US Government Bonds 10 YR Yield

No trades

Market insights

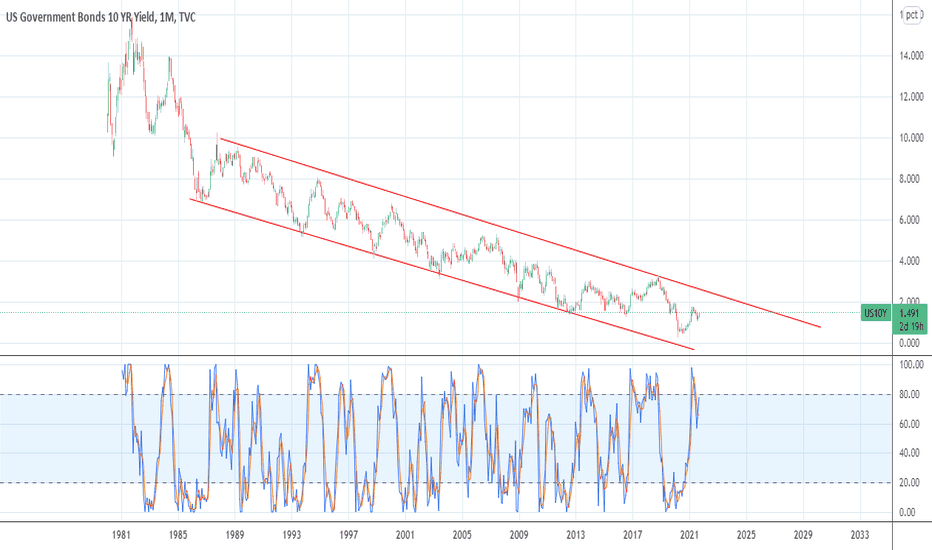

US10Y aheading to cross 2% this timeUS10Y has been trending in a downward channel, currently aheading towards its resistance. It acts as a leading indicator to US equity indexes and works in contrast to major benchmarks.

Disclaimer: View for Educational purpose only, not to be taken as trading/investment advice.

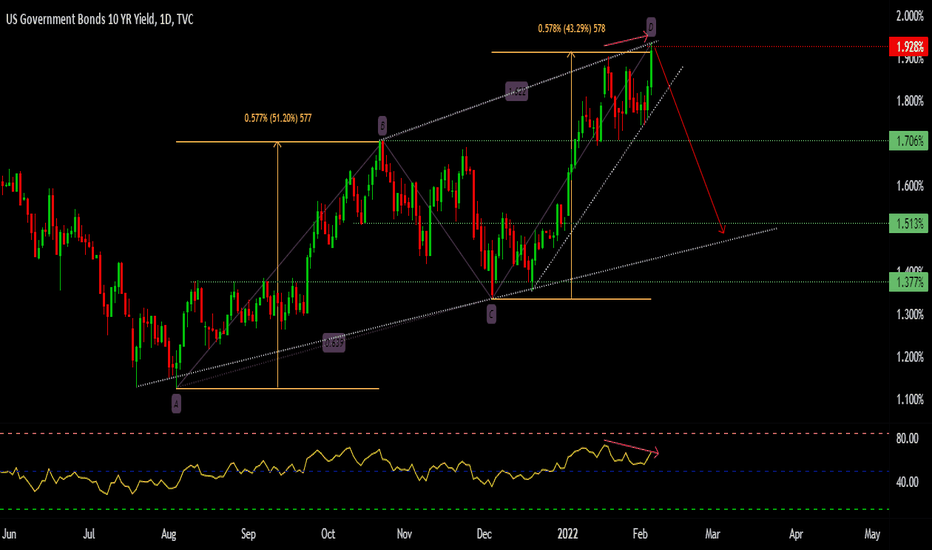

US10Y scaring the markets again?I do not have the detailed economic understanding of this matter but have observed that a rise in the US 10 year treasury yields leads to a overall feeling of fear and turmoil in the markets. Back in the March and April of 2021, US10Y was continuously making news as it was reaching levels of about 1.75, with commentators discussing how a test of the levels of 2 and beyond could lead to a sharp sell off in the markets. But, it failed to move past decisively beyond the 1.75 levels as market on the chart.

_____________________________________________________________________________________________________________________________________________________

Since then I have been following this ticker, US10Y corrected back to levels of around 1.12 which it failed to break below in July and August. After that it had started forming higher lows leading to bullish structure. It was consolidating just below 1.38 trying to break through it, which it finally did on the 23rd of September.

_____________________________________________________________________________________________________________________________________________________

In short, if this trend continues upward leading the US10Y to the April highs of 1.75 and beyond, we could observe the markets struggling to move ahead, also possibly correcting. It would be prudent to keep watch.

Manage risks properly and trade your plan.

