$TVC:SILVER MOON MISSION:2025-29 is History Repeating Again? TP?🚀 Silver Feature Analysis 2026 – 2029: The Historical Repeat 🚀

TVC:SILVER has recently hit its All-Time High (ATH) three times in history with massive rallies. My analysis is based on the duration and percentage returns of these specific periods:

1️⃣ 1980: (1 Aug 1979 to 29 Jan 1980) – A 6-month

Futures market

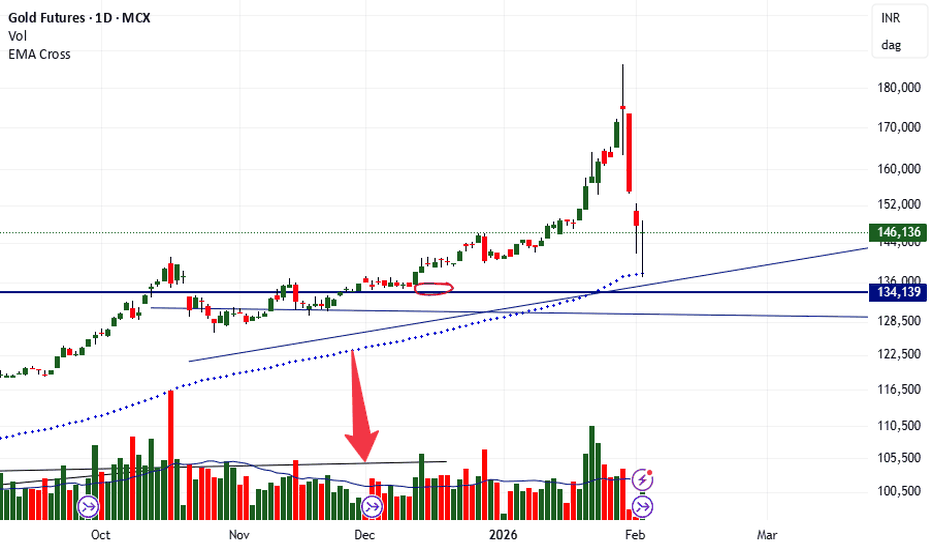

XAUUSD: Liquidity Swap Near PDL – Relief Bounce Into Sell ZoneDescription

Gold is currently trading inside a key liquidity zone after a strong bearish impulse.

Price swept sell-side liquidity and is now showing a short-term corrective bounce.

What I’m seeing:

Clear bearish market structure (lower highs & lower lows)

Price reacting from sell-side liquidity

XAUUSD/GOLD PMI NEWS FORECAST 02.02.26XAUUSD / GOLD – ISM Manufacturing PMI Trade Plan

Date: 02-02-2026

Hello traders,

Welcome back to Tamil Trading Education.

Today we are analyzing XAUUSD (Gold) based on the ISM Manufacturing PMI news.

This is a news-based breakout and retest strategy, so please avoid emotional or early entries.

🔑

XAUUSD – High volatility, monitor key reaction zones.📌 Market Context

Gold is currently trading in a high-volatility environment after a sharp drop below the $5,000 level, reflecting aggressive repricing ahead of major macro uncertainty. The market has shifted away from smooth trend behavior into a liquidity-driven, fast-reaction phase, where price m

Crude Oil: The Market Is Revisiting the Scene of the BreakdownCrude Oil is revisiting a level where a major structural breakdown occurred in the past.

Markets don’t forget such zones easily. What once triggered aggressive selling often turns into active supply when revisited.

The recent move is not random strength — it’s a retest of prior imbalance, followed

XAUUSD - Brian | H1 AnalysisXAUUSD – Brian | H1 Technical Outlook – SELL Bias Aligned With the Main Trend

Gold is entering a strong corrective phase after forming a short-term top, with the H1 structure clearly shifting to the downside. The latest bearish leg is impulsive in nature, reflecting active position unwinding and sh

Gold intraday levelsPrevious Day High: 4885 – 4888

→ Acts as a major intraday resistance. A clean breakout and hold above this zone can open upside momentum.

Previous Day Open: 4831

→ Key intraday pivot level. Price reaction around this zone will decide bullish or bearish bias.

Previous Day Close / Demand Zone: 4655 –

See all popular ideas

Quotes

Futures collections

Frequently Asked Questions

A futures contract is a legal agreement to buy or sell an asset (such as a commodity or security) at a set price on a specific future date. The buyer agrees to purchase and receive the asset when the contract expires, while the seller agrees to deliver it at that time.

