Government bonds

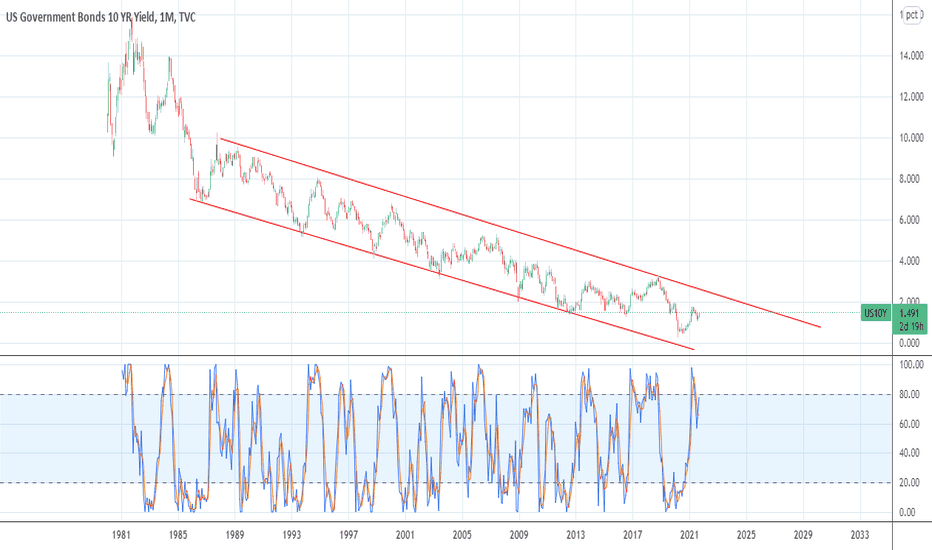

US10YAt their policy meeting in December, FOMC participants agreed to double down on QE pace to close the same by Mar’22 amid growing concerns about hotter inflation. Fed officials also began discussing at the December meeting about balance sheet (bond holdings), and some policymakers are pushing to start shrinking them sooner and faster than they did after an earlier asset-purchase (QE) program after 2007-08 GFC. Markets would see that as a form of tightening monetary policy because it would signal the central bank’s desire to deliberately slow the economy.

Once the Fed stops buying bonds/assets (after QE tapering), it could keep the holdings steady by reinvesting the proceeds of maturing securities into new ones, which should have an economically neutral effect. Alternatively, the Fed could allow its holdings to shrink by allowing bonds to mature, or runoff (QT-Quantitative Tightening).

Good News for Bulls In the Market- H&S pattern in US 10 YR BondsHey Guys, Fingers crossed!! I Hope this Right shoulder gets complete on monday and again Bonds may get to hell. Reversal in bonds may happen from now on if this pattern gets rightfully completed. So, Monday is a very crucial day to decide what the stock market will be going to perform in the coming week and month.

Hope you all would have liked the analysis. Also see my recent analysis on Axis Bank and Berger paint as well.

Do follow me on trandingview for more analysis like this.

The Infamous US Debt and Equity Connection !!In the words of Sir Ray Dalio,

"Due to the lack of free-market buying of US debt, the central banks had to buy it and had to print a lot of money to buy it with so much so that they drove rates down to “artificially” low levels, which “artificially” supported financial asset prices. Now, there’s just so much money injected into the markets and the economy that the markets are like a casino with people playing with funny money. They’re buying all sorts of things and pushing yields on everything down. Now you have stocks that have gone up, and you have classic bubble dynamics in so many different assets."

Markets are overheated because of the funny money. The rising 10Y yield is not a good sign for equity markets. The majority of the asset classes are overvalued, don't let anyone tell you otherwise. It will take less than a week for FII's to withdraw their money from the markets and DII's won't be able to hold for long.

Even the most progressively optimistic strategy is to plan out a good short trade from here.