AJANTPHARM | Consolidation | Breakout | Daily--

### 📊 **Technical Analysis Summary:**

#### 🔹 **Chart Pattern:**

* **Falling Channel** (Yellow trendlines): Price has been respecting a downward-sloping channel since mid-2023.

* Recently, the price **broke out above the upper trendline**, indicating a **potential trend reversal**.

#### 🔹 **Consolidation Zone:**

* There was a **rectangle consolidation** (boxed region) between ₹2,480 and ₹2,700.

* The breakout above ₹2,700 confirms bullish intent and may act as a new support.

#### 🔹 **Breakout Target:**

* The measured move from the box is **approx. ₹217.75**.

* Adding to the breakout level gives a projected **target of ₹2,920**.

#### 🔹 **Volume:**

* **Volume spike** on breakout day = strong confirmation of the breakout.

#### 🔹 **RSI (Relative Strength Index):**

* RSI broke out of its own **downtrend resistance**.

* Now trading above 60 = bullish momentum building up.

---

### 🎯 **Levels to Watch:**

| Type | Price (₹) |

| ----------------------- | ----------- |

| **Breakout Point** | 2,700 |

| **Current Price** | 2,730 |

| **Target** | 2,920 |

| **Support Zone** | 2,480–2,700 |

| **Volume Confirmation** | Yes ✅ |

---

### ✅ **Conclusion:**

Ajanta Pharma is showing strong bullish signs:

* Breakout from falling channel

* Volume-backed move

* RSI confirmation

**As long as the price holds above ₹2,700**, the upside towards ₹2,920 remains intact.

Community ideas

Pfizer: supply zone breakout-A simple supply zone breakout

-My entry is at 5800, with a stop loss of 5599

-there has been a volume uptick of late with some interesting developments in the cancer and other fields including expansion in China by the parent company

-Covid resurgence also increases the demand of the vaccine which may again improve the top and bottom line

BPCL Breaks Out of Triangle: Wave 5 Takes the WheelBharat Petroleum (BPCL) appears to have completed a correction phase and is now showing signs of beginning its final leg higher. The entire corrective structure ended at ₹234.01. From there, a clear five-wave impulsive rally began, marking the beginning of Wave 1 of a new trend. After a brief correction as Wave 2, the stock surged again to ₹325.85, completing Wave 3. What followed was a contracting triangle, unfolding as an A-B-C-D-E pattern—suggesting a typical Wave 4 consolidation.

The breakout from this triangle came with a strong bullish candle, supported by a spike in volume. Price has now convincingly moved above both the 50-day and 200-day moving averages, with the 200-day MA serving as a platform for the triangle structure itself. This alignment of price, structure, and moving averages supports the hypothesis that Wave 5 has just begun.

MACD has triggered a fresh bullish crossover, adding confirmation to the momentum buildup seen after the triangle breakout. The structure remains valid as long as the price holds above ₹308.25, which marks the end of Wave 4 and serves as the key support level. Additionally, the 50-day moving average (MA50) sits just below, offering another layer of dynamic support. A sustained hold above these zones keeps the bullish bias intact and supports the ongoing development of Wave 5.

Wave 5 targets lie near ₹369.95, which is the 1.0 extension of the Wave 1 length projected from the Wave 4 low. Any pullback toward the breakout zone near ₹308–₹315 could offer a low-risk entry opportunity as long as the structure remains valid.

Chart will be updated as price action evolves.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

"Bearish Reversal Opportunity Following Supply Zone Rejection"1. Double Top Formation (Resistance Level Identified)

The chart displays a clear double top structure at the 2,760–2,800 USDT level.

This level has acted as a strong supply zone (highlighted in red), where price previously reversed, indicating heavy selling interest.

Current price action has retested this resistance zone and shown signs of rejection.

2. Liquidity Sweeps & False Breakouts

On the left side of the chart, an aggressive downward wick (marked with a blue arrow) suggests a liquidity sweep below a key low before strong bullish momentum returned.

This type of price action indicates smart money involvement, designed to remove weak hands before pushing price higher.

