Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instea

Hindustan Copper – Breakout, Retest & Bullish Continuation SetupNSE:HINDCOPPER

Hindustan Copper has delivered a powerful breakout followed by healthy consolidation near highs — indicating strength rather than exhaustion.

Technical Observations

Breakout zone: ₹570–₹590 area (now acting as support)

Current structure: Flag-type consolidation near highs

Volume:

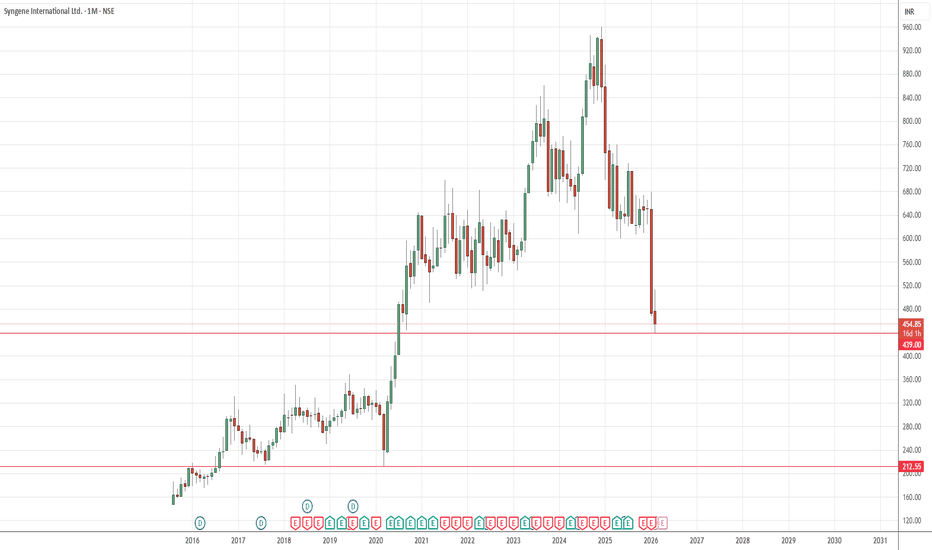

Syngene International Ltd not looks good below 439Below 439 target 212.55

Weak Q3 Results (Jan 2026): The company reported a sharp decline in profits, with margins squeezed due to biologics destocking. This disappointed investors and triggered a sell-off.

Revenue Guidance Miss: Analysts had expected ~15% revenue growth for FY26, but Syngene guide

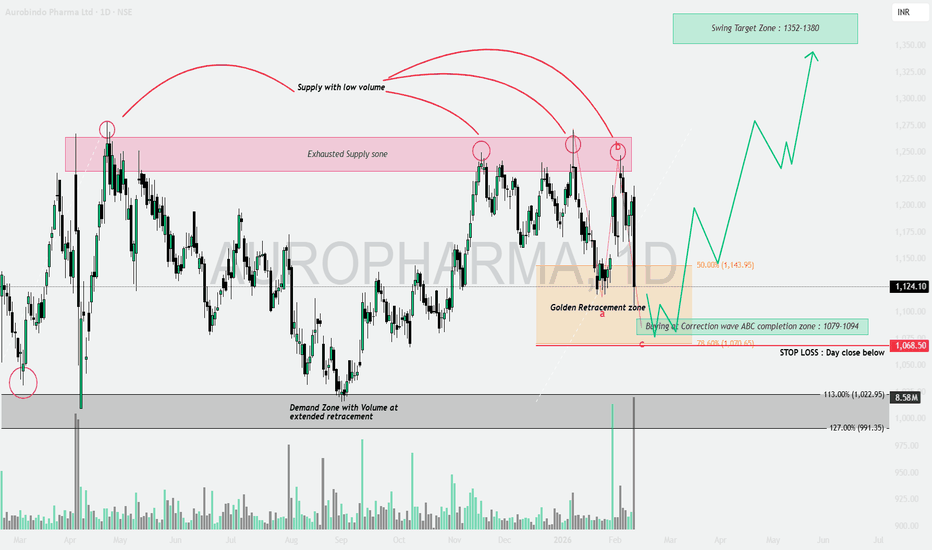

AUROPHARMA: Supply Exhaustion & The Golden Retracement📝 The Technical Breakdown (Educational Guide)

This chart is a masterclass in understanding Volume Price Analysis + Fibonacci Confluence. Let’s decode the setup through 4 key educational pillars:

1️⃣ Supply Exhaustion Zone 🔴

Observe the pink box marked as “Exhausted Supply Zone.”