Like and follow for more. :)

Rising bond yields are dollar bearishThe number of classic relationships that I have to debunk just to be on the right side and convince the world is just overboard. And the charts are as straightforward as they can be. So here goes stupidity. Rising bond yields are not dollar bullish, at least not in the time frame of this chart. So when bond yields rise then the dollar actually falls. Yes naturally if I sell US bonds and take my money out of the US, the dollar should fall, right? They why do you expect the opposite? Because some overnight Journo on Bloomberg says so? Or because you were taught this in economics class? Interest rate parity in your Forex lecture. Then you find it very hard to accept or explain the chart below. Or maybe you find periods in the chart when the two are directly correlated to make your point. The answer is simple it is a risk on trade till it is not. The day falling stocks cause bond yields to decline, the dollar will rise and it is time to take risk off the table by reducing your market exposure. Till that happens it is all noise. Weak hands get cleaned out this way. Bond yields started to breakout higher above the 2021 high recently and the dollar fell. This is good for risk assets, unless we see that trend clearly change I do not see a reason to be concerned about incremental changes in bond yields.

US10YAt their policy meeting in December, FOMC participants agreed to double down on QE pace to close the same by Mar’22 amid growing concerns about hotter inflation. Fed officials also began discussing at the December meeting about balance sheet (bond holdings), and some policymakers are pushing to start shrinking them sooner and faster than they did after an earlier asset-purchase (QE) program after 2007-08 GFC. Markets would see that as a form of tightening monetary policy because it would signal the central bank’s desire to deliberately slow the economy.

Once the Fed stops buying bonds/assets (after QE tapering), it could keep the holdings steady by reinvesting the proceeds of maturing securities into new ones, which should have an economically neutral effect. Alternatively, the Fed could allow its holdings to shrink by allowing bonds to mature, or runoff (QT-Quantitative Tightening).

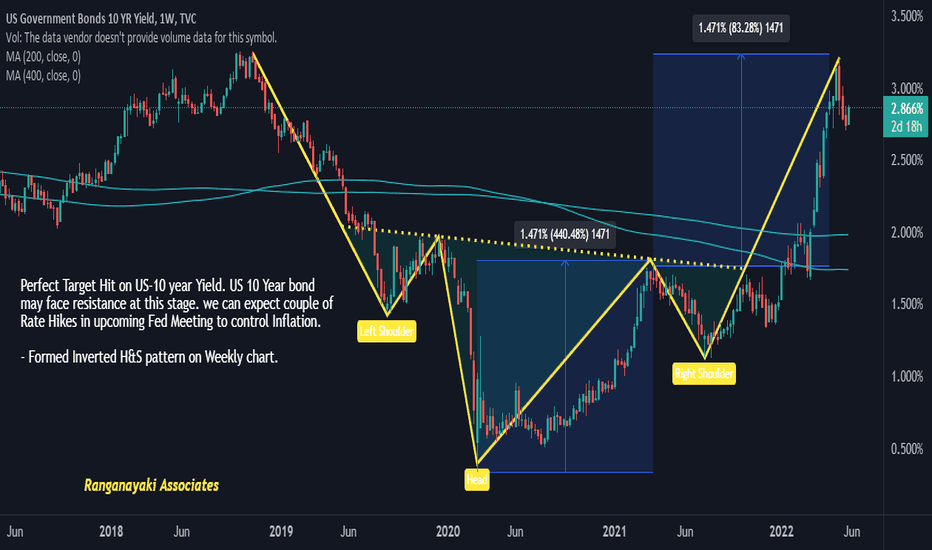

Good News for Bulls In the Market- H&S pattern in US 10 YR BondsHey Guys, Fingers crossed!! I Hope this Right shoulder gets complete on monday and again Bonds may get to hell. Reversal in bonds may happen from now on if this pattern gets rightfully completed. So, Monday is a very crucial day to decide what the stock market will be going to perform in the coming week and month.

Hope you all would have liked the analysis. Also see my recent analysis on Axis Bank and Berger paint as well.

Do follow me on trandingview for more analysis like this.

The Infamous US Debt and Equity Connection !!In the words of Sir Ray Dalio,

"Due to the lack of free-market buying of US debt, the central banks had to buy it and had to print a lot of money to buy it with so much so that they drove rates down to “artificially” low levels, which “artificially” supported financial asset prices. Now, there’s just so much money injected into the markets and the economy that the markets are like a casino with people playing with funny money. They’re buying all sorts of things and pushing yields on everything down. Now you have stocks that have gone up, and you have classic bubble dynamics in so many different assets."

Markets are overheated because of the funny money. The rising 10Y yield is not a good sign for equity markets. The majority of the asset classes are overvalued, don't let anyone tell you otherwise. It will take less than a week for FII's to withdraw their money from the markets and DII's won't be able to hold for long.

Even the most progressively optimistic strategy is to plan out a good short trade from here.