Titan Share Anylysis**Titan Company Ltd – Business Model Overview**

**Company Overview:**

Titan Company Ltd is a part of the **Tata Group** and is one of India’s leading lifestyle companies, primarily known for its **watches, jewellery, eyewear, and accessories**. Incorporated in **1984**, Titan has built iconic brands such as **Tanishq, Fastrack, Sonata, Titan EyePlus**, and more.

---

### 🔑 **Key Business Segments**

1. ### **Jewellery (Tanishq, Mia, Zoya, CaratLane)**

* **Contribution**: \~85% of total revenue

* **Model**: Company-owned and franchise retail outlets

* **Revenue Sources**: Gold, diamond & platinum jewellery

* **USP**: Purity assurance (Karatmeter), craftsmanship, and design

2. ### **Watches & Wearables (Titan, Fastrack, Sonata, Zoop)**

* **Contribution**: \~8–10% of revenue

* **Model**: Manufacturing + Retail + E-commerce

* **Expansion**: Into smartwatches and wearables (Titan Smart, Fastrack Reflex)

3. ### **Eyewear (Titan EyePlus)**

* **Model**: Affordable and premium eyewear offerings via exclusive stores

* **Growth Areas**: Prescription glasses, lenses, and sunglasses

4. ### **Fragrances, Bags & Accessories**

* **Brands**: Skinn (perfumes), Fastrack (bags & wallets)

* **Strategy**: Lifestyle branding for youth-centric products

5. ### **Taneira – Ethnic Wear**

* Targeting India’s ethnic apparel market with premium handloom sarees

---

### 🛒 **Business Model Type: B2C (Business-to-Consumer)**

* **Retail Network**: Over 2,500 stores across India and international locations

* **Franchise Model**: Expands reach with limited capital investment

* **Online Sales**: Through brand websites and e-commerce platforms

* **Omnichannel Strategy**: Integrated digital + physical store experience

---

### 🔄 **Value Chain**

| **Stage** | **Details** |

| ----------------- | ------------------------------------------- |

| **Design** | In-house innovation & R\&D labs |

| **Manufacturing** | Owned facilities + outsourcing for scale |

| **Retail** | Titan World, Tanishq showrooms, Eye+ stores |

| **After-sales** | Lifetime warranty, in-store services |

---

### 💡 **Unique Selling Propositions (USPs)**

* **Strong Brand Trust** (Tata Group legacy)

* **Purity Certifications** (especially in gold jewellery)

* **Innovative Retail Experience** (e.g., Karatmeter, Try @ Home)

* **Youth-centric Brands** (Fastrack, Skinn)

* **Omnichannel Retail Strategy**

---

### 📈 **Revenue Streams**

1. **Product Sales** (jewellery, watches, eyewear, apparel)

2. **Export Sales** (especially watches & jewellery)

3. **Online Marketplace Sales**

4. **Value-added Services** (warranty, customization, insurance)

---

### 🔧 **Future Strategy**

* **International Expansion** (Middle East & US)

* **Smart Products** (IoT-enabled wearables)

* **Sustainability & ESG Goals**

* **Customer Personalization** using AI & analytics

---

### 🧠 **SWOT Analysis Summary**

| **Strengths** | **Weaknesses** |

| ------------------- | ------------------------------------------- |

| Strong brand equity | High dependency on jewellery |

| Wide retail network | Premium pricing may limit mass-market reach |

| **Opportunities** | **Threats** |

| ------------------------------------- | --------------------------------------------- |

| Growing e-commerce & smart wearables | Competition from unorganized & online players |

| Rising gold demand in Tier 2/3 cities | Gold price volatility & regulatory risks |

