Part 1 Technical Analysis Vs. Institutional Option Trading What Are Options?

Options are financial contracts that give you the right, but not the obligation, to buy or sell an asset at a specific price before a certain date.

Two types of options:

Call Option – Right to buy

Put Option – Right to sell

Options are written on assets like:

Stocks

Index (Nifty, Bank Nifty)

Commodities

Currencies

Harmonic Patterns

Part 3 Technical Analysis Vs. Institutional Option TradingCall Options (CE) Explained

Call = Right to buy

You buy a call when you expect the price to go up.

Your loss is limited to premium paid.

Your profit can be unlimited (theoretically).

Example:

If Nifty is at 22,000 and you buy a 22,100 CE, you are expecting Nifty to rise above 22,100 before expiry.

Profit if market rises → premium increases.

Loss if market falls → premium decreases.

Part 1 Intraday Institutional Trading ITM, ATM, OTM Options

These describe where the current price is compared to strike price.

a) ITM – In The Money

Call: Current price > Strike

Put: Current price < Strike

ITM options cost more.

b) ATM – At The Money

Current price ≈ Strike price

Most volatile and liquid.

c) OTM – Out of The Money

Call: Current price < Strike

Put: Current price > Strike

OTM is cheaper but risky; goes to zero quickly on expiry.

Part 4 Technical Analysis Vs. Institutional Option TradingPut Options (PE) Explained

Put = Right to sell

You buy a put when you expect the price to go down.

Loss is limited to premium paid.

Profit can rise significantly in sharp downtrends.

Example:

If Nifty is at 22,000 and you buy 21,900 PE, you are expecting Nifty to fall below 21,900.

Part 5 Advance Trading Strategies Why Do Options Have Time Decay? (Theta)

Options lose value as expiry approaches.

This is called Theta Decay.

Example:

Monday premium: ₹100

Thursday premium: ₹20

Expiry day: ₹0

This happens because time is part of the option’s value. If market doesn’t move, buyer loses money; seller gains.

Part 1 Technical Analysis Vs. Institutional Trading Volatility and Option Trading

Volatility is the backbone of option pricing.

Types of Volatility

Historical Volatility – Past price movement.

Implied Volatility (IV) – Market’s expectation of future volatility.

High IV → Expensive options.

Low IV → Cheap options.

Option sellers prefer high IV, while buyers prefer low IV with upcoming expansion.

Part 1 Intraday Master Class Introduction to Option Trading

Option trading is a form of derivatives trading that gives market participants the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. Unlike traditional stock trading—where investors buy or sell shares outright—options allow traders to control risk, enhance returns, hedge portfolios, or speculate on price movements with relatively lower capital.

Options are widely used in equity markets, commodity markets, currency markets, and index trading. Over time, option trading has evolved from a niche hedging tool into a sophisticated financial instrument used by retail traders, institutional investors, hedge funds, and market makers.

Part 2 Technical Analysis Vs. Institutional Option Trading Key Components of an Option Contract

Every option contract has a few standard elements:

a) Strike Price

The price at which you can buy (call) or sell (put) the underlying asset.

b) Premium

The price you pay to buy the option.

Think of it like a ticket price to take the trade.

c) Expiry Date

Options expire on a fixed date (weekly/monthly).

If not exercised, they lose value after expiry.

d) Lot Size

You cannot buy 1 share option.

Every option contract has a fixed lot size (e.g., Nifty = 50 units).

