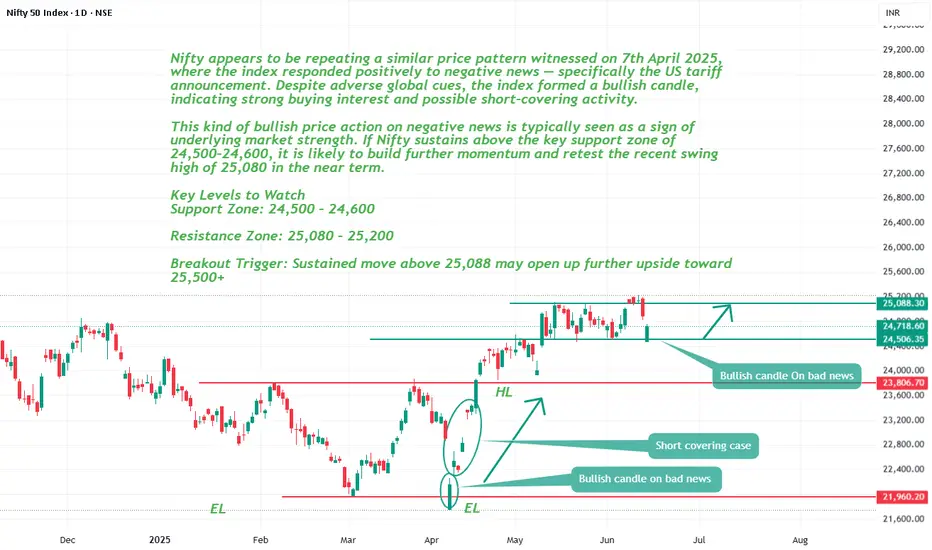

Nifty appears to be repeating a similar price pattern witnessed on 7th April 2025, where the index responded positively to negative news — specifically the US tariff announcement. Despite adverse global cues, the index formed a bullish candle, indicating strong buying interest and possible short-covering activity.

This kind of bullish price action on negative news is typically seen as a sign of underlying market strength. If Nifty sustains above the key support zone of 24,500–24,600, it is likely to build further momentum and retest the recent swing high of 25,080 in the near term.

Key Levels to Watch

Support Zone: 24,500 – 24,600

Resistance Zone: 25,080 – 25,200

Breakout Trigger: Sustained move above 25,088 may open up further upside toward 25,500+

This kind of bullish price action on negative news is typically seen as a sign of underlying market strength. If Nifty sustains above the key support zone of 24,500–24,600, it is likely to build further momentum and retest the recent swing high of 25,080 in the near term.

Key Levels to Watch

Support Zone: 24,500 – 24,600

Resistance Zone: 25,080 – 25,200

Breakout Trigger: Sustained move above 25,088 may open up further upside toward 25,500+

Trade active

History repeat itself. Nifty bounce 300 points now 24900+Trade closed: target reached

Nifty Technical Update – Profit Booking RecommendedNifty successfully tested the 25,500+ level today, marking a sharp 1,000-point rally from the identified reversal zone near 24,500.

📌 Chart Insight:

The current uptrend aligns with a classic Flag & Pole continuation pattern. With the pattern nearly complete, Nifty has the potential to test 25,700+ in the near term.

💼 Actionable Strategy:

Investors and traders are advised to initiate partial profit booking at current levels to secure gains. Fresh entries should be considered only after a decisive breakout or healthy retracement.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.