Most futures contracts are traded through centralized exchanges like the Chicago Board of Trade and the Chicago Mercantile Exchange (CME). But there's no need to leave TradingView to trade futures — you can do it right from your charts. Just check out the list of our integrated brokers and find the best one for your needs and strategy.

Before you start, it's crucial to do you research: perform technical analysis on the chart, evaluate risks, and test your strategy.

Before you start, it's crucial to do you research: perform technical analysis on the chart, evaluate risks, and test your strategy.

Energy futures are contracts tied to energy commodities — they're aimed at facilitating the trading of specific quantities of crude oil, natural gas, gasoline, etc. Energy futures allow producers, consumers, and traders to manage price volatility in energy markets or capitalize on future price movements.

Explore a wide range of energy futures with detailed stats directly on TradingView.

Explore a wide range of energy futures with detailed stats directly on TradingView.

Agricultural futures are derivative contracts with agricultural commodities (wheat, corn, soybeans, etc.) as the underlying. They're widely used to trade standardized quantities of commodities, allowing farmers, food producers, and traders to hedge against price fluctuations or to profit from expected price changes in the agricultural market.

Browse a full list of agricultural futures with detailed stats directly on TradingView.

Browse a full list of agricultural futures with detailed stats directly on TradingView.

Futures market is a bustling place with many interested parties. Here are some key participants to keep in mind:

- Hedgers (traders using futures to protect their existing positions or trades from risk caused by market volatility or direction)

- Speculators (traders executing trades based on their price predictions)

- Arbitrageurs (traders trying to win from market inefficiency and price difference by buying and selling the underlying in different markets)

- Institutional investors

- Retail investors

- Hedgers (traders using futures to protect their existing positions or trades from risk caused by market volatility or direction)

- Speculators (traders executing trades based on their price predictions)

- Arbitrageurs (traders trying to win from market inefficiency and price difference by buying and selling the underlying in different markets)

- Institutional investors

- Retail investors

Futures markets are platforms where traders gather to buy and sell futures contracts. In the past, trading was performed physically: traders would come to a 'pit' in the trading floor and conduct trading by shouting and actively gesturing. But today, this is all done electronically.

In a futures market, buyers and sellers post margin to secure their positions, and profits or losses are settled daily through mark-to-market. At expiration, contracts are settled in cash or through physical delivery, though most traders close positions beforehand. Since futures offer flexibility and leverage, futures markets attract diverse participants: hedgers, speculators, arbitrageurs, institutional and retail investors.

Some of the largest futures markets today are the New York Mercantile Exchange (NYMEX), the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), and the Cboe Options Exchange (Cboe). They're registered with the Commodity Futures Trading Commission (CFTC), the main body in charge of futures markets regulation in the US. In other countries, futures markets are regulated by a corresponding national body.

In a futures market, buyers and sellers post margin to secure their positions, and profits or losses are settled daily through mark-to-market. At expiration, contracts are settled in cash or through physical delivery, though most traders close positions beforehand. Since futures offer flexibility and leverage, futures markets attract diverse participants: hedgers, speculators, arbitrageurs, institutional and retail investors.

Some of the largest futures markets today are the New York Mercantile Exchange (NYMEX), the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), and the Cboe Options Exchange (Cboe). They're registered with the Commodity Futures Trading Commission (CFTC), the main body in charge of futures markets regulation in the US. In other countries, futures markets are regulated by a corresponding national body.

Open interest is the total number of active futures contracts that haven’t been closed or expired. It reflects how much interest or participation exists in a market.

Traders use open interest to gauge market strength. For example, declining open interest often signals that traders are closing positions — a possible sign of a weakening trend.

Traders use open interest to gauge market strength. For example, declining open interest often signals that traders are closing positions — a possible sign of a weakening trend.

Futures prices are mainly driven by supply and demand, economic indicators, and central bank policies. Disruptions like droughts or geopolitical tensions can affect supply, while inflation or interest rate changes shape investor expectations. These shifts influence how traders value future prices relative to current conditions.

Market sentiment and speculation also play a big role, with traders often reacting to news or forecasts before fundamentals change. Factors like storage costs, inventory levels, and contract expiration impact pricing too, especially in commodities. Seasonal trends, government policies, and even new technologies can further sway futures markets.

Market sentiment and speculation also play a big role, with traders often reacting to news or forecasts before fundamentals change. Factors like storage costs, inventory levels, and contract expiration impact pricing too, especially in commodities. Seasonal trends, government policies, and even new technologies can further sway futures markets.

It's always best to test you skills in futures trading before going to the real markets. You can do it right on TradingView thanks to our Paper Trading functionality — just find the Paper trading icon on the trading panel and put your ideas to the test. You can also check out our Bar Replay feature — it simulates past price movements for strategy testing.