NIFTY Scalping / Short Range Level Analysis for 11th FEB 2026 NIFTY Scalping / Short Range Level Analysis for 11th FEB 2026

PCR Data Analysis:

Weekly EXP (17 Feb 2026)=>

Put OI: 10,24,409, Call OI: 9,95,773, PCR: 1.03. TREND Strength: Neutral

Intraday Change Basis=>

Put OI Chg: 5,81,650, Call OI Chg: 5,47,290, Chg OI PCR: 1.06. TREND Strength: NEUTRAL

Market indices

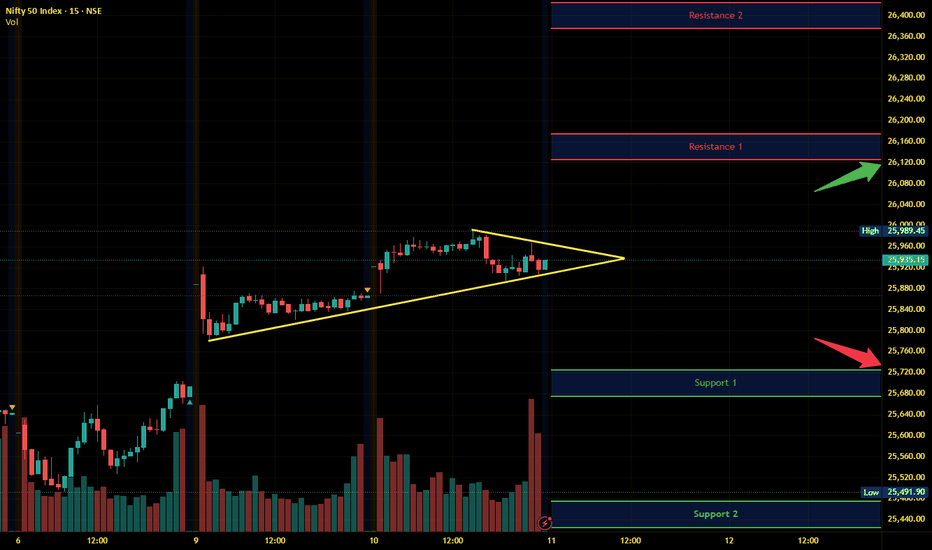

NIFTY : Trading levels and Plan for 11-Feb-2026📘 NIFTY Trading Plan – 11 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,156 – Higher Timeframe Resistance

🟢 25,917 – Immediate Resistance

🟠 25,859 – 25,917 – Opening Support / Resistance (No-Trade Zone)

🟢 25,776 – Last Intra

NIFTY KEY LEVELS FOR 11.02.2026NIFTY KEY LEVELS FOR 11.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential

Big Vs Small Breakaway Gaps and Old concepts Revision In this video, I have revised all the old concepts I have been sharing taking only 1 thing as my main object which is Nifty, I believe 1 instrument, 1 strategy can change your life but it takes many concepts - combined together to get to that strategy, its simple yet difficult .

No Bias - No forec

Sensex - Expiry day analysis Feb 11This week, the price moved in a narrow range daily and did not give good trading opportunities for option buyers. Yesterday and today, the movement happened within the range of 84000 to 84500. 84000 is acting as a strong support, and 84500 is acting as a strong resistance.

Buy above 84100 with the s

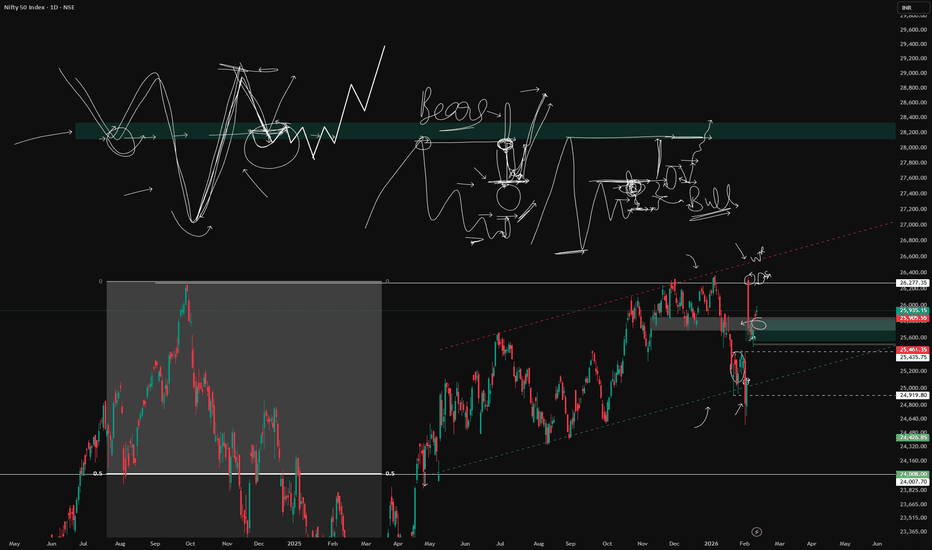

Nifty Analysis for Feb 11-16, 2026Wrap up:-

Earlier we have marked Major wave c, in which wave 1 is completed at 25473, wave 2 at 26341 and wave 3 is currently in progress.

