🔍 Market Context

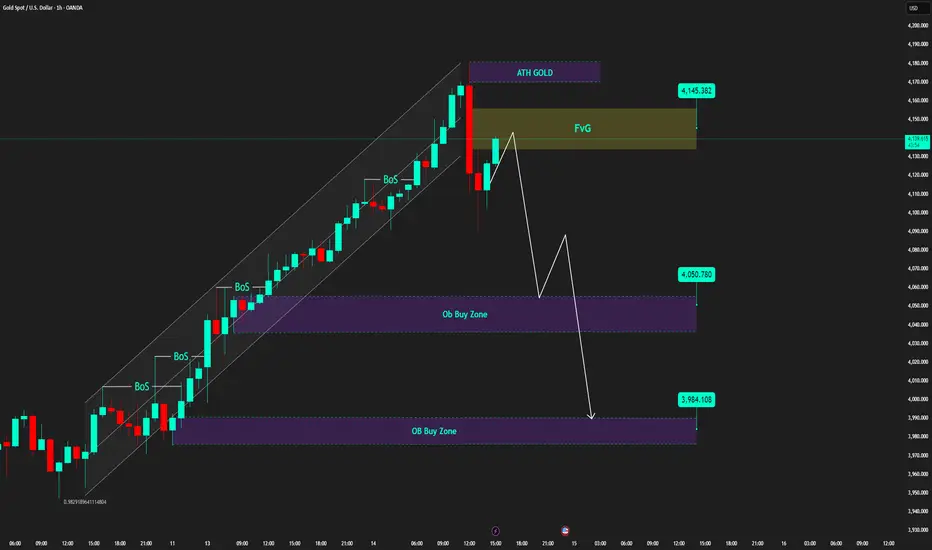

Gold prices have just reached an all-time high (ATH GOLD) around the 4,180 USD mark, following a steep upward rally over several sessions.

Immediately after, the market witnessed the first break of structure (BoS) – a sign that the upward momentum is weakening.

Currently, prices are returning to fill the Fair Value Gap (FVG) at 4,125 – 4,145 USD, and this is likely a liquidity rebalancing phase before prices choose the next direction.

💎 Technical Analysis

ATH GOLD: 4,180 – 4,185 USD

Fair Value Gap (FVG): 4,125 – 4,145 USD → an empty price zone that needs to be filled.

Order Block Buy Zone 1: 4,050 – 4,060 USD → the nearest demand zone, potentially creating the first technical reaction.

Order Block Buy Zone 2: 3,980 – 3,985 USD → a deeper demand zone, large liquidity confluence, possibly becoming the main "accumulation point."

Overall Structure: After breaking the upward channel, the market is in a retracement phase – the medium-term structure remains bullish.

📈 Trading Scenarios

1️⃣ Short-term Sell Scenario – filling FVG and technical adjustment

If prices continue to test the FVG 4,125 – 4,145 USD zone without surpassing it,

→ consider a short-term sell to catch the technical retracement phase.

Target: the first OB Buy Zone at 4,050 USD.

Stop Loss: above 4,155 USD (to avoid being swept above the FVG peak).

➡️ This scenario suits short-term traders following corrective waves – only enter when there is a clear reversal candle confirmation.

2️⃣ Trend-following Buy Scenario – catching the rebound from OB Zone

If prices adjust to the 4,050 – 4,060 USD zone, observe reaction signals such as Bullish Engulfing or strong Rejection.

Upon confirmation, initiate a trend-following buy order.

Target: zone 4,125 → 4,145 USD or the previous peak at 4,180 USD.

Stop Loss: below 4,030 USD.

If the first OB zone does not hold, the 3,980 – 3,985 USD zone will be an ideal area for long-term "accumulation."

⚠️ Risk Management

Avoid FOMO buying at high prices when the FVG is not yet filled.

Prioritise trading at clear reaction zones (OB, FVG edge).

Reduce volume when entering counter-trend orders to preserve capital.

💬 Conclusion

After a steep rise, gold is entering a value rebalancing phase.

The current market structure leans towards a short-term technical retracement before continuing the main upward trend.

