Part 3 Technical VS. InstitutionalThe "Greek" Influence

Professional traders don't just look at the stock price; they look at "The Greeks." These mathematical values explain how an option’s price might change:

Delta: Measures how much the option price moves for every $1 move in the stock.

Theta: This is time decay. Options lose value every day they get closer to expiration. Theta is the "silent killer" for buyers.

Vega: Measures sensitivity to implied volatility. If the market expects a massive move (like during earnings), Vega increases the premium.

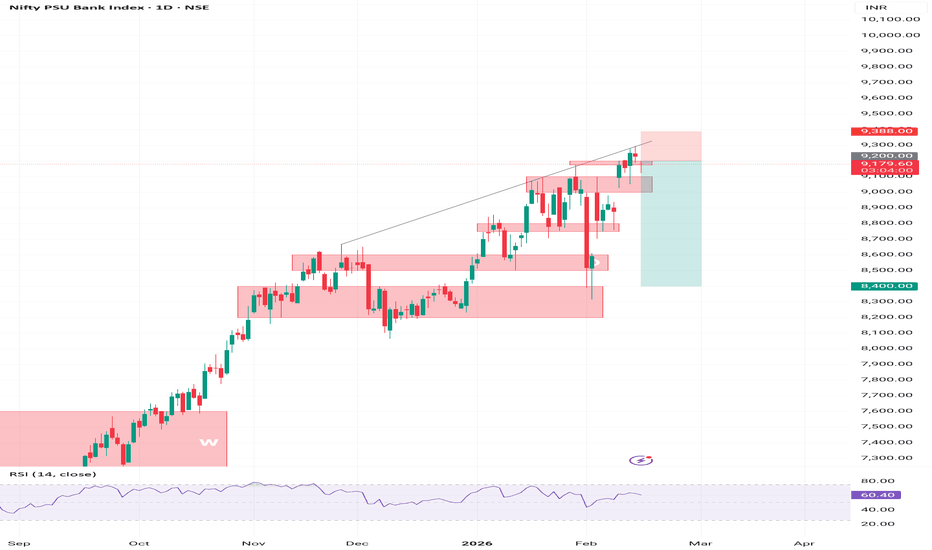

Trend Analysis

Part 1 Technical VS. Institutional The Core Mechanics: Calls and Puts

To understand options, you must first master the two primary instruments:

Call Options (The Right to Buy)

When you buy a Call, you are "bullish." You believe the stock price will go up.

The Right: You have the right to buy 100 shares at a set price (the Strike Price).

The Goal: If the stock price rises above your strike price before the expiration date, you can buy those shares at a discount or sell the contract for a profit.

Put Options (The Right to Sell)

When you buy a Put, you are "bearish." You believe the stock price will go down.

The Right: You have the right to sell 100 shares at the Strike Price.

The Goal: If the stock price falls below the strike price, your contract becomes more valuable because it allows you to sell the stock for more than its current market value.

Part 2 Technical VS. InstitutionalKey Terms You Need to Know

Before placing a trade, you have to speak the language. Every options contract is defined by four pillars:

Underlying Asset: The stock or ETF the option is based on (e.g., Apple, Tesla).

Strike Price: The predetermined price at which the option holder can buy or sell the stock.

Expiration Date: The "shelf life" of the contract. Unlike stocks, options do not last forever. If the stock hasn't moved your way by this date, the option expires worthless.

Premium: This is the price you pay to own the option. It’s the "entry fee."

Safe-Haven Assets Demand (Gold, Treasuries)🟡 Gold as a Safe-Haven Asset

Historical Role and Psychological Appeal

Gold has been regarded as a store of value for thousands of years. Unlike fiat currencies, it is not issued by any government and cannot be created at will. This intrinsic scarcity gives gold a reputation as a hedge against currency debasement, inflation, and systemic financial collapse. During crises—such as wars, financial crashes, or inflationary spirals—investors often flock to gold because it is perceived as tangible and universally valuable.

The psychological component of gold demand is significant. In times of uncertainty, trust in financial institutions or paper assets may weaken. Gold, being a physical asset, provides reassurance. It is not subject to default risk and does not rely on a counterparty’s promise to pay.

Gold During Economic Stress

Gold prices typically rise during:

Stock market downturns

High inflation periods

Currency depreciation

Geopolitical tensions

Banking crises

For example, during the 2008 global financial crisis, gold prices increased substantially as investors sought safety amid collapsing financial institutions. Similarly, during the COVID-19 pandemic in 2020, gold reached record highs as economic uncertainty intensified.

Inflation Hedge

Gold is often described as a hedge against inflation. When inflation erodes the purchasing power of currency, gold tends to maintain its real value over the long term. Although the relationship is not perfect in the short run, over extended periods gold has preserved wealth during inflationary cycles.

Portfolio Diversification

Gold also plays a diversification role. It often exhibits low or negative correlation with equities and other risk assets. By adding gold to a portfolio, investors can potentially reduce overall volatility. Institutional investors, central banks, and retail investors alike incorporate gold to manage systemic risk exposure.

🏛️ United States Treasury securities as a Safe-Haven Asset

Credit Quality and Government Backing

U.S. Treasury securities—such as Treasury bills, notes, and bonds—are debt instruments issued by the U.S. government. They are widely considered among the safest investments in the world because they are backed by the “full faith and credit” of the United States government.

Unlike corporate bonds, Treasuries carry minimal default risk. The U.S. government has the authority to tax and issue currency, making the probability of outright default extremely low relative to other borrowers.

Flight to Safety

When financial markets become volatile, investors often engage in what is called a “flight to safety.” This involves selling risky assets like stocks or emerging market securities and reallocating funds into Treasuries. Increased demand for Treasuries pushes their prices up and yields down.

This inverse relationship between price and yield is central to understanding Treasury market behavior. During crises, Treasury yields frequently fall sharply as investors seek protection.

Liquidity and Market Depth

Another key reason Treasuries serve as a safe haven is liquidity. The U.S. Treasury market is one of the largest and most liquid financial markets in the world. Investors can quickly buy or sell large quantities without significantly affecting prices. In times of stress, liquidity becomes extremely valuable, and Treasuries provide that stability.

Role in Monetary Policy

Treasuries also serve as critical instruments in global finance. Central banks use them in open market operations, and they function as benchmark rates for other financial assets. Their deep integration into the financial system reinforces their safe-haven status.

Drivers of Safe-Haven Demand

Safe-haven demand for gold and Treasuries is influenced by several interconnected factors:

1. Economic Uncertainty

Recession fears, weak economic data, or financial instability often increase demand for safe assets. Investors prioritize capital preservation over high returns.