3. Accumulation Phases (Sideways Consolidation)

Multiple accumulation ranges are highlighted with blue rectangles.

These ranges show horizontal consolidation, where price builds up energy before breakout.

The most recent breakout led to a vertical rally toward the resistance zone, signaling an end of the accumulation and a start of distribution.

4. Double Bottom Support Structure

Identified near the 2,480 level, marked by red circles.

This level has historically acted as demand/support, evidenced by multiple bounces from this price zone.

Now highlighted with a grey zone, it is projected to act as the next key support area.

5. Bearish Projection

A large black arrow suggests a forecasted bearish move from the current high (~2,800) back to the support zone (~2,480).

This aligns with the idea of a mean reversion or pullback after a strong bullish impulse.

---

Conclusion & Trade Idea:

🔻 Bias: Bearish (Short-term)

The chart presents a classic reversal pattern with a double top at a well-defined supply zone.

Entry could be considered after confirmation of rejection from this level.

🧠 Trade Plan Suggestion:

Entry: Short near 2,780–2,800 after bearish confirmation (e.g., bearish engulfing candle or break of structure).

Target: 2,480 (support zone).

Stop Loss: Above 2,820 (recent high).

Risk-Reward: Approximately 1:2.5 or better depending on execution.

Solana Technical Commentary on Bullish Rally (SPOT ETF APPROVAL)- Solana is currently trading at 165$

- Solana can be the next Money Printer

- Solana could be the next one to rally because SOL Spot ETFs may get approved by the SEC next month according to Bloomberg

- Bloomberg has mostly been accurate on past SPOT ETF approval calls

- Solana has a higher transaction volume with minimal congestion and low fees.

- Technically, I see the 140-150$ range as an OTE and once Solana breaks above 180$ I will wait for a pullback before adding more size

- Betting Big on Solana looks highly rewarding from a structure perspective 250$ looks easy by the end of Q4

TVSSCS - Triangle into a flag!The following points are of note:

------------------------

1. A symmetrical triangle formed as a near-term bottom for the stock

2. After breaking out of the triangle, price is consolidating in a rectangular range

3. A pole and flag formation, when broken out can give targets of 143, 147, with SL of 123

Disclaimer:

This is NOT a trading recommendation, only my observation. Please do your own analysis before entering any trade.

GODREJIND - Inverse Head and Shoulders Breakout Pattern Overview:

A classic Inverse Head and Shoulders pattern has formed on the Godrej Industries chart. This is a strong bullish reversal pattern, indicating a possible trend change from downtrend to uptrend.

What is an Inverse Head and Shoulders Pattern?

This pattern consists of three troughs:

Left Shoulder: Price declines, then rebounds.

Head: Price declines more deeply, then rebounds.

Right Shoulder: Price again declines but not as much as the head.

A neckline connects the peaks between the troughs.

A breakout happens when the price moves above the neckline.

This formation signals selling pressure is reducing and buyers are gaining strength.

How to Trade This Pattern:

Entry: After a confirmed breakout above the neckline.

Stop-Loss: Slightly below the right shoulder or neckline.

Target Price: Measure the distance from the neckline to the head, and project that above the neckline

.

Godrej Industries – Key Points:

Diversified holdings across chemicals, real estate, FMCG, agri-business, and financial services.

Strong portfolio of listed subsidiaries like Godrej Consumer, Godrej Properties, and Godrej Agrovet.

Backed by the trusted and time-tested Godrej Group with over 125 years of legacy.

Generates stable cash flows through dividends and investments in high-growth businesses.

Long-term value creation potential as a holding company with exposure to multiple growth sectors.

Disclaimer : Trade only if you have a written Trading Plan and aware of your risk reward setup

SHAKTI PUMP : A text book break out• Stock broke a 4 month long short term trendline on 06th Jun25.

• Taken support from long term trendline.

• Big boys took position for the last 2 months without disturbing the price.

• An increase in volume is the testament of the hypothesis.

• Go long on positional/swing basis.

• Target 1: 1029.5

• Target 2: 1192

• Target 3: 1356.5

• SL for Swing traders: 878

• SL for positional trader: 839

• A RR of 1:4.75. A classical textbook breakout.

