Search in ideas for "MACD"

MACD CROSSOVER - Double Digit Stock - SARLAPOLY📊 Script: SARLAPOLY

📊 Sector: Textiles

📊 Industry: Textiles - Spinning - Synthetic / Blended

Key highlights: 💡⚡

📈 Script is trading at upper band of BB and giving breakout of it.

📈 MACD is giving crossover .

📈 Right now RSI is around 67.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 98.50

🟢 Target 🎯🏆 - 111

⚠️ Stoploss ☠️🚫 - 92

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

MACD Crossover - MTARTECH📊 Script: MTARTECH

📊 Sector: Aerospace & Defense

📊 Industry: Engineering

Key highlights: 💡⚡

📈 Script is trading at middle band of BB.

📈 MACD is giving crossover.

📈 Script may fill the gap.

📈 Right now RSI is around 50.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 1911

🟢 Target 🎯🏆 - 2071

⚠️ Stoploss ☠️🚫 - 1828

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

MACD Crossover - BIOCON📊 Script: BIOCON

📊 Sector: Pharmaceuticals

📊 Industry: Pharmaceuticals - Indian - Bulk Drugs

Key highlights: 💡⚡

📈 Script is trading at upper band of BB.

📈 MACD is giving crossover .

📈 Already Crossover in Double Moving Averages.

📈 Right now RSI is around 66.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 323

🟢 Target 🎯🏆 - 350

⚠️ Stoploss ☠️🚫 - 311

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

MACD Crossover - INDIGO📊 Script: INDIGO

📊 Sector: Air Transport Service

📊 Industry: Transport - Airlines

Key highlights: 💡⚡

📈 Script is trading near upper band of BB.

📈 MACD is giving crossover .

📈 Already Crossover in Double Moving Averages.

📈 Right now RSI is around 62.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 3179

🟢 Target 🎯🏆 - 3385

⚠️ Stoploss ☠️🚫 - 3072

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

MACD Crossover - HINDCOPPER📊 Script: HINDCOPPER

📊 Sector: Non Ferrous Metals

📊 Industry: Mining / Minerals / Metals

Key highlights: 💡⚡

📈 Script is trading near at middle band of BB.

📈 MACD is giving crossover .

📈 Double Moving Averages will give crossover.

📈 Right now RSI is around 59.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 281

🟢 Target 🎯🏆 - 306

⚠️ Stoploss ☠️🚫 - 269

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

MACD Crossover - SUNTECK📊 Script: SUNTECK

📊 Sector: Realty

📊 Industry: Construction

Key highlights: 💡⚡

📈 Script is trading at upper band of BB.

📈 MACD is giving crossover .

📈 Double Moving Averages giving crossover.

📈 Right now RSI is around 61.

📈 There is Formation of Symmetrical Triangle breakout soon.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 483

🟢 Target 🎯🏆 - 532

⚠️ Stoploss ☠️🚫 - 462

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

MACD bullish crossover in CUMMINSIND CUMMINSIND trading in downtrend channel since last 1 month trading session. Yesterday it reached near the resistance level of downtrend channel in same its also shows MACD bullish crossover. This indicates that more chances it will give breakout of this downtrend channel and give projected target upto 935+.

Nifty: Price Action Macd Strategy: RevisitedFree stuff -- something which we ignore in haste. Unfortunately, whatever education I have been doling out is absolutely free. So please bear with me.

Rules:

-------

Only Long trades when price > 55 EMA

Only short trades when price < 55 EMA

-------------------------------------------------------------------------------------------------------------------------------

Time Frame 1H

-------------------------------------------------------------------------------------------------------------------------------

Long Entry Preconditions:

a) Price above 55 EMA

b) MACD histogram above zero line

--Positive Divergence seen on MACD signal line (a complementary condition for High probability Entries)

Long Entry Trigger:

Price break above Significant peak fractal of previous downwave OR the break above prior peak fractal high.

Exit Strategy or Stop:

Type 1 Exit

Precondition: Negative Divergence seen on MACD signal line; and

Trigger: Break below a consolidation level or the prior minor swing low

Type 2 Exit

Hourly close below 55 EMA

Exit type I or type II whichever comes earlier

-----------------------------------------------------------------------------------------------------------------------------

Short Entry Preconditions:

a) Price below 55 EMA

b) MACD histogram below zero line

--Negative Divergence seen on MACD signal line (a complementary condition for High probability Entries)

Short Entry Trigger:

Price break below Significant fractal of previous upwave OR the break below prior swing fractal low.

Exit Strategy or Stop:

Type 1 Exit

Precondition: Positive Divergence seen on MACD signal line; and

Trigger: Break above a consolidation level or the prior minor swing high

Type 2 Exit

Hourly close above 55 EMA

Exit type I or type II whichever comes earlier

------------------------------------------------------------------------------------------------------------------------------------

# If trade exited but price shoots back piercing out of 55 EMA or is already above/below 55 EMA , a break of previous peak fractal with MACD histogram above/below zero line triggers entry again.

