Hello, traders!

Gold started the new week on an impressive note, trading at $3,685 in early Monday's session. The main drivers are the market's continued reaction to the Fed's recent rate cut and escalating geopolitical events. So, the big question is, how far will this rally go?

Fundamental Analysis: Why Is Gold Still Soaring?

Although the Fed cut interest rates by 0.25%—the first time in 2025—Chair Jerome Powell maintained a cautious stance, calling it a "risk management cut." While this initially caused some market jitters, in the long run, lower interest rates are a strong supporting factor for gold.

Lower Rates: They reduce the opportunity cost of holding gold, which is a non-yielding asset.

Geopolitical Tensions: Conflicts in Ukraine and the Middle East are escalating, boosting safe-haven demand. Ukrainian President Zelenskyy reported that Russia carried out a major drone and missile attack, reaffirming gold's role as a protective asset against global risks.

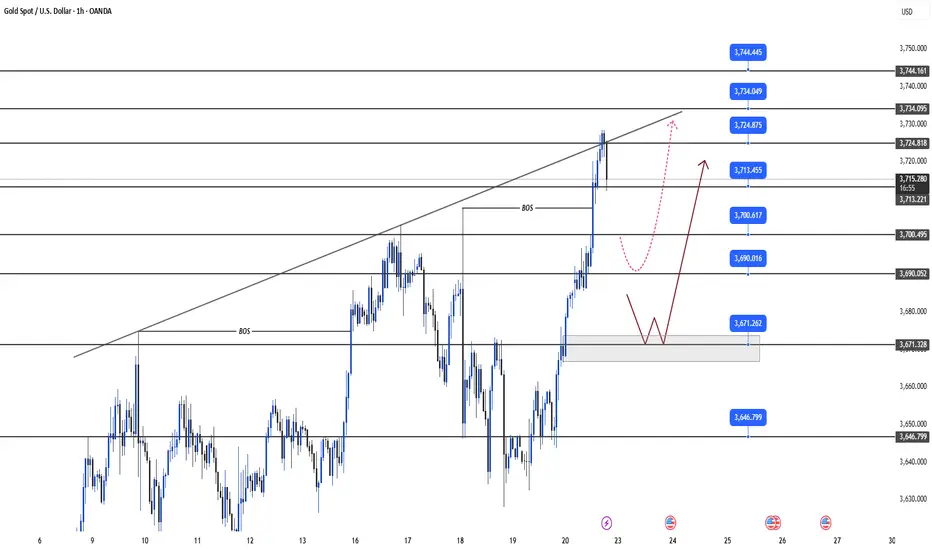

Technical Analysis: Breaking Resistance, The Uptrend Continues

Gold had a powerful rally at the start of the week, successfully breaking the key resistance zone at $370x. The price is currently hovering around $3720 with a slight correction, but the uptrend remains firmly intact.

Outlook: Given the strong upward momentum, short-selling (going short) with a tight stop-loss is extremely risky. We will continue to prioritize long positions (going long) as long as gold holds above the $370x level.

Suggested Trading Strategy (Strict Risk Management):

BUY SCALP

Zone: $3413 - $3711

SL: $3407

TP: $3716 - $3721 - $3726 - $3731 - $3741

BUY ZONE

Zone: $3700 - $3798

SL: $3790

TP: $3708 - $3718 - $3728 - $3738 - $3758

SELL ZONE

Zone: $3734 - $3736

SL: $3744

TP: $3726 - $3716 - $3706 - $3796 - $3779

The market is showing unpredictable volatility. Can gold overcome all barriers and set new records? Share your opinion in the comments below! 👇

#Gold #XAUUSD #Fed #GoldAnalysis #TradingView #FinancialMarkets #TechnicalAnalysis #GoldTrading #USD #Geopolitics

Gold started the new week on an impressive note, trading at $3,685 in early Monday's session. The main drivers are the market's continued reaction to the Fed's recent rate cut and escalating geopolitical events. So, the big question is, how far will this rally go?

Fundamental Analysis: Why Is Gold Still Soaring?

Although the Fed cut interest rates by 0.25%—the first time in 2025—Chair Jerome Powell maintained a cautious stance, calling it a "risk management cut." While this initially caused some market jitters, in the long run, lower interest rates are a strong supporting factor for gold.

Lower Rates: They reduce the opportunity cost of holding gold, which is a non-yielding asset.

Geopolitical Tensions: Conflicts in Ukraine and the Middle East are escalating, boosting safe-haven demand. Ukrainian President Zelenskyy reported that Russia carried out a major drone and missile attack, reaffirming gold's role as a protective asset against global risks.

Technical Analysis: Breaking Resistance, The Uptrend Continues

Gold had a powerful rally at the start of the week, successfully breaking the key resistance zone at $370x. The price is currently hovering around $3720 with a slight correction, but the uptrend remains firmly intact.

Outlook: Given the strong upward momentum, short-selling (going short) with a tight stop-loss is extremely risky. We will continue to prioritize long positions (going long) as long as gold holds above the $370x level.

Suggested Trading Strategy (Strict Risk Management):

BUY SCALP

Zone: $3413 - $3711

SL: $3407

TP: $3716 - $3721 - $3726 - $3731 - $3741

BUY ZONE

Zone: $3700 - $3798

SL: $3790

TP: $3708 - $3718 - $3728 - $3738 - $3758

SELL ZONE

Zone: $3734 - $3736

SL: $3744

TP: $3726 - $3716 - $3706 - $3796 - $3779

The market is showing unpredictable volatility. Can gold overcome all barriers and set new records? Share your opinion in the comments below! 👇

#Gold #XAUUSD #Fed #GoldAnalysis #TradingView #FinancialMarkets #TechnicalAnalysis #GoldTrading #USD #Geopolitics

Join Jeremy_NPC's FREE Telegram Now! 🚀

🎯 8–12 FREE scalping signals daily

📈 Accurate Forex & Gold charts

💰 30–50% monthly profits, 300–1000 pips/day

t.me/+1aSqbdspbEdkYjU9

👉 Level up your trading!

🎯 Lock. Aim. Profit!

🎯 8–12 FREE scalping signals daily

📈 Accurate Forex & Gold charts

💰 30–50% monthly profits, 300–1000 pips/day

t.me/+1aSqbdspbEdkYjU9

👉 Level up your trading!

🎯 Lock. Aim. Profit!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join Jeremy_NPC's FREE Telegram Now! 🚀

🎯 8–12 FREE scalping signals daily

📈 Accurate Forex & Gold charts

💰 30–50% monthly profits, 300–1000 pips/day

t.me/+1aSqbdspbEdkYjU9

👉 Level up your trading!

🎯 Lock. Aim. Profit!

🎯 8–12 FREE scalping signals daily

📈 Accurate Forex & Gold charts

💰 30–50% monthly profits, 300–1000 pips/day

t.me/+1aSqbdspbEdkYjU9

👉 Level up your trading!

🎯 Lock. Aim. Profit!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.