BULLISH BankNifty !!! Go long for a new target of 23250Hi this is Trader Kanishk

today i have given the new targets in BANK NIFTY

our last targets were 22250 which have achieved yesterday

Now go for a new Target of 23250

I have shared my analysis in this video

watch the entire video and take your decisions.

Guys let me know you that i am a trader and a trader have a winning probability of 50-65% no any trader is there who have a winning ratio more than this . Who says you that i am having a 100% winning strategy then F**k these type of people and try to be correct only 50 - 60 % of time which will give you a lot of money if you properly follow the risk reward ratio .

Guys you can also follow me on twitter @thisiskanisk for any queries.

Thank You

Signing Off

Trader Kanishk (8954002500)

Technical Analysis

Buy IGL !! Go for a long positional trade.Hii this is trader Kanishk

Today there is an analysis of IGL indraprastha gas limited.

we can go for a long positional trade by putting s small stop loss.

Buy IGL and go for a longer positional

But

After watching the full video till end

After confirmation of trend change

After following all the steps told in this video.

This is a bear market phase and this is not the recovery this is the bullish trap .

so please avoid yourself to put the long positional trade at this time without any confirmation.

Please watch this video complete and follow all the steps .

Please do the multi timeframe analysis during these type of phases .

Guys let me know you that i am a trader and a trader have a winning probability of 50-65% no any trader is there who have a winning ratio more than this . Who says you that i am having a 100% winning strategy then F**k these type of people and try to be correct only 50 - 60 % of time which will give you a lot of money if you properly follow the risk reward ratio .

Guys you can also follow me on twitter for any queries.

RELIANCE Don't take long position still......Hii this is trader Kanishk

This is the analysis of RELIANCE

Here the phase is very volatile and we don't have to took long position in RELIANCE without confirmation .

Reliance is an uptrend stock of=n each and every time frame.

we can take our long positional trade in RELIANCE but after confirmation.

Watch this complete video i've discussed everything.

this is a bear market phase and this is not the recovery this is the bullish trap .

so please avoid yourself to put the long positional trade at this time without any confirmation.

Please watch this video complete and follow all the steps .

Please do the multi timeframe analysis during these type of phases .

Guys let me know you that i am a trader and a trader have a winning probability of 50-65% no any trader is there who have a winning ratio more than this . Who says you that i am having a 100% winning strategy then F**k these type of people and try to be correct only 50 - 60 % of time which will give you a lot of money if you properly follow the risk reward ratio .

DISCLAIMER

I am not recommending you to buy or sell any stock, i am just sharing my analysis here.

Maintain your risk reward ratio and then trade.

Guys you can also follow me on twitter for any queries.

Market Crashing ALERT !!!! SHORT NIFTY & DON'T INVESTHii

This is trader Kanishk

Today NIFTY ant the INDIAN ECONOMY

This is a crashing ahead. Watch full analysis and take it seriously please.

SHORT NIFTY

DON'T INVEST

This is not the right time to invest.

This is the time for traders

we can earn only by short selling.

Thank you.

Nifty - WaveTalks : Right in the Block Hole 12110-12125Secret to the bounce from 11910 lies in the history - If you are missing this point then you are missing the key aspect of being a good analyst

Trading Strategy

Plan A -

Sell below 12085 with strict stops above 12135 for targets 12010 / Below 12000 for 11900-11910 / Below 11900 for 11600

Plan B -

Holding 12085 - Current wave can extend upside to 12160-12180 / Above 12200 for 12230 / Above 12245 for 12275+

You can check TradingView profile page for previous ideas at

in.tradingview.com

IRCTC - 1st Halt ( Amazing Journey 625 to 980) - What Next ?Trading Strategy

Scenario 1-

Holding above 920

Part A:

Expect upside push to 980-1000 zone

Part B:

Selling if fails to cross 1000 or crosses 1000 falls immediately then expect 920 / 850 /700

Scenario 2 -

Strictly Holding above 1000 for extreme bullish scenario- Expect 1500 -1600 Target zone. Failing to hold 1000 post crossing above becomes "Part B - Scenario 1" as mentioned above.

Thanks for all support

Wish All of You A Happy, Prosperous & Terrific 2020 !!!