# Exit Strategy discussed above works well in long trades but chops in short trades. Tweaking a little by taking 1:1 or smaller targets (to previous support zones) instead of the Exit strategy may help in this issue.

Backtesting 10/2017 to 2/2018:

--------------------------------------

9896/10413 = +517

*10331/10255 = +76

*10254/10130 = +124

10344/10355 = +11

*10211/10130 = +81

*10095/10148 = -53

10323/10210 = -113

*10210/10255 = -45

10374/10469 = +95

*10409/10504 = -95

10504/11009 = +505

*10878/10781 = +97

*10511/10411 = +100

*10379/10330 = +49

10475/10478 = +3

Profit points = +1352

What I have noticed is that this strategy works very well in a trending market. It help to ride the trend to this full potential.

On short trades, we have to take profits at previous supports or else it will chop the profits. May be this is because we have been in a bull market.

I sideways market there are hits and misses.

I will try to further fine tune but keep in mind that no strategy works all the time, as visible from backtesting results.

Do hit the like button for appreciation.

Regards

Bravetotrade

ABFRL - Understanding MACD for buying and sellingMoving Average Convergence Divergence (MACD) is a technical indicator that helps investors identify price trends and potential trade reversals. It's calculated by subtracting a security's 26-day exponential moving average (EMA) from its 12-day EMA

Components of MACD:

- MACD Line - the fastest moving average (short-term EMA) : Blue line

- Signal Line - the slowest moving average (long-term EMA) : Orange line

- MACD Histogram - swings above and below a zero line, allowing bullish and bearish momentum readings to be distinguished.

- Dashed line is Zero line

From the above chart we can see:

1) On 28-03-2024 blue line crossed orange line below the zero line indicating trend reversal from bearish to bullish

2) On 22-04-2024 blue line was just above orange line and both are above zero line indicating bullish momentum

3) On 20-06-2024 blue line crossing orange line from above indicating end of bullish momentum

Price on 22-04-2024 : 231

Price on 20-06-2024 : 333

It gave 44% returns in less than 2 month

Please do hit like if you learnt from this post.

Intra Day - Analysis - Bitcoin - MACDHi,

This chart with help from Macd , one is 15 mins Macd and the other is 1 Hour Macd.

1 Hour Macd is above Zero line & hence we will look out for Buy only.

Currently the price is above Pivot Level.

And the 15 mins chart will give a clue along with EMA when to go Long.

KEI INDUSTRIES LTD. reversal in MACD.This stock shows a reversal in price as well as MACD.

Buy at 4635-4650.

1st Target- 5048

2nd Target- 5355

3rd Target- Exit immediately after price touches the upper trend-line.

Exit as per the trader's risk appetite. However, 3rd target is only for the risky traders.

Note:- This is only for educational purpose and not a recommendation.

PRICE ACTION MACD STRATEGY -- LEARN TO EARNREAD CAREFULLY TO LEARN AND EARN

Strategy backtested below for two years from 12/2/2014 to 12/2/2016

Rules:

Only Long tardes when 55 EMA is above 200 EMA

Only short trades when 55<200 EMA

Time Frame 1H

Long Entry Preconditions:

Price above 55 EMA

Positive Divergence seen on MACD signal line (for High probability Entries)

MACD histogram above zero line

Long Entry Trigger:

Price break above Significant peak fractal of previous downwave OR the break above prior peak fractal high.

Exit Strategy or Stop:

Type 1 Exit

Precondition: Negative Divergence seen on MACD signal line; and

Trigger: Break below a consolidation level or the prior minor swing low

Type 2 Exit

Hourly close below 55 EMA

Exit type I or type II whichever comes earlier

# If trade exited but price shoots back piercing out of 55 EMA or is already above 55 EMA, a break of previous peak fractal with MACD histogram above zero line triggers entry again.

# Exit Strategy discussed above works well in long trades but chops in short trades. Tweaking a little by taking 1:1 or smaller targets instead of the Exit strategy may help in this issue.

Back Testing

12/2/2014 to 12/2/2016

1) E=6283 Ex=6487 +204

2) E=6575 Ex=6723 +148

3) E=6725 S=6743 +18

4) E=6749 Ex=6808 +59

5) E=6741 Ex=7269 +528

6) E=7345 Ex=7589 +244

7) E=7572 S=7530 -42

8) E=7548 Ex=7740 +192

9) E=7734 Ex=7770 +36

10) E=7709 Ex=8056 +347

11) E=8051 Ex=8064 +13

12) E=7815 Ex=7759* +56

13) E=7928 Ex= 8364 +436

14) E=8455 Ex=8521 +66

15) E=8152 Ex=7995* +157

16) E=8206 S=8270* -64

17) E=8148 S=8281* -133

18) E=8531 Ex=8861 +330

19) E=8681 Ex=8791 +110

20) E=8840 Ex=8862 +22

21) E=9612 Ex=8413* +1199

22) E=8808 S=8732 -76

23) E=8284 S=8311* -27

24) E=8270 Ex=8066* +204

25) E=8421 S=8390 -31

26) E=8428 Ex=8557 +129

27) E=8461 Ex=8549 +88

28) E=8322 Ex=7559* +763

29) E=8180 Ex=8210 +30

30) E=7988 Ex=7784* +204

31) E=7812 Ex=7682* +130

32) E=7945 S=7905 -40

33) E=7556 Ex=7403* +153

34) E=7402 S=7463* -61

35) E=7255 Ex=6884 +371

#Trades with asterisk mark (*) at the end are short trades.