2. Geopolitical Risk

Wars, trade conflicts, political instability, and sanctions can trigger global uncertainty. Gold, being internationally recognized and not tied to a specific government, becomes attractive. Meanwhile, Treasuries benefit from the U.S. dollar’s reserve currency status.

3. Inflation and Currency Risk

If inflation accelerates or currency values decline, investors may hedge by purchasing gold. In contrast, during deflationary shocks, Treasuries become more attractive due to falling yields and capital gains potential.

4. Market Volatility

Spikes in volatility indices often coincide with increased safe-haven flows. Investors rebalance portfolios toward lower-risk assets when uncertainty rises.

Differences Between Gold and Treasuries

Although both are safe havens, they respond differently to economic conditions.

Gold performs well during inflationary crises and when trust in fiat currency weakens.

Treasuries perform well during deflationary recessions and liquidity crunches.

Treasuries generate interest income, while gold does not. Therefore, when real interest rates rise significantly, gold can become less attractive because it has an opportunity cost. Conversely, when real yields are low or negative, gold demand typically strengthens.

Gold is also influenced by central bank purchases and global jewelry demand, while Treasuries are influenced by fiscal policy, monetary policy, and debt issuance levels.

Central Banks and Institutional Demand

Central banks play a significant role in safe-haven markets. Many central banks hold gold as part of their foreign exchange reserves. In recent years, several countries have increased gold holdings to diversify away from U.S. dollar dependence.

At the same time, global investors—including pension funds, insurance companies, and sovereign wealth funds—hold large quantities of U.S. Treasuries as reserve assets. The dollar’s status as the world’s primary reserve currency enhances Treasury demand, especially during crises.

Impact on Financial Markets

Safe-haven demand can significantly influence asset prices and capital flows:

Equity markets may decline as funds rotate into safer assets.

Treasury yields often fall sharply during panic-driven buying.

Gold prices may spike during geopolitical shocks.

Emerging market assets can experience capital outflows.

These flows reflect investor sentiment and risk perception. Monitoring safe-haven demand provides clues about broader market confidence.

Limitations of Safe-Haven Assets

Despite their reputation, gold and Treasuries are not risk-free in all scenarios.

Gold can experience significant short-term volatility. It does not generate income and can underperform during periods of strong economic growth and rising interest rates.

Treasuries carry interest rate risk. If inflation rises unexpectedly and bond yields increase, Treasury prices can decline. Additionally, long-term fiscal sustainability concerns could affect confidence, although historically Treasuries have maintained strong credibility.

Modern Developments

In recent years, safe-haven demand has been influenced by:

Ultra-low and negative interest rate environments

Large-scale quantitative easing

Rising geopolitical tensions

High global debt levels

Some investors have also considered alternative safe havens, such as certain currencies or even digital assets. However, gold and Treasuries remain dominant due to their long-standing trust, liquidity, and institutional backing.

Conclusion

Safe-haven assets like gold and U.S. Treasury securities play a critical role in global financial markets. Their demand rises when uncertainty increases, reflecting investor preference for stability over growth. While gold provides protection against inflation and currency debasement, Treasuries offer security, income, and liquidity during economic downturns.

Together, they serve as cornerstones of defensive investment strategies. By observing shifts in safe-haven demand, analysts and policymakers can better understand market sentiment, systemic risk, and macroeconomic expectations.

Part 3 Technical Analysis Vs. Institutional Option TradingBreakout Strategy (Options Buying)

Perfect during:

✔ High volatility

✔ News-driven moves

✔ Index breakout/breakdown

Setup

Mark key levels: yesterday high/low, intraday range

Wait for high-volume breakout

Buy ATM call for upside, ATM put for downside

Benefits

Best RR ratio. Trend moves explode premiums quickly.

Axis Bank | Gann Square of 9 Intraday Observation | 20/10/2023Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 20 October 2023

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Normal Price Capacity Study)

This idea highlights a historical intraday observation where Axis Bank’s price behavior aligned with a normal Square of 9 downside capacity level, followed by a temporary reaction once price and time came into alignment.

📊 Market Structure & Reference Selection

During the session, Axis Bank showed downward movement after the reference point was identified.

In declining conditions, the high of the reference candle (~993) was treated as the 0-degree level, following commonly used Gann principles.

This reference served as the base for evaluating the stock’s expected intraday price expansion.

The focus remains on structure and measurement rather than prediction.

🔢 Square of 9 Level Mapping

Using the selected reference:

0 Degree: ~993

45 Degree (Observed Normal Downside Capacity): ~977

The 45-degree level is often studied as a zone where normal intraday movement may complete, especially if reached early in the session.

⏱️ Observed Price–Time Behavior

Price declined steadily from the reference level.

The 45-degree zone was approached well before the latter part of the trading day.

Around mid-session, price made a low close to the calculated level, with a small variation.

Minor deviations around derived levels are commonly observed in live markets.

After interacting with this zone, price showed temporary buying interest and moved higher.

Historically, such behavior reflects how early completion of normal price capacity can coincide with short-term reactions.

📘 Educational Takeaways

Importance of selecting the correct 0-degree reference

Measuring normal intraday movement using Square of 9

Studying time alignment alongside price levels

Allowing reasonable price tolerance in real-market data

Observing reactions rather than anticipating outcomes

This example demonstrates how a rule-based framework can help interpret intraday market behavior objectively.

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 11/03/ 2024Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 11 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Alignment)

This post shares a historical intraday observation showing how price interacted with a normal Square of 9 capacity level, leading to a temporary reaction when time and price aligned.

📊 Market Context & Reference Selection

Axis Bank displayed upward momentum after the completion of the first 15-minute candle.

In such market conditions, the low of the first 15-minute candle (~1104) was treated as the 0-degree reference level, following Gann methodology.

This reference point was used to study the session’s expected price expansion.

Correct identification of the reference level is critical for objective Square of 9 analysis.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~1104

45 Degree (Observed Normal Capacity): ~1121

The 45-degree level often represents the normal intraday movement range under regular market conditions.

⏱️ Observed Price–Time Behavior

Price approached the 45-degree level well before the later part of the trading session.

Early completion of normal price capacity has historically been associated with short-term trend fatigue.

After interacting with this zone, price showed temporary selling pressure and moved lower.

A minor variation around the calculated level was observed, which is common in live market conditions.

This aligns with a widely observed Gann concept:

When expected price capacity is completed early in time, the probability of a reaction may increase.