---

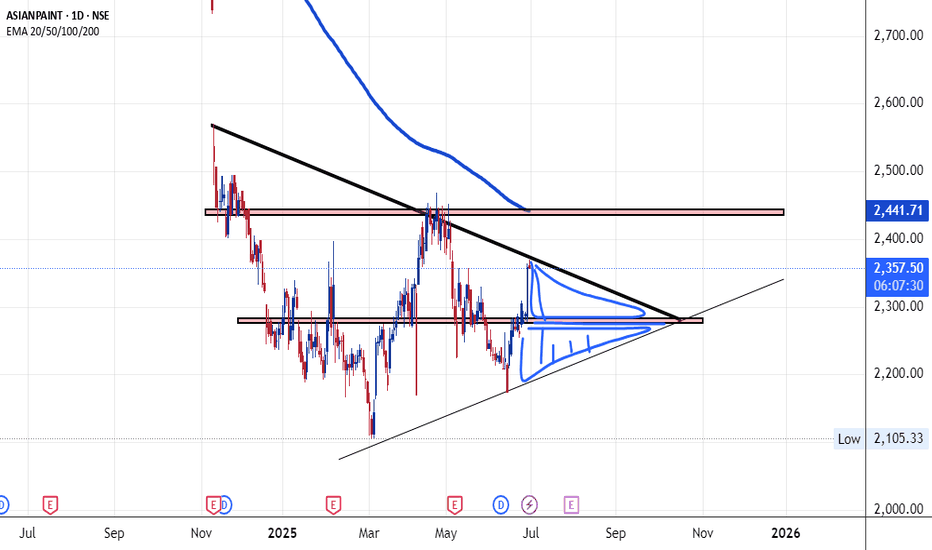

Harmonic Patterns

Asian Paints Chart Move Update **Asian Paints Business Model**:

---

## 🏢 **Asian Paints Ltd – Business Model Overview**

### 1. **Company Overview**

* **Founded:** 1942

* **Headquarters:** Mumbai, India

* **Founders:** Champaklal H. Choksey, Chimanlal Choksi, Suryakant Dani & Arvind Vakil

* **CEO & MD:** Amit Syngle (as of 2024)

* **Industry:** Paints and Coatings, Home Décor, Bath Fittings

* **Market Position:** India's largest and Asia’s third-largest paint company

---

### 2. **Core Business Segments**

| Segment | Description |

| ---------------------------- | --------------------------------------------------------------- |

| **Decorative Paints** | Wall paints, enamels, wood finishes, distempers, primers, etc. |

| **Industrial Coatings** | Automotive and powder coatings in partnership with PPG Inc. |

| **Home Improvement & Décor** | Kitchen, bath fittings (via Sleek and Ess Ess), waterproofing |

| **International Operations** | Presence in 15+ countries, strong in South Asia and Middle East |

---

### 3. **Key Revenue Streams**

* **Retail Sales** (B2C): Via large dealer and distributor networks across India.

* **Institutional/B2B Sales**: Projects, contractors, automotive OEMs.

* **Premium Product Lines**: Royale, Ultima, Tractor Emulsion.

* **Services**: Home painting services, waterproofing, colour consultancy.

---

### 4. **Distribution Network**

* Over **70,000+ dealers** in India

* **Robust supply chain** with over 30+ manufacturing facilities globally

* Digital tools like **Colour Visualizers, SmartCare App** for consumer engagement

---

### 5. **Digital & Technology Integration**

* **ColourNext** trend forecasting platform

* Use of **AI/ML in demand forecasting** and inventory management

* E-commerce platforms for paints & décor

* CRM systems for improved customer service and feedback

---

### 6. **Business Strategy**

* **Backward Integration**: Manufacturing of raw materials like emulsions & pigments

* **Innovation**: Focus on eco-friendly and long-lasting paints

* **Brand Building**: Iconic advertising (e.g., “Har Ghar Kuch Kehta Hai”)

* **Customer-Centric Services**: Safe Painting Service, Colour Consultancy, etc.

---

### 7. **Competitive Advantages**

* **Strong Brand Loyalty**

* **Pan-India Dealer Network**

* **In-house R\&D** and innovation capabilities

* **Diverse Product Portfolio** for all price points and segments

* **Agile supply chain and logistics**

---

### 8. **Recent Initiatives**

* Expansion into **home décor** through **Beautiful Homes platform**

* Entry into **furnishings & lighting**

* Strengthening of **waterproofing solutions**

* Focus on **sustainable paints** (low VOC, green-certified)

---

### 9. **Challenges**

* Raw material price volatility (e.g., crude oil-based inputs)

* Competitive pressure from **Berger Paints, Nerolac, Akzo Nobel**

* Seasonal demand patterns

* Margin pressure in low-end segments

---

### 10. **Conclusion**

Asian Paints is not just a paint company; it’s evolving into a **comprehensive home improvement brand**. With its innovation-driven strategy, strong retail presence, and digital transformation efforts, it continues to lead the Indian market and expand globally.

---

thanks & regards

the golden farms of equity

Put Call Ratio (PCR) Explained in Simple TermsWhat is PCR?