Winning Trades= 27

Profit= 6237 points

Losing Trades= 8

Loss=474 points

Net points= 5763

Profit with one lot= Rs4,32,225

I have also tested this strategy for current year but I ll update the results later as its very time consuming.

It has been observed that the strategy keeps us in a trade as long as trend is strong. The losses made in the strategy are quite manageable due to price action and divergence combination.

Maximum loss made in a trade was 133 points and maximum profit was 1199 points.

I ll further test this strategy; and the comments of fellow traders can surely help in fine tuning.

I have noticed some fellows make carbon copies of already published ideas :) Its a highly undesirable practice and should be avoided by all means. B'coz readers can differentiate between the original idea and the copied one. Hope I made my point.

Trade safe and stay healthy.

Do hit like and comment.

Best Regards

Bravetotrade

Torrent Power MACD crossoverThe price has given a reversal signal from the lower trendline of the channel with MACD Crossover Above Signal Line. Below are some possitive points for a possible bullish move:

=> There is a strong momentum as price is above short, medium and long term moving average(MA).

=> There is a strong growth in QoQ EPS in recent results.

=> Good quarterly growth in the recent results.

=> Growth in Net Profit with increasing Profit Margin (QoQ)

=> Increasing profits every quarter for the past 2 quarters.

Buy between 1763-1800.

Target 1- 1911, Target 2- 1990 and T3- 2090

SL- 1690. Safe traders can exit on Target 2.

Note- This is not a recommendation but only for educational purpose.

Moving Averages + MACD Crossover - DEVYANI📊 Script: DEVYANI

📊 Sector: Quick Service Restaurant

📊 Industry: Hotels

Key highlights: 💡⚡

📈 Script is trading at upper band of BB and giving Breakout of it.

📈 MACD is giving crossover .

📈 Double Moving Averages are giving crossover.

📈 Right now RSI is around 70.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 170

🟢 Target 🎯🏆 - 191

⚠️ Stoploss ☠️🚫 - 160

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

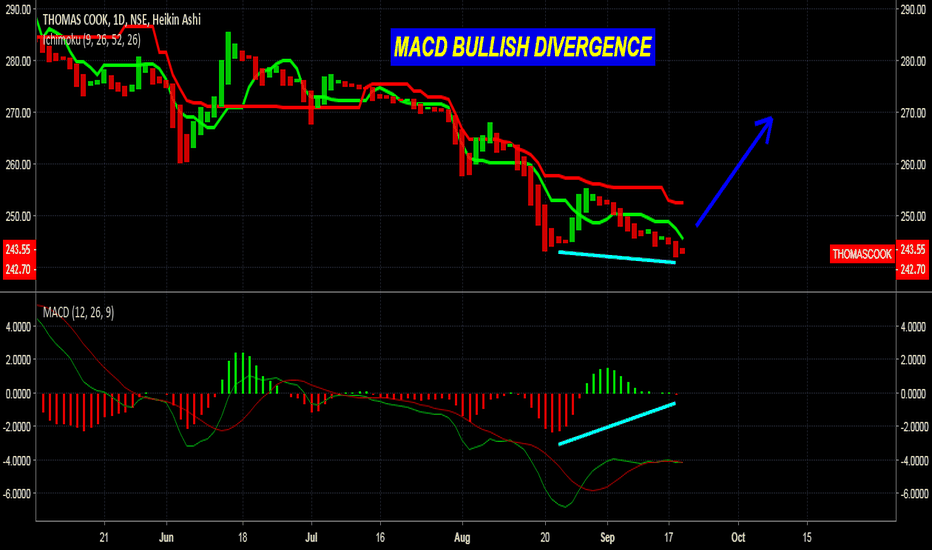

Thomas Cook India Ltd - Double Digit + MACD Crossover📊 Script: THOMASCOOK (THOMAS COOK (INDIA) LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: NIFTY 500

📊 Sector: Consumer Services

📊 Industry: Tour Travel Related Services

Key highlights: 💡⚡

📈 Script is trading at upper band of Bollinger Bands (BB) and giving breakout of it.

📈 MACD is giving crossover.

📈 Double Moving Averages may give crossover in next trading session.

📈 Volume is increasing along with price which is volume breakout.

📈 Current RSI is around 67.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 81

🟢 Target 🎯🏆 - 91

⚠️ Stoploss ☠️🚫 - 75

⚠️ Important: Always maintain your Risk & Reward Ratio.

⚠️ Purely technical based pick.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat🔁

Happy learning with trading. Cheers!🥂