📘 Educational Takeaways

Square of 9 helps define logical intraday price limits

Early capacity completion can indicate temporary exhaustion

Time plays a supporting role in validating price-degree levels

Small price deviations are normal and should be viewed structurally

The method promotes rule-based observation over prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Part 2 Technical Analysis Vs. Institutional Option TradingDirectional Intraday Strategy: ATM/ITM Option Buying

Best when:

✔ Strong momentum

✔ Trend day

✔ Breakout or breakdown

How it works

Identify trend using 5-min chart

Use VWAP + 20 EMA confirmation

Enter ATM or ITM option

Keep tight SL based on premium

Why it works

ITM/ATM options have better delta (0.5–0.7), giving faster premium movement.

Risk

Time decay hurts if market stays flat.

Deglobalization and Supply Chain FragmentationUnderstanding Globalization

Globalization refers to the increasing interconnectedness of economies through trade, investment, technology, and the movement of labor and capital. Institutions such as the World Trade Organization (WTO) facilitated this integration by promoting trade liberalization and reducing tariffs. The late 20th and early 21st centuries saw multinational corporations expand their operations globally, optimizing production by locating different stages of manufacturing in countries with cost advantages.

For example, a smartphone designed in the United States might rely on rare earth minerals from Africa, semiconductors from East Asia, assembly in China, and global distribution networks spanning multiple continents. This model maximized efficiency and minimized costs, forming what became known as global value chains (GVCs).

What Is Deglobalization?

Deglobalization refers to the slowdown or reversal of global economic integration. It does not necessarily imply a complete retreat from international trade, but rather a reduction in the intensity of cross-border flows of goods, capital, technology, and labor.

Several indicators suggest deglobalization trends:

Slower growth in global trade relative to GDP

Rising tariffs and non-tariff barriers

Increased protectionist policies

Stricter foreign investment screening

National industrial policies aimed at reshoring production

Major geopolitical events have accelerated this trend. The trade tensions between the United States and China, particularly during the presidency of Donald Trump, marked a turning point. Tariffs imposed on hundreds of billions of dollars’ worth of goods disrupted established supply chains and encouraged firms to reconsider reliance on a single country.

Similarly, the COVID-19 pandemic exposed vulnerabilities in global supply networks. Lockdowns, transportation bottlenecks, and export restrictions led to shortages of medical supplies, semiconductors, and essential goods. Governments began emphasizing resilience over pure efficiency.

The conflict between Russia and Ukraine further intensified deglobalization by disrupting energy markets, grain exports, and industrial supply chains. Sanctions, trade restrictions, and financial decoupling fragmented global markets along geopolitical lines.

Supply Chain Fragmentation Explained

Supply chain fragmentation refers to the breaking up or regionalization of previously integrated global production systems. Instead of relying on a single, globally optimized chain, companies increasingly diversify suppliers, shift production closer to home (nearshoring), or move operations back domestically (reshoring).

In the era of hyper-globalization, companies followed a “just-in-time” model, minimizing inventory and depending on precise coordination across borders. While cost-effective, this approach proved fragile in times of disruption.

Fragmentation now manifests in several ways:

Reshoring – Bringing production back to the home country.

Nearshoring – Moving production to geographically closer countries.

Friend-shoring – Shifting supply chains to politically aligned or “friendly” nations.

Multi-sourcing – Diversifying suppliers to reduce reliance on one country.

For example, semiconductor supply chains—once heavily concentrated in East Asia—are now being reconfigured. The U.S. government has passed legislation encouraging domestic chip manufacturing, while European and Asian countries are investing heavily in local production capacity.

Causes of Deglobalization and Fragmentation

Several structural and political factors drive these trends:

1. Geopolitical Rivalry

Strategic competition between major powers, especially the United States and China, has encouraged technological decoupling. Restrictions on advanced semiconductor exports and concerns over data security have led governments to treat certain industries as matters of national security rather than pure economic efficiency.

2. Economic Nationalism

Populist movements in many countries argue that globalization has harmed domestic industries and workers. Politicians respond with policies aimed at protecting local jobs and industries, often through tariffs, subsidies, and local content requirements.

3. Technological Change

Automation reduces the importance of low labor costs, making reshoring more viable. Robotics, artificial intelligence, and additive manufacturing (3D printing) allow companies to produce closer to end markets without significant cost disadvantages.

4. Supply Chain Shocks

The COVID-19 pandemic revealed the risks of concentrated production hubs. For instance, disruptions in Chinese manufacturing centers caused global shortages in electronics and consumer goods. Firms now prioritize resilience, redundancy, and inventory buffers over minimal costs.

5. Climate and Sustainability Pressures

Environmental concerns also play a role. Long-distance transportation contributes to carbon emissions. Regional production networks may reduce environmental footprints and align with sustainability goals.

Economic Consequences

The shift toward deglobalization and fragmentation carries both benefits and costs.

Benefits

Increased resilience against geopolitical shocks and pandemics

Enhanced national security in critical sectors

Job creation in reshored industries

Reduced overdependence on single suppliers

Costs

Higher production costs, as companies lose efficiency gains from global specialization

Inflationary pressures due to more expensive inputs

Reduced global economic growth

Potential trade conflicts and retaliation

International organizations such as the International Monetary Fund (IMF) have warned that severe fragmentation could significantly reduce global GDP. Dividing the world into competing economic blocs may undermine decades of integration and poverty reduction.

Regionalization vs. Full Deglobalization

It is important to distinguish between complete deglobalization and regionalization. In many cases, trade is not disappearing but becoming more regionally concentrated. For example, North American trade has deepened under agreements like the United States–Mexico–Canada Agreement (USMCA). Similarly, Asian countries continue to expand intra-regional trade through frameworks such as the Regional Comprehensive Economic Partnership (RCEP).

Thus, instead of a fully globalized system, the world may be transitioning toward multiple regional blocs with limited interconnection between them.

Corporate Strategy in a Fragmented World

Businesses are adapting to this new environment by redesigning supply chains with flexibility in mind. Strategies include:

Dual sourcing of critical components

Investing in digital supply chain visibility tools

Increasing inventory buffers

Forming regional production hubs

Engaging in political risk analysis

Multinational corporations now consider geopolitical stability as carefully as labor costs when making investment decisions.

The Future Outlook

Deglobalization is unlikely to mean the complete collapse of international trade. Instead, the global economy appears to be entering a phase of “slowbalization”—a slower, more cautious form of globalization with greater emphasis on resilience, strategic autonomy, and regional partnerships.

Technological innovation, digital trade, and services may continue to integrate economies even as goods supply chains fragment. However, the balance between efficiency and security will remain a defining tension.

In conclusion, deglobalization and supply chain fragmentation represent a structural transformation of the global economy. Driven by geopolitical rivalry, economic nationalism, technological change, and systemic shocks, these trends are reshaping how goods are produced and distributed. While they may enhance resilience and national security, they also carry risks of higher costs and reduced global cooperation. The challenge for policymakers and businesses alike is to strike a balance between openness and security in an increasingly uncertain world.

