Coal India Ltd - Breakout & Retest with Bullish MomentumCoal India Ltd has successfully broken a key resistance level and is currently retesting it, indicating potential bullish continuation. Entry zones are well-defined with a stop-loss to manage risk. Targets align with previous resistance levels, confirming strong risk-reward potential.

⚡ Key Technical Points:

- Resistance Breakout & Retest: Price has broken resistance and is retesting, a bullish confirmation signal.

- Resistance Breakout & Re-test 🔵

- Entry 1 - 401 🟢

- Entry 2 - 354 🟢 (Support Zone)

- Stop-Loss below 346 🔴 (Risk Management)

- Target 1 - 440.80 📈

- Target 2 - 502.75 📈

Why This is a Technically Strong Setup:

- ✅ Resistance Breakout & Retest: Price has broken a key resistance and is retesting it, a classic bullish continuation signal.

- ✅ Strong Support Levels: The 354 zone has acted as a solid support multiple times, making it a high-probability entry.

- ✅ Moving Averages Alignment: Price is reclaiming key moving averages, signaling trend reversal.

- ✅ Volume Confirmation: The breakout was backed by increasing volume, adding strength to the move.

- ✅ Favorable Risk-Reward Ratio: Defined stop-loss below 346 minimizes downside risk while upside targets offer a strong reward.

- ✅ Higher Highs & Higher Lows: Market structure suggests a shift to an uptrend.

🚨 No financial advice. Do your own research.

Community ideas

Technical Analysis of MOLD-TEK TECHNOLOGIES LTD (NSE) - Monthly Chart Pattern: Cup and Handle Breakout with Retest

The chart displays a cup and handle pattern that completed a breakout in early 2023.

The price surged significantly post-breakout, reaching new highs.

However, after the sharp uptrend, the stock has corrected and is now retesting the breakout zone, which aligns with a long-term trendline.

Key Technical Observations

1. Support and Demand Zone (Retest of Breakout)

The stock has fallen from its highs and is currently testing a critical support zone around ₹120 - ₹145. This zone represents the previous breakout level from the cup and handle pattern.

A strong bounce from this area suggests that buyers are defending this demand zone.

2. Long-Term Trendline Support

The red diagonal trendline, drawn from past swing highs, has historically acted as resistance.

After the breakout, this trendline is now acting as a support.

The stock has bounced off this trendline, indicating a potential reversal.

3. Volume Analysis

Increased volume was seen during the cup and handle breakout, confirming the strength of the move.

Recent volume spikes on the dip suggest accumulation by strong hands.

A rise in volume on a reversal would confirm buyer strength.

4. Fibonacci Retracement & Mean Reversion

The current correction aligns with a 50%-61.8% Fibonacci retracement from the previous rally.

This is a healthy retracement level, often indicating the end of a correction.

Mean reversion to previous support zones before resuming the uptrend is common in strong stocks.

5. RSI & Momentum Indicators

While RSI is not explicitly shown in the image, the deep correction suggests oversold conditions.

A bullish divergence (price making lower lows, but RSI making higher lows) would strengthen the reversal case.

Conclusion & Strategy

Bullish Case (If the stock holds ₹120 - ₹145)

If the stock sustains this level and forms a higher low, it could resume an uptrend.

Breakout confirmation would come if the price reclaims ₹180 - ₹200 with strong volume.

Potential targets: ₹250, ₹280, and ₹350 in the long run.

Bearish Case (If ₹120 breaks)

A breakdown below ₹120 could lead to further downside, possibly towards ₹90 or even ₹68.

This would invalidate the bullish retest scenario.

Action Plan

For Long-Term Investors: This could be a buying opportunity if support holds.

For Traders: Look for bullish confirmation before entering. Stop-loss near ₹120.

NAVA LTDCMP 485

Technically its a Regression Trend

Need to follow the Marked Channel

SL CLB & Probable Targets are mentioned in the Chart

Plz Stick to given levels & Maintain TSL in order to retain your profits

if you like this idea 💡 --- Plz don't miss to Boost 🚀

For more info - Plz visit my profile & Follow me

Rgds,

Naresh G

SEBI Reg.RA

EURUSDIf you go on 4H you can see to the left in the last couple of months EurUsd has consistantly been making HH and it has been in an up trend, however on Monday market open price has made an important new leg and new Trading range was made. Not the strongest one yet, however suitable for looking for trades. On the rigth side of the screen you can see I where I have looked for a trade opportunity. If you zoom in on an 15 min time frame you can see great short opportunities today, 2 to be exact. Waiting for price to drop and take out the most recent low. Now there is more of a educational explenation while on 15min you can go and see what is happening into the region where the price is currently sitting at.

