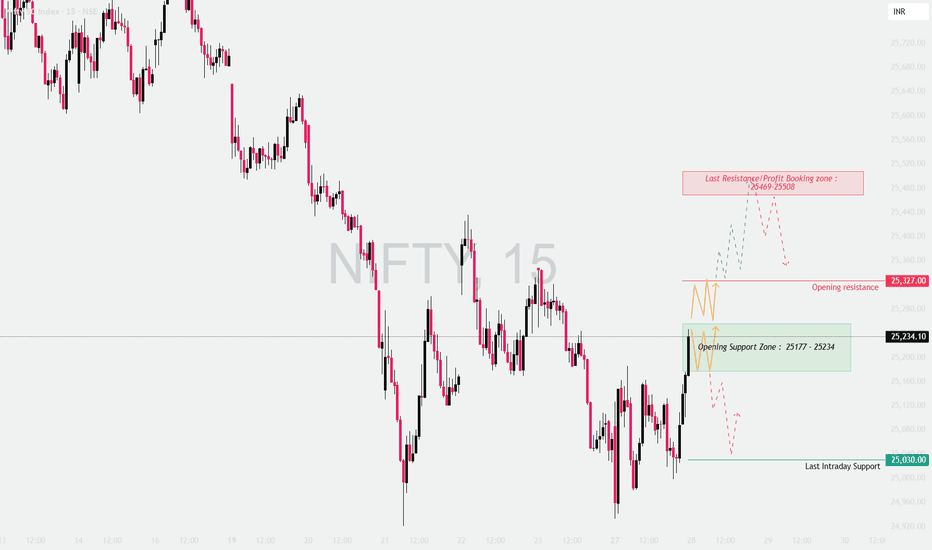

NIFTY – Detailed Intraday Trading Plan | 28 JAN 2026📊

Timeframe: 15-Min

Instrument: NIFTY (Index)

Gap Considered: 100+ Points

🔍 MARKET CONTEXT & STRUCTURE

NIFTY has shown volatile price action with sharp intraday swings, indicating active participation from both buyers and sellers.

The current structure suggests the market is transitioning from panic selling to selective buying, making key levels extremely important for the next session.

This plan is reaction-based, not prediction-based — we trade how price behaves at levels, not assumptions.

📌 IMPORTANT LEVELS FOR THE DAY

Opening Support Zone: 25,177 – 25,234

Opening Resistance: 25,327

Major Resistance / Profit Booking Zone: 25,469 – 25,508

Last Intraday Support: 25,030

🔼 SCENARIO 1: GAP UP OPENING (100+ POINTS) 🚀

A gap-up open signals short-covering or global support, but sustainability is key.

🟢 Bullish Continuation Plan

Price opens above 25,327

15-min candle closes above resistance

Retest of 25,327 holds as support

Upside targets: 25,469 → 25,508

🔴 Gap-Fill / Rejection Plan

Failure to sustain above 25,327

Long upper wicks / weak follow-through

Expect pullback towards 25,234

🧠 Trading Psychology:

Gap-up moves often trap late buyers near resistance. Acceptance above resistance confirms institutional participation.

➡️ SCENARIO 2: FLAT / NEUTRAL OPENING ⚖️

A flat open usually indicates indecision, leading to range-bound price action initially.

🟢 Upside Breakout Plan

Sustained price above 25,327

Volume expansion on breakout

Targets: 25,400 → 25,469

🔴 Downside Breakdown Plan

Breakdown below 25,177

Strong bearish 15-min candle

Targets: 25,100 → 25,030

🧠 Trading Psychology:

Flat opens create fake moves. Waiting for a 15-min confirmation avoids emotional entries and whipsaws.

🔽 SCENARIO 3: GAP DOWN OPENING (100+ POINTS) 📉

A gap-down open tests buyer strength immediately.

🟢 Support Hold / Pullback Buy

Price reacts positively from 25,177 – 25,234

Long lower wicks / higher-low structure

Bounce targets: 25,300 → 25,327

🔴 Breakdown Continuation

Acceptance below 25,177

Selling pressure increases

Targets: 25,030 → 24,950

🧠 Trading Psychology:

If key demand zones fail, sellers gain confidence and momentum accelerates.