Latest IMF & World Bank Growth Outlooks (global context)I. Overview: Global Growth in 2025–2027

1. Recent Forecasts — IMF

The IMF’s World Economic Outlook (WEO) January 2026 update projects the global economy to grow around 3.3 % in 2026 and about 3.2 % in 2027. This represents an upward revision from some earlier forecasts and reflects an assessment that global activity has been more resilient than expected amid persistent trade and policy uncertainty.

These projections imply moderate growth rather than a major acceleration — roughly in line with recent years, yet still below pre-pandemic trends (~3.7 % annual average between 2000 and 2019).

Key IMF estimates include:

2026 global GDP growth: ~3.3 %

2027 global GDP growth: ~3.2 %

Advanced economies: ~1.5–1.8 %

Emerging & developing economies: ~above 4 %

The IMF notes uneven performance across regions and economies — with stronger activity in select emerging markets and more subdued growth in advanced economies shaped by aging populations, weaker investment, and structural headwinds.

2. World Bank Global Prospects

The World Bank’s Global Economic Prospects (January 2026) paints a broadly similar picture: global growth is expected to remain steady but modest over the near term. Growth is projected at ~2.6 % in 2026 and ~2.7 % in 2027, slightly lower than IMF forecasts but still signalling moderate expansion.

This forecast was revised upward compared with mid-2025 projections, reflecting stronger-than-expected performance (especially in the U.S.) but also emphasising that the 2020s will likely be the weakest decade for global growth since the 1960s.

According to the World Bank:

Global growth will soften slightly before stabilising.

Developing economies are expected to grow faster than advanced ones (~4 % average).

Low-income countries could reach ~5.6 % annual growth.

However, the World Bank highlights persistent structural limitations — such as rising debt, limited investment, and income divergence — that constrain stronger expansions.

3. Trend Analysis: 2024–2027

Longitudinal IMF data (from 2024 and 2025 outlooks) show that:

Global growth slowed from ~3.3 % in 2023 to ~3.2–3.3 % in early 2025, with projections for flattened growth around 3.1–3.3 % in 2025–26.

Growth expectations have been adjusted multiple times upwards or downwards in response to global trade tensions, tariff policy changes, and macroeconomic shifts.

In summary, the broad consensus — among IMF, World Bank, and other analysts — is moderate global growth in the low-to-mid single digits, below long-term historical averages and reflective of subdued investment and productivity trends.

II. Drivers of Current Global Growth Outlook

1. Technological Investment and AI

One of the most discussed factors mid-2025 through early 2026 is the impact of artificial intelligence (AI) investment and adoption:

IMF updates highlight that investment in AI and related technologies can boost global productivity and output, partly offsetting trade and policy headwinds.

Some forecasts suggest tech-driven sectors could lift broad growth rates by 0.1–0.3 percentage points if adoption accelerates.

However, analysts emphasise caution — noting that AI’s broader productivity impact remains uncertain, and there is potential risk of speculative bubbles if technology hype outpaces real economic gains.

2. Trade Policy and Geopolitical Risks

Trade tensions and geopolitical friction remain a recurrent theme:

Persistent tariff regimes and policy uncertainty have periodically weighed on forecasts and increased downside risk.

IMF and World Bank stress that policy uncertainty reduces investment and trade activity, crystallising one of the main downside risks to growth.

These risks encompass broader geopolitical tensions (e.g., U.S.–China relations), supply chain reconfigurations, and regional conflicts — all complicating global economic integration and dampening confidence.

3. Monetary & Fiscal Policy Support

While tighter monetary policy historically constrained growth in 2022–24 amid inflationary pressures, some easing and fiscal support policies in late 2025 and early 2026 have cushioned downside risks:

Lower interest rates in advanced economies and continued fiscal stimulus in select countries help sustain activity.

However, public and private debt levels remain high, reducing policy space for future shocks.

4. Regional Performance Divergence

Growth drivers vary greatly by region:

Advanced economies (e.g. U.S., Eurozone) generally exhibit slower growth ~1.5–2.5 %, limited by structural constraints like aging populations.

Emerging markets and developing economies typically grow faster (~4 %+), with strong domestic demand and investment playing crucial roles.

Low-income countries are often projected to expand even more rapidly (~5–6 %), but from lower income bases.

This divergence is emphasised by the World Bank’s observation that per-capita income growth remains uneven — with around 25 % of developing economies poorer than in 2019 despite global recovery.

III. Downside Risks & Long-Term Challenges

1. Structural Weaknesses

Both IMF and World Bank highlight structural impediments that could dampen growth:

Weak productivity gains relative to past decades.

High debt burdens that limit fiscal support capability.

Slow investment and inadequate structural reform in parts of the developing world.

2. Policy Uncertainty and Protectionism

Persistent policy uncertainty — especially involving trade and global cooperation — is flagged as a major risk driver by both institutions.

This is compounded by rising protectionist sentiment in some economies, which can fragment global markets and escalate supply chain costs.

3. Geopolitical Tensions

Escalating geopolitical tensions — whether in trade, military conflict, or regional diplomacy — create additional downside risk for growth through disrupted trade flows and investment aversion.

4. Climate and Environmental Shocks

Although not central to the immediate numerical forecasts, climate shocks and energy disruptions are increasingly integrated into medium-term risk assessments. Extreme weather events can blunt growth by disrupting agriculture, infrastructure, and labour productivity.

IV. Synthesis & What It Means

Overall, the IMF and World Bank agree that:

The global economy is growing, but slowly — generally projected between ~2.5–3.3 % annually through 2026–27.

Growth remains uneven across regions, with developed markets lagging emerging and low-income countries.

Risks remain tilted to the downside, especially due to policy uncertainty, structural weaknesses, and geopolitical tensions.

While some private sector forecasts (e.g., Goldman Sachs) suggest slightly ‘sturdier’ growth near 2.8 % in 2026, the overarching narrative remains cautiously optimistic amidst ongoing global headwinds.

V. Key Takeaways

Moderate global growth is projected — roughly 3 % annually in 2025–27.

Emerging and developing economies outpace advanced economies, but significant income gaps persist.

AI and technology investment offer upside potential, but their long-term productivity impact is uncertain.

Trade tensions, policy uncertainty, and geopolitical risks continue to cloud the outlook.

Structural challenges — debt, weak investment, demographic pressures — underline persistent growth constraints.