Blessings, T

Kotak set for new highKotak Mahindra Bank is nearing a retest of its 2021 high at ₹2,253, with immediate resistance at ₹2,201.65. The stock is currently trading at ₹2,186.40. If the price sustains above this resistance and the RSI, now at 73.98, closes above its previous high, it could signal strong momentum for a breakout. This may lead to the formation of new higher highs beyond ₹2,253.

Nifty Respect 23800 Resistance and Down Close 25/03/2025 NSE INDIA, Symbol : Nifty Index Timeframe : Daily. Nifty 24/03/2025 I was predicted one day before on 24/03/2025 Nifty face 23800 Resistance this condition 100% truth .Today Nifty high 23860 but no sustained above 23800 the level and return down side today close Nifty 23665. Tomorrow Nifty more down side go for support test possible.

REC : Bullish due to break out from inverted Head & Shoulder

INVERTED HEAD & SHOULDER -

stock is now bullish after breaking out an inverted head & shoulder pattern with strong confirmation of a green candlestick

BULLISH MACD -

MACD indicator of this stock is very bullish now with macd line having crossed over signal line properly over a period of time

WHITE CLOUD COVER -

apartfrom it a white cloud cover candlestick formed in the right shoulder indicating bullish movement

PROFIT TARGET -

463 level

STOP LOSS -

412 level

AXIS BANKTechnical Analysis Report

Stock Overview: Axis Bank Ltd - NSE - Current Price: ₹1,097.85. Axis Bank Ltd is a prominent private sector bank in India, offering a wide range of financial services, including retail banking, corporate banking, and treasury operations.

Key Levels:

Support (Yellow Zone): ₹926.70 - ₹952.52

Swing Zone (Green Zone): ₹1,015.00 - ₹1,091.53

Technical Indicators:

RSI (Relative Strength Index): The RSI value is 52.62, indicating neutral momentum as it is close to the midpoint of 50.

Volume: The trading volume is 8.28M, reflecting moderate investor interest. Higher volume often signals stronger price movements.

MA (Moving Average): The stock is trading above its 50-day moving average (₹1,091.53) but below its 200-day moving average (₹952.52), suggesting a mixed trend.

Sector and Market Context: Axis Bank operates in the financial sector, which has been experiencing fluctuations due to economic conditions, interest rate changes, and regulatory policies. While the overall market shows signs of recovery, uncertainties persist, impacting the banking sector's performance.

Risk Considerations: Potential risks include changes in interest rates, regulatory shifts, economic downturns, and geopolitical events. These factors could influence the stock's movement and overall market sentiment.

Analysis Summary: Axis Bank Ltd presents a mixed technical outlook with identified support and resistance levels. The RSI indicates neutral momentum, and the volume suggests moderate investor interest. Moving averages provide a mixed trend signal. Investors should carefully consider sector and market conditions, along with potential risks, before making investment decisions.

Abbott India Swing TradeOn weekly time frame, sellers are trapped badly in Abbott India which can fuel a good potential up move. Also it has recently grabbed liquidity from previous week low so if Nifty holds above 23000 then there are high chances of Abbott to reach T1 and T2 which will be a 1:5 RR trade.

Mankind Pharma - Breakout out of Falling Wedge PatternMankind Pharma is one of the 4 largest Pharma from domestic market perspective. It has fallen 30% from peak price, but has recently given BO from fallen wedge pattern. This looks a great stock:

1. 4 brands are having top market share and growing

2. First Co. to make oral anti-obesity medicine

3. Acquisition of BSV has made a very strong hold in women healthcare

4. Best YoY results with rising EPS

Technically also, Pharma sector looking strong and especially top 5 Indian Pharma Industry companies which includes Mankind Pharma.

Keep this in your radar.

Keep following @Cleaneasycharts as we prvoide Right Stock at Right Time at Right Price!!

