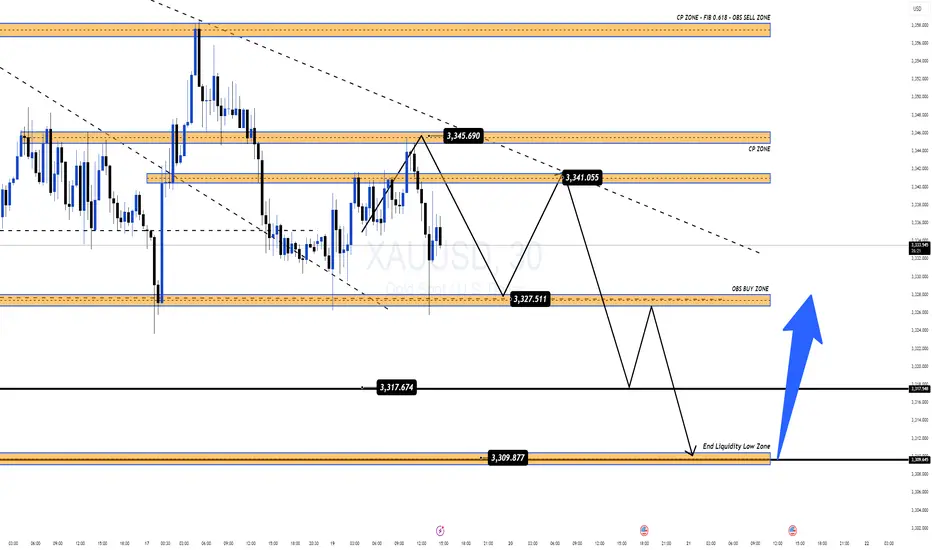

Gold is currently moving within a narrow range, with downside pressure becoming increasingly evident. With just over a day left before the FOMC meeting – an event that could shape the next major trend – the market seems to be preparing for a sharp liquidity sweep.

👉 At first glance, price action looks frustrating and unclear. But for traders following MMFLOW KeyLevels, this is actually the “golden range”, as key zones continue to hold with remarkable precision.

📉 Today’s Outlook

Main Trend: Ongoing corrective downside move.

Potential Scenario: A deep liquidity sweep towards the 331x zone before a strong bullish rebound.

🔑 Key Trading Levels

SELL Zone: 3340 – 3345 | Short SL: 4 – 5$

🎯 Targets: 3325 → 3317 → extended 3310

📌 Note: Manage risk tightly and watch reactions around KeyLevels – a single BreakOut move post-FOMC could unlock the next major opportunity.

✨ Once again: KeyLevels = Profits ✅

👉 Follow MMFLOW TRADING for daily KeyLevel strategies, liquidity maps & smart money insights

👉 At first glance, price action looks frustrating and unclear. But for traders following MMFLOW KeyLevels, this is actually the “golden range”, as key zones continue to hold with remarkable precision.

📉 Today’s Outlook

Main Trend: Ongoing corrective downside move.

Potential Scenario: A deep liquidity sweep towards the 331x zone before a strong bullish rebound.

🔑 Key Trading Levels

SELL Zone: 3340 – 3345 | Short SL: 4 – 5$

🎯 Targets: 3325 → 3317 → extended 3310

📌 Note: Manage risk tightly and watch reactions around KeyLevels – a single BreakOut move post-FOMC could unlock the next major opportunity.

✨ Once again: KeyLevels = Profits ✅

👉 Follow MMFLOW TRADING for daily KeyLevel strategies, liquidity maps & smart money insights

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.