The Put-Call Ratio (PCR) is a popular market sentiment indicator used in option trading. It helps traders understand whether more people are buying put options (bearish bets) or call options (bullish bets) at a given time.

Put Options: Contracts betting the price will go down.

Call Options: Contracts betting the price will go up.

How to Read PCR?

PCR < 1: More call options → Bullish sentiment.

PCR > 1: More put options → Bearish sentiment.

PCR = 1: Neutral sentiment.

But extreme values often suggest the opposite:

Very High PCR: Possible market reversal upwards (too many bearish bets).

Very Low PCR: Possible market reversal downwards (too many bullish bets).

Example:

Put OI: 5,00,000 contracts

Call OI: 10,00,000 contracts

PCR = 5,00,000 / 10,00,000 = 0.5 → This indicates bullish sentiment.

Why PCR Matters?

Helps identify market mood (bullish or bearish).

Gives contrarian signals (overcrowded trades can reverse).

Used in option trading strategies for timing entry and exit.

Copper Weekly PlanAll detail for chat. good entry at mark price only. and must stoploss minimum risk and good profit. risk ratio 1:1 to manage modified SL.

📌 This is not a buy/sell recommendation, just an educational trading idea.

📌 Market conditions can change; always conduct your own research.

📌 Understand risks before investing and take full responsibility for decisions.

Crude Oil Weekly predictions All detail for chat. good entry at mark price only. and must stoploss minimum risk and good profit. risk ratio 1:1 to manage modified SL.

📌 This is not a buy/sell recommendation, just an educational trading idea.

📌 Market conditions can change; always conduct your own research.

📌 Understand risks before investing and take full responsibility for decisions.

Learn Institutional Option Trading Part-4Recent Growth of Options in India:

Retail participation has surged.

Weekly expiry options (especially on Bank Nifty) have become extremely popular.

SEBI introduced lot size and margin regulations to control excessive speculation.

Investing in India

What is Investing?

Investing means allocating money into assets like stocks, mutual funds, bonds, gold, or real estate to earn returns over time.

Major Investment Options in India:

Equities (Shares)

Mutual Funds

Fixed Deposits

Public Provident Fund (PPF)

Gold (Physical and Digital)

Real Estate

Bonds and Debentures

Institutions Option Database Trading Part-4Advanced traders use machine learning to forecast:

Option price movement

Volatility changes

IV spikes before events

Popular Models:

Random Forest → Trend direction.

LSTM (Deep Learning) → Predict future IV.

Logistic Regression → Probability of ITM expiry.

These are trained on millions of past trades using structured databases.

Institutions Option Database Trading Part-6Deep Dive into Options Basics (For Data Traders)

Options are contracts giving the right but not the obligation to buy or sell an asset at a certain price before a set date. They are used for hedging, speculation, and generating income.

🛠️ Two Types:

Call Option: Right to buy an asset.

Put Option: Right to sell an asset.

Backtesting means testing a strategy using past data to check performance. Key for data-driven option trading.

Example:

Load 1-year option chain data for BANKNIFTY.

Apply rules: Buy Call when IV drops by 10% & PCR < 0.8.

Check PnL for each trade.

Filter for success rate > 65%.

All Major Indices Review in Few Minutes Here are the **major indices of the Indian stock market**, categorized by exchange and segment:

---

## 🇮🇳 **Major Indian Stock Market Indices**

### 🔷 **On NSE (National Stock Exchange)**

| Index | Description |

| -------------------------------- | ------------------------------------------------------------------------------------------- |

| **Nifty 50** | Benchmark index of the NSE comprising the 50 largest and most liquid stocks across sectors. |

| **Nifty Next 50** (Nifty Junior) | Represents 50 companies ranked after the Nifty 50 in terms of free-float market cap. |

| **Nifty Bank** | Includes the 12 most liquid and large banking stocks. |

| **Nifty Financial Services** | Covers banks, NBFCs, and insurance companies. |

| **Nifty IT** | Consists of major IT companies like TCS, Infosys, Wipro, etc. |

| **Nifty FMCG** | Tracks the performance of Fast-Moving Consumer Goods companies. |

| **Nifty Auto** | Represents automobile manufacturing companies. |

| **Nifty Pharma** | Contains top pharmaceutical companies. |

| **Nifty Metal** | Focuses on companies from the metal sector. |

| **Nifty Realty** | Tracks real estate sector performance. |

| **Nifty Midcap 150** | Covers the top 150 mid-sized companies. |

| **Nifty Smallcap 250** | Focuses on 250 small-cap companies. |

---

### 🔶 **On BSE (Bombay Stock Exchange)**

| Index | Description |

| ----------------------------------------------------- | --------------------------------------------------------------------- |