🧠 OPTIONS TRADING STRATEGY (EDUCATIONAL)

Near resistance → Prefer Bull Call Spread, avoid naked CE buying

Inside range → Iron Condor / Short Strangle (low momentum)

Breakdown confirmed → Bear Put Spread

🛡 RISK MANAGEMENT RULES 🔐

Trade only after confirmation

Risk maximum 1–2% capital per trade

Avoid overtrading inside no-trade zones

Book partial profits near key levels

One setup = one trade

🧾 SUMMARY & CONCLUSION ✍️

25,177 – 25,234 is the most critical decision zone

Above 25,327 → buyers regain control

Below 25,177 → sellers dominate

Let price confirm direction — patience is the edge

Trade what you see, not what you feel 📊

⚠️ DISCLAIMER

This analysis is for educational purposes only.

I am not a SEBI registered analyst.

Markets involve risk — trade responsibly.

NIFTY KEY LEVELS FOR 27.01.2026NIFTY KEY LEVELS FOR 27.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 27/01/2026A gap-up opening near the 25200 zone in Nifty indicates an attempt by the market to stabilize after recent selling pressure, but the broader structure still suggests a range-bound to weak undertone unless key resistance levels are decisively crossed. The gap-up itself is not a confirmation of trend reversal; instead, it places the index right at an important decision-making area, where both buyers and sellers are active. The initial 30 minutes of trade will be critical to judge whether the gap sustains or starts filling.

From a technical perspective, the 25250–25300 region is acting as a major intraday resistance. This zone has previously seen supply and rejection, which means any upside move without volume support may struggle here. A reversal long setup becomes valid only if Nifty sustains above 25250, with follow-through buying. In such a case, upside targets can be projected towards 25350, 25400, and 25450+, where partial profit booking is advisable due to overhead supply and previous breakdown levels.

On the downside, 25200–25150 is the immediate support band. Failure to hold above this level, especially if the gap starts getting filled, can invite fresh selling pressure. A breakdown below 25200 opens up a short-selling opportunity, with downside targets around 25100, 25050, and 25000. These levels are psychologically and technically important, and price reactions here should be watched closely for potential intraday bounces.

If selling momentum intensifies and Nifty breaks below 24950, it would signal continuation of the broader bearish structure. Below this level, the index may slide towards 24850, 24800, and 24750, where stronger demand zones are placed. These lower levels can act as temporary support, but trend reversal should only be considered after clear price confirmation and structure change.

Overall, the market is showing a gap-up within a corrective or consolidation phase, not a confirmed bullish trend yet. Traders should remain level-driven, avoid chasing the opening move, and wait for price acceptance above resistance or breakdown below support. Tight stop-losses, partial profit booking, and disciplined risk management are essential, as volatility and false breakouts are likely around the current zone.

NIFTY : Trading levels and Plan for 27-Jan-2026📘 NIFTY TRADING PLAN – 27 JAN 2026

⏱ Timeframe: 15-Min

📊 Gap Considered: 100+ Points

🎯 Approach: Trade only after price acceptance / rejection

🔼 GAP UP OPENING SCENARIO 🚀

If NIFTY opens with a strong gap-up, avoid emotional buying in the first few candles.

📍 Key Resistance Zone: 25,177 – 25,230

• This zone acted as supply earlier

• High probability of consolidation or rejection

🟢 Bullish Continuation Plan:

15-min candle closes above 25,230

Follow-up candle shows higher low

Targets → 25,300 → 25,347

🔴 Rejection / Pullback Plan:

Failure to sustain above 25,177

Expect retracement towards 25,081

🧠 Options Strategy:

• Bull Call Spread (ATM CE Buy + OTM CE Sell)

• Avoid naked CE buying near resistance

➡️ FLAT / RANGE OPENING SCENARIO ⚖️

Flat open indicates indecision and option decay opportunity.

🚧 NO TRADE ZONE: 25,109 – 25,177

• Whipsaw probability is high

• Directional trades only after breakout

🟢 Upside Plan:

Acceptance above 25,177

Targets → 25,230 → 25,300

🔴 Downside Plan:

Breakdown below 25,109

Drift towards 25,081

🧠 Options Strategy:

• Short Strangle / Iron Condor

• Only with strict SL on breakout

🔽 GAP DOWN OPENING SCENARIO 📉

Gap-down open tests buyer strength early.