• Enjoy the show!!!

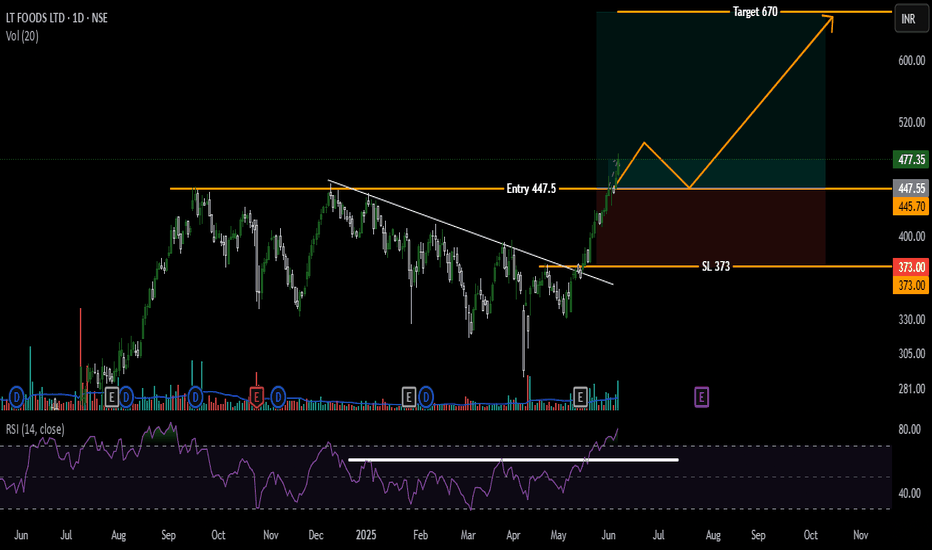

LT Foods | Fresh Breakout Above 52-Week High | Swing Trade SetupLT Foods Ltd (DAAWAT) has given a strong breakout above its multi-month resistance zone around ₹447.5, backed by rising volume and momentum. This marks a fresh 52-week high, supported by bullish RSI strength (above 80).

📈 Trade Setup:

🔹 Entry: ₹447.5 (Breakout Retest Zone)

🔹 Target: ₹670

🔹 Stop Loss: ₹373

🔹 Risk-Reward Ratio: ~3:1

✅ Why I Like This Setup:

Clean breakout from consolidation

Strong volume confirms participation

RSI above 80 indicates trend strength

Bullish price structure across daily chart

⚠️ CMP is currently above entry zone; ideal entry would be on a retest of ₹447–455 range.

Position sizing is key due to SL distance (~16%).

This setup is ideal for swing traders with a short-to-medium term view (2–4 months).

📊 Disclaimer: Not financial advice. Do your own research before investing.

Swing/Positional Trade Idea: Jamna Auto (NSE: JAMNAAUTO)Pattern Alert: Rounding Bottom Nears Breakout!

📈 Technical Setup

Daily Chart Pattern: Price is completing a multi-month rounding bottom (bullish reversal pattern), signaling accumulation.

Current Price: Consolidating near ₹88.80, approaching the crucial breakout zone of ₹94.25–95.60.

Confirmation Trigger: A decisive close above ₹95.60 on rising volume validates the breakout.

🎯 Trade Strategy

Entry: Buy on breakout confirmation above ₹95.60 (close basis).

Stop Loss: ₹86.36 (below the recent swing low & pattern support).

Targets:

T1: ₹106 (+11% from breakout)

T2: ₹113 (+18%)

T3: ₹123 (+29%)

T4: ₹133 (+39%)

Final Target: ₹149 (all-time high, +56%)

Risk-Reward: 1:5+ (based on SL to T1).

⚠️ Key Notes

Patience Required: This is a positional trade with a 3–6 month horizon. Hold through minor pullbacks.

Volume Confirmation: Breakout must be backed by +50% above average volume for conviction.

💡 Why This Works

Rounding bottoms indicate long-term trend reversal with high follow-through probability.