If the 4,050 – 4,060 USD zone reacts well, gold may soon rebound and aim for the 4,150 – 4,180 USD zone.

👉 Reasonable Strategy:

Short-term sell when price reacts at FVG.

Wait to buy at OB Buy Zone when there is a confirmed bullish signal.

Gold prices have just reached an all-time high (ATH GOLD) around the 4,180 USD mark, following a steep upward rally over several sessions.

Immediately after, the market witnessed the first break of structure (BoS) – a sign that the upward momentum is weakening.

Currently, prices are returning to fill the Fair Value Gap (FVG) at 4,125 – 4,145 USD, and this is likely a liquidity rebalancing phase before prices choose the next direction.

💎 Technical Analysis

ATH GOLD: 4,180 – 4,185 USD

Fair Value Gap (FVG): 4,125 – 4,145 USD → an empty price zone that needs to be filled.

Order Block Buy Zone 1: 4,050 – 4,060 USD → the nearest demand zone, potentially creating the first technical reaction.

Order Block Buy Zone 2: 3,980 – 3,985 USD → a deeper demand zone, large liquidity confluence, possibly becoming the main "accumulation point."

Overall Structure: After breaking the upward channel, the market is in a retracement phase – the medium-term structure remains bullish.

📈 Trading Scenarios

1️⃣ Short-term Sell Scenario – filling FVG and technical adjustment

If prices continue to test the FVG 4,125 – 4,145 USD zone without surpassing it,

→ consider a short-term sell to catch the technical retracement phase.

Target: the first OB Buy Zone at 4,050 USD.

Stop Loss: above 4,155 USD (to avoid being swept above the FVG peak).

➡️ This scenario suits short-term traders following corrective waves – only enter when there is a clear reversal candle confirmation.

2️⃣ Trend-following Buy Scenario – catching the rebound from OB Zone

If prices adjust to the 4,050 – 4,060 USD zone, observe reaction signals such as Bullish Engulfing or strong Rejection.

Upon confirmation, initiate a trend-following buy order.

Target: zone 4,125 → 4,145 USD or the previous peak at 4,180 USD.

Stop Loss: below 4,030 USD.

If the first OB zone does not hold, the 3,980 – 3,985 USD zone will be an ideal area for long-term "accumulation."

⚠️ Risk Management

Avoid FOMO buying at high prices when the FVG is not yet filled.

Prioritise trading at clear reaction zones (OB, FVG edge).

Reduce volume when entering counter-trend orders to preserve capital.

💬 Conclusion

After a steep rise, gold is entering a value rebalancing phase.

The current market structure leans towards a short-term technical retracement before continuing the main upward trend.

If the 4,050 – 4,060 USD zone reacts well, gold may soon rebound and aim for the 4,150 – 4,180 USD zone.

👉 Reasonable Strategy:

Short-term sell when price reacts at FVG.

Wait to buy at OB Buy Zone when there is a confirmed bullish signal.

Trade active

XAU/USD – Gold reacts precisely at the FVG zone, preparing to move towards the lower OB

As planned, gold prices have touched the Fair Value Gap (FVG) and reacted with a decline. Previously, gold rose to the $4,145 zone, then dropped about 220 pips, and slightly accumulated back — this is the moment to trigger the SELL order.

Currently, gold has dropped more than 480 pips and the downward momentum remains strong. If the price hits the Order Block (OB) at $4,050 and a strong wick appears, this will be a potential BUY signal.

Conversely, if the bearish candles are strong and continuous, hold the SELL order from the FVG zone with the expectation that the price will move deeper towards the lower OB.

In case of a strong reaction at the OB zone, take profit on SELL and reverse to BUY, prioritising observing candle behaviour before entering the order.

🟡✨⚜️📊🎯

👉 Follow my TradingView channel for real-time gold analysis, trading plans, and the earliest entry zones.

Don't miss any market moves — Follow now to catch the next scenario!

Join Real - Time Trade Post: t.me/+vPyQJ6Ohb-RkMjNl

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join Real - Time Trade Post: t.me/+vPyQJ6Ohb-RkMjNl

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.