🟢 Opening Support Zone: 25,029 – 25,081

• Buyers may attempt initial bounce

🟢 Bounce Confirmation:

Rejection wicks near support

Higher low on 15-min chart

Upside target → 25,109 → 25,177

🔴 Breakdown Scenario:

Sustained trade below 25,029

Next downside zone → 24,854 – 24,781

🧠 Options Strategy:

• Bear Put Spread if breakdown confirms

• Avoid panic selling near support

🛡 OPTIONS RISK MANAGEMENT TIPS

Never trade inside NO-TRADE ZONE

Prefer spreads over naked options

Risk max 1–2% capital per trade

Book partial profits near levels

One trade = one idea (no revenge trading)

📌 SUMMARY & CONCLUSION

• 25,109 – 25,177 is the key decision zone

• Directional move only after acceptance

• Gap days reward patience, not speed

• Let price confirm → then execute 📊

⚠️ DISCLAIMER

This analysis is for educational purposes only.

I am not a SEBI registered analyst.

Markets involve risk—trade responsibly.

NIFTY 50 – Weekly Outlook (Key Levels & Structure)

NIFTY has decisively broken below the rising trendline that was supporting the index for the past few months. This trendline had multiple confirmations, and the breakdown signals a shift from bullish to corrective / sideways-to-bearish structure in the near term.

The index is currently testing a crucial horizontal support zone around 25,000–25,050. This level will be very important for next week’s price action.

⸻

Key Levels to Watch

Support Zones:

• 25,000 – 25,050 → Immediate and psychological support

• 24,600 – 24,650 → Major demand zone (next downside support)

• 24,350 – 24,400 → Strong long-term support if selling accelerates

Resistance Zones:

• 25,350 – 25,450 → Minor pullback resistance

• 25,750 – 25,850 → Breakdown retest zone

• 26,200 – 26,350 → Strong supply / rejection zone

⸻

Market Structure View

• As long as price remains below the broken trendline, rallies may face selling pressure.

• A sustained hold above 25,450 can lead to short-term relief bounce.

• Break and hold below 25,000 may open gates for 24,600 levels in coming sessions.

• Expect volatile moves, especially around weekly expiry and global cues.

⸻

Trading Approach

• Prefer wait & watch near support levels

• Avoid aggressive trades in the middle of the range

• Let price confirm direction before taking positional bias

⸻

Disclaimer

I am not a SEBI registered analyst/advisor.

This analysis is only for educational and informational purposes.

This is NOT a buy or sell recommendation.

Trading in the stock market involves risk. Please consult your financial advisor before taking any trade.

I am not responsible for any profit or loss arising from this analysis.

NIFTY Faces Pressure: Can 24,300 Hold?NIFTY has turned weak after falling around 2.5% on the weekly chart. The index has made a double top near 26,250, which usually means the market is finding it hard to move higher from that area.

On the weekly chart, the candles look bearish. NIFTY is currently holding near an important support around 25,000 (50 EMA). If this level breaks, the market may move lower towards 24,300 and even 23,900.

On the daily chart, NIFTY is trading below all major moving averages (20, 50, 100 & 200 EMA). In the past, whenever NIFTY stayed below these averages, it usually corrected further. Right now, there is no strong support before 24,600.

On the monthly chart, a double top is visible again, showing weakness at higher levels. However, there is decent support near 24,300–24,240, which is also close to the monthly 20 EMA.

Momentum is also weakening. RSI is showing bearish divergence on weekly and monthly charts, which suggests upside strength is fading.

Resistance Levels :- 25,200 – 25,300, 25,500, 26,250

Support Levels :- 24,987, 24,600, 24,300 – 24,240, 23,900

Overall View

As long as NIFTY stays below 25,500, the trend remains weak. Market direction will become clearer near the 24,300 support zone.

NIFTY – Intraday Structure | Breakout from Bullish ConsolidationOn 5m, 15m and 1H timeframes, NIFTY formed a bearish trendline breakout around 2 PM, followed by a pullback and formation of a bullish intraday consolidation channel.