Targets align with Fibonacci extensions & prior swing highs.

Low-risk entry: Tight SL (8% risk) for asymmetric upside.

Trade smart. Track volume. Patience pays!

🔥 Like this idea? Hit "Boost" to increase visibility!

-------------------------------------------------------------------------------------------------------------

📜 GENERAL DISCLAIMER

This analysis is for educational purposes only and does not constitute financial advice, a recommendation, or an offer to buy/sell securities. Trading involves substantial risk of loss and is not suitable for every investor.

❗ KEY RISK ACKNOWLEDGMENTS

Not Personalized Advice: This idea is based on technical analysis and may not align with your risk profile, capital, or goals.

Past Performance ≠ Future Results: Patterns may fail due to market volatility, news, or sector weakness.

Capital Risk: You may lose all or more than your initial investment. Use only risk capital.

Stop Loss Execution: SL orders may trigger below ₹86.36 during gaps or low liquidity.

Holding Period: Positional trades require monitoring. Unforeseen events (earnings, regulations, global shocks) could invalidate the setup.

Bias Alert: This is a bullish bias idea. Always assess bearish scenarios.

🔍 Verify Independently

Cross-verify with fundamentals (debt, earnings, management).

Check broader market trends (Nifty Auto, Nifty 500).

Consult a SEBI-registered advisor before acting.

⚠️ YOUR RESPONSIBILITY

You alone are accountable for trading decisions. The author/platform assumes no liability for losses.

NOCIL LTD

Breakout Confirmation:

Strong bullish breakout above the ₹195–₹198 resistance zone.

Volume & Strength:

A breakout after a multi-week sideways range indicates potential trend reversal from the previous downtrend.

Resistance Ahead:

Immediate resistance near ₹208–₹212, which coincides with March swing highs.

Major resistance at ₹225, then ₹240.

Support Levels: New support at breakout zone: ₹195–₹198.

Stronger base at ₹185-170.

Trend Shift: The chart shows a base formation between ₹170–₹195, now breaking out.

If price sustains above ₹198 for 1–2 sessions, it confirms a short-term uptrend.

Conclusion:

Bullish bias above ₹198 with upside targets of ₹208 → ₹225.

Watch for retest of ₹198 for fresh entries with SL below ₹193.

Avoid if it dips below ₹190 with volume – that would invalidate the breakout.

SRF Ltd Breaks Out Above 2022 High — Is ₹3,300 the Next DestinatSRF Ltd has officially broken above its previous all-time high of ₹2,865 (from 2022), closing strong at ₹3,112, with an impressive weekly gain of +8.78%. Backed by increasing volume and a strong RSI of 66.70, the breakout looks technically significant.

• ✅ Breakout above life high of ₹2,865 (2022)

• 📈 Weekly High: ₹3,127

• 💰 Closing Price: ₹3,112

• 📉 50 EMA Support: ₹2,673

• 🔰 Major Support Zone: ₹2,050–₹2,080

• 📊 RSI (Weekly): 66.70 — bullish momentum building

• 🔄 Volume: 3.66M — above average

With price sustaining above the key breakout zone, the path could open toward the next resistance levels around ₹3,300–₹3,350. Watch for consolidation or retest around ₹2,865 for stronger conviction.

Analysis By Mayur Jayant Takalikar -- For LEARNING & OBSERVATIONAL USE ONLY.

⚠️ Disclaimer:

This chart analysis is purely for educational and informational purposes only.

I am not a SEBI-registered investment advisor.

Please do your own research or consult a certified financial advisor before making any investment decisions. Stock markets are subject to risk.

FXHUNTER / XAUUSDHello, I am FXHUNTER. In this post, we will analyze the XAUUSD symbol. As you can see, the structure of the gold symbol is bullish. In this situation, the block order candle that I have identified as the last block order is bearish before a strong upward move. You can wait and enter the trade when the price reaches it with confirmations such as choch, pin bar candle or trend line breakout on the 1-minute timeframe. The target is set on the higher timeframe.

