EURCAD - CONTINUATION TRADEThe pair is in a clear uptrend, consistently forming higher highs and higher lows. I’m waiting for a healthy pullback into the demand zone, where I’ll look for confirmation to enter long position. Setup remains solid as long as structure is maintained. If in any case price drop below the demand zone

CANADIAN DOLLAR / EURO

No trades

Related currencies

EURCAD - APPROACHES KEY LIQUIDITY ZONESymbol - EURCAD

EURCAD is currently undergoing a correction towards a key liquidity zone within the context of a broader and well established bullish trend. The question remains - will the bulls step in around the 1.6175 area?

EURCAD is retracing toward a strong support zone near 1.6175, contribut

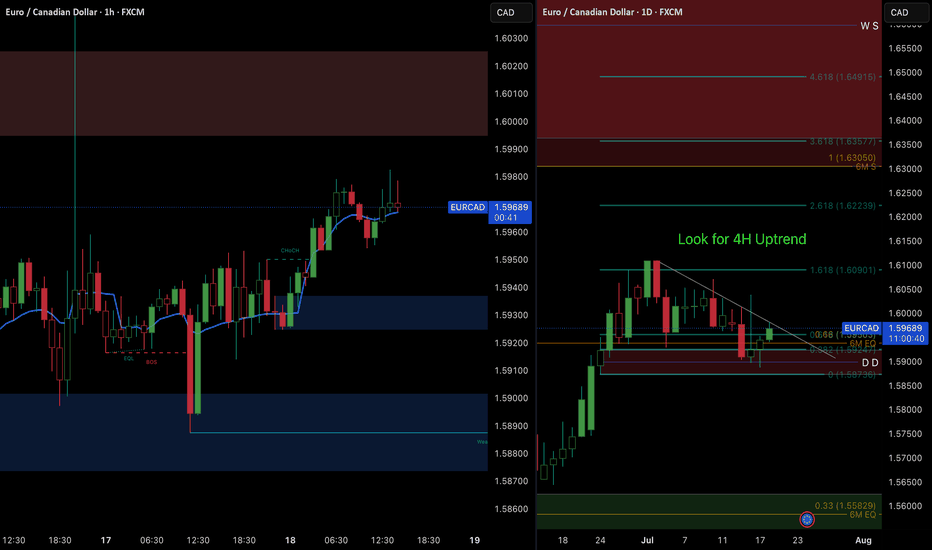

EURCAD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest yo

EURCAD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest yo

EURCAD BUYSPrice flipped the 4H structure on EURCAD, making a new higher high and shifting bullish. I’m watching for a retrace back down into the demand zone around 1.58500 that caused the flip.

Looking for buyers to come in here again and push the price higher. Will wait for some confirmation on the 15-minut

EURCAD Technical Analysis – Bearish Reversal from Resistance 📉 EURCAD Technical Analysis – Bearish Reversal from Resistance Zone

(Timeframe: Intraday – as of July 24, 2025)

🔍 Market Context

The EURCAD pair has recently tested a strong resistance zone around the 1.60200 – 1.60400 level, where it faced clear rejection, forming a sharp bearish move.

🔸 Key Tech

EUR/CAD Bearish Setup – Supply Zone Reversal Trade Plan"Trend:

⬆️ Uptrend (past) → 🔄 CHoCH (Change of Character) → ⬇️ Potential Downtrend

1. Pattern Formed:

📐 Rising Wedge → Bearish Reversal Pattern

➡️ Price broke structure at the bottom = CHoCH ⚠️

2. Supply Zone:

🟧 Supply Zone = 1.56580 - 1.56602

🔄 Price may pull back here before dropping

📍This is y

EUR/CAD FLAG$POLEThe "flag and pole pattern" in technical analysis is a continuation pattern that signals a potential continuation of an existing trend. It's characterized by a sharp price movement (the "pole") followed by a period of consolidation within a defined range (the "flag"). A breakout from this range, in

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CADEUR is 0.6186 EUR — it hasn't changed in the past 24 hours. See more of CADEUR rate dynamics on the detailed chart.

The value of the CADEUR pair is quoted as 1 CAD per x EUR. For example, if the pair is trading at 1.50, it means it takes 1.5 EUR to buy 1 CAD.

The term volatility describes the risk related to the changes in an asset's value. CADEUR has the volatility rating of 0.08%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CADEUR showed a 0.52% rise over the past week, the month change is a 0.45% rise, and over the last year it has decreased by −8.03%. Track live rate changes on the CADEUR chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CADEUR is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CADEUR right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CADEUR technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CADEUR shows the sell signal, and 1 month rating is sell. See more of CADEUR technicals for a more comprehensive analysis.