Cheers!!

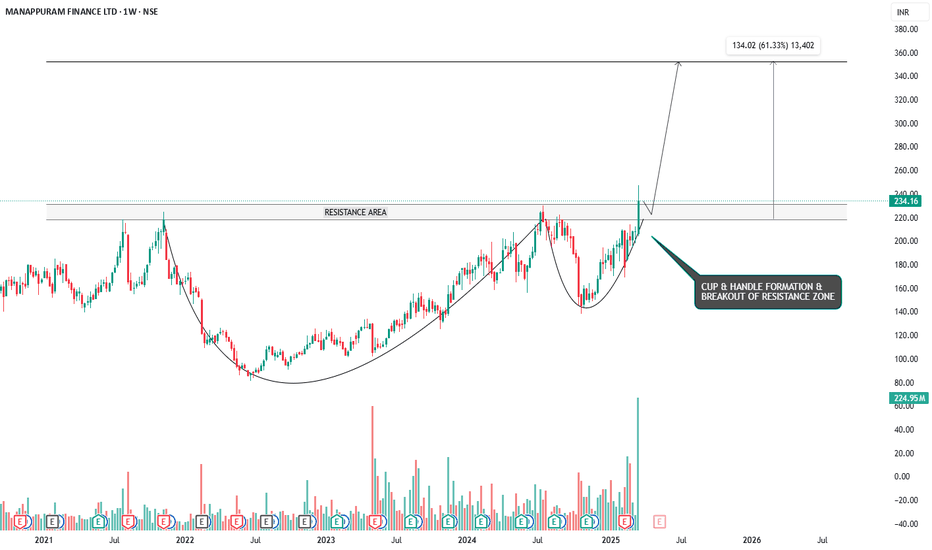

RIDING THE WAVE - CUP & HANDLE BREAKOUT IN MANAPPURAM FINANCESymbol - MANAPPURAM

CMP - 234.16

Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC.

Manappuram Finance Ltd. has recently demonstrated a significant bullish breakout, having formed a classic cup and handle pattern on a larger time frame and breaking out with strong volume. The cup and handle pattern is a well-regarded bullish breakout formation, and when it occurs on weekly or larger time frames, it tends to be highly reliable, indicating a robust upward momentum.

Currently, the stock price may retest the breakout zone, which coincides with the previous resistance area; now turned support - around the 230 to 217 range. This retest is a natural price action behavior and offers an attractive entry point for long positions before the stock continues its upward trajectory.

The target for this breakout, based on technical projections, is around 350, representing a 60% upside from the current market price. Given the strength of the breakout and the established pattern, this target appears achievable over the medium term.

For risk management, a stop loss can be placed around the 197 level, providing a reasonable cushion in case of a price reversal.

From a broader perspective, the formation of a cup and handle pattern coupled with a successful breakout on higher time frames adds a significant bullish bias to the stock. Investors looking for a favorable risk-to-reward setup may find this an opportune time to initiate or add to their positions in Manappuram Finance.

Disclaimer: The information provided here should not be construed as a buy or sell recommendation. It reflects my personal analysis and my trading position. Please consider this trading idea for educational purposes only. Thank you!

NIFTY detailed countingAs discussed in the last post, NIFTY's price has crossed over 23026.85 before 21st March so we can count the current move as wave (3). We can also see that price has broken the base channel, which is an important sign of wave (3) progression.

The detailed counting is given in the chart.

As we can see, the price is in subordinate wave 3 of the bigger wave (3).

The minimum target of Trending Impulse is 161.8% as per the rule.

We can expect the price to touch that level in the upcoming session.

I have marked, for now, a bigger wave (3) (in red) at 161.8% but as mentioned earlier, it is just the minimum target of it and the price may go beyond this level too.

This analysis is based on Elliott Wave theory and Fibonacci.

This is not any buying recommendation.

This analysis is for educational purposes only.

When Will Gold Fall ?Structure of Gold Clearly shows Wev can expand more , But How Much . Sp the answer is Wave Theory . We have a Impulse Waves of almost 22% . So its come Around 3150$ - 3160$ in the 3rd Wave . At these Price we can Expect Some corrrection or fall in Gold . Till Then You can use Dips To long And Can Capitalize the Gainsa till It doesnt Reach its peak of 3rd Wave .