Central Bank Decisions & 2026 Interest Rate Outlook1. Central Bank Policy Trends in Early 2026

1.1 The Federal Reserve (U.S.) — “Steady as She Goes”

The U.S. Federal Reserve has held its key policy rate in a tight range (around 3.50–3.75%) after a series of cuts during 2025. Policymakers are now maintaining policy on hold, balancing solid growth with still-elevated inflation pressures. Recent statements emphasize data dependence, acknowledging uncertainties around labour markets and price dynamics. Policymakers made it clear they’re not cutting further for now, even as markets sometimes price in possible rate cuts later in the year.

This approach reflects a broader “higher for longer” interest rate environment in the U.S., where inflation remains above the Fed’s 2% target and labour conditions are tight — making central bankers cautious about premature easing.

Key takeaway: Rate cuts are unlikely in the near term; if anything, the Fed is prepared to keep rates steady until inflation is decisively under control.

1.2 European Central Bank (ECB) — Longest Pause Since Negative Rates

The ECB has extended its interest rate pause, keeping its deposit rate around 2.00% through 2026 — its longest period without a change since the below-zero era. This reflects inflation dipping toward the ECB’s target, but the bank is wary of weakening price pressures and external economic vulnerabilities.

The eurozone economy continues growing modestly, and inflation has slowed to around 1.7%, below the ECB’s target, strengthening the rationale for continued patience. If inflation were to rebound sustainably, the ECB might consider adjustments — but for now, the bias is toward holding steady until 2027 at the earliest.

Key takeaway: The ECB’s policy is data-driven, cautious and inclined toward a long pause, reflecting slower inflation and subdued growth.

1.3 Bank of England (BoE) — Possible Future Cuts

The Bank of England also kept its Bank Rate at 3.75% in early 2026. Inflation is expected to drift back toward the BoE’s 2% target later in the year thanks to easing energy prices and softer services inflation. Some economists even foresee multiple rate cuts in 2026 if inflation weakens further and economic slack builds.

However, the decision remains close — with dissent among policymakers on the pace and timing of future moves. The BoE is clearly leaning toward easing if the economic data supports it — especially if inflation continues to normalize.

Key takeaway: BoE looks poised to cut rates if inflation softens enough — but commitment depends heavily on near-term data.

1.4 Bank of Japan (BOJ) — From Ultra-Easy to Gradual Tightening

Japan’s central bank has shifted away from its decades-long ultra-loose policy. After a series of moves that raised the policy rate to 0.75% in late 2025, some officials now signal the possibility of more rate hikes in 2026 — potentially up to three increases, as inflation becomes more entrenched and wage-led price pressures build.

This is a significant change: the BOJ’s policy path is tightening after years of ultra-accommodation. The bank’s cautious stance still reflects uncertainty, but inflation dynamics are drawing policymakers toward a more conventional stance.

Key takeaway: BOJ may tighten more if inflation proves sticky and wage growth strengthens.

1.5 Emerging Market Central Banks: Turkey & India

Turkey’s central bank continues to grapple with high inflation (well above 15%) and has been gradually reducing its policy rate from extremely high levels — most recently to around 37%. Inflation forecasts have been revised upward for year-end 2026, hinting that further rate reductions may moderate or pause in response to slowing disinflation.

In contrast, the Reserve Bank of India (RBI) has kept its repo rate unchanged at 5.25% in early 2026, with a neutral policy stance. This suggests the RBI is balancing benign inflation against robust growth and external headwinds. Despite significant cuts in 2025 (totaling 125 basis points), recent data suggest the RBI wants to stay flexible and watch how previous easing affects inflation and growth before acting again.

Key takeaways:

Turkey is cautiously easing but faces inflation risks.

India’s RBI maintains neutrality and data dependence in policy decisions.

2. Forces Driving the Interest Rate Outlook

2.1 Inflation Dynamics

Central banks primarily adjust interest rates to achieve stable inflation. Most major economies are now experiencing disinflation — inflation slowing toward or near target levels — after elevated price pressures in 2022–24. However, inflation remains uneven across countries:

In advanced economies (U.S., UK, Eurozone), inflation is cooling but not uniformly reaching targets.

In Japan, inflation is becoming more entrenched due to domestic wage pressures.

In emerging markets like Turkey, persistent high inflation continues despite key rate cuts.

These divergent inflation paths mean central banks must tailor their response: some are pausing rate moves, others are embracing further easing or tightening depending on local conditions.

2.2 Growth & Labour Market Conditions

Central bankers always balance inflation with economic growth and employment:

Strong labour markets (e.g., U.S.) make policymakers reluctant to cut rates, fearing an inflation resurgence.

Sluggish growth prompts others (e.g., ECB, RBI) to hold steady so as not to tighten financial conditions prematurely.

Japan’s shift reflects an attempt to normalize policy as inflation appears more structural rather than transitory.

2.3 Political Pressure & Central Bank Independence

Independence matters. Recent warnings from European policymakers highlight concerns that political pressure — for example on the U.S. Federal Reserve — could undermine central bank credibility and lead to higher inflation globally. Central banks rely on independence to maintain long-term price stability, so political interference can disrupt policy effectiveness and market confidence.

2.4 Global Financial Conditions & Spillovers

Central bank decisions do not happen in isolation:

U.S. rate decisions heavily influence global borrowing costs, financial conditions and capital flows.

Currency movements (like a strong euro) can influence price pressures and import costs.

Trade tensions and external shocks affect inflation and growth prospects, complicating policy planning.

3. Tools Beyond the Policy Rate

Central banks use more than just the policy interest rate:

Quantitative easing (QE) expands money supply to stimulate growth when rates are at or near zero.

Quantitative tightening (QT) reduces liquidity to reinforce restrictive monetary conditions.

Yield curve control targets long-term interest rates.

These tools reflect a broadening of monetary policy beyond conventional rate adjustments.

4. Outlook — What Comes Next?

4.1 Advanced Economies

U.S.: Likely to hold rates steady throughout 2026; further cuts are conditional on inflation dynamics.

Eurozone: Continuation of the rate pause; policymakers carefully watch inflation and growth signals.

UK: Potential for rate cuts if inflation continues to ease.

Japan: Possible gradual hikes as inflation stabilizes at more structural levels.

4.2 Emerging & Developing Markets

Countries with persistent inflation (e.g., Turkey) remain cautious in easing, while others (like India) adopt neutral, data-driven stances.

5. Conclusion

The global interest rate outlook for 2026 reflects a broad shift from aggressive tightening (2021–22) to cautious, data-dependent monetary policy. Central banks today face a delicate balancing act: ensuring inflation returns to targets without derailing economic growth or financial stability.

Advanced economies largely pause or prepare for modest easing.

Some central banks (e.g., BOJ) are adjusting toward normalization.

