📊 Market Context

Gold continues to maintain its upward trend amidst the political and economic instability in the US. The US government has entered its second week of shutdown with no signs of reaching an agreement, raising further concerns about the impact on economic performance.

Simultaneously, the Fed's entry into a monetary easing cycle since September, with expectations of further 25-point rate cuts in October and December, is driving strong buying momentum in gold.

Not just investors, but global central banks are also continuing to accumulate gold, adding 15 tonnes to reserves, indicating a gradual shift away from US public debt.

All these factors combined continue to reinforce a sustainable upward trend, opening up opportunities for strategic BUY moves.

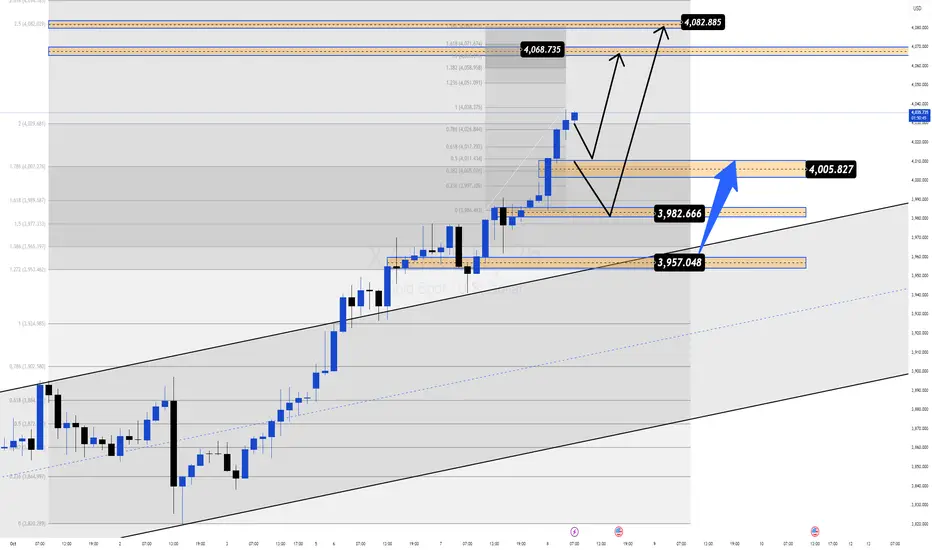

🔎 Technical Analysis (H1/H4)

Prices remain within the upward channel, continuously retesting and bouncing off support zones.

Buy Scalp Zone 4004–4002: a quick reaction zone in the short term.

Main Buy Zone 3986–3984: key support, combined with FVG.

Target Resistance: 4068–4082 (Liquidity Zone).

📈 Trading Plan

✅ BUY SCALP: 4004–4002

SL: 3996

TP: 4008 - 4012 - 4016 - 4020 - 4030 - 4040 - ????

✅ BUY ZONE: 3986–3984

SL: 3980

TP: 3990 - 3995 - 4000 - 4010 - 4020 - 4030 - 4040 - ????

⚠️ Risk Management Note

The 4000 level is a psychological resistance – prone to liquidity sweeps.

Prioritise waiting for clear price action signals at BUY zones.

Adjust volume sensibly as volatility may increase with political news & Fed impacts on market sentiment.

✅ Summary

Gold's uptrend remains solid thanks to political instability, Fed easing, record ETF inflows, and central banks continuing to hoard gold. Strategy prioritises BUY at 4004–4002 and 3986–3984 with targets aiming at 4068–4082.

Gold continues to maintain its upward trend amidst the political and economic instability in the US. The US government has entered its second week of shutdown with no signs of reaching an agreement, raising further concerns about the impact on economic performance.

Simultaneously, the Fed's entry into a monetary easing cycle since September, with expectations of further 25-point rate cuts in October and December, is driving strong buying momentum in gold.

Not just investors, but global central banks are also continuing to accumulate gold, adding 15 tonnes to reserves, indicating a gradual shift away from US public debt.

All these factors combined continue to reinforce a sustainable upward trend, opening up opportunities for strategic BUY moves.

🔎 Technical Analysis (H1/H4)

Prices remain within the upward channel, continuously retesting and bouncing off support zones.

Buy Scalp Zone 4004–4002: a quick reaction zone in the short term.

Main Buy Zone 3986–3984: key support, combined with FVG.

Target Resistance: 4068–4082 (Liquidity Zone).

📈 Trading Plan

✅ BUY SCALP: 4004–4002

SL: 3996

TP: 4008 - 4012 - 4016 - 4020 - 4030 - 4040 - ????

✅ BUY ZONE: 3986–3984

SL: 3980

TP: 3990 - 3995 - 4000 - 4010 - 4020 - 4030 - 4040 - ????

⚠️ Risk Management Note

The 4000 level is a psychological resistance – prone to liquidity sweeps.

Prioritise waiting for clear price action signals at BUY zones.

Adjust volume sensibly as volatility may increase with political news & Fed impacts on market sentiment.

✅ Summary

Gold's uptrend remains solid thanks to political instability, Fed easing, record ETF inflows, and central banks continuing to hoard gold. Strategy prioritises BUY at 4004–4002 and 3986–3984 with targets aiming at 4068–4082.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.