Dow jones bearish view for 37500The Dow Jones Industrial Average (DJIA), often referred to as "the Dow," is a price-weighted index that tracks 30 prominent blue-chip companies trading on U.S. stock exchanges. Established in 1896 by Charles Henry Dow, it serves as a key indicator of the U.S. stock market's overall health.

Investing in Europe's defence industry : Saab ABHello,

Saab AB (publ) provides products, services, and solutions for military defence, aviation, and civil security markets Internationally. The company operates through Aeronautics, Dynamics, Surveillance, Kockums (shipyard), and Combitech (technical consulting) segments.

The company develops military aviation technology, as well as conducts studies on manned and unmanned aircraft. It also provides ground combat weapons, missile systems, torpedoes (self-propelled underwater missiles), unmanned underwater vehicles, training and simulation systems, and signature management systems for armed forces; and niche products for the civil and defence market, such as underwater vehicles for the offshore industry.

Europe is currently undergoing its most significant strengthening of total defence since the Cold War and Sweden is not being left behind. In response to a shifting international landscape, European countries are rapidly rearming, adding substantial investments into both its civil and military defences. By 2030, In Sweden alone, defence expenditures are expected to receive over SEK 200 billion (18 million euros). Military spending is projected to hit 2.6% of Sweden’s GDP by 2028. A robust Swedish total defence doesn’t just bolster Sweden’s own security—it also reinforces NATO’s and in place Europe’s defence systems as well. As Europe rearms itself, it will be looking at Sweden’s top arms manufacturer to build on stock for equipments. According to a Sweden's security police (SAPO) report released in March 2025, Russia poses the greatest threat to Sweden due to its aggressive attitude towards the West. Sweden became a Nato member last year (March 7, 2024), seeing it as the best guarantee against Russia.

These risks provide an opportunity for Sweden’s top defence manufacturing contractors Saab AB. Saab AB recognized for designing and manufacturing military aircrafts, like the Saab JAS 39 Gripen, a highly regarded multirole fighter jet. The Gripen rivals the F-35 in capability, and though it lacks stealth, it cleverly jams enemy radar to stay off the grid. Plus, it’s a budget-friendly alternative to the pricier F-35s. It is very likely that European countries will prefer the JAS 39 Gripen over the US made F-35’s due to the current political environment and recent news that the US had an ability to apply a kill switch on European F-35’s. The company also manufactures air, land and sea artilleries. In August 2024, The U.S. Army awarded Saab an Indefinite Delivery, Indefinite Quantity (IDIQ) contract, which allows the U.S. Army to place orders for up to $494 million over five years for the XM919 Individual Assault Munition (IAM) programme. On the customer side, Saab has a global customer base, with notable presence in countries like Sweden, Czech Republic, Hungary, South Africa, Thailand, Brazil, Canada, United States of America and the UK. Just six days ago (March 2025) Saab received a contract modification award from the U.S. Marine Corps for additional Marine Corps Training Instrumentation Systems (MCTIS) equipment. The order value for this award is USD $37 million (SEK 375 million) with deliveries taking place from 2025 to 2027. Separately, Saab has also signed a memorandum of understanding with Radionix (a Ukrainian defence company), on bolstering Ukraine’s capabilities. This partnership will zero in on developing and maintaining sensors and defence electronic systems. This covered Ukraine when the United States could not provide military intelligence to Ukraine. Saab’s equipment has been battle-tested and proven effective, making it a preferred choice for advanced military forces worldwide.

The Europe, EU efforts to boost defence through resource pooling and coordinated procurement are creating great ground for Saab’s growth. The company is well-positioned to meet rising demand for its support weapons, tank attack artillery, sensor systems, airborne early warning, and surface radar systems. As European nations restock their military arsenals, Saab’s prospects look even brighter.

Canada is a Saab customer—and it’s rethinking its defence strategy after it had canceled the Saab contract and gave it to Lockheed Martin. After a recent tariff spat with the United States, Canada’s new prime minister, Mark Carney, signalled a shift. “It’s clear that our security relationship is too focused on the United States. We must diversify,” he told reporters during a visit to London. With Canada spending roughly 80% of its defence budget on American weapons, the push for alternatives could open doors for Saab since they have worked together before.