| **Sensex** | Flagship index of BSE, includes 30 large, well-established companies. |

| **BSE 100** | Represents the top 100 companies on BSE. |

| **BSE 200** | A broader index that includes 200 companies. |

| **BSE 500** | Captures 93% of total BSE market capitalization. |

| **BSE Midcap** | Mid-sized companies listed on the BSE. |

| **BSE Smallcap** | Small-sized companies with growth potential. |

| **BSE Bankex** | Focuses on the banking sector. |

| **BSE IT** | Includes leading IT companies. |

| **BSE FMCG / BSE Auto / BSE Healthcare / BSE Realty** | Sector-specific indices similar to NSE counterparts. |

---

## 📊 **Other Specialized Indices**

| Index | Type |

| ------------------------------------------- | --------------------------------------------------- |

| **India VIX** | Volatility Index (fear gauge of the market) |

| **Nifty ESG** | Based on Environmental, Social & Governance metrics |

| **Nifty Alpha / Low Volatility / Momentum** | Smart beta indices for factor-based investing |

---

Thanks & Regards

Mohinder Singh

The Golden Farms of Equity

Support and Resistance ExplainedWhat is Support?

Support is a price level where a stock tends to stop falling due to increased buying interest. Traders view it as a demand zone where bulls often enter the market.

Example: If Reliance repeatedly bounces from ₹2,700, that level is acting as support.

🔹 What is Resistance?

Resistance is a level where a stock tends to stop rising due to selling pressure. It's a supply zone where bears usually take control.

Example: If Nifty keeps failing to cross 23,500, it's a resistance level.

🔹 Why They Matter:

Help in identifying entry and exit points

Show where trend reversals may occur

Aid in setting stop-loss and targets

🔹 How to Spot Them:

Look for price bounces or rejections

Use tools: horizontal lines, moving averages, Fibonacci retracements

Confirm with volume spikes

🔹 Key Strategy:

Buy near support (low risk)

Sell near resistance (high probability)

Trade breakouts or reversals with confirmation

Advanced Institutions Option Trading - Part 7Time Decay (Theta) Strategies

Options lose value over time due to Theta Decay.

Strategies to Take Advantage of Theta:

Selling options (Covered Calls, Naked Puts)

Calendar Spreads

Iron Butterflies

Caution:

Theta decay accelerates as expiry nears. Option sellers must hedge their deltas to stay safe.

Risk Management in Options

Institutions and pro traders always focus on capital protection.

🔐 Techniques:

Position sizing (no more than 2-3% risk per trade)

Hedging with opposite legs or underlying

Stop-loss on premium or delta exposure

Use of Greeks for real-time adjustment

Risk management > Strategy in the long run.

Advanced Institutions Option Trading - Part 5Institutional Tools & Platforms

Bloomberg Terminal / Reuters Eikon: Institutional-grade data

FIX Protocols: For high-frequency option order routing

Quant Models: Statistical arbitrage using Python/R

Option Analytics Engines: Measure IV Skew, Smile, Surface modeling

Institutions don’t just trade options—they engineer risk-managed portfolios using AI and predictive analytics.

Option Chain Analysis for Traders

Option Chain provides a list of all available option contracts for a stock/index.

Key Elements:

Strike Prices

Call & Put Prices

Open Interest (OI)

Volume

Implied Volatility (IV)

Change in OI

Interpretation:

High OI + Rising Price = Strong Trend

IV Surge = High Volatility Expectation

PCR (Put-Call Ratio) = Market Sentiment Indicator

PCR > 1: Bearish sentiment

PCR < 1: Bullish sentiment

Nifty & Bank Nifty View For 18 June 2025 **Bank Nifty**:

1. **Bank Nifty** is a sectoral index on the **National Stock Exchange (NSE)** of India.

2. It represents the performance of the **12 most liquid and large capitalized banking stocks**.

3. The index includes both **public and private sector banks**.

4. Bank Nifty was launched in **September 2003**.

5. It is used to measure the **performance of the banking sector** in the stock market.

6. The index is **market-cap weighted and free-float adjusted**.

7. It helps traders and investors to track **banking sector trends**.

8. Bank Nifty is widely used for **derivatives trading (futures and options)**.

9. It is **reviewed semi-annually** to ensure relevance and liquidity.

10. The index is a key indicator of the **health of the Indian financial system**.

**Nifty**:

1. **Nifty**, or **Nifty 50**, is a benchmark stock market index in India.