Emerging markets navigate higher inflation and structural imbalances.

Across the board, policymakers emphasize flexibility, careful monitoring of economic data, and a strong commitment to price stability in an environment marked by geopolitical risks and uneven growth patterns.

What Most Traders Still Don’t Understand About Market CyclesMarket Cycle Logic Most People Miss

1) Core Idea

The market follows a simple macro chain:

Income visibility ↓ → Confidence ↓ → Spending ↓ → Credit quality ↓ → Cyclical sectors weaken

This is not theory — this is how institutional macro models actually work.

In economic terms, this phase is called a demand-compression stage of the business cycle.

2) How the Effect Spreads Across Sectors

Banks — Early Signal Sector

When job security weakens, people delay EMIs.

When businesses slow down, working capital stress rises.

Result → credit costs rise and loan growth slows.

Banks usually underperform quietly first, before any big fall.

Autos — Confidence Indicator

Auto buying depends on confidence and credit.

Weak sentiment → people postpone purchases.

High rates → affordability drops.

Dealers cut inventory.

Auto stocks usually weaken before sales numbers fall.

Housing / Realty — Rate + Confidence Sensitive

Housing needs:

long-term confidence

stable income

reasonable interest rates

If uncertainty rises → buyers delay decisions → real estate slows.

Luxury & Travel — Sentiment Barometers

These are the first expenses people cut.

When uncertainty rises, spending shifts from:

Wants → Needs

So discretionary sectors weaken early.

Insurance — Often Misunderstood Sector

Insurance inflows depend on:

disposable income

savings surplus

agent productivity

When cash flow tightens → new policy buying slows.

3) The Missing Piece Most People Ignore

Professional investors track three macro forces:

Factor Why It Matters

Interest Rates Higher rates reduce liquidity

Liquidity Liquidity drives risk assets

Dollar Strength Controls global capital flow

When all three tighten together → risk-off environment

4) How Market Cycles Actually Work

Formal economic cycle:

Expansion → Peak → Contraction → Trough → Expansion

Trader version:

Liquidity → Euphoria → Tightening → Panic → Reset → Liquidity

Markets don’t move because of news.

They move because of liquidity cycles.

News is usually just a narrative built around the move.

5) Geopolitics Example

Events like discussions about countries shifting currency systems are not random headlines.

They signal:

global trade realignment

currency stability attempts

geopolitical repositioning

Markets interpret this as:

“Capital flows may change.”

And capital flow is what moves markets.

6) Important Rule Professionals Follow

Leading sectors weaken first. Lagging sectors later.

Typical slowdown order:

Tech → Financials → Cyclicals → Consumption → Defensives last

When defensive sectors also start falling, it often signals the cycle is near its bottom.

7) Final Takeaway

Market Truth Most People Ignore

When income visibility falls → confidence falls

When confidence falls → spending falls

When spending falls → credit stress rises

And when credit stress rises — cyclical sectors weaken first:

Banks, Autos, Realty, Luxury, Travel, Insurance

Markets don’t run on headlines.

They run on liquidity cycles.

Boom → Slowdown → Fear → Reset → Boom

Smart money doesn’t chase stories.

It tracks cycles.

Part 2 Intraday Institutional TradingHow Beginners Should Start?

✔ Step-by-Step:

Start with understanding futures & spot movement

Trade small lots

Focus on ATM & ITM

Avoid expiry day

Avoid illiquid stocks

Study Greeks

Backtest simple strategies

Track OI & volume data

Start with debit spreads instead of naked options

Never sell naked options without hedge

Part 1 Intraday Institutional Trading How Option Premium Is Calculated

Premium = Intrinsic Value + Time Value + Volatility Value

1. Intrinsic Value (IV)

Actual value based on difference between spot and strike.

2. Time Value

More days to expiry → higher premium

Closer to expiry → premium decays (Theta)

3. Volatility (Implied Volatility – IV)

Higher volatility = higher premium

Low volatility = low premium

Part 5 Advance Trading Strategies The Option Contract Components (Very Important)

These are the most important terms every trader must understand:

1. Spot Price

Current market price of the underlying asset.

2. Strike Price

Pre-decided price at which the option buyer may buy/sell.

3. Premium

Price paid for the option.

4. Expiry

Last date on which option is valid.

In India:

Weekly expiry → Thursday

Monthly expiry → Last Thursday

5. Lot Size

Options are traded in fixed lots.

E.g., Nifty = 25 units per lot.

6. Option Chain

A data table that shows all strikes, premiums, volume, OI, IV.

Axis Bank | Gann Square of 9 Intraday Observation Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 20 October 2023

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Normal Price Capacity Study)

This idea highlights a historical intraday observation where Axis Bank’s price behavior aligned with a normal Square of 9 downside capacity level, followed by a temporary reaction once price and time came into alignment.

📊 Market Structure & Reference Selection

During the session, Axis Bank showed downward movement after the reference point was identified.

In declining conditions, the high of the reference candle (~993) was treated as the 0-degree level, following commonly used Gann principles.

This reference served as the base for evaluating the stock’s expected intraday price expansion.

The focus remains on structure and measurement rather than prediction.

🔢 Square of 9 Level Mapping

Using the selected reference:

0 Degree: ~993

45 Degree (Observed Normal Downside Capacity): ~977

The 45-degree level is often studied as a zone where normal intraday movement may complete, especially if reached early in the session.

⏱️ Observed Price–Time Behavior

Price declined steadily from the reference level.

The 45-degree zone was approached well before the latter part of the trading day.

Around mid-session, price made a low close to the calculated level, with a small variation.

Minor deviations around derived levels are commonly observed in live markets.

After interacting with this zone, price showed temporary buying interest and moved higher.

Historically, such behavior reflects how early completion of normal price capacity can coincide with short-term reactions.

📘 Educational Takeaways

Importance of selecting the correct 0-degree reference

Measuring normal intraday movement using Square of 9

Studying time alignment alongside price levels

Allowing reasonable price tolerance in real-market data

Observing reactions rather than anticipating outcomes

This example demonstrates how a rule-based framework can help interpret intraday market behavior objectively.

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 11 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 11 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Alignment)

This post shares a historical intraday observation showing how price interacted with a normal Square of 9 capacity level, leading to a temporary reaction when time and price aligned.

📊 Market Context & Reference Selection

Axis Bank displayed upward momentum after the completion of the first 15-minute candle.

In such market conditions, the low of the first 15-minute candle (~1104) was treated as the 0-degree reference level, following Gann methodology.

This reference point was used to study the session’s expected price expansion.