Now, In wave 3, wave 1 is completed at 25641 and wave 2 is in progress which is making a wxy corrected pattern and currently wave x is in progress and is expe

Nifty Intraday Analysis for 11th February 2026NSE:NIFTY

Index has resistance near 26125 – 26175 range and if index crosses and sustains above this level then may reach near 26375 – 26425 range.

Nifty has immediate support near 25725 – 25675 range and if this support is broken then index may tank near 25475 – 25425 range.

The market is expe

NIFTY Levels for Today

Here are the NIFTY's Levels for intraday (in the image below) today. Based on market movement, these levels can act as support, resistance or both.

Please consider these levels only if there is movement in index and 15m candle sustains at the given levels. The SL (Stop loss) for each BUY trade

See all popular ideas

Index collections

Frequently Asked Questions

An index is a financial instrument that measures the performance of underlying assets or tracks other financial data. Some indices are designed to provide a broad view of the market, while others focus on tracking a particular sector of the economy. Indices give traders an instant snapshot of market sentiment with a rising index suggesting optimism about the economy and a declining index signaling uncertainty.

For example, the S&P 500 Index (SPX) tracks the performance of 500 large publicly traded companies in the United States, while the US consumer price index (CPI) measures US inflation and deflation.

Usually, indices are expressed in points, but some, like the S&P 500, can be expressed in the national currency.

With TradingView, you can follow all indices in one place.

For example, the S&P 500 Index (SPX) tracks the performance of 500 large publicly traded companies in the United States, while the US consumer price index (CPI) measures US inflation and deflation.

Usually, indices are expressed in points, but some, like the S&P 500, can be expressed in the national currency.

With TradingView, you can follow all indices in one place.

Indices are used to track assets or financial data, so they're not designed for trading, but some financial instruments linked to indices can be traded on exchanges. They include mutual funds, exchange-traded funds (ETFs), index futures, contracts for difference (CFDs), and options on indices.

We recommend conducting a thorough analysis before settling with any of these instruments: explore indices ideas and forecasts and then select a reliable brokerage on TradingView. Once you open an account, you'll be all set to start investing in indices.

We recommend conducting a thorough analysis before settling with any of these instruments: explore indices ideas and forecasts and then select a reliable brokerage on TradingView. Once you open an account, you'll be all set to start investing in indices.

The main global indices that investors and traders track include the S&P 500, FTSE 100, Dow Jones, and more.

For your convenience, we have a list of all major indices in one place — analyze their stats to conduct a well-rounded analysis.

For your convenience, we have a list of all major indices in one place — analyze their stats to conduct a well-rounded analysis.

Stock market indices are mainly used to gauge the health of a particular sector of the world economy. For example, as one of the main global indices, the S&P 500 (SPX) provides investors and traders with insight into the health of the US economy. Another reputable index, the DAX Index, helps assess the performance of German blue-chip companies. It is one of the primary indicators of Germany's economic health in particular and, more broadly, the EU's economic health.

Today, CAC 40 is 8,313.24 EUR. It has decreased by 0.35% over the past month. DAX is 24,856.15 EUR (1.55% down since last month) while FTSE 100 is 10,472.10 GBP (3.43% up since last month).

For the broader outlook, we have a list with indices of the European countries.

For the broader outlook, we have a list with indices of the European countries.

As of today, the S&P 500 stands at 6,941.46 USD, showing a 0.04% decrease over the past month. Dow Jones is currently at 50,121.41 USD, reflecting a 1.26% increase during the same period. Meanwhile, Nasdaq 100 has reached 25,201.26 USD, marking a 1.62% decrease compared to the previous month.

For the broader outlook, we have a list with all indices in one place.

For the broader outlook, we have a list with all indices in one place.

The Standard and Poor's 500 (SPX) is one of the most reputable indices, tracking the performance of 500 largest publicly traded US-based companies. It represents approximately 80% of the total US equity market capitalization, making it the prime indicator of the US economy's health.

Today, the SPX is 6,941.46 USD, it has decreased by 0.04% over the past month.

On TradingView, you can track SPX components and watch the SPX chart to stay on top on index dynamics.

Today, the SPX is 6,941.46 USD, it has decreased by 0.04% over the past month.

On TradingView, you can track SPX components and watch the SPX chart to stay on top on index dynamics.

The Dow Jones, or just the Dow, is short for the Dow Jones Industrial Average Index (DJI). It is one of the most reputable indices, tracking the performance of 30 blue-chip US stocks. All of them are stable and trusted companies boasting a long history of weathering the market under different circumstances, from gains during bull runs to surviving global economic crises.

Today, the DJI is 50,121.41 USD, it has increased by 1.26% over the past month.

On TradingView, you can track DJI components and watch the DJI chart to stay on top of index dynamics.

Today, the DJI is 50,121.41 USD, it has increased by 1.26% over the past month.

On TradingView, you can track DJI components and watch the DJI chart to stay on top of index dynamics.

An index fund is a financial instrument that tracks the performance of a financial index. Since indices cannot be bought as they are, index funds can have different structures that provide investors with exposure to the identical price fluctuations of a given set of stocks.

For example, an index fund can hold the exact stocks in a proportion similar to the index's initial weight, given to each stock. Therefore, as the index changes, a well-structured index fund would change by the same value.

To gain insight into market indices, explore our community ideas on indices.

For example, an index fund can hold the exact stocks in a proportion similar to the index's initial weight, given to each stock. Therefore, as the index changes, a well-structured index fund would change by the same value.

To gain insight into market indices, explore our community ideas on indices.