2. It represents the weighted average of **50 of the largest** and most liquid Indian companies.

3. The index is managed and owned by the **National Stock Exchange (NSE)**.

4. It was introduced in **1996** with a base value of 1000.

5. Nifty covers **13 sectors** of the Indian economy, including IT, finance, and energy.

6. Companies in Nifty are selected based on **free-float market capitalization**.

7. It serves as a **barometer of the Indian equity market’s performance**.

8. Nifty is reviewed and rebalanced **semi-annually**.

9. It is widely used by **investors, mutual funds, and analysts**.

10. Nifty's performance impacts **investment decisions and economic outlook** in India.

Bank Nifty View for 17 June 2025 **Bank Nifty**:

1. **Bank Nifty** is a sectoral index on the **National Stock Exchange (NSE)** of India.

2. It represents the performance of the **12 most liquid and large capitalized banking stocks**.

3. The index includes both **public and private sector banks**.

4. Bank Nifty was launched in **September 2003**.

5. It is used to measure the **performance of the banking sector** in the stock market.

6. The index is **market-cap weighted and free-float adjusted**.

7. It helps traders and investors to track **banking sector trends**.

8. Bank Nifty is widely used for **derivatives trading (futures and options)**.

9. It is **reviewed semi-annually** to ensure relevance and liquidity.

10. The index is a key indicator of the **health of the Indian financial system**.

Nifty View For 17 June 2025 **Nifty**:

1. **Nifty**, or **Nifty 50**, is a benchmark stock market index in India.

2. It represents the weighted average of **50 of the largest** and most liquid Indian companies.

3. The index is managed and owned by the **National Stock Exchange (NSE)**.

4. It was introduced in **1996** with a base value of 1000.

5. Nifty covers **13 sectors** of the Indian economy, including IT, finance, and energy.

6. Companies in Nifty are selected based on **free-float market capitalization**.

7. It serves as a **barometer of the Indian equity market’s performance**.

8. Nifty is reviewed and rebalanced **semi-annually**.

9. It is widely used by **investors, mutual funds, and analysts**.

10. Nifty's performance impacts **investment decisions and economic outlook** in India.

Option Trading Master class Part -7Fundamentals of Stock Investing

Types of Investors:

Value Investors: Focus on undervalued companies

Growth Investors: Target high-growth potential stocks

Dividend Investors: Prefer regular income from dividends

Research Parameters:

Earnings per Share (EPS)

Price-to-Earnings Ratio (P/E)

Return on Equity (ROE)

Debt-to-Equity Ratio

Industry Trends

Tools for Investing:

Demat and Trading Account

Research Platforms (e.g., TradingView, Screener.in)

Portfolio Tracker (e.g., Zerodha Console)

Option Trading Master classIntroduction to Investing and Option Trading

Investing and option trading are two pillars of wealth creation and risk management in modern finance. Investing focuses on long-term growth by acquiring assets that appreciate over time, while option trading involves strategic bets on price movements within a defined period using derivative contracts. Together, they offer investors a combination of growth, income, and hedging capabilities.

What is Investing?

Definition:

Investing is the process of allocating money into financial instruments (like stocks, bonds, ETFs, or real estate) with the expectation of generating a return over time.

Key Objectives:

Wealth accumulation

Passive income generation

Capital preservation

Beating inflation

Common Asset Classes:

Equity (Stocks): Ownership in companies

Fixed Income (Bonds): Lending capital to earn interest

Real Estate: Physical properties generating rental income

Mutual Funds/ETFs: Pooled investments

Commodities and Gold: Inflation hedges

Bank Nifty View for 16-06-2025 **Bank Nifty**:

1. **Bank Nifty** is a sectoral index on the **National Stock Exchange (NSE)** of India.

2. It represents the performance of the **12 most liquid and large capitalized banking stocks**.

3. The index includes both **public and private sector banks**.

4. Bank Nifty was launched in **September 2003**.

5. It is used to measure the **performance of the banking sector** in the stock market.

6. The index is **market-cap weighted and free-float adjusted**.

7. It helps traders and investors to track **banking sector trends**.

8. Bank Nifty is widely used for **derivatives trading (futures and options)**.

9. It is **reviewed semi-annually** to ensure relevance and liquidity.

10. The index is a key indicator of the **health of the Indian financial system**.

NIfty View For 16-06-25Sure! Here's a 10-line summary on **Nifty**:

1. **Nifty**, or **Nifty 50**, is a benchmark stock market index in India.