Correct identification of the reference level is critical for objective Square of 9 analysis.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~1104

45 Degree (Observed Normal Capacity): ~1121

The 45-degree level often represents the normal intraday movement range under regular market conditions.

⏱️ Observed Price–Time Behavior

Price approached the 45-degree level well before the later part of the trading session.

Early completion of normal price capacity has historically been associated with short-term trend fatigue.

After interacting with this zone, price showed temporary selling pressure and moved lower.

A minor variation around the calculated level was observed, which is common in live market conditions.

This aligns with a widely observed Gann concept:

When expected price capacity is completed early in time, the probability of a reaction may increase.

📘 Educational Takeaways

Square of 9 helps define logical intraday price limits

Early capacity completion can indicate temporary exhaustion

Time plays a supporting role in validating price-degree levels

Small price deviations are normal and should be viewed structurally

The method promotes rule-based observation over prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Part 3 Institutional Trading VS. Technical AnalysisWhat Are Options? — The Foundation

Options are derivative contracts whose price is derived from an underlying asset like:

Stocks

Indices (Nifty, Bank Nifty)

Commodities

Currencies

An option is a contract between a buyer and a seller that gives special rights to the buyer.

✔ In simple words:

An option gives you the right, but not the obligation, to buy or sell the underlying at a fixed price before a fixed date.

This fixed price = Strike Price

This fixed date = Expiry Date

Options are of two types: Call & Put.

Part 2 Institutional Trading VS. Technical AnalysisOption Trading:

Option trading involves buying and selling contracts that give the right, but not the obligation, to buy or sell an underlying asset at a fixed price (strike price) before a certain date (expiry). It's used for speculation, hedging, or income generation with leverage and limited risk for buyers.

Key Components- Underlying Asset: Stock, index, commodity, etc.

- Strike Price: Fixed price to buy/sell.

- Expiry Date: Last day to exercise.

- Premium: Price paid for option.

- Lot Size: Contracts per lot.

Types of Options- Call Option: Right to buy.

- Put Option: Right to sell.

Part 1 Institutional Trading VS. Technical Analysis Option Trading Profits

Call Option Profit

- Buyer: Profit if underlying price > strike price + premium paid.

- Seller: Profit is the premium received (if option expires worthless).

Put Option Profit- Buyer: Profit if underlying price < strike price - premium paid.

- Seller: Profit is the premium received (if option expires worthless).

Profit Factors- Price Movement: Direction and magnitude.

- Volatility: Impacts option value.

- Time Decay: Options lose value over time.

Derivatives and Options TradingWhat Are Derivatives?

A derivative is a financial contract whose value is derived from an underlying asset. The underlying asset can be:

Stocks

Bonds

Commodities (gold, oil, wheat)

Currencies

Interest rates

Market indexes (like the S&P 500 or Nifty 50)

In simple terms, a derivative does not have independent value; its price depends on the value of something else.

Common Types of Derivatives

Futures Contracts

Options Contracts

Forwards Contracts

Swaps

Among these, futures and options are the most actively traded on exchanges.

Purpose of Derivatives

Derivatives serve three main purposes:

1. Hedging (Risk Management)

Hedging is used to reduce or eliminate financial risk. For example, a farmer expecting to harvest wheat in three months may use a futures contract to lock in a selling price today. This protects against the risk of falling prices.

Similarly, investors use options to protect stock portfolios from market downturns.

2. Speculation

Speculators use derivatives to profit from price movements. Because derivatives often require a smaller initial investment (called margin or premium), they provide leverage, allowing traders to control large positions with less capital.

However, leverage increases both potential profits and potential losses.

3. Arbitrage

Arbitrage involves exploiting price differences between markets. Traders buy an asset in one market and sell it in another where the price is higher, locking in a risk-free profit.

Understanding Options

An option is a type of derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date.

There are two main types of options:

Call Option

Put Option

Call Option

A call option gives the buyer the right to buy an asset at a fixed price (called the strike price) before expiration.

Example:

Stock price: $100

Call option strike price: $105

Expiration: 1 month

If the stock rises to $120, the call option becomes valuable because the buyer can purchase at $105 and potentially sell at $120.

If the stock stays below $105, the option may expire worthless.

Put Option

A put option gives the buyer the right to sell an asset at a fixed price before expiration.

Example:

Stock price: $100

Put strike price: $95

If the stock falls to $70, the put increases in value because the holder can sell at $95 instead of the market price of $70.

If the stock stays above $95, the option may expire worthless.

Key Components of an Option

1. Strike Price

The predetermined price at which the asset can be bought or sold.

2. Expiration Date

The date on which the option contract expires.

3. Premium

The price paid to buy the option. This is the maximum loss for the buyer.

4. Intrinsic Value

The real value if exercised immediately.

5. Time Value

The extra value based on time remaining before expiration.

Option Buyers vs Option Sellers

Option Buyer (Holder)

Pays the premium

Has limited risk (loss = premium paid)

Has unlimited profit potential (for calls)

Option Seller (Writer)

Receives the premium

Has limited profit (premium received)

May face large or unlimited losses

Selling options can be riskier than buying them.

In-the-Money, At-the-Money, Out-of-the-Money

In-the-Money (ITM)

Call: Stock price > Strike price

Put: Stock price < Strike price

At-the-Money (ATM)

Stock price = Strike price

Out-of-the-Money (OTM)

Call: Stock price < Strike price

Put: Stock price > Strike price

Leverage in Options Trading

Options provide leverage because traders control large positions with smaller investments.

Example:

Buying 100 shares at $100 = $10,000 investment

Buying one call option might cost $300

If the stock rises significantly, the percentage return on the option can be much higher than owning the stock directly.

However, if the stock does not move as expected, the option can expire worthless.

Risks in Derivatives and Options Trading

While derivatives provide opportunities, they also involve risks:

1. Market Risk

Price movements can lead to losses.

2. Time Decay (Theta)

Options lose value as expiration approaches.

3. Volatility Risk

Changes in volatility affect option prices.

4. Leverage Risk

Losses can be magnified.

5. Liquidity Risk

Some contracts may be difficult to buy or sell.

Option Pricing Basics

Option prices are influenced by:

Current stock price

Strike price

Time until expiration

Volatility

Interest rates

The Black-Scholes model is commonly used to estimate theoretical option prices.

Popular Options Strategies

Traders use different strategies depending on their outlook.

1. Covered Call

Holding a stock and selling a call against it to earn income.

2. Protective Put

Buying a put to protect a stock position.

3. Straddle

Buying both a call and a put at the same strike price to profit from large moves in either direction.

4. Spread Strategies

Combining multiple options to reduce risk.