Price is currently consolidating inside this bullish channel, and a decisive break on either side can define the next intraday move.

🔹 Intraday Plan

Upside Scenario:

Break above bullish channel

Targets:

T1: 25,500

T2: 25,550

T3: 25,650

Stop Loss: 25,300 – 25,280

Downside Scenario:

Break below bullish channel

Targets:

T1: 25,150

T2: 25,000

T3: 24,900 – 24,920

Stop Loss: 25,360 – 25,380

This is a pure intraday range-break setup based on post-breakout bullish consolidation.

⚠️ Disclaimer

I am not a SEBI registered advisor or trader.

This analysis is shared only for educational purposes.

Please consult a registered financial advisor before taking any trading decisions.

NIFTY – Multi-Timeframe Parallel Channel | Long-Term ViewOn Daily, 4H and 1H timeframes, NIFTY continues to trade inside a bullish parallel channel.

This consolidation has been active from April to December, with price repeatedly respecting both the lower and upper channel boundaries.

At the same time, the upper bullish trendline has been continuously extending from April till date, showing that the primary trend remains intact despite time-wise consolidation.

This reflects a time-based consolidation inside an ongoing uptrend, not a distribution structure.

🔹 Key Observations

Same parallel channel aligned on 1H, 4H and Daily

Consolidation range active from April to December

Upper bullish trendline continuing from April till date

Repeated rejections from both channel boundaries

RSI consistently rejects from oversold zones

Strong historical rejection zone near 24,900 – 24,500

🔹 Long-Term Plan (Positional)

Buy on Dips Zone: Around 25,000

Stop Loss (Invalidation): 24,700 – 24,600 (closing basis)

Targets:

T1: 26,000

T2: 26,400

T3: 26,500 – 26,700 (on trendline breakout)

🔹 Scenarios

Sustained breakout above 26,400 and above the upper channel can lead to further upside continuation.

Breakdown below 25,000 can turn the bias negative.

Historically, deep breakdowns have occurred only during extreme events.

Until any major impact news appears, channel continuation remains the higher-probability structure.

⚠️ Disclaimer

I am not a SEBI registered advisor or trader.

This analysis is shared only for educational purposes.

Please consult a registered financial advisor before taking any trading or investment decisions

NIFTY KEY LEVELS FOR 23.01.2026NIFTY KEY LEVELS FOR 23.01.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 23/01/2026A flat opening is expected in Nifty 50, indicating continuation of the ongoing consolidation after the recent sharp sell-off and recovery attempts. The index is currently trading in a well-defined range, where buyers and sellers are both active near key levels, resulting in choppy price action. This kind of opening usually suggests that the market is waiting for fresh triggers and confirmation before committing to a directional move, especially after multiple volatile sessions.

From a technical standpoint, the 25250–25300 zone is acting as an important intraday support and decision-making area. If Nifty manages to sustain above 25250, it signals short-term strength and opens the door for a reversal-based long trade. In such a case, upside targets can be expected near 25350, followed by 25400 and 25450+, where previous supply zones are placed. However, traders should note that this upside is likely to face resistance near 25450, which remains a strong hurdle unless there is a clear breakout with volume.

On the downside, the 25450–25400 zone continues to behave as a strong resistance area. Any rejection or failure to sustain above this region can trigger selling pressure again. Short positions can be considered near 25450–25400 with a cautious approach, aiming for pullbacks towards 25350, 25300, and 25250. This makes the upper range a selling-on-rise zone rather than a breakout-buying zone, unless price decisively closes above resistance.

If Nifty breaks and sustains below 25200, the structure may turn weak once again. A breakdown below this level can accelerate downside momentum towards 25100, 25050, and 25000, which are important psychological and technical supports. Any sharp move into these lower levels could invite temporary bounces, but overall sentiment would remain cautious as long as the index trades below the major resistance zones.

Overall, the broader view suggests a range-bound market with mild bearish undertones, where aggressive trades should be avoided. Traders are advised to focus on level-based trades, book partial profits quickly, and keep strict stop-losses. Patience will be key, as a clear directional move is likely to emerge only after Nifty breaks out decisively from this consolidation range.