IGL trade ideas

IGL's Chart: Support at Rising Trendline and SharkIn this analysis, we will thoroughly examine the technical aspects of IGL's chart, focusing on the support at the rising trendline and the presence of a Shark Harmonic Pattern on the daily timeframe. We will assess the potential buying opportunity for IGL based on these technical signals. Let's proceed with the analysis.

Chart Analysis:

The TradingView chart for IGL reveals significant technical factors that may impact the stock's price action.

Support at Rising Trendline:

IGL's candlestick chart is finding support at the rising trendline, indicating a potential area of price support. The rising trendline suggests a positive trend in the stock and may attract buying interest from traders and investors.

Shark Harmonic Pattern:

The chart shows the presence of a Shark Harmonic Pattern on the daily timeframe. The Shark pattern is a potential reversal pattern based on Fibonacci ratios. The completion of the Shark pattern could signal a bullish trend continuation for the stock.

Trading Opportunity and Targets:

Considering the technical signals, a potential buying opportunity may be presented for IGL. Traders may consider initiating a long position at the current market price (CMP) of ₹456. However, it is essential to acknowledge that the suggested stop loss at ₹446 is intended to manage potential risks.

For the target, a potential level is set at ₹477, representing a potential upside target based on the Shark Harmonic Pattern formation.

Conclusion:

The technical analysis of IGL's chart suggests a potentially bullish outlook for the stock. The support at the rising trendline and the presence of the Shark Harmonic Pattern indicate a possible trend continuation. Traders may consider entering a long position at the CMP of ₹456, with a stop loss set at ₹446 and a target of ₹477.

As with any investment decision, caution should be exercised, and it is recommended to conduct thorough research and consult with a financial advisor before making any investment choices. Additionally, traders should closely monitor the stock's price action and consider implementing appropriate risk management strategies.

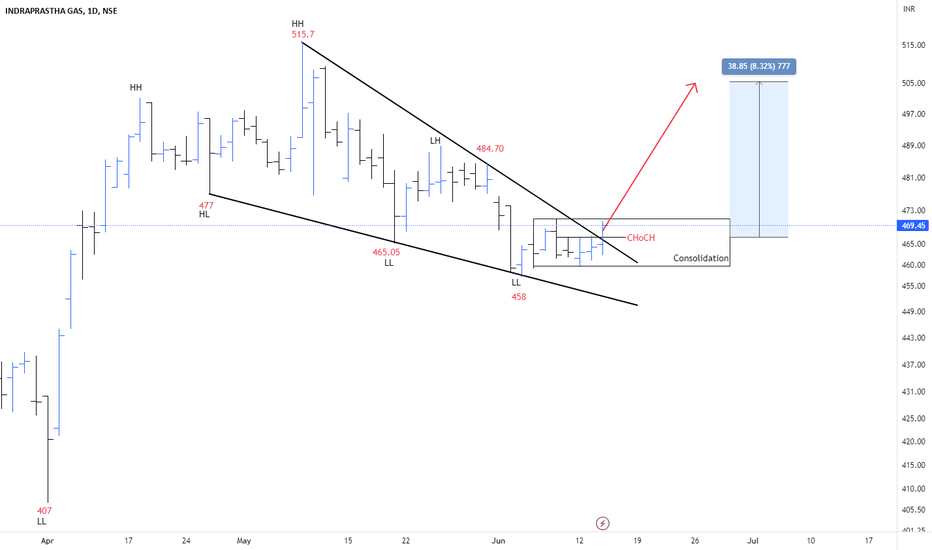

Falling wedge pattern breakout in IGLINDRAPRASTH GAS LTD

Key highlights: 💡⚡

✅On 1Hour Time Frame Stock Showing Breakout of Falling wedge Pattern .

✅ Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 510+.

✅Can Go Long in this stock by placing a stop loss below 487-.

IGL: Bullish Falling Wedge Pattern IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs.

The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 .

Buyers have to break and stay above 504 to increase demand pressure.

Note: Do your own research / discuss it with your advisor

Buy IGL above 470Buy IGL above 470 for target of 479. Reason for trade, Trendline breakout and RSI divergence. Also "W" pattern formed on daily time frame.

Please Note I am not SEBI registered advisor, this is just my view and is for educational purpose. Please consult your financial advisor before taking trade.

Indraprasth Gas Trend on upside can resume NOW.As seen on the chart of IGL this stock now at an important zone of support which is also a 50% retracement support, also a positive candle pattern is seen on the mentioned support area.

An outside-inside price pattern is seen on bollinger band and other stocks in the gas sector are showing strength.

Rsi Momentum indicator is also on a support area.

Cmp is 466 and support at 455 The target at 495 and 510 give a good risk reward setup.

Analyst: Abhay Bhatia

IGL - Intraday Trade || 15th June, 2023 #stocks Analysis Criteria Used:

1. Please find the Chart Analysis done for the Intraday Trade Idea levels for 15th June, 2023

2. The analysis for the Trade ideas, has been done based on Trend analysis and Chart Patterns with Volume Buildups

Focus On:

1. Always keeping your Risk Management in play

2. Using a Stop Loss; because it is your Best Friend

3. Always Plan your Trade and stick to your Plan

4. Dont overthink or overanalyse

5. Treat this as your Business and get serious about it

#sharemarket #stockmarket #nifty #sensex #investing #trading #nse #bse #stockmarketindia #stocks #indianstockmarket #investment #stockmarketnews #banknifty #finance #money #intraday #intradaytrading #investor #niftyfifty #dalalstreet #sharemarketindia #sharemarketnews #stockmarketinvesting #business #sharemarkettips #stock #india #indiansharemarket #rakeshjhunjhunwala #bhfyp #mumbai #share #wealth #investment #market #invest #trading #investing #finance #FinancialFreedom #investor #trader #stocks #profit #investors #economy #equity #shares #nifty #stockexchange

DISCLAIMER:

.