2. It represents the weighted average of **50 of the largest** and most liquid Indian companies.

3. The index is managed and owned by the **National Stock Exchange (NSE)**.

4. It was introduced in **1996** with a base value of 1000.

5. Nifty covers **13 sectors** of the Indian economy, including IT, finance, and energy.

6. Companies in Nifty are selected based on **free-float market capitalization**.

7. It serves as a **barometer of the Indian equity market’s performance**.

8. Nifty is reviewed and rebalanced **semi-annually**.

9. It is widely used by **investors, mutual funds, and analysts**.

10. Nifty's performance impacts **investment decisions and economic outlook** in India.

Advanced Technical Master classMulti-Timeframe Analysis involves analyzing multiple chart timeframes (Monthly, Weekly, Daily, 4H, 1H) to confirm trend direction and improve timing accuracy.

Application:

Identify long-term trend (Monthly/Weekly)

Use Daily/4H for entry signals

Filter noise with lower timeframes

Key Tools: Moving Averages, Trendlines, MACD

Module 2: Advanced Chart Patterns

Key Patterns Covered:

Harmonic Patterns (Gartley, Bat, Crab)

Elliott Waves (Impulse & Corrective Waves)

Wyckoff Method (Accumulation/Distribution Phases)

Practical Use:

Pattern + Volume = Strong Entry

Combine with Fib levels for reversal confirmation

Module 3: Volume Price Analysis (VPA)

Core Principle:

Volume precedes price. Learn to read volume spikes, absorption, and exhaustion.

Indicators to Use:

On Balance Volume (OBV)

Volume Profile

VWAP

Institution Option Trading Part-1In today’s fast-paced financial world, where milliseconds can make a difference, Option Database Trading has become an essential tool for serious traders, quantitative analysts, and institutional investors. This strategy revolves around using structured historical and real-time data from the options market to make informed, data-driven trading decisions.

This guide will help you understand what Option Database Trading is, how it works, what tools are required, and how it can significantly improve your edge in the options market.

📊 What is Option Database Trading?

Option database trading involves the systematic storage, analysis, and utilization of large datasets from the options market to find patterns, identify opportunities, and execute trades. It typically includes:

Historical Option Prices

Implied Volatility (IV) & Historical Volatility (HV)

Open Interest (OI) & Volume

Greeks (Delta, Theta, Vega, Gamma, Rho)

Option Chain Snapshots

Corporate Actions, Earnings, News Impact

By creating or accessing an options data warehouse, traders can backtest strategies, run simulations, and refine their models using real market data.

What does the Nifty Bank chart say, is there a need to panic ? **Bank Nifty**:

1. **Bank Nifty** is a sectoral index on the **National Stock Exchange (NSE)** of India.

2. It represents the performance of the **12 most liquid and large capitalized banking stocks**.

3. The index includes both **public and private sector banks**.

4. Bank Nifty was launched in **September 2003**.

5. It is used to measure the **performance of the banking sector** in the stock market.

6. The index is **market-cap weighted and free-float adjusted**.

7. It helps traders and investors to track **banking sector trends**.

8. Bank Nifty is widely used for **derivatives trading (futures and options)**.

9. It is **reviewed semi-annually** to ensure relevance and liquidity.

10. The index is a key indicator of the **health of the Indian financial system**.

What does the Nifty chart say? Is there a need to panic or not?**Nifty**:

1. **Nifty**, or **Nifty 50**, is a benchmark stock market index in India.

2. It represents the weighted average of **50 of the largest** and most liquid Indian companies.

3. The index is managed and owned by the **National Stock Exchange (NSE)**.

4. It was introduced in **1996** with a base value of 1000.

5. Nifty covers **13 sectors** of the Indian economy, including IT, finance, and energy.

6. Companies in Nifty are selected based on **free-float market capitalization**.

7. It serves as a **barometer of the Indian equity market’s performance**.

8. Nifty is reviewed and rebalanced **semi-annually**.

9. It is widely used by **investors, mutual funds, and analysts**.

10. Nifty's performance impacts **investment decisions and economic outlook** in India.