DYCL STRONG BREAKOUT CANDIDATENSE:DYCL

Cable and WIre Industry Stock Good for Swing

#DYCL Strong Conviction - Increasing day by day.

Study the Price and Volume action closely.

Spikes are grabbing supplies from top and low volatility closing showing - accumulation.

Today price respected the previous day close and formed a higher high higher low structure.

All Major Levels are marked on chart.

Keep Learning,

Happy Trading.

Nifty June Iron Condor Strategy–Range is Back Premiums are JuicyHello Traders!

Here’s a plan for calm minds who want to generate passive monthly income by leveraging the power of non-directional option selling. Based on the current Nifty structure and OI data, I’ve spotted a new range-bound opportunity — perfect for executing a safe, hedged Iron Condor setup.

Why This Strategy Now? (Based on Chart Analysis)

Resistance Zone: 25400-25500 (Heavy supply, multiple rejection visible)

Support Zone: 23400-23500 (Major bounce levels, strong OI support)

Nifty is currently trading near 24500, well inside this range — perfect for deploying a neutral premium-selling setup.

Strategy Setup (Iron Condor – 26 June 2025 Monthly Expiry)

Sell 25400 CE @ ₹123

(to protect upside move rejection)

Buy 25800 CE @ ₹56

(risk protection on breakout)

Sell 23650 PE @ ₹99

(to protect downside move rejection)

Buy 23200 PE @ ₹51.4

(risk protection on breakdown)

Strategy Highlights

(Screenshot – )

Why This Works? (OI Logic + Technical View)

Strong resistance visible at 25400–25500 zone with rising CE OI

Solid put writing zone at 23400–23500 — confirms downside support

Volatility is stable, time decay is in our favor — perfect for Iron Condor writers

Risk Management & Exit Plans

Exit early if either side breaks with volume

Don’t hold till expiry — aim to exit around 70–80% max profit

Always keep SL alert at breakdown range breaches

Rahul’s Tip

"Option writing is not for thrill, it’s for discipline. Iron Condor is a weapon when range is visible — use it like a sniper, not like a gambler."

Conclusion

If your view is Nifty likely to stay between 23400–25400 for the next few weeks, this Iron Condor setup offers high-quality time-based potential. Use proper lot sizing and risk control — let the theta do the work for you!

Have you ever deployed an Iron Condor on Nifty? What was your experience? Drop your thoughts in the comments!

If you liked this post, don’t forget to LIKE and FOLLOW!

I regularly share high-quality trading setups based on real analysis, OI data, and smart risk-managed strategies.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

YESBANK: Riding the Bullish WaveYes Bank has exhibited a notable breakout above the resistance level established in December 2024. This breakout is accompanied by a classic flag pattern formation, which has resolved to the upside—typically interpreted by technical analysts as a continuation signal within an existing trend.

A significant increase in trading volume during the breakout phase adds weight to the move, suggesting heightened market participation. Furthermore, the 20-day EMA has crossed above the 200-day EMA, a crossover often referred to as a "Golden Cross" , which is generally viewed as a bullish signal indicating potential for continued upward momentum.

The RSI is currently positioned above 60, reflecting sustained buying interest without yet entering overbought territory.

From a structural perspective:

Immediate resistance may be encountered near the 24.75 level.

A secondary resistance zone appears around 28.54.

On the downside, the stock seems to have established a support base near 19.54, which could act as a cushion in the event of a pullback.

Disclaimer:

This analysis is intended solely for informational and educational purposes. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change rapidly, and all trading involves risk. Individuals should conduct their own due diligence or consult with a qualified financial advisor before making any investment decisions.

BirlaSoft : Giving another Multibagger Opportunity of ~145% ?Hi Friends,

BirlaSoft a looking very good in terms of chart formation at this junture. Though The fundamentals are yet to reflect.

It usually corrects by 55-75% from the top. This time it has corrected by 60% almost .

Now the Target comes out to be around ~600 level (~145%) from the current levels .

How Target was calculated :

----------------------------------

yellow parallel lines are for channel which is respected by the stock . The same lower yellow channel line should be treated as stoploss (5-8% below the lower Yellow channel line must be stoploss).

