Background

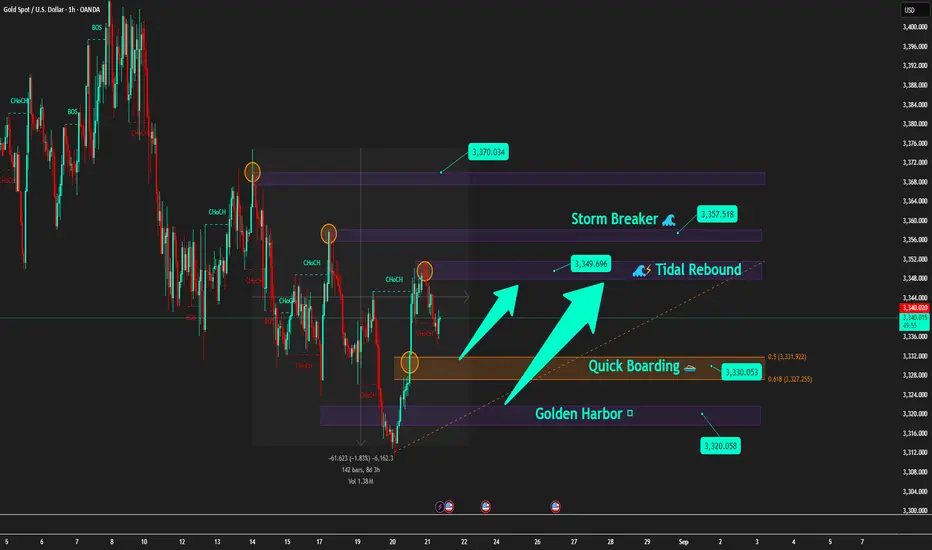

After the early morning FOMC session, Gold is showing signs of a sell-side pullback to gain momentum.

On higher timeframes (H4–D1), the structure remains bearish with lower highs.

However, consistent buying pressure around 3320 – 3330 keeps this zone as the key battlefield.

🪙 Key Levels Today

🔹 Storm Breaker 🌊 (Sell Zone 3357 – 3355)

SL: 3362

TP: 3350 → 3345 → 3340 → 33xx

🔹 Tidal Rebound 🌊⚡ (Sell Scalp 3349 – 3347)

SL: 3353

TP: 3345 → 3340 → 3335 → 33xx

🔹 Quick Boarding 🚤 (Buy Scalp 3330 – 3328)

SL: 3322

TP: 3335 → 3337 → 3339 → 3341

🔹 Golden Harbor 🏝️ (Buy Zone 3320)

SL: 3313

TP: 3325 → 3330 → extend further

📌 Trading Scenarios

After FOMC, the market may show rebound waves.

During Asia–Europe, price may consolidate between 3345 – 3357.

If price tests Storm Breaker 🌊 → Prioritise Sell setups in line with the main bearish trend.

If price drops to Quick Boarding 🚤 or Golden Harbor 🏝️ → Short-term Buy scalps on pullback moves.

📰 Market Context

FED remains dovish leaning, with high probability of a rate cut in September (~82%, CME FedWatch).

Geopolitical variables (Trump–Putin, Ukraine) remain unpredictable and may spark sudden volatility.

⚓ Captain’s Note

"Let Storm Breaker 🌊 test the buyers’ strength. Those who board at Golden Harbor 🏝️ will be lifted by the waves, but those who drift into the storm will soon feel the sea’s fury."

After the early morning FOMC session, Gold is showing signs of a sell-side pullback to gain momentum.

On higher timeframes (H4–D1), the structure remains bearish with lower highs.

However, consistent buying pressure around 3320 – 3330 keeps this zone as the key battlefield.

🪙 Key Levels Today

🔹 Storm Breaker 🌊 (Sell Zone 3357 – 3355)

SL: 3362

TP: 3350 → 3345 → 3340 → 33xx

🔹 Tidal Rebound 🌊⚡ (Sell Scalp 3349 – 3347)

SL: 3353

TP: 3345 → 3340 → 3335 → 33xx

🔹 Quick Boarding 🚤 (Buy Scalp 3330 – 3328)

SL: 3322

TP: 3335 → 3337 → 3339 → 3341

🔹 Golden Harbor 🏝️ (Buy Zone 3320)

SL: 3313

TP: 3325 → 3330 → extend further

📌 Trading Scenarios

After FOMC, the market may show rebound waves.

During Asia–Europe, price may consolidate between 3345 – 3357.

If price tests Storm Breaker 🌊 → Prioritise Sell setups in line with the main bearish trend.

If price drops to Quick Boarding 🚤 or Golden Harbor 🏝️ → Short-term Buy scalps on pullback moves.

📰 Market Context

FED remains dovish leaning, with high probability of a rate cut in September (~82%, CME FedWatch).

Geopolitical variables (Trump–Putin, Ukraine) remain unpredictable and may spark sudden volatility.

⚓ Captain’s Note

"Let Storm Breaker 🌊 test the buyers’ strength. Those who board at Golden Harbor 🏝️ will be lifted by the waves, but those who drift into the storm will soon feel the sea’s fury."

Join Real - Time Trade Post: t.me/+vPyQJ6Ohb-RkMjNl

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join Real - Time Trade Post: t.me/+vPyQJ6Ohb-RkMjNl

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.