Futures vs Options

Feature Futures Options

Obligation Both parties obligated Buyer has right, not obligation

Risk Can be unlimited Buyer risk limited to premium

Upfront Cost Margin required Premium paid

Complexity Moderate More complex

Exchange-Traded vs OTC Derivatives

Exchange-Traded Derivatives

Standardized contracts

Regulated exchanges

Lower counterparty risk

Over-the-Counter (OTC)

Customized contracts

Private agreements

Higher counterparty risk

Importance in Financial Markets

Derivatives increase:

Market efficiency

Price discovery

Liquidity

Risk management capabilities

However, misuse or excessive speculation can cause instability, as seen during the 2008 financial crisis involving complex derivatives like credit default swaps.

Who Uses Derivatives?

Individual traders

Hedge funds

Banks

Corporations

Institutional investors

For example, airlines hedge fuel costs using oil futures, and multinational companies hedge currency risk using forex derivatives.

Conclusion

Derivatives and options trading are powerful financial tools that allow market participants to hedge risk, speculate on price movements, and enhance portfolio returns. Options, in particular, offer flexibility because they provide the right—but not the obligation—to buy or sell an asset at a fixed price.

However, these instruments involve complexity and significant risk, especially due to leverage and time decay. Successful derivatives trading requires strong knowledge, risk management, and disciplined strategy.

In summary, derivatives and options are essential parts of global financial markets. When used wisely, they can reduce risk and create opportunities. When misused, they can lead to substantial financial losses. Understanding their structure, purpose, and risks is the foundation for participating safely and effectively in derivatives markets.

Equity Market Trading 1. Meaning and Importance of Equity Markets

An equity market is a marketplace where shares of publicly listed companies are issued and traded. These markets connect companies that need capital with investors who have funds to invest. Companies raise money by issuing shares through an Initial Public Offering (IPO) in the primary market. After issuance, shares are traded among investors in the secondary market, such as the New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE), or Bombay Stock Exchange (BSE).

Equity markets are essential because they:

Help companies raise long-term capital for expansion and innovation.

Provide liquidity to investors.

Facilitate price discovery based on supply and demand.

Encourage economic growth by supporting businesses.

2. Types of Equity Markets

Equity trading takes place in two main markets:

Primary Market:

In this market, companies issue new shares to investors for the first time through IPOs or follow-on public offerings. Investors buy shares directly from the company.

Secondary Market:

Here, previously issued shares are traded among investors. The company does not receive money from these transactions. Stock exchanges regulate and facilitate these trades.

3. Participants in Equity Market Trading

Several participants are involved in equity trading:

Retail Investors: Individual investors who buy and sell shares for personal investment.

Institutional Investors: Large entities such as mutual funds, pension funds, insurance companies, and hedge funds.

Brokers: Licensed intermediaries who execute trades on behalf of investors.

Market Makers: Firms that provide liquidity by continuously buying and selling stocks.

Regulators: Government agencies like the SEC (U.S.) or SEBI (India) that oversee market activities to ensure fairness and transparency.

Each participant plays a crucial role in maintaining market efficiency and stability.

4. How Equity Trading Works

Equity trading typically occurs electronically through stock exchanges. Investors place buy or sell orders through brokers using trading platforms. Orders are matched through an automated system based on price and time priority.

There are different types of orders:

Market Order: Executes immediately at the current market price.

Limit Order: Executes only at a specified price or better.

Stop-Loss Order: Automatically sells a stock when it reaches a certain price to limit losses.

Stop-Limit Order: Combines features of stop and limit orders.

Once a trade is executed, settlement usually occurs within two business days (T+2 settlement cycle in many markets).

5. Types of Equity Trading Strategies

Equity trading can be short-term or long-term depending on the investor’s objectives.

a) Long-Term Investing:

Investors buy shares and hold them for years to benefit from company growth and dividends. This strategy relies on fundamental analysis.

b) Day Trading:

Traders buy and sell shares within the same day to profit from short-term price movements.

c) Swing Trading:

Positions are held for several days or weeks to capture price trends.

d) Scalping:

Traders make multiple small profits from minor price changes within minutes.

e) Value Investing:

Investors buy undervalued stocks based on financial analysis.

f) Growth Investing:

Focuses on companies expected to grow faster than the overall market.

6. Fundamental and Technical Analysis

Equity traders use two main types of analysis:

Fundamental Analysis:

This involves evaluating a company’s financial statements, earnings, revenue, management, competitive position, and economic factors. Key indicators include:

Earnings Per Share (EPS)

Price-to-Earnings (P/E) ratio

Return on Equity (ROE)

Debt-to-Equity ratio

Fundamental analysis aims to determine the intrinsic value of a stock.

Technical Analysis:

This method studies past price movements and trading volume using charts and indicators. Tools include:

Moving Averages

Relative Strength Index (RSI)

MACD (Moving Average Convergence Divergence)

Candlestick patterns

Technical analysis helps traders predict short-term price movements.

7. Risks in Equity Market Trading

Equity trading offers high returns but also carries significant risks:

Market Risk: Prices fluctuate due to economic and political events.

Company Risk: Poor performance or management decisions can reduce stock value.

Liquidity Risk: Some stocks may be difficult to buy or sell quickly.

Volatility Risk: Sudden price changes can cause losses.

Emotional Risk: Fear and greed often lead to irrational decisions.

Proper risk management techniques include diversification, stop-loss orders, and position sizing.

8. Benefits of Equity Market Trading

Despite risks, equity markets offer many advantages:

Potential for high returns compared to fixed-income investments.

Dividend income.

Liquidity and flexibility.

Ownership participation in business growth.

Inflation protection over the long term.

Historically, equities have outperformed many other asset classes over extended periods.

9. Role of Technology in Equity Trading

Modern equity trading is largely driven by technology. Online trading platforms allow investors to trade instantly from anywhere. Algorithmic trading and high-frequency trading (HFT) use computer programs to execute trades at high speeds. Artificial intelligence and big data analytics are increasingly used to analyze market trends and investor behavior.

Mobile trading apps have also increased retail participation globally.

10. Regulation and Ethical Practices

Equity markets are regulated to prevent fraud, insider trading, and market manipulation. Regulatory bodies ensure companies disclose accurate financial information and maintain transparency. Ethical trading practices help maintain investor confidence and market stability.

Conclusion

Equity market trading is a fundamental component of the global financial system. It allows companies to raise capital and investors to grow wealth through ownership in businesses. While it offers opportunities for significant returns, it also involves risks that require careful analysis and disciplined decision-making. Successful equity trading depends on knowledge, strategy, risk management, and emotional control. As technology continues to evolve, equity markets are becoming more accessible, efficient, and dynamic, making them an essential avenue for both individual and institutional investors worldwide.