Price has tested

Positional View for Infyosys Ltd.Wrap up:-

As per chart of Infosys Ltd., it seems that correction in the stock is now over with a abc pattern in major wave 4. Now, major wave 5 is started of which inner wave 1 is completed at 1649 and wave 2 is expected to be completed in the range 1433-1307.

What I’m Watching for 🔍

Low Risk

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed t

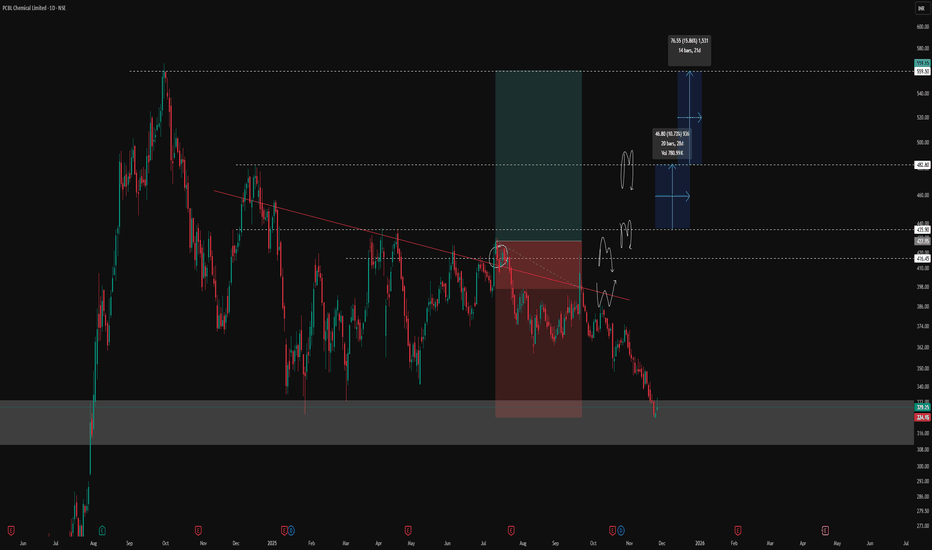

PCBL: Reversal Structure and Key LevelsThe stock of PCBL has experienced a significant decline from the ₹437 level, followed by a notable recovery from a major support zone, often referred to by traders as a discount or value area. Recent price behaviour indicates the possibility of a trend reversal supported by multiple technical fa

Titan 1H: Wave (iv) Pullback Before One More Push?Titan appears to have completed a strong impulsive move into wave (iii), followed by early signs of a corrective pullback. The recent decline looks corrective so far, suggesting wave (iv) may be unfolding.

The ideal retracement zone lies between ₹4,193–₹4,135 (0.382–0.5 Fibonacci zone) . If price

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

PURVAPuravankara Limited

Actual

—

Estimate

—

Today

HINDALCOHindalco Industries Limited

Actual

21.41

INR

Estimate

21.40

INR

Today

SPICEJETSpiceJet Limited

Actual

—

Estimate

—

Today

GFLLIMITEDGFL Ltd

Actual

—

Estimate

—

Today

TITAGARHTitagarh Rail Systems Ltd

Actual

—

Estimate

4.23

INR

Today

FAZE3QFaze Three Ltd.

Actual

—

Estimate

—

Today

SHAILYShaily Engineering Plastics Limited

Actual

—

Estimate

11.68

INR

Today

CMSINFOCMS Info Systems Ltd.

Actual

—

Estimate

—

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Finance | ||||||||

| Technology Services | ||||||||

| Producer Manufacturing | ||||||||

| Energy Minerals | ||||||||

| Non-Energy Minerals | ||||||||

| Consumer Durables | ||||||||

| Consumer Non-Durables | ||||||||

| Communications | ||||||||

| Health Technology | ||||||||

| Utilities |