* Please do your own research and/or contact your financial advisor before taking any trading opportunities

** We will not be responsible for your profit or loss

*** We are NOT SEBI REGISTERED

______________________

best stocks to buy today

best stocks to buy now

best stocks to buy

best stocks for Intraday tomorrow

best stocks for long term investment

best stocks to buy today india

best stocks for swing trading

swing trading strategies

swing trading beginners

what is swing trading

swing trading stocks

swing trading stock selection

swing trading kya hai

nifty analysis

nifty view

bank nifty analysis

top stocks to buy now

strong stocks

nifty view

nifty prediction

stock market view tomorrow

bank nifty Levels

bank nifty prediction

share news

stock market news

best stocks to buy now

profit booking stocks

multibagger stocks in discount

breakout stocks

best short term stocks

best short term shares

next multibagger stocks

IGL - Intraday Trade || 31st May, 2023 #stocks Analysis Criteria Used:

1. Please find the Chart Analysis done for the Intraday Trade Idea levels for 31st May, 2023

2. The analysis for the Trade ideas, has been done based on Trend analysis and Chart Patterns with Volume Buildups

Focus On:

1. Always keeping your Risk Management in play

2. Using a Stop Loss; because it is your Best Friend

3. Always Plan your Trade and stick to your Plan

4. Dont overthink or overanalyse

5. Treat this as your Business and get serious about it

#sharemarket #stockmarket #nifty #sensex #investing #trading #nse #bse #stockmarketindia #stocks #indianstockmarket #investment #stockmarketnews #banknifty #finance #money #intraday #intradaytrading #investor #niftyfifty #dalalstreet #sharemarketindia #sharemarketnews #stockmarketinvesting #business #sharemarkettips #stock #india #indiansharemarket #rakeshjhunjhunwala #bhfyp #mumbai #share #wealth #investment #market #invest #trading #investing #finance #FinancialFreedom #investor #trader #stocks #profit #investors #economy #equity #shares #nifty #stockexchange

DISCLAIMER:

.

* Please do your own research and/or contact your financial advisor before taking any trading opportunities

** We will not be responsible for your profit or loss

*** We are NOT SEBI REGISTERED

______________________

best stocks to buy today

best stocks to buy now

best stocks to buy

best stocks for Intraday tomorrow

best stocks for long term investment

best stocks to buy today india

best stocks for swing trading

swing trading strategies

swing trading beginners

what is swing trading

swing trading stocks

swing trading stock selection

swing trading kya hai

nifty analysis

nifty view

bank nifty analysis

top stocks to buy now

strong stocks

nifty view

nifty prediction

stock market view tomorrow

bank nifty Levels

bank nifty prediction

share news

stock market news

best stocks to buy now

profit booking stocks

multibagger stocks in discount

breakout stocks

best short term stocks

best short term shares

next multibagger stocks

IGL - #intraday Chart Analysis || 17th May,2023 #stocksAnalysis Criteria Used:

1. Please find the Chart Analysis done for the Intraday Trade Idea levels for 17th May, 2023

2. The analysis for the Trade ideas, has been done based on Trend analysis and Chart Patterns with Volume Buildups

Focus On:

1. Always keeping your Risk Management in play

2. Using a Stop Loss; because it is your Best Friend

3. Always Plan your Trade and stick to your Plan

4. Dont overthink or overanalyse

5. Treat this as your Business and get serious about it

#sharemarket #stockmarket #nifty #sensex #investing #trading #nse #bse #stockmarketindia #stocks #indianstockmarket #investment #stockmarketnews #banknifty #finance #money #intraday #intradaytrading #investor #niftyfifty #dalalstreet #sharemarketindia #sharemarketnews #stockmarketinvesting #business #sharemarkettips #stock #india #indiansharemarket #rakeshjhunjhunwala #bhfyp #mumbai #share #wealth #investment #market #invest #trading #investing #finance #FinancialFreedom #investor #trader #stocks #profit #investors #economy #equity #shares #nifty #stockexchange

DISCLAIMER:

.

* Please do your own research and/or contact your financial advisor before taking any trading opportunities

** We will not be responsible for your profit or loss

*** We are NOT SEBI REGISTERED

______________________

best stocks to buy today

best stocks to buy now

best stocks to buy

best stocks for Intraday tomorrow

best stocks for long term investment

best stocks to buy today india

best stocks for swing trading

swing trading strategies

swing trading beginners

what is swing trading

swing trading stocks

swing trading stock selection

swing trading kya hai

nifty analysis

nifty view

bank nifty analysis

top stocks to buy now

strong stocks

nifty view

nifty prediction

stock market view tomorrow

bank nifty Levels

bank nifty prediction

share news

stock market news

best stocks to buy now

profit booking stocks

multibagger stocks in discount

breakout stocks

best short term stocks

best short term shares

next multibagger stocks

IGLIGL:- Ascending triangle pattern has formed, wait for a proper breakout, till then keep an eye on the stock

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.