Globally, escalating tensions—especially between the West, China, and Russia—are driving defence budgets upward, particularly in Europe and the Asia-Pacific. Spurred by the Russia-Ukraine war, nearly every European country plan to raise defence spending to at least 2% of GDP in the coming years. For Saab, this spells long-term opportunity, letting it capitalize on its geographic reach and diverse product line-up. The EU’s executive arm expects around 650 billion euros ($702 billion) to be unlocked through this initiative over the next four years. Even if only a small percentage (5%) of that trickles down to Saab each year it would more than double the company’s current revenue. This fundamentals, geo-politics and technical analysis makes the stock a strong buy for the medium/long term. A correction would provide better opportunities for entry.

Rationale for

Saab is well positioned to capitalize on growth in European defence budgets in the next five years.

The company is an international leader in antitank weapons, radar, and electronic warfare, allowing it to take full advantage of the surge in demand

Saab is the largest defence contractor for Sweden and among the biggest in Europe. It is set to benefit from the country's admission to NATO and the increase in its defence budget to SEK 300 billion between 2023 and 2025.

Risks to consider

Saab's sales depend on military funding, where contracts are awarded in an inherently political and uncertain process.

Future growth partially targets countries that are not included in European and NATO alliances, with potential geopolitical risks and shifting alliances precluding company deliveries.

A persistent valuation overhang due to increased ESG pressure on investment mandates will weigh on global defence shares even as earnings grow.

Next earnings report date: April 25, 2025

PE ratio: 50.30x

Industry average: The industry is trading at a PE ratio of 54.3x

Market cap: 207.8B SEK

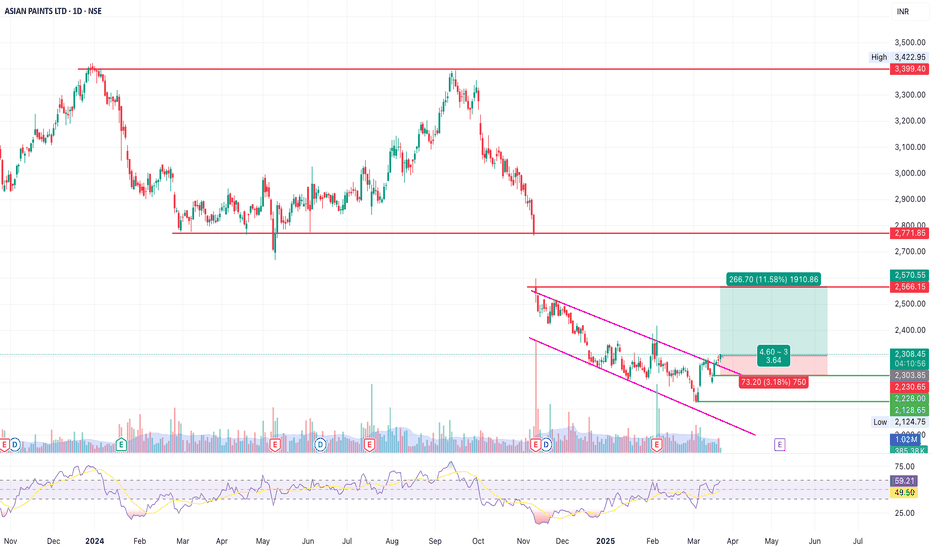

Asian Paints Ltd (NSE: ASIANPAINT) - Breakout AnalysisAsian Paints is showing a potential breakout from a falling wedge pattern, which is a bullish reversal pattern.

Key Observations:

Pattern Formation: The stock has been in a falling wedge since November 2024 and is now attempting a breakout.

Breakout Confirmation: The price has moved above the wedge's upper trendline and is testing it as support. A confirmed breakout could push the stock towards higher levels.

Support & Resistance Levels:

Immediate Support: ₹2,228

Breakout Level (Entry): ₹2,301

Target 1: ₹2,566

Target 2: ₹2,771

Major Resistance: ₹3,399

Indicators & Volume Analysis:

✅ RSI (Relative Strength Index): RSI is around 49.44, rising towards 58.31, indicating increasing momentum. A breakout above 50 could confirm bullish strength.

✅ Volume Analysis: Volume has been picking up, signaling buying interest. A surge in volume post-breakout will add conviction.