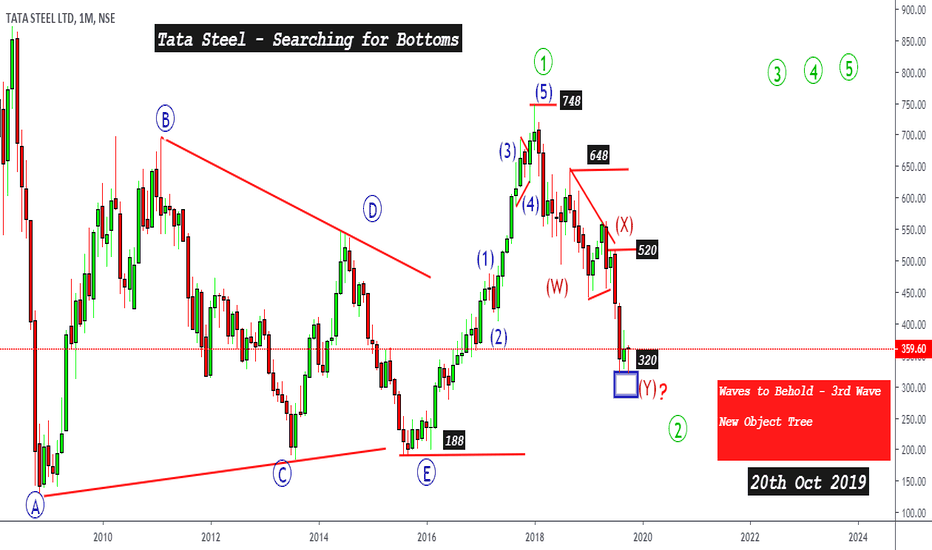

Tata Steel - Searching for Bottoms from 280-320Correction Stock is trading in 100's -have wrongly used 11000+ in the video (11000 is for Benchmark Index -Nifty)- should be taken as 1000+

Disclaimer

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Trading Strategy

Possible dip below 320 can support at 280's -300 - getting dip & bouncing above psychological level of 300 shall be next clue for upside beyond 1000+

Plan A

Buying in 280-290 Strict stops below 280 for Target 400-410 & Above 400 for 510-520

Plan B

Buying above 520 for 645-650

Plan C

Buying above 650 for 750 & 1000+

Plan D

Buying from 280-300 if holds above 280 (should not move below 280) expect 1150-1200 as the explosive target upside which wave 3 distance -normally travels 161.8% of wave 1 -

Current case :

Wave ((1)) Distance = 748 - 188 = 560

161.8% of 560 points = 560 * 1.618 = 907 approx

Measuring 907 from yet to bottom Wave ((2)) which could be 320 or close to 280 downside so ... (907 + approx 280/320 = 1150 to 1200 zone) which gives upside objective of 1150-1200 target mentioned in Plan D above- which is minimum Wave 3 Distance it can travel next as per the books.

Thanks for watching the video & your support.

Nifty/Comex Gold -Solving Explosive puzzle with Golden ShineDisclaimer

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Comex Gold

Trading above 1490$ - There is room for gold to move 80-100$ upside in 1580-1625$

Later below 1490$ - It can slip to 1410/1265/1050$ as per long term strategy.

Nifty Index

Holding below 11310-11325 – Bias remains negative & whole explosive rally of last trading day could fizzle out & Index could slip back to

Target 1-

11140-11150

Target 2-

Below 11140 – target is 11080-11090

Target 3-

Below 11080- Expect 10950

Target 4-

Below 10890– Expect 10750

Target 5-

Below 10740– Expect 10580-10615

Note – Above 11325 – This idea gets invalidated

E- wave or Extradition Bill -Hong Kong- Is it too late?Disclaimer

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Trading Strategy

Daily Outlook

Index is close to the current supply zone 11025-11050 & this zone acted as supply zone even earlier so we need to be careful. Any upside extension can be expected once index sustains above 11050 where It has scope to travel upside in 11100-11125 & it shall face key resistance zone of 11140-11150.

Few confirmations required for short term trading

Trade below 10950

Break of the rising channel which holds – “wave-e”

Initial clue confirmed with bearish Candlestick pattern- Evening Star

Weekly outlook –

Bearish Till Critical Level of 11200 acts as resistance (holding stops above that level) our downside objective – 10750/10630-10650/10580/Below 10580 for 10525-10535.

Don’t forget to tune in the next video idea – on “Gold at 15K– Raising Mercury Level’s ”

Nifty - We got the Gartley M@11135 Correction - Pardon for Saying 11740's as target for Auropharma at the end of the video- Target if 700 intact is 740/790's

Thanks for watching the video. Don't forget to support the idea.

----------------------------------------------------------------------------------------------------------------------------------------

Five Leg Pattern Gartley - XA- AB-BC-CD-XD Standing above 11109 Lows. Pattern gets invalidated going below 11109.

Target for Nifty

11280-11290

11350-11360

11400-11425

15th May 2019 - Amazing Trading Session - Both The Plans achieved for Nifty Index & Auro pushed to 737 from 709 (partial) as mentioned in video idea of Auropharma

Last Video Idea on Auropharma (click below to watch the video)