Target is Upper yellow line of the channel.

Please feel free to share your thoughts & ask if any query related to any analysis done by me .

Note : I am not a SEBI registered advisor . Please consider my analysis only for Education purpose .

LIC of India cmp 954.45 by Weekly Chart view since listedLIC of India cmp 954.45 by Weekly Chart view since listed

- Support Zone 865 to 900 Price Band

- Resistance Zone 1010 to 1055 Price Band

- Bullish Rounding Bottom under Resistance Zone

- Heavy Volume surge by demand based buying last week

- Rising Support Trendline respected and Falling Resistance Trendline Breakout, both seem well sustained

Ambuja Cement Chart Analysis with Confirm Targets 2025 Cement Industry: A Strong Pillar of India’s Growing Economy

India remains the world’s second-largest cement producer as of 2025, and the pace of its growth continues to accelerate.

The demand for cement has surged due to infrastructure development projects such as housing construction, road expansion, railways, metro projects, and Smart Cities initiatives.

To boost infrastructure development, the Indian government has announced an interest-free assistance package of approximately ₹1.5 lakh crore.

Schemes like "Housing for All" and rural-urban housing programs have intensified construction activities across the country.

In this dynamic environment, the cement sector is receiving solid support and is expected to grow significantly in the coming years.

Ambuja Cement Company Profile

Ambuja Cements is one of India’s leading cement companies, established in 1983. It is now a part of the **Adani Group, a diversified and rapidly expanding conglomerate. The company primarily manufactures and sells grey cement and ready-mix concrete (RMC).

As the Smart City Mission, metro rail networks, expressways, flyovers, and industrial corridors progress rapidly, cement consumption continues to rise. Several large-scale cement road and railway infrastructure projects are underway across the country, expected to sustain the sector’s momentum over the next few years.

Ambuja Cement Technical Analysis

Major Resistance Zone: ₹590 – ₹700

₹590 acts as a strong resistance level, where the stock has previously faced multiple rejections.

A weekly candle closing above ₹590 would signal a strong bullish breakout.

Once this level is breached convincingly, the stock may **quickly move towards ₹700, testing its previous all-time high.

Trading Plan:

1.If the stock gives a weekly close above ₹590, it could be a buy signal.

2. The next potential target would be ₹700** based on the breakout confirmation.

Strong Demand Zone: ₹450 – ₹460

Significance of this zone:

1.The range of ₹450–₹460 has consistently shown bounce-back behavior, indicating strong buying interest.

2.Swing traders and investors** can consider accumulating when the stock nears this zone, as historical data shows this level has acted as **strong support**.

Stop-loss Strategy:

If any **weekly candle closes below ₹445, it could indicate a breakdown of support, and exiting the position would be advisable.

Support Zone Trading Plan

If the stock drops to ₹450–₹460 and **buying volume** increases, it could present a good buying opportunity.

Short-Term Potential Targets

First Target: ₹578

Second Target: ₹640

Manoj Strengthen Support – ₹413.50

The level of ₹413.50 is recognized on the chart as a strong psychological and emotional support, named “Manoj Strengthen Support.”

Why is this level important?

1. In case of a sudden market correction due to war, global recession, or political instability, this level may act as a temporary strong support.

2. It may prevent further decline and hold price levels in such events.

Investor Tip:

1. If the stock declines but this level holds, it becomes a **critical risk-management zone**.

2. Investors can look for potential **bounce-back** opportunities and strengthen their conviction around this level.

Ambuja Cement Long-Term Targets (2025–2028)

The long-term structure of Ambuja Cement appears bullish, and based on technical charts, the following major targets have been identified:

First Target: ₹700

Expected during 2025–26 if the stock gives a strong closing confirmation above ₹590.

Second Target: ₹840

If the stock decisively breaks above ₹700 (its all-time high), this target could be achievable in 2026.

Third Target: ₹1040

In the long term, if the stock sustains above ₹840, a move towards ₹1040 is likely by 2027–2028.

This analysis is based on technical breakouts, price action, and support-resistance principles, and can serve as a strategic guideline for long-term investors.