✅ Risk-to-Reward Ratio: 1:3.64, making this a favorable trade setup.

Verdict: Bullish

The stock is showing signs of a trend reversal with a potential breakout from the falling wedge.

Plan of Action:

BUY at ₹2,301 once the breakout is confirmed with volume.

Stop Loss: ₹2,228 (below recent support).

Target 1: ₹2,566

Target 2: ₹2,771

Trailing Stop Loss: Move stop-loss higher as the stock progresses.

A breakout above ₹2,301 with strong volume could trigger a momentum rally. Keep an eye on volume and RSI for further confirmation. 🚀

Pcbl Chemical – Supply Turned Demand, Higher Lows & Breakout Set📊 Stock: PCBL CHEMICAL LTD (NSE) – 1W Chart

📈 Bullish Structure Developing!

Supply turned into demand! Initially, the stock faced a strong supply zone, leading to a correction and consolidation.

Breakout & Sustained Move – After breaking out, the stock sustained above the breakout level for a long period, confirming demand at this zone.

Higher Lows Formation – A classic bullish structure is developing, indicating accumulation.

CT Base Breakout Approaching – The stock is breaking out of a contraction phase, which could lead to further upside.

Volume is a concern, but price action remains strong. A volume pickup could fuel a stronger move! 🚀

💬 What’s your take on this setup? Are you tracking PCBL? Drop your thoughts below! ⬇️

SPLPETRO : #SPLPETRO #swingtrade #patterntrading

SPLPETRO : Swing Trading

>> Inverse H&S pattern visible

>> Good Strength in Stock

>> Volume Building up

>> Risk Reward Favourable

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings.

Note : Markets are still Tricky and can go either ways so don't be over aggressive while choosing & planning your Trades, Calculate your Position sizing as per the Risk Reward you see and most importantly don't go all in

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

Bajaj Finance (BAJFINANCE) – Ascending Triangle Pattern FormingBajaj Finance's stock is currently forming an Ascending Triangle Pattern, which is often seen as a bullish continuation pattern. For the first time, BAJFINANCE has closed above the September 2021 highs, which was previously a strong resistance level. This indicates that the stock might be gearing up for a potential breakout!

Breakout Alert: Tata Steel and Mazagon Dock Power Up for a Surge◉ Tata Steel NSE:TATASTEEL

● The stock price has recently broken out of a falling broadening wedge pattern, signaling a potential upward movement.

● With the government's plans to impose taxes on steel imports, the stock could experience a rally in the near future.

◉ Mazagon Dock NSE:MAZDOCK

● The price has formed a bullish Pole & Flag pattern on the chart.

● Following a fresh breakout, the stock is expected to continue its upward trajectory.

Balrampur Chini: Channel Breakout, Targeting 690Details:

Asset: Balrampur Chini Mills Ltd (BALRAMCHIN)

Breakout Level: 500

Potential Target: 690

Stop Loss: Below 500 or as per risk management

Timeframe: Medium-term

Rationale: Balrampur Chini has given a confirmed channel breakout at 500, indicating strong bullish momentum. Sustained buying could push the stock toward 690 in the coming sessions.

Market Analysis:

Technical Setup: The channel breakout at 500 signals a bullish continuation with upward potential.

Sector Outlook: Increased demand for sugar and ethanol, along with government policies favoring the sugar sector, supports the stock’s growth.

Risk Management:

Place a stop loss below 500 to protect against any reversal.

Timeframe:

Medium-term move toward 690 expected, contingent on sustained momentum.

Risk-Reward Ratio:

Favorable, with a clear breakout level and strong upside potential.

Watch for continued strength and volume confirmation to validate the target.

#GABRIEL - VCP Break Out in Daily chart with Volume Spike📊 Script: GABRIEL

Key highlights: 💡⚡

📈 VCP formation in Daily chart.

📈 Price gave a good up move and consolidated.

📈 Volume spike on Breakout

📈 MACD Bounce

📈 RS is making 52WH

📈 One can go for Swing Trade.

BUY ONLY ABOVE 565DCB

⏱️ C.M.P 📑💰- 561

🟢 Target 🎯🏆 – 21%

⚠️ Stoploss ☠️🚫 – 11%

️⚠️ Important: Market conditions are getting better, Position size 25% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