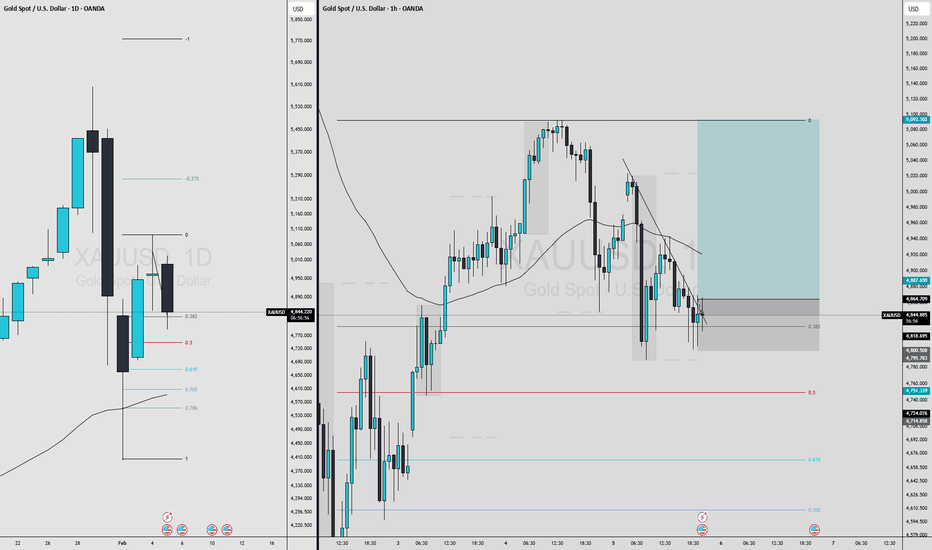

Gold PA Scalping FrameworkScanning XAUUSD to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. This content is for educational purposes only and should not be considered financial advice. Trade at your own risk.

DAILY FOREX SCAN Session – 26 05 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. This content is for educational purposes only and should not be considered financial advice. Trade at your own risk.

Part 2 Ride The Big MovesLot Size

Options trade in lots, not single units.

Lot size varies by instrument.

Why Are Options Popular?

Low upfront premium.

Leverage.

Sophisticated hedging.

High liquidity.

European vs American Options

Indian index options are European — can only be exercised on expiry.

Stock options are American — can be exercised any time (but rarely done).

Part 1 Ride The Big Moves Option Buyer vs Option Seller

Buyer pays premium, limited risk, unlimited profit.

Seller collects premium, limited profit, unlimited risk.

In real market volume, 80–90% of time sellers (institutions) dominate.

Expiry

Every option has a deadline (weekly, monthly).

On expiry day, option either:

ITM: Has value.

OTM: Becomes zero.

DAILY FOREX SCAN Session – 25 05 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. This content is for educational purposes only and should not be considered financial advice. Trade at your own risk.

Part 1 Technical Analysis VS. Institutional Option Trading What Are Options?

Options are contracts that give you the right but not the obligation to buy or sell an asset at a fixed price before a certain date.

They are derivative instruments — their value comes from the underlying asset (index, stock, commodity, currency).

Options are mostly used for hedging, speculation, and income generation.

Two Types of Options

Call Option (CE): Right to buy at a chosen price.

Put Option (PE): Right to sell at a chosen price.

DAILY FOREX SCAN Session – 24 04 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. This content is for educational purposes only and should not be considered financial advice. Trade at your own risk.

Part 3 Institutional Vs. Technical AnalysisMax Pain Theory

Price gravitates toward the strike where option writers lose the least.

Works well near expiry.

Building an Option Trading System

Identify trend with market structure.

Use volume profile for levels.

Use OI for confirmation.

Use Greeks for probability.

Execute with discipline.

Part 2 Institutional Vs. Technical AnalysisGamma Scalping

Involves hedging delta during fast markets.

Mostly used by institutions.

Put-Call Ratio (PCR)

Extreme PCR < 0.7 → oversold.

PCR > 1.3 → overbought.

Helps identify reversal zones.

Impact of News

Options react instantly to news.

High IV before news, low IV after.

Part 2 Intraday Institutional TradingGreeks – The Heart of Option Pricing

The Greeks show how the option premium behaves:

Delta

Measures price change vs underlying.

Call delta: 0 to +1

Put delta: 0 to –1

Theta

Time decay.

Biggest enemy of buyers, friend of sellers.

Gamma

Rate of change of Delta.

High gamma = rapid premium movement.

Vega

Impact of volatility on premium.

Rho

Impact of interest rates (minor in India).

Part 4 Institutional Option Trading Vs. Techncal AnalysisLot Size

Options trade in lots, not single units.

Lot size varies by instrument.

Why Are Options Popular?

Low upfront premium.

Leverage.

Sophisticated hedging.

High liquidity.

European vs American Options

Indian index options are European — can only be exercised on expiry.

Stock options are American — can be exercised any time (but rarely done).

Part 2 Institutional Option Trading Vs. Techncal AnalysisTwo Types of Options

Call Option (CE): Right to buy at a chosen price.

Put Option (PE): Right to sell at a chosen price.

Strike Price

The fixed price at which you can buy/sell.

Example: Nifty 22,000 CE = option to buy Nifty at 22,000.

Premium

The price of the option contract.

Paid by